Corn Exports: Rocket Ship to Where?

US corn export sales have been extremely strong in the past month. Weekly sales exceeded 2 million metric tons or roughly 79 million bushels in each of four weekly USDA Foreign Agricultural Service (FAS) Export Sales reports to the week ending October 31. On 15 of the 23 business days in October, USDA FAS announced sales activities for corn that exceeded the reporting threshold of 100,000 metric tons (3.9 million bushels) to a single destination country in a day. Since November 1, USDA has announced five more of these so-called flash sales, suggesting the wave of export activity has yet to break.

What does this rush in export sales imply for the US corn market outlook? Corn prices have rallied in response to this news. The corn futures price for December 2024 delivery has increased roughly 30 cents per bushel in the past four weeks but current prices remain roughly similar to where they began October. From the farmer’s perspective, the export sales boom can be viewed as an opportunity to make sales or a reason to continue holding in expectation that this trend will persist.

This article puts the recent corn export sales surge in context. I discuss reasons for more corn export sales, where this leaves the overall supply and demand situation, and whether the corn export sales rocket ship might continue to the moon, head back to earth, or follow some altered trajectory.

The Corn Export Sales Surge

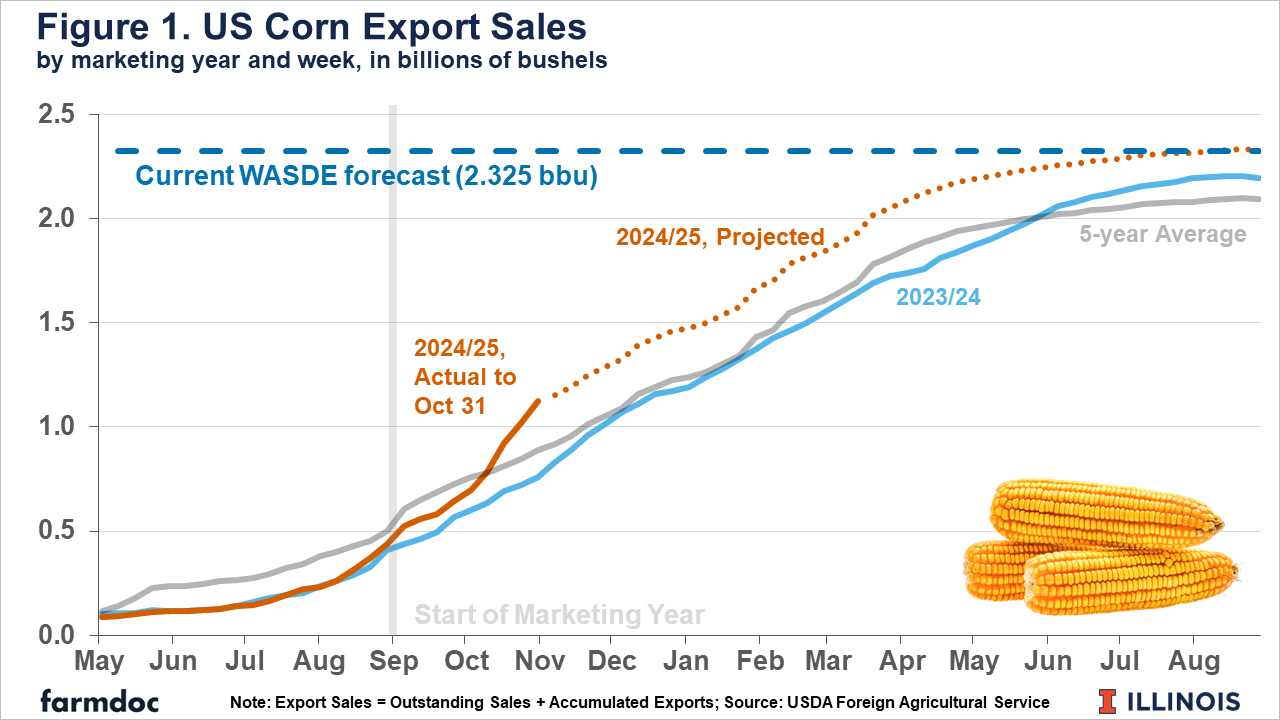

The US corn export sales surge began in early September. At the start of the corn marketing year on September 1, export sales as shown in Figure 1 were slightly above the previous 2023/24 marketing year level but below the previous 5-year average. By October, some green shoots in the form of announced sales justified marketing year corn export forecasts by USDA that some had viewed as optimistic. (See farmdoc daily October 8, 2024) However, only in the last few weeks did the export sales pace move above the previous five-year average. Week-over-week changes in export sales are a combination of changes in both new outstanding sales added to the export sales book and realized export shipments. In the last four weeks, corn export sales have increased more than 100 million bushels per week, more than three times the typical five-year average pace.

Figure 1 also shows the current USDA forecast level for corn exports. Last week’s World Agricultural Supply and Demand Estimates (WASDE) report left total marketing year exports at 2,325 million bushels. This level represents an increase from initial corn export projections which the WASDE had pegged at 2,200 million bushels back in May. The increase in expected marketing year exports of just 125 million bushels appears small when compared to the torrid pace of sales observed in the past month.

Explanations for greater corn export sales in the past month have generally centered on the US corn harvest, the response of particular trading partners, and expectations for future US trade policy. The export sales surge has coincided with the conclusion of a relatively successful corn harvest. Last week’s updated USDA projections confirmed a record national corn yield of 183.1 bushels per acre. (This was down slightly from last month’s estimate, suggesting big crops don’t always get bigger, see farmdoc daily October 3, 2024) Buyers have responded to a large US corn crop that is competitively priced relative to alternative origins and substitute grains.

Mexico has been the major buyer of US corn in the past few weeks. This is perhaps unsurprising given Mexico’s role as the biggest importer of US corn in the past few years. However, it has been suggested that Mexico is front-loading their corn purchases from the US earlier in the marketing year. Mexico and other countries may have been buying early due to concerns about a more complex and costly environment for international trade when the Trump administration assumes office in January.

What Trajectory for Future Corn Export Sales?

What are the prospects for marketing year total US corn exports, given both strong export sales to date and concerns that importers have shifted activity earlier in the marketing year? If the current October 2024 pace continued – a wildly optimistic, ‘to-the-moon’ scenario – then exports would exceed the current WASDE forecast by mid-January. This will not happen. On the other hand, export sales activity has also stopped abruptly and crashed to earth in the past. In the 2022/23 marketing year, US corn export sales were basically flat between April and August of 2023.

Figure 1 presents an in-between forecast scenario (given by the dotted line) where the exports sales pace slows immediately, but then follows the previous five-year average pace. Under this scenario, total marketing year export sales would be almost exactly in line with the current WASDE forecast of 2,325 million bushels.

Concluding Thoughts

US corn is relatively cheap, compared both to other origins and especially to price levels seen the past four years. Abundant supply, as much as new demand, explains the very active market for US corn exports in the past month. Much of this increase was already built into the overall market outlook from USDA and many other analysts. While the specific pace of US corn export sales may have been surprising, the past month’s activity does not imply much higher prices in the context of the overall market situation.

Going forward, market watchers will key on the prospects for the South American corn crop, especially planted acreage estimates for Argentina and Brazil. Significant production issues for corn in the southern hemisphere in 2025 seem the most likely catalyst for higher prices in the near term.

However, the US agricultural trade picture remains especially murky in the transition to a new administration in Washington DC. Even current export sales commitments are perhaps less solid than one might like. Roughly 30% of current marketing year outstanding sales for corn are listed having unknown destinations in USDA FAS data. This is the highest proportion observed at this time of the marketing year since 2016/17. Export sales commitments are a form of forward-looking data that require confirmation in the form of realized export shipments. Market analysts will be watching to see on which shores those ship land and when.

References

Irwin, S. and D. Good. "Revisiting Big Corn and Soybean Crops Get Bigger." farmdoc daily (14):180, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 3, 2024.

Janzen, J. "A Breath of Optimism for Corn in a Down Market." farmdoc daily (14):182, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 7, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.