Overview of Commodity Program Decisions from the 2014 Farm Bill

This article provides an overview of the commodity program decisions of the 2014 Farm Bill, thereby provide a context for each decision that must be made. More details for each decision are available on the Farm Bill Toolbox. In summary, the article covers the following: 1) the definition of FSA farms; 2) the three decisions that will be made for each FSA farm; 3) the nature of the decisions that will be made; 4) linkages between commodity program and crop insurance decisions; and 5) payments and Adjusted Gross Income (AGI) limits.

Farm Service Agency

The Farm Service Agency (FSA) is an agency of the U.S. Department of Agriculture. FSA administers commodity programs through local offices located across the United States. Farmers and landowners will go to these offices to make commodity program decisions and sign contracts to enroll in the elected programs.

Farm Service Agency Farms

Decisions will be made for each Farm Service Agency (FSA) farm. Each FSA farm has a fixed description, a specific numerical designation, and a fixed number of acres. Over time, FSA farms can change through a reconstitution process. In some cases, landowners combined two or more FSA farms together into one FSA farm. In other cases, multiple farms arise from one FSA farm. Take, for example, one FSA farm that has 240 acres. Suppose 80 acres is sold to another individual. The one 240-acre FSA farm could become two: one for the 80 acres and the second for the remaining 160 acres. FSA rules govern the reconstitution process.

FSA farms that exist as of August 2014 will be used for the commodity program decisions. No reconstitutions can occur now that will affect 2014 Farm Bill decisions.

Each FSA farm has a “farm number”. This farm number defines the farm for FSA purposes. Farmers and landowners should determine what acres are included in each FSA farm.

Many farmers and landowners will have interests in multiple FSA farms. The following decisions will be made for each FSA farm, meaning the decisions for any one farm are not dependent upon the decisions made for other FSA farms.

Farmers and Landowners

Often, ownership and operation of an FSA farm will be split across individuals. There will be a landowner who owns the farm and a producer who operates the farm. More complex relationships with multiple owners and multiple producers can arise. For the following decisions, landowners will be responsible for specific decisions and producers will be responsible for others. If there are multiple individuals involved in an operation, there cannot be different decisions across individuals. There will be one set of decisions for each FSA farm.

Decisions

There will be three sets of decisions made for each FSA farm:

- Keep or update payment yields.

- Retain or reallocated base acres

- Determine program choice for each crop on an FSA farm.

A brief description of each decision is provided in the following sections.

Keep or Update Payment Yields

On most FSA farms, there are covered commodities (also called program crops) that have program yields (see Figure 1 for a list of program crops). These program yields are on record with FSA and FSA sent the information to landowners and farmers in letter around the beginning of August. Landowners can choose to keep current “program” yields or update those yields. In most cases, actual yields from 2008 through 2012 will be used to update yields, with the updated yield calculated as 90 percent of the average yields in those years.

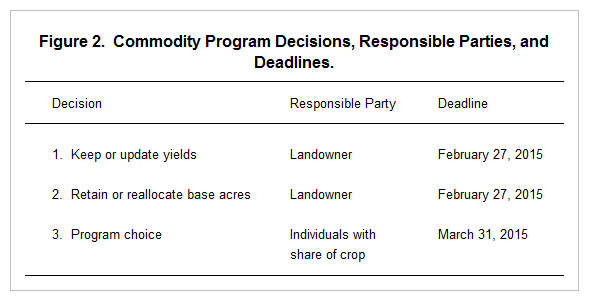

The keep-or-update yield decision is a landowner decision. Landowners have until February 27, 2015 to make the yield updating decision (see Figure 2 for deadlines).

More details on the yield updating decision are provided in step 2 of the ARC-PLC Decision Steps available in the Farm Bill Toolbox.

Retain or Reallocate Base Acres

Each FSA farm has a set of base acres for the covered commodity or program crop on the farm. The base acres also on record with FSA and sent to landowners and farmers in the above-referenced letter. These acres can be “retained” as they currently exist. Alternatively the distribution of acres across program crops can be updated to the proportion of acres in program crops from 2009 through 2012.

As an example, take a farm with a current allocation of 40 base acres in corn, 30 base acres in soybeans, and 30 base acres in wheat. This farm has 100 total base acres. Reallocated base acres will be proportional to program crop plantings from 2009 through 2012. Suppose that average acres in program crops were 50% in corn and 50% in soybeans. In this case, reallocated base acres are 50 base acres in corn and 50 base acres in soybeans. The reallocation decision will not change total base acres in the farm. It will only impact the distribution of base acres for the program crops recently planted on the farm.

The choice is between two alternatives:

- Retain current base acres. In the above example, 40 acres in corn, 30 acres in soybeans, and 30 acres in wheat.

- Reallocate base acres. In the above example, 50 acres in corn and 50 acres in soybeans.

This decision will be made by the landowner and must be made by February 27, 2015. More details on the yield updating decision are provided in step 3 of the ARC-PLC Decision Steps available in the Farm Bill Toolbox.

Program Choice Decision

Producers and share rent landowners can choose to receive commodity program payments through one of three programs (see Figure 3). For this decision, a landowner in a cash rent lease does not make the decision for the FSA farm due to the definition of producer, which requires sharing in the risk of producing a crop and in the marketing of any crop produced. The following are the three programs:

- Price Loss Coverage (PLC) is a fixed-price price program. PLC payments will be made when the national market year average (MYA) price is below a reference price (see Figure 1 for reference prices) set in the statute; the reference price does not vary across years.

- Agricultural Risk Coverage at the county level (ARC-CO). ARC-CO is a county-level revenue program that makes payments when county revenue is below a guarantee. The guarantee is set at 86% of a benchmark revenue that is based on previous county yields and national MYA prices. The guarantee will change over time. There is a per acre limit on ARC-CO payments equal to 10% of the benchmark.

- ARC at the individual level (ARC-IC). ARC-IC is a whole farm revenue program in that it calculates all program crops on the FSA farm together and provides payments when farm revenue for program crops as a whole falls below a guarantee. Previous farm yields are used to set the benchmark, and the guarantee is also at 86% of that benchmark. There is a per acre limit on ARC-IC payments equal to 10% of the benchmark.

For each program crop, a farmer could choose to enroll a crop in either PLC or ARC-CO. Decisions could be the same or split across crops. For example, corn could be enrolled in ARC-CO and wheat could be enrolled in PLC. If ARC-IC is chosen, however, all crops on the FSA farm must be enrolled in ARC-IC. In addition, if multiple farms are enrolled in ARC-IC, there will be one guarantee and payment rate across all ARC-IC farms.

The above program decisions also impact the availability of Supplemental Coverage Option (SCO). SCO is a county-level crop insurance program administered through crop insurance agents. SCO provides protection for a coverage zone that extends from 86% down to the coverage level of the COMBO product.

These decisions will be made by individuals with a share of revenue. If a farm is cash rented, the farmer cash renting the farm has the responsibility of making the decision. If a farm is share rented, both the farmer and land owner are involved in the decision-making. The deadline for making these decisions is March 31, 2015.

More details on the program choices are provided in steps 4 through 6 of the ARC-PLC Decision Steps available in the Farm Bill Toolbox.

Nature of these Decisions

- The decisions cannot be changed once the deadline has passed. This means that yields cannot be updated and acres cannot be reallocated after February 27, 2015. Program choices cannot be changed after March 31, 2015.

- These decisions will last the life of the 2014 Farm Bill. The 2014 Farm Bill is scheduled for 2014 through the 2018. If extensions are passed to the 2014 Farm Bill, the above decisions will carry forward through those extensions unless the U.S. Congress specifically includes provisions in the extension legislation that allows for decision changes.

- The decisions follow the FSA farm. Suppose a farmer makes a program choice on cash rent farmland and farms the FSA farm in 2014 and 2015. A new farmer then takes over in 2016. The new farmer cannot change the program choice, program yields, or base acres on that farm. The decisions made by the first farmer will carry through. Similarly, selling a farm to a new owner will not change the decisions; the new owner has purchased the program attached to that farm as well as the base acres and payment yields.

- Program yields and base acres may carry through to future farm bills. History suggests that the elected program yields and base acres could exist for additional farm bills.

- There are defaults if decisions are not made:

- Old program yields will be kept.

- Base acres will be retained.

- The program choice will be PLC and payments for 2014 will be forfeited. This default option also applies if all operators on a FSA farm do not elect the same program option.

Linkages with Crop Insurance

A producer does not need to buy crop insurance in order to receive commodity program (ARC and PLC) payments. Also, a producer does not have to participate in a commodity program to be able to buy crop insurance. However, program choice will impact the availability of SCO. SCO will not be available on base acres for commodities enrolled in either version of ARC.

Payment Limits and AGI limits

There are payment limitations associated with commodity programs. Each individual cannot receive more than $125,000 in total commodity program payments during a year, including marketing loan gains and loan deficiency payments. In most cases, a husband and wife can have separate payment limits together totaling $250,000. No limit exists for payments made by crop insurance products, including SCO.

No payments can be received by an individual with an Adjusted Gross Income (AGI) of more than $900,000. AGI is calculated using a three-year average of previous taxable year income.

Summary

This article provides an overview of the commodity program decisions that are part of the 2014 Farm Bill. More details on each of these decisions are provided in a seven-step process available on the Farm Bill Toolbox.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.