Record Soybean Harvest in South America and Favorable Outlook for Exports

South American countries, which together produce about 55% of the world’s soybean supply, are on track to set a record in the 2024-25 crop season, despite localized drought challenges in some regions. Brazil’s soybean production is expected to reach an all-time high, Argentina’s production is projected to remain steady compared to last season, while Paraguay’s soybean output is forecast to decline from last year’s record harvest. In this article, we analyze the latest forecasts for South America’s harvest season and how record production in the coming months should keep downward pressure on global soybean prices. Additionally, we explore the potential impact of recent U.S. tariffs and Argentina’s export tax reductions on global soybean trade this year.

Different Results Across Countries

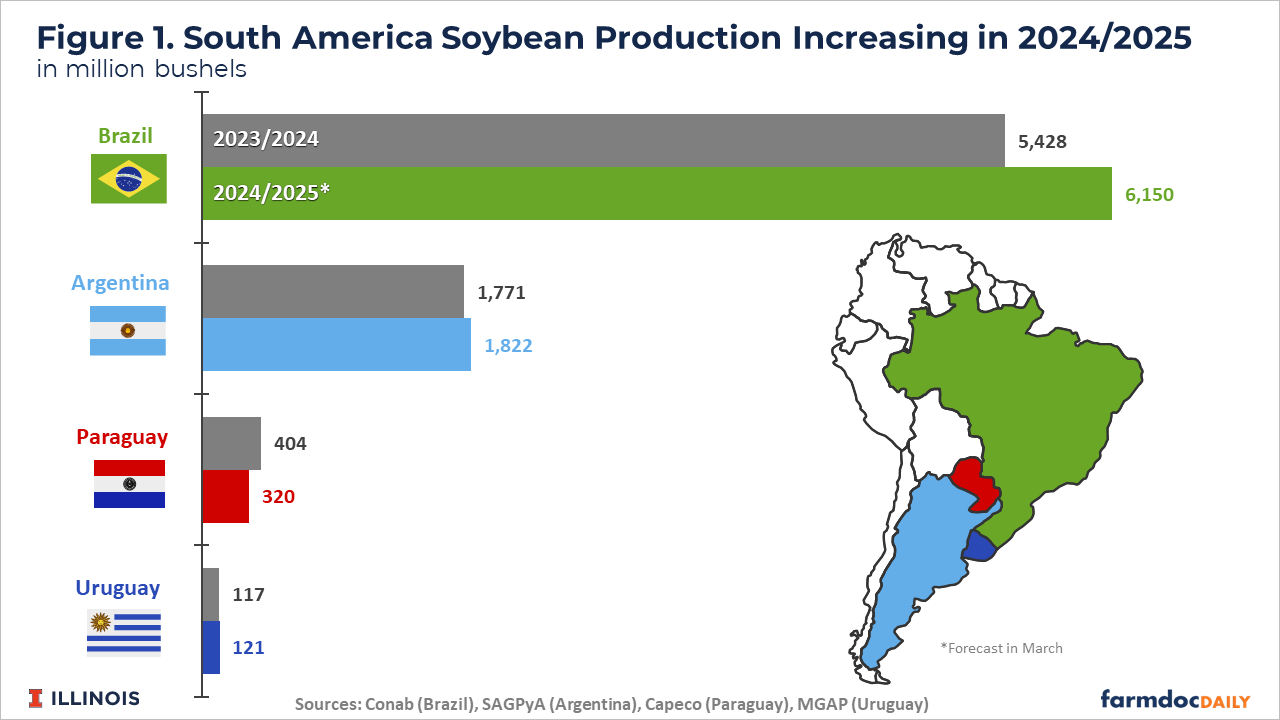

Current estimates suggest 2024-25 soybean output in Brazil, Argentina, Paraguay, and Uruguay will reach 8,413 million bushels, an increase of 693 million bushels (9%) compared to the previous season (see Figure 1). South America’s soybean harvest could have been even larger if not for the impact of La Niña, a weather phenomenon that has reduced rainfall in southern Brazil, as well as parts of Argentina and Paraguay, while increasing rainfall in Brazil’s Center-West and Northeast regions.

While the harvest is still underway in Brazil and set to begin in Argentina in April, a sudden shift significant enough to alter the outlook for a record South American soybean harvest seems unlikely. In Paraguay, the harvest is nearly complete, with production forecast at 320 million bushels—a 20% decline from last year’s record output. The decrease is attributed to lower yields in the Paraguayan northern regions due to drought, while the southern regions have experienced favorable yield levels.

Brazil’s Harvest Reaches Historic High

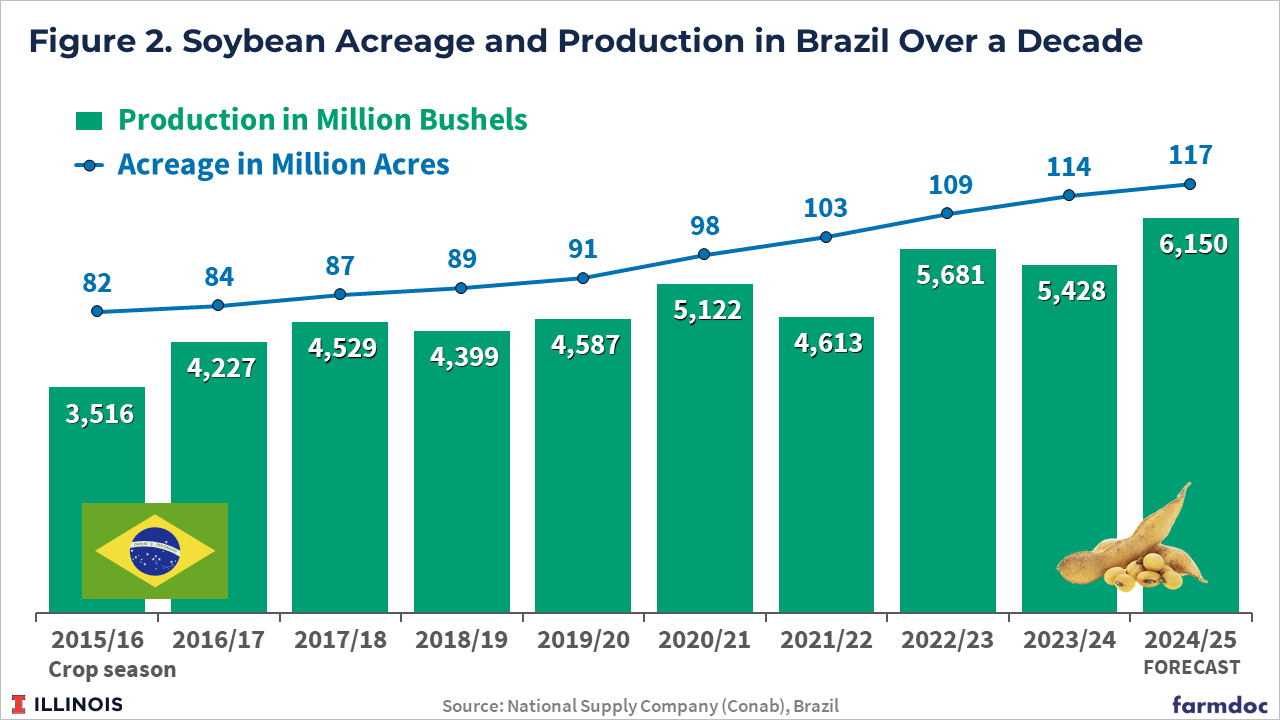

The Brazilian soybean crop is projected to reach a record 6,150 million bushels, a 13% increase from last year, according to the latest report from the National Supply Company (Conab), released last week and discussed during a farmdoc webinar (see Figure 2). Some private consultancies have even higher estimates, forecasting Brazil’s soybean harvest between 6.2 and 6.3 billion bushels. Brazil is the world’s largest producer and exporter of soybeans.

As of March 16, approximately 70% of the soybean area had been harvested in Brazil, above the five-year average of 65%, according to Conab. Overall, yields were strong across the Center-West, Southeast, and Northeast regions, benefiting from abundant rainfall, with only a few exceptions. In Mato Grosso, the country’s largest soybean-producing state, the harvest is nearly complete, with an average yield projected at 58 bushels per acre—25% higher than the previous season, according to the Mato Grosso Institute of Agricultural Economics (IMEA).

In contrast, dry conditions have impacted Brazil’s southern states, particularly Rio Grande do Sul, the country’s southernmost state. Yields there are expected to reach only 37 bushels per acre due to hot and dry weather in January and early February. Another state affected by drought is Mato Grosso do Sul, in the Center-West, where the estimated yield is 47 bushels per acre. Despite these regional differences, the national average yield remains strong at 52 bushels per acre, representing an 10% increase from last year, according to Conab.

Abundant supplies, a highly favorable exchange rate, and potential repercussions from a new trade war between the U.S. and multiple trading partners could push Brazil to set a new export record in 2025 (see farmdoc daily, January 21, 2025). At the beginning of March, soybean export premiums at Brazilian ports reached their highest level for this period since 2022, when the conflict between Russia and Ukraine started. At Paranaguá Port in southern Brazil, the premium for March 2025 shipment stands at $0.85 per bushel, according to the Center for Advanced Studies in Applied Economics at the University of São Paulo (Cepea/USP). In the last week of February, the premium was offered at $0.50 per bushel, compared to – $0.35 per bushel one year ago.

The Brazilian Association of Vegetable Oil Industries projects that Brazil’s soybean exports will reach 3.9 billion bushels this year. In 2024, exports totaled 3.6 billion bushels, the second-highest volume on record. The depreciation of the Brazilian Real against the U.S. dollar has made Brazilian soybeans more competitive in the global market, although it raises the cost of imported inputs (see farmdoc daily, February 20, 2024). Market expectations indicate that the Brazilian Real will continue trading above R$5,50 to USD $1 in 2025.

Argentina’s Potential Production Recovers

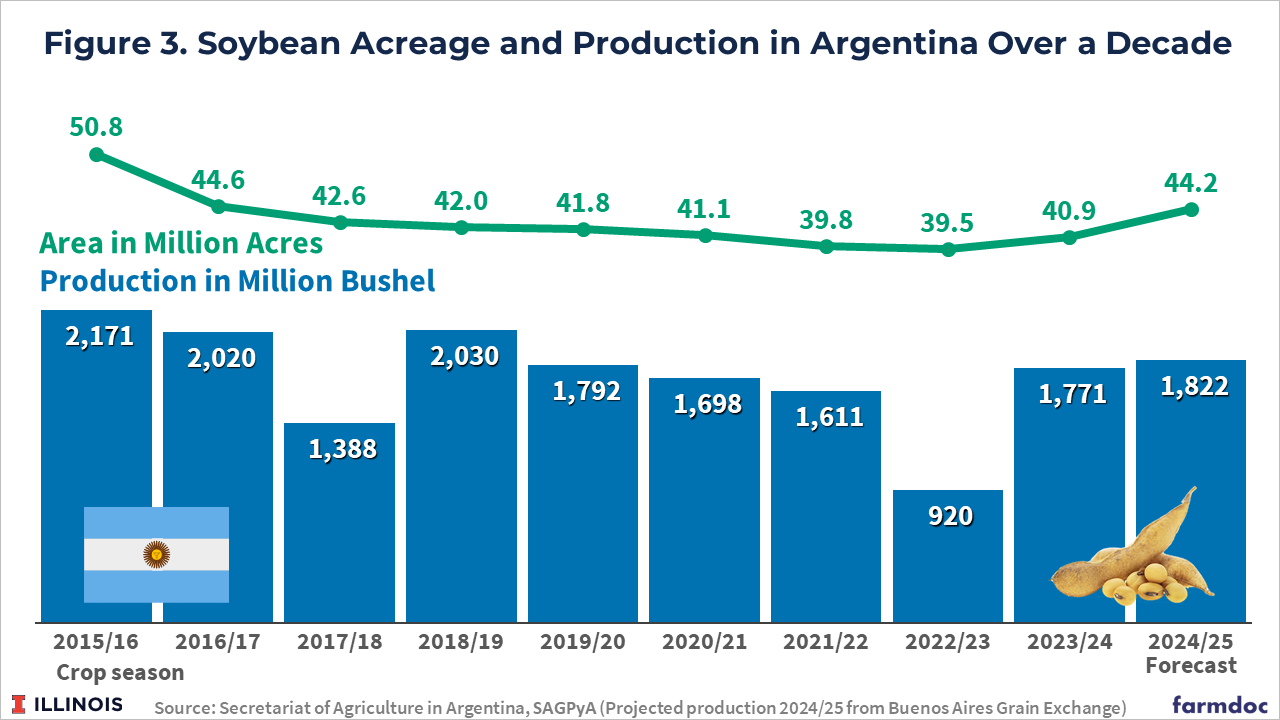

The 2024-25 Argentine soybean crop is projected to be similar to last year’s, totaling 1,822 million bushels, according to the Buenos Aires Grain Exchange (see Figure 3). Lower yields are expected to be offset by an 8% increase in planted area compared to the previous season, driven by a reduction in corn acreage due to losses caused by the presence of corn stunt disease (see farmdoc daily, May 28, 2024). In the 2024-25 crop year, soybean acreage expanded to 44.2 million acres—the largest increase in planting since the 2015-16 season.

Crop prospects in Argentina looked bleak after a dry January, but much-needed rainfall in late February brought some relief. Precipitation across key agricultural regions, including La Pampa, Buenos Aires, and Entre Ríos, has helped stabilize crop conditions. In Argentina’s 2024/25 soybean crop, approximately 70% of the fields were planted early, while 30% were sown later, over a winter crop. While late-planted soybeans have faced challenges in crop establishment due to high temperatures and drought conditions, early planted soybeans are in general in good condition. The harvest is expected to begin in April.

During the summer growing season, Argentine producers received positive news. At the end of January, President Javier Milei’s government reduced export tariffs on soybean meal and soybean oil from 31% to 24.5%, while the tax on unprocessed soybeans was lowered from 33% to 26%. These reduced export taxes will remain in effect until June 30 and could be further reduced afterward. Argentina remains the world’s largest exporter of processed soybean meal and oil.

Final Considerations

Brazil’s soybean production is expected to reach a record high, driven by an expansion in planted area and strong yields across most regions. In Argentina, production is projected to remain steady compared to last year, with a larger planted area offset by lower yields. Meanwhile, Paraguay’s soybean output is forecast to decline from last year’s record harvest.

With the harvest about halfway complete in Brazil, finished in Paraguay, and just a few weeks away in Argentina, major shifts that would change the outlook for a record South American harvest are unlikely. The expected total production of nearly 8.5 billion bushels for 2024/25 is likely to keep global prices under pressure, at least through the first half of the year.

In the context of global soybean trade, Brazil could further expand its share of exports due to a new round of emerging trade tensions between the United States and major trading partners and continued strength of the U.S. dollar. The current scenario is also favorable for higher exports from Argentina. In the coming crop years, lower export taxes and a more stable macroeconomic environment could encourage investment and technology adoption in Argentina’s agricultural sector, leading to higher productivity and increased exports.

Data Source and References

Buenos Aires Grain Exchange, Agricultural Estimates. Buenos Aires. March 2025.

Cabrini, S., J. Colussi and N. Paulson. “Spread of Corn Stunt Disease Lowers Production Expectations in Argentina.” farmdoc daily (14):100, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 28, 2024.

Colussi, J., G. Schnitkey, N. Paulson and C. Zulauf. “U.S. Agricultural Trade Background Given Potential Tariffs.” farmdoc daily (15):13, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 21, 2025.

Colussi, J., G. Schnitkey, J. Janzen and N. Paulson. “The United States, Brazil, and China Soybean Triangle: A 20-Year Analysis.” farmdoc daily (14):35, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 20, 2024.

Conab, National Supply Company. Crops Time Series. Soybean Production. Brasília, Brazil. March 2025.

SAGyP, Agriculture, Livestock and Fisheries Secretary of Argentina. Agricultural Estimates. Buenos Aires. March 2025.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.