Farm Policy Background: Income of U.S. Farm vs. Nonfarm Population

Overview

This post is the first in a series that will examine big picture issues that frame U.S. farm safety net policy. Impetus for the series is the recent rejection by the U.S. House of Representatives of the proposed 2013 Farm Bill. While spending on food nutrition programs was a key issue, both the proposed spending and structure of the farm safety net impacted at least some, maybe many, votes. Thus, the decision by the House of Representatives suggests the U.S. is now fully engaged in a major debate about the future of its farm safety net. These types of debates are more about the big policy picture than about specific policy parameters, such as the level of target prices. This post specifically examines the issue of farm income relative to the income for the rest of the U.S.

Historical Perspective

Average income of U.S. farm households has exceeded average income of all U.S. households every year since 1996, a full decade before the start of the recent farm prosperity (see Figure 1). Moreover, since 1972, income of farm households has exceeded income of all households in 67% of the years. The major exception is 1979 through 1984, a period that overlaps with the farm financial crisis. Note that farm household income is calculated using net farm income. For a more detailed discussion comparing U.S. farm household and all U.S. household income see the U.S. Department of Agriculture (USDA), Economic Research Service (ERS) website (available here).

Average household incomes can be compared back to 1960. In 1960, average farm household income was 65% of average U.S. household income. Thus, over the last half century, farm household income has increased substantially relative to income of U.S. households.

To obtain a longer historical perspective, two data series need to be spliced. Specifically, USDA, ERS published a comparison of per capita (per person) personal income from 1934 through 1983. This data also is presented in Figure 1. It is from the Economic Indicators of the Farm Sector: Income and Balance Sheet Statistics, 1983 (available here). Specifically, Figure 1 contains per person disposal personal income. Disposable income is total personal income minus personal current taxes. In 1934, per person disposable income of farms was 39% of U.S. per person disposable income. By 1983, the ratio was 69%. The ratio of farm household income to all U.S. household income usually exceeds the ratio of per person disposable income because farm households are larger on average than nonfarm households. Again, per capita farm income is calculated using net farm income.

Caution is always in order when conducting a comparison over time and when comparing across different data sets. Nevertheless, the trend is so strong that it is difficult to argue that farm income is not substantially higher relative to nonfarm income now than when farm programs began in 1933. This historical perspective is relevant for the current debate because farm programs were adopted in part as a response to the poverty of the U.S. farm population, which was 25% of U.S. population in 1930. Critics of farm policy commonly mention this historical change in relative economic status.

Role of Nonfarm Income

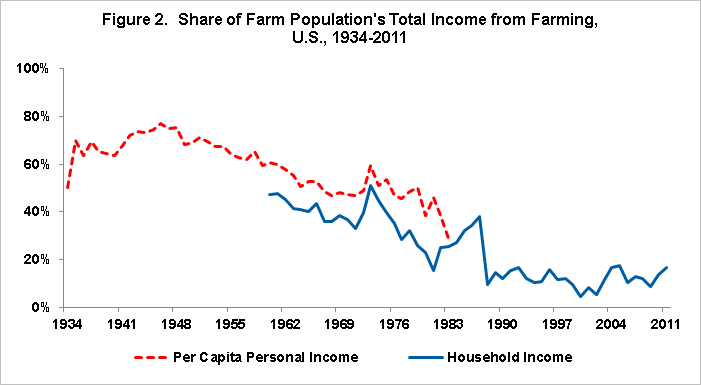

The increase in farm income relative to nonfarm income is the result of many factors, but two stand out. One is the increasing size of the farm production unit, which in turn is partially driven by technology. The second is the increasing role of nonfarm income (also referred to as off-farm income). Figure 2 is a companion to Figure 1, specifically presenting the ratio of the income of the farm population (or households) that comes from farm sources. Nonfarm income comes from varied sources. The majority are wages and salaries from off-farm jobs, followed by transfers, such as Social Security, and income from nonfarm businesses. Farm income provided over 60% of per capita income of the U.S. farm population in the 1940s and 1950s. In contrast, farm income has provided less than 15% of all income of farm households in recent years, even including the farm prosperity years since 2005.

Supporters of farm programs are quick to point out that the role of nonfarm income is smaller on larger farms, which produce the majority of U.S. farm output. Figure 3 presents the household income figures for farms with gross sales of $250,000 or more in 2011. These farms accounted for 82% of the value of U.S. farm production in 2011. The data are from the USDA, ERS website (available here). While nonfarm sources accounted for only 25% of the household income of these farms, their total household income averaged $205,215 or 194% more than average U.S. household income for 2011. Thus, it is not clear that focusing on larger U.S. farms necessarily strengthens the argument for a U.S. farm safety net policy.

It is worth noting that, while nonfarm income is a smaller share of household income on larger farms, it is not small on average. Off-farm income of farms with over $250,000 in farm sales in 2011 exceeded $50,000, which is 72% of U.S. average household income in 2011. While not commonly discussed, it appears that an important prerequisite for farming in the 21st Century in the U.S. is to have a second (or more) source of income not from the farm. Nonfarm income not only increases total household income but also is an important risk management strategy.

Farm Size Consideration

It is commonly pointed out that an increasingly small share of the U.S. population has any tie to farming, including through grandparents and friends. A related issue is the ability of the nonfarm population to relate to the size of a modern farm. Figures 4 and 5 are an attempt to illustrate how this consideration has changed over the last half century. It is the comparison of these two figures, not the individual figures that matter.

Total gross farm sales for the median size farm that raised the 5 largest value farm commodities included in the farm safety net is calculated. The commodities are corn, cotton, soybeans, wheat, and dairy. The calculation uses data from the 2007 and 1964 Census of Agriculture (available here). The median size farm is the farm for which 50% of the farms raising the commodity had fewer acres of the commodity (fewer milk cows) and the farm for which 50% of the farms raising the commodity had more acres of the commodity (more milk cows). To illustrate, in the 2007 Census, the corn farm with 50% of all farms growing corn having less acres of corn and 50% of all farms growing corn having more acres of corn had gross farm sales from all farm commodities of $132,216. The reason for using total farm sales, not sales from corn only, is that the concern in this article is comparing farm households with the nonfarm household. The median size farm is arrived at using the arithmetic technique of interpolation.

In 2007, total farm sales of the median size farm raising corn, soybeans, wheat, dairy, and cotton was at least 95% higher than average U.S. household income (see Figure 4). Obviously this comparison is not valid because gross sales include expenses. However, contrast the picture of 2007 with the picture from the 1964 Census (see Figure 5). In 1964, average U.S. household income was $7,336, which exceeded the gross sales of the median size cotton, dairy, and corn farm. Even gross sales for the median size farm raising soybeans was only 41% greater than average U.S. household income in 1964. Taken together, Figures 4 and 5 illustrate that it is increasing harder for U.S. households to relate to the size of current farms.

Summary Observations

There is nothing novel in this discussion. Farm household income has increased relative to nonfarm household income. Key reasons for this increase are the increasing role of nonfarm income and the increasing size of farms. Non-farmers have an increasingly hard time relating to the larger size of farms. Each of these considerations influences the willingness of the non-farm population to support the farm safety net. However, these trends are not new. Thus, it appears that, either individually or in combination, they have not been a compelling set of reasons to substantially reduce or eliminate spending on the U.S. farm safety net.

However, their influence may be changing. The U.S. is currently engaged in updating its safety net. The key update is the extension of access to medical care to the general U.S. citizenry. This decision, which culminates a long run trend toward increasing access to medical care, is an expensive government program. There are 3 options for paying for it: increased government revenues, reducing the cost of existing medical services, and reducing spending on other government items. The answer will likely be a combination of all three. The size of the redistribution of spending from other government items to medical care will depend on the growth rate of the U.S. economy and the cost savings achieved in existing medical services.

Given the current state of the relationship between farm and nonfarm household income and the current size of farms, it will be hard for the U.S. farm safety net to avoid continuing cuts. Lower spending on the farm safety net will make it difficult to reach agreement because each farm actor wants to protect their part of the farm safety net. It would be easier to craft a new farm bill if projected baseline spending in the future was higher, but that means farm income would have to decline. Higher government spending on the farm safety net as a result of lower farm income may not be a desirable situation for the U.S. farm sector.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.