The Relationship between Stocks-to-Use and Corn and Soybean Prices: An Alternative View

The release of the USDA’s Prospective Plantings report provides the first survey-based information for forming expectations about the size of the 2016 corn and soybean crops. Production expectations can now be used to project the 2016-17 U.S. marketing year balance sheets–supply, consumption, ending stocks, and marketing year average price. The surprisingly large increase in corn acres to 93.6 million acres intended for 2016 creates a particularly strong interest in corn price prospects. Many are asking just how low corn prices can go if the intended level of planted acreage and trend yield are realized. In an attempt to quantify marketing year price expectations based on supply and consumption balance sheet projections, we have previously examined the variation of the marketing year ending-stocks-to use ratio as an explanation of the marketing year average farm price of corn and soybeans (farmdoc daily, April 9, 2015; May 14, 2015). In today’s article, we review and update our previous analysis of the relationship between the marketing year ending stocks-to-use ratio and the marketing year average farm price of corn and soybeans in the U.S. We then present an alternative model for the relationship between the stocks-to-use-ratio and average farm price that we believe may provide a more accurate representation of the true relationship.

Previous Analysis

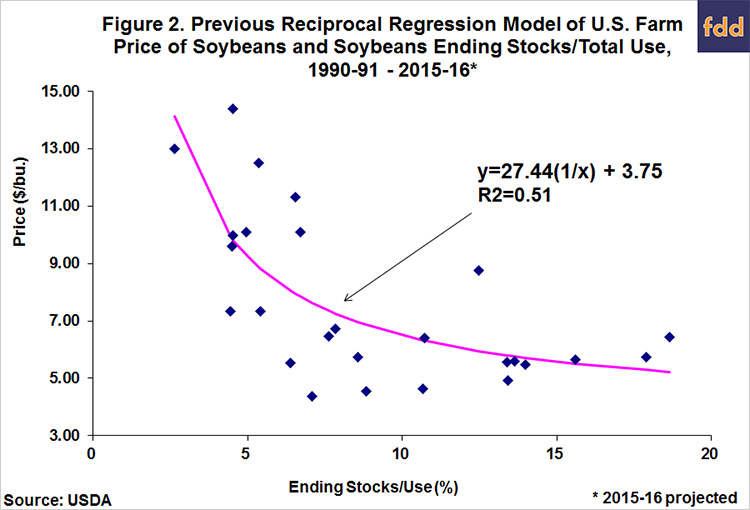

We start with a brief update of the analysis of the relationship between the marketing year ending stocks-to-use ratio and the marketing year average price of corn and soybeans presented last year (farmdoc daily, April 9, 2015; May 14, 2015). The relationships between ending stocks and marketing year average price that we previously identified are presented in Figures 1 and 2 for the period 1990-91 through 2015-16. Observations for the current year are based on projections of ending stocks and the mid-point of the projected marketing year average price presented in the March 9, 2016 USDA WASDE report. The only difference between our results last year and those presented in Figures 1 and 2 is the addition of the observation for 2015-16.

As expected, there is a general negative relationship between the stocks-to use ratio and the average farm price in Figures 1 and 2. That is, a low stocks-to-use ratio is associated with a high price and vice versa. For corn, we argued that the relationship should be viewed in the context of two different eras. The first era spans from 1990-91 through 2005-06 and consists of the lower and more horizontal cluster of points in Figure 1. The second era spans from 2007-08 through 2015-16 and it contains the upper and more steeply sloped cluster of points in Figure 1. Note that 2006-07 is treated as a transition year is this division of eras. As we have argued for some time now (e.g., Irwin and Good, 2009), the two eras represented in Figure 1 are mainly differentiated by the substantial increase in ethanol demand for corn that began in 2007-08.

For soybeans, we also argued last year that the relationship in Figure 2 should be viewed in the context of two separate eras differentiated by the increase in biofuel production and the rapid increase in Chinese soybean imports that both began in 2007-08.

Unlike what was found for corn, however, separating the observations into two eras did not result in a better fit between the stocks-to-use ratio and the average marketing year farm price, so a single model was fit to all the observations over 1990-91 through 2015-16.

In both Figures 1 and 2, we estimate the relationship between the average marketing year price and ending stock-to-use ratio over 1990-91 through 2015-16 (two separate eras for corn) using as a reciprocal regression specification:

- Price = a + b (1/Stocks-Use Ratio).

This specification is simple and imposes a curvilinear relationship between price and the stocks-to-use ratio. That is, the curves become steeper as the stocks-to-use ratio declines, and vice versa. The intercept coefficient, a, in this reciprocal specification has the interesting interpretation as the estimated minimum price for the period under consideration. The “slope” coefficient, b, does not have the usual interpretation of the change in price for a one-unit increase in the stocks-to-use ratio because of the inverse specification. Instead, at any given stocks-to-use ratio, the change in price for a one-unit increase in the stocks-to-use ratio is -b/(stocks-to-use ratio)2.

For corn the fit is particularly good in the latter period, with the stocks-to-use ratio explaining 86 percent of the annual variation in the marketing year average price from 2007-08 through 2015-16. The estimated regression line is much steeper for the second era compared to the first and also has an estimated minimum price (intercept) of only $0.35 per bushel. This is obviously an unrealistically low minimum price and may be a red flag that something is amiss with the specification during this latter period. For soybeans, the fit between the stocks-to-use ratio and average marketing year price is poor, as confirmed by the small percentage of variation in price explained by the stocks-to-use-ratio (R2 of 0.50).

For the 2015-16 corn marketing year, the regression specification for the latter period suggests an average price of $3.64, very close to the average price experienced in the first half of the marketing year and very close to mid-point of the current USDA forecast of the average price for the year of $3.60. For the 2015-16 soybean marketing year, the regression specification suggests an average price of $5.94, obviously well below the average price experienced in the first half of the marketing year and well below the mid-point of the current USDA forecast of the average price for the year of $8.75.

While the previous model of the relationship between the stocks-to-use ratio and price appeared to provide a satisfactory level of explanation of the marketing year average farm price of corn, the ratio clearly does not satisfactorily explain the average farm price of soybeans. In fact, we concluded last year that the projected soybean stocks-to-use ratio was not useful in projecting the marketing year U.S. average price of soybeans. The estimated relationship for corn in the latter period, while exhibiting a good fit, is much more steeply sloped than the base period relationship and has an unrealistically low estimated minimum price. While the slope of the stocks-to-use and price relationship can certainly change over time, reflecting changes in the slopes of the underlying demand curves, the slope change in Figure 1 seems unreasonable. These potential problems motivate the search for an alternative model that better explains the relationship between stocks and price for corn and soybeans.

Alternative Model Specification

In a recent study, Verteramo and Tomek (2015) investigate changes in U.S. corn demand by utilizing futures price changes after the release of USDA WASDE reports and the supply forecasts contained in the reports. They confront the basic identification problem presented by a scatter of price-quantity observations. Specifically, is a specific observation due to a shift in demand, a shift in supply, or both? Verteramo and Tomek make two basic assumptions that allow them to address this classic identification problem: 1) futures prices provided unbiased expectations of subsequent cash prices; and 2) demand variability is less than supply variability. These assumptions allow the authors to identify the relationship traced out by price and quantity observations as corn demand curves. In essence, the authors assume that shifts in the supply curve swamp shifts in the demand curve and this traces out a demand curve (or curves). Another key assumption used by the authors is that the slope of the demand curve is most accurately estimated during the base period of 1995-2005 and that observations after 2005 are simply the result of parallel shifts in this base demand relationship. In other words, the much higher prices observed after 2006 are primarily the result of demand shifts with a relatively fixed supply.

We use the framework of Verteramo and Tomek to specify an alternative reciprocal regression model for 1990-91 through 2015-16 in corn and soybeans. Specifically, we estimate a base relationship for 1990-91 through 2005-2006, skip 2006-07 as a transition year, and then estimate relationships after 2005-06 that are exactly parallel to the base period model. By way of contrast, in Figure 1 we estimated one regression model for corn using all the observations between 2007-08 and 2015-16. This model had both a different intercept and slope than the base period model. In the new model, we assume the slope is unchanged between the base period and relationships after 2005-06, but the intercept varies in the latter period to reflect demand shifts that occurred after 2005-06. Hence, the assumption that the slope does not change during the entire sample period is central to this alternative model specification. This is not as extreme an assumption as it may first appear. As we noted earlier, the slope of the stocks-to-use and price relationship can certainly change over time, reflecting changes in the slopes of the underlying demand curves, but the very large literature on demand elasticities for agricultural commodities (e.g. Tomek and Kaiser, 2014) suggest these underlying slopes do not change a great deal over time.

Another potential issue is the impact of government price support programs that historically limited the downside movement of corn and soybean prices. This could clearly bias the slope estimates in the base period if this were the case. Fortunately, loan rates (effectively minimum price levels) for the non-recourse loan program in operation from 1990-1996 were well-below market prices, and therefore, did little to limit market price variability. After the 1996 “Freedom-to-Farm Bill,” the loan program allowed cash payments to be made in lieu of the Federal government supporting market prices through loan operations. This meant that even during periods when loan rates were above market prices, such as 1999-00 through 2001-02, that market price variability was minimally impacted. In sum, the operation of U.S. government price support programs during the 1990-91 through 2005-06 base period was not likely to have had a significant role in limiting the downside price variability of the market price for corn and soybeans. This was even more the case after 2005-06 as market prices far exceeded price support levels offered through the loan program.

Figure 3 presents our alternative reciprocal stocks-to-use and price model for corn. The base period model is very similar to the one presented in Figure 1 (it is not exactly the same due to the dummy variable specification used in the new model for later years.) Whereas Verteramo and Tomek specify a unique dummy variable intercept shifter for each year after 2005, we find that a simplified model with four groups of years works reasonably well, with the different groups reflecting different strengths of demand. The first group includes 2009-10, 2014-15, and 2015-16 and represents “weak” demand after 2005-06. The second group represents the first level of “moderate” demand and includes 2007-08, 2008-09, and 2013-14. The third group contains only one year, 2010-11, and it represents the second level of “moderate” demand. The fourth and final group includes 2011-12 and 2012-13 and it represents “strong” demand. A useful way to benchmark the strength of demand in the different groups is by comparing the intercepts, which estimate minimum (season-average farm) prices. From lowest to highest, the estimated intercepts are $2.96, $3.50, $4.20, and $5.44, which means that at any given stocks-to-use ratio the price of corn is $2.48 bushel higher under the strong demand relationship compared to weak demand. The R2 for the alternative model in Figure 3 is 0.99, but this is due to the inclusion of the dummy variables for the different groups of years. It is more important to note that all of the coefficients in the model are highly statistically significant.

Figure 4 presents our alternative reciprocal stocks-to-use and price model for soybeans. The base period model for soybeans is modified from that of corn to reflect the relatively large impact of the Asian financial crisis of the late 1990s (1999-00 through 2001-02) on soybean prices. The dummy variable coefficient is $1.63, providing concrete evidence of the large impact of this slump on the soybean market. It is also interesting that the estimated slopes for the base period models in corn and soybeans are quite close at 8.52 for corn and 8.04 for soybeans. This indicates that a one percentage point change in the stocks-to-use ratio has a similar effect on the dollar per bushel change in corn and soybean prices. Like corn, we find that the nine years starting in 2007-08 can be usefully formed into groups that reflect the strength of demand. Note that the groups have some overlap between corn and soybeans but they are not exactly the same. The first of the three groups includes 2007-08, 2008-09, 2009-10, 2014-15, and 2015-16 and represents “weak” demand. The second group represents “moderate” demand and includes 2010-11, 2011-12, and 2013-14. The third group contains only one year, 2012-13, and it represents and it represents “strong” demand. Once again, the strength of demand in the three groups can be best understood based on the intercepts. From lowest to highest, the estimated intercepts are $8.29, $10.33, and $12.61, which means that at any given stocks-to-use ratio the price of corn is $4.32 bushel higher under strong demand compared to weak demand. Like corn, the R2 for the alternative model in Figure 4 is very high at 0.98 and due to the inclusion of the dummy variables for the different groups of years. It is more important to note that all of the coefficients in the model are highly statistically significant.

For the 2015-16 marketing year, the “weak” corn regression specification in Figure 3 projects an average price of $3.59, very close to the average price experienced in the first half of the marketing year and only 1 cent different than the mid-point of the current USDA forecast of the average price for the year of $3.60. For the 2015-16 soybean marketing year, the “weak” regression specification in Figure 4 projects an average price of $8.94, close to the average price experienced in the first half of the marketing year and only 19 cents higher than the mid-point of the current USDA forecast of the average price for the year of $8.75. Both the corn and soybean models fit the observation for 2015-16 quite well, but the improvement for soybeans is especially notable.

Three final observations are noteworthy regarding the alternative models presented in Figures 3 and 4. First, the term “weak” demand is used in a relative, not absolute, sense. The “weak” demand scenario for 2007-08 through 2015-16 is substantially stronger than demand during the 1990-91 through 2005-06 base period for both corn and soybeans. For example, the estimated minimum price (intercept) for the “weak” corn demand relationship in Figure 3 is $1.34 higher than the minimum price in the base period. Second, the upward shift in relationships post-2005-06 is consistent with our earlier argument (e.g., Irwin and Good, 2009) that the shifts were the result of substantial increase in ethanol demand for corn that began in 2007-08 and the rapid increase in Chinese soybean imports that also began around 2007-08. Third, the assumption that prices after 2005-06 are generated purely by intercept shifts in the base period relationship risks mistaking slope shifts for intercept shifts. This may be more problematic at very low stocks-to-use ratios.

Implications

The marketing year ending-stocks-to use ratio is a widely used indicator of the “tightness” of corn and soybean market conditions. However, translating this basic concept into quantitative relationships that can be used to forecast corn and soybean prices is not an easy task. In this article, we follow recent work by Verteramo and Tomek (2015) and specify a reciprocal regression model of the relationship between the stocks-to-use-ratio and the average farm price for the base period of 1990-91 through 2005-06. The argument is that this base period provides an accurate estimate of the slope of the relationship. Next, we model the price jumps that occurred after 2005-06 as parallel upward shifts in the base period relationship. The relationships in 2007-08 through 2015-16 are classified as relatively “weak,” “moderate,” or “strong” demand. All coefficients in the models are highly statistically significant. Both the corn and soybean models fit the observation for 2015-16 quite well, but the improvement for soybeans over our previous model is especially notable. In sum, we believe the new corn and soybean models provide a much more accurate representation of the true relationship between prices and stocks-to-use ratios and considerably improves our understanding about pricing relationships in this “new era” of corn and soybean prices. Forecasting is a two-step process with the new models, as the stocks-to-use ratio must be projected first and then the scenario for demand has to be specified. Even with this limitation, the new models provide a useful way of framing the fundamental dynamics of corn and soybeans price formation. In forthcoming articles, we will: i) develop corn and soybean balance sheet projections for 2016-17 and make price projections based on the new models; and ii) address the question of whether or not the “new era” of corn and soybean prices is fading.

References

Irwin, S., and D. Good. "The Relationship between Stocks-to-Use and Soybean Prices Revisited." farmdoc daily (5):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 14, 2015.

Good, D., and S. Irwin. "The Relationship between Stocks-to-Use and Corn Prices Revisited." farmdoc daily (5):65, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 9, 2015.

Irwin, Scott H., and Darrel L. Good. "Market Instability in a New Era of Corn, Soybean, and Wheat Prices." Choices 1st Quarter 2009, 24(1). Accessed April 6, 2016. http://www.choicesmagazine.org/magazine/article.php?article=56.

NASS/USDA. Prospective Plantings. http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1136

Tomek, W.G., and H.M. Kaiser. Agricultural Product Prices, Fifth Edition. Cornell University Press: Ithaca, NY, 2014.

U.S. Department of Agriculture (USDA), Office of the Chief Economist. World Agricultural Supply and Demand Estimates. WASDE - 551. March 9, 2016. http://www.usda.gov/oce/commodity/wasde/index.htm

Verteramo, L., and W. Tomek. "Anticipatory Signals of Changes in Corn Demand." Proceedings of the NCCC-134 Conference on Applied Commodity Price Analysis, Forecasting, and Market Risk Management. St. Louis, MO, 2015. http://www.farmdoc.illinois.edu/nccc134/conf_2015/pdf/Verteramo_Tomek_NCCC_134_2015.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.