Implications of Non-Increasing Farmer Returns

Since 2006, farm returns to cash rent farmland have been highly variable but have not exhibited a trend up or down. At the same time, cash rents have generally increased. As a result, there has been a shift with more of the returns accruing to owning the farmland rather than operating the farmland. That situation will likely continue until low financial returns necessitate a significant drop in cash rents.

Farmer Returns from Cash Rent Farmland

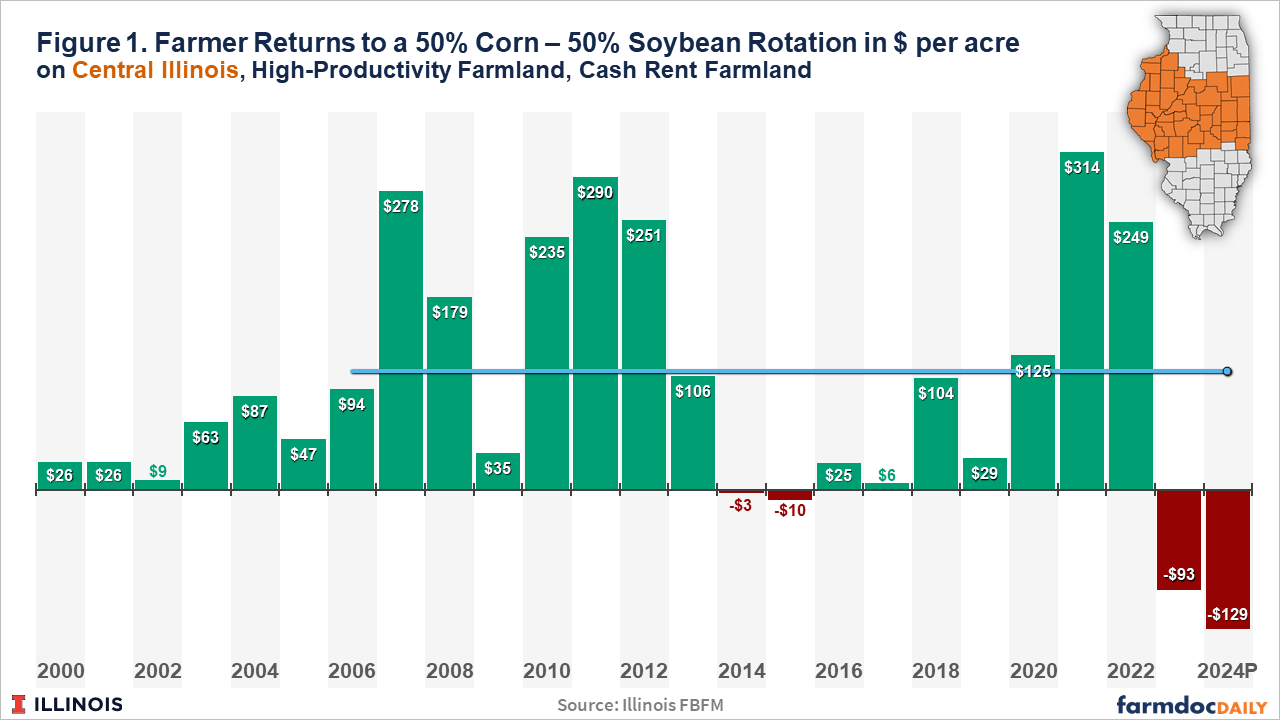

Figure 1 shows farmer returns from corn-soybean rotations on high-productivity farmland in central Illinois. These estimates include gross revenue from crop sales, as well as receipts from crop insurance, commodity title payments, and ad hoc disaster assistance programs. From gross revenue, all non-land costs and cash rent are subtracted to arrive at a farmer return. This farmer return is the financial return from farming rented acres.

In evaluating returns, note that there has been no trend up or down since 2006 when increasing amounts of corn began being used in ethanol production. Time series analysis suggests that returns are not been trending up or down since 2006. Over the period from 2006 to 2024, average farmers’ returns to an acre of cash-rent farmland have averaged $110 per acre.

While there have been no trends in nominal returns, there has been extreme variability. Over time, farmer returns have ranged from a high of $314 per acre in 2021 to a projected low of -$129 per acre in 2024. That variability has not been going down with time. The lowest low (-$129 per acre) is projected to occur in 2024, while the high ($313 per acre) occurred in 2024.

That variability occurred with crop insurance and commodity title programs in place, and those safety net programs are included in the returns shown in Figure 1. Most farmers in central Illinois purchase revenue insurance at 80 and 85% levels. Even given those levels, gross revenue can range considerably. Revenue guarantees on corn farmland in central Illinois are often based on $1,000 of expected revenue per acre. With an 85% coverage level, a 15% decline in revenue occurs before crop insurance makes a payment or a $150 per acre decline. A $150 revenue decline can move a farm from a reasonable return to a negative return. Moreover, price declines across years are not protected by crop insurance. Commodity title programs can dampen negative farmer returns, but the possibility of significant negative returns still exists (see farmdoc daily, September 10, 2024).

While returns have been variable, cash rents have been far less variable (see Figure 2). Except from 2014 to 2017, when cash rents declined by $26 per acre, cash rents have been on a general upward trend. Note that the relatively small decline in cash rents was preceded by a dramatic decline in farmland returns from positive returns in 2010 to 2013 to two years of negative returns in 2014 and 2015.

Implications

Since 2006, one can argue that farm returns for cash rent farmland have remained stable while cash rent has increased. Cash rent represents a passive return to owning farmland. Over the 2006 to 2024 time period, returns to owning farmland have increased above the average returns to operating farmland. This trend leads to concerns over competitive pressures among farmers, particularly those who need to increase their farmland base to remain financially viable. This has significant implications for younger producers attempting to use returns from cash rented farmland to increase the owned land base throughout their farming careers. Historically, cash rents have been positively related to farmland prices. Debt service requirements also typically increase with farmland prices. The combination of these factors results in and increasing number of cash rented acres needed to support an acre of purchase. Hence, it becomes more difficult for young producers to grow their farms.

On the other hand, owned farmland provides a financial buffer for those farmers who already own more of their farmland base. Many farmers who own farmland do so with little mortgage debt. Hence, these farmers are trading a cash rent ($359 per acre) with the costs of owning farmland, which include property taxes, maintenance, and remaining debt service. Owned farmland can be associated with average cash flow requirements close to $100 per acre. Hence, owning farmland near debt-free can result in a $259 cash flow advantage over cash renting farmland. This can provide a great deal of financial stability to a farming operation. Hence, more established farms will have a much stronger financial basis for withstanding periods of low returns.

From 2014 to 2017, cash renting farmland generated marginal financial returns. Excellent returns and the financial resources accumulated between 2007 and 2013 helped offset the low returns from 2014 to 2017. The more positive returns from owned and shared rental farmland also assisted in mitigating the low returns from 2014 to 2017.

Lower commodity prices and higher production costs have led to another period of low returns for the 2023 and 2024 crop years. In fact, the low returns experienced in 2023 and projected for 2024 are much lower than those experienced from 2014 to 2017. Still, the excellent returns and re-building of financial resources from 2020 to 2022 will likely provide funds for the current low returns. A slight decline in cash rents, as was experienced from 2015 to 2017, will likely occur in 2025.

At the end of 2024, working capital on many farms will be eroded, and debt-to-asset ratios will rise. A continuation of 2024 returns into 2025 will result in further erosion. At some point in the future, the financial resources of farms with significant debt may become depleted, and those farms will be forced to negotiate lower cash rents or release the land to higher bids from other farmers. The extent to which this will occur will depend on how long low returns persist.

Summary

We have again reached the point where cash renting farmland has negative returns. History would suggest that reductions in cash rents gradually occur with small adjustments over multiple years. Furthermore, downward adjustments in cash rents historically do not fully reflect downturns in farm returns. That situation likely will continue until a larger share of farm operations are forced to reduce cash rents because of the erosion of their financial positions. Whether that occurs will depend on commodity price and cost changes over the next several years. Agricultural returns are hard to predict far into the future.

Over the last 20 years, it appears that a larger share of the returns to farming are accruing to owning the farmland rather than operating the farmland. That switch benefits individuals who own farmland, which includes more established farmers. On the other hand, younger producers trying to increase their owned land base are disadvantaged by this switch.

References

Schnitkey, G., N. Paulson and C. Zulauf. "2024 Low Returns, Prices, and the Federal Safety Net." farmdoc daily (14):164, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 10, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.