Updated Estimates of the Production Capacity of U.S. Renewable Diesel Plants Through 2026

Renewable diesel production capacity in the U.S. exploded in recent years, increasing over three billion gallons (farmdoc daily, March 8, 2023; March 29, 2023). This had a substantial impact on fats and oils feedstock markets, as well as diesel markets in states with low carbon fuel programs. Numerous announcements about additional renewable diesel plants have been made in the press, and based purely on this information, it appears that the renewable diesel boom is far from over. However, the profitability of renewable diesel production has taken a major hit in the last year (Khan and Jao, 2024), as the industry began to produce at a level greater than the demand ceiling set by the annual renewable volume obligations (RVOs) under the U.S. Renewable Fuel Standard (RFS) program. In an earlier farmdoc daily article (May 31, 2023), we explained the process as the biomass-based diesel industry going over the “RIN cliff.” In this uncertain environment, it is important to understand how much longer the boom in renewable diesel might last and how much more capacity may be added. Consequently, the purpose of this article is to update our estimates of renewable diesel production capacity through 2026. The analysis is based on a review of capacity that can be projected with reasonable confidence and that which cannot. This is the 19th in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

The two main types of biomass-based diesel fuels used to comply with the U.S. Renewable Fuel (RFS) mandates are “FAME biodiesel” and “renewable diesel.” Although FAME biodiesel and renewable diesel are produced with the same organic fats and oils feedstocks, their production process differs substantially, resulting in the creation of two fundamentally different fuels (for details see farmdoc daily, February 8, 2023). The vast majority of renewable diesel in the U.S. is fully refined and cracked using HEFA (hydrotreated esters and fatty acids) petroleum refining technology. This results in a “drop-in” hydrocarbon fuel that meets the same performance specifications as petroleum diesel. Thus, it can be blended at any level, making it potentially a complete replacement for petroleum diesel. In contrast, biodiesel produced using FAME (fatty acid methyl ester) technology must be blended with petroleum diesel in relatively low proportions to be used in modern diesel engines.

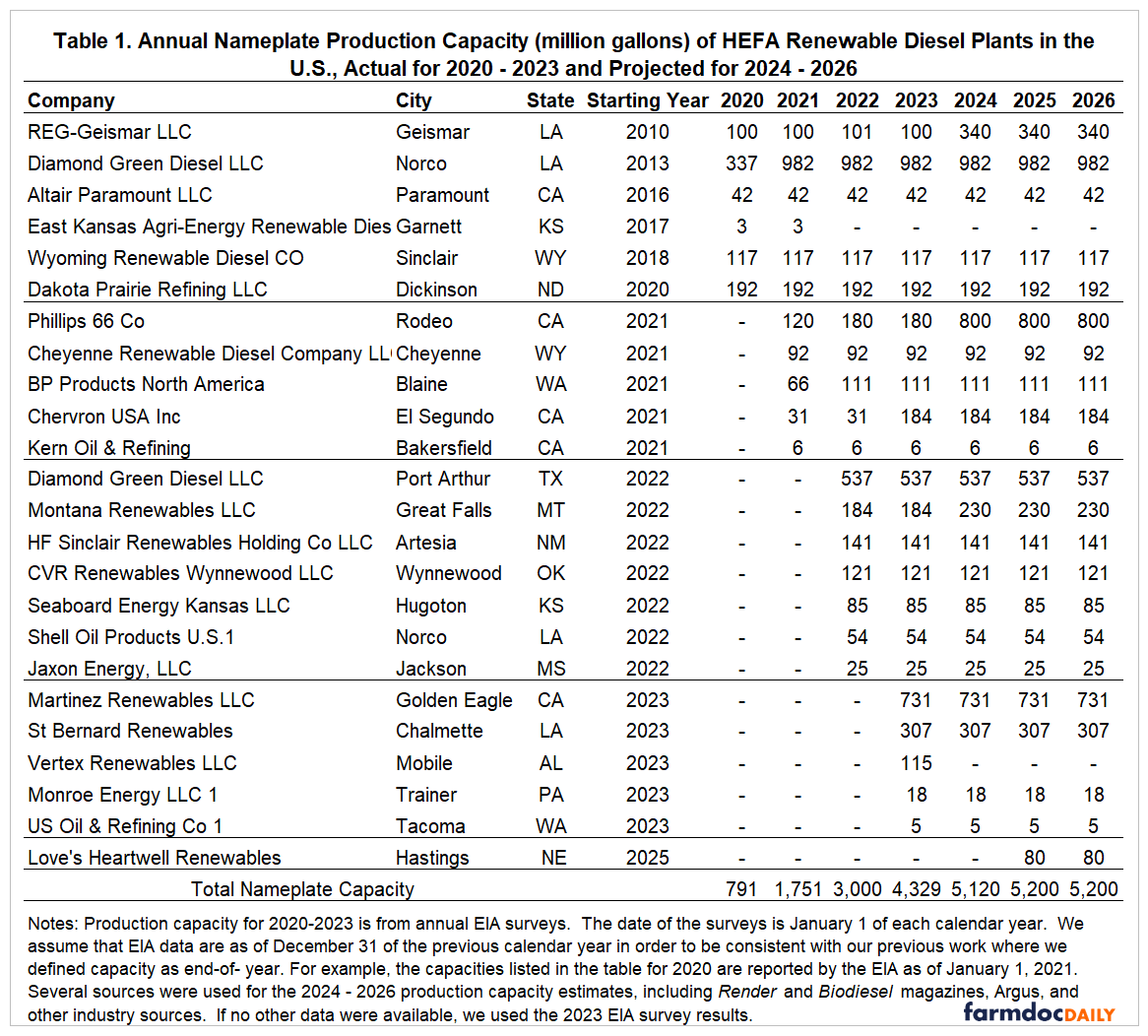

Our updated estimates of HEFA renewable diesel plant capacity in the U.S. are shown in Table 1. Several sources are used. For 2020 through 2023, we use the list of plants and capacities collected by the Energy Information Agency (EIA) in its annual survey of nameplate production capacity. The date of the survey is January 1 of each calendar year (2021-2024). We assume the “as of” date for the survey is December 31 of the previous calendar year to be consistent with our previous work where we defined capacity as end-of-year. For example, the capacities listed in the table for December 31, 2020, are reported by the EIA as of January 1, 2021. Several sources are used for the 2024 – 2026 production capacity estimates, including the Render and Biodiesel magazines, Argus, and other industry sources. If no other data were available, we used the 2023 EIA survey results.

In total, Table 1 shows that there will be 22 renewable diesel plants in operation by the end of 2026. There are four expansions and one contraction included in this list. First, the REG-Geismer plant at Geismer, Louisiana expanded from 100 to 340 million gallons of annual capacity in 2024. Second, the Phillips 66 Co. plant at Rodeo, California expanded from 180 to 800 million gallons in 2024. With this expansion, the Phillips plant is by far the largest renewable diesel plant in the U.S. Third, Montana Renewables plant at Great Falls, Montana expanded in 2024 from 184 to 230 million gallons. Fourth, the Love’s Heartwell Renewables plant at Hastings, Nebraska is on schedule to begin operating in 2025 with a nameplate capacity of 80 million gallons. The sources we consulted indicated that this is the only new renewable diesel plant with a confirmed start date between 2024 and 2026. Fourth, the 115-million-gallon Vertex Renewables plant at Mobile, Alabama that began operation in 2023 filed for bankruptcy earlier in 2024 and has ceased operation.

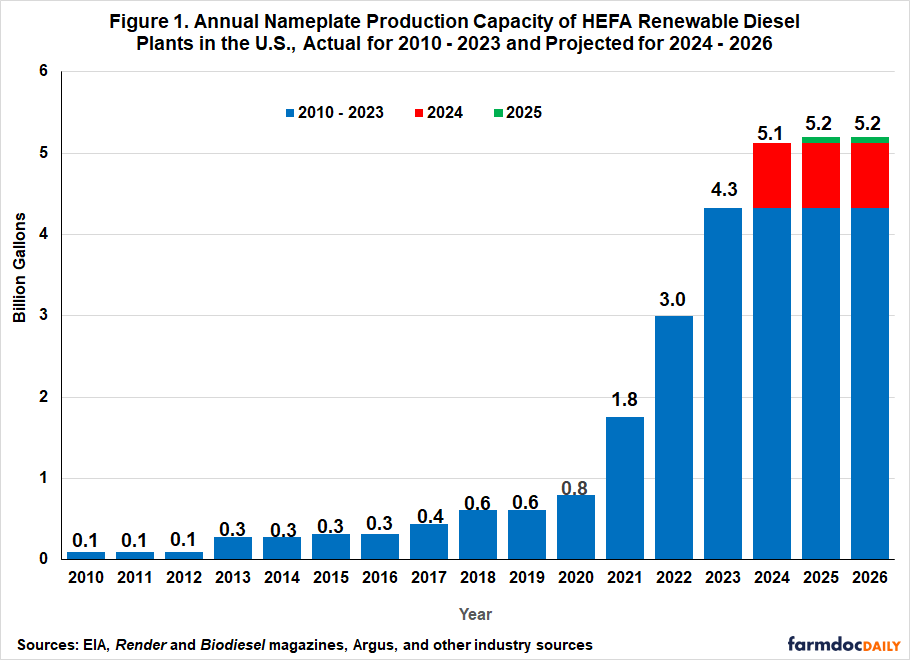

Figure 1 shows total annual nameplate capacity for HEFA renewable diesel plants in the U.S. These totals are the same as those shown in the last row of Table 1. The capacities for 2010 through 2019 were first published in an EIA article (Troderman and Shi, 2023), and the authors generously shared the data with us. The blue bars in Figure 1 represent the EIA production capacity for 2010-2023, and for perspective, the 2023 capacity is plotted as the first component of the bars for 2024-2026. The red bars indicate a net capacity expansion of nearly 800 million gallons for 2024. The green bar shows that projected total capacity increases in 2025 by 80 million gallons to a total of 5.2 billion gallons. Total capacity is projected to remain static for 2026.

It is interesting to compare the capacity projections in Figure 1 to projections that we made less than two years ago (farmdoc daily, March 29, 2023). In our previous article, we projected renewable diesel capacity of 4.1 billion gallons in 2023, 5.5 billion gallons in 2024, and 6.0 billion gallons in 2025. By comparison, our updated estimates are 4.3 billion gallons in 2023, 5.1 billion gallons in 2024, and 5.2 billion gallons in 2025. The earlier estimates reflected more optimism about the future profitability of renewable diesel production. The experience of going over the “RIN cliff” has essentially capped the nameplate capacity of renewable diesel plants in the U.S. at a little above five billion gallons.

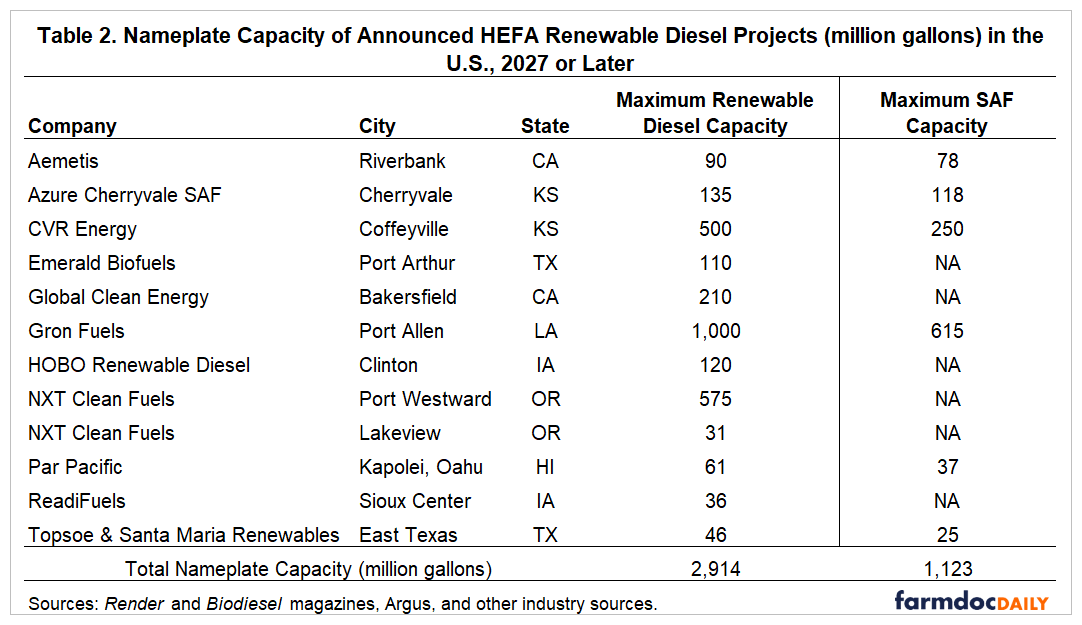

Table 2 contains our list of announced HEFA renewable diesel plant projects in the U.S. for 2027 or later. We developed this list based on the same industry sources we used for Table 1 (Render and Biodiesel magazines, Argus, and other industry sources). The projects have a wide range of capacity, with the largest being 1.0 billion gallons and the smallest being 31 million gallons. The total, 2.914 billion gallons, is quite large and would increase existing renewable diesel plant capacity in the U.S. by more than 50 percent. Several of the projects also list potential capacity for producing sustainable aviation fuel (SAF).

A key question is the likelihood that the announced projects listed in Table 2 will actually come online at some point in the future. Information in this regard is sketchy and uncertainty about the success of projects moving forward is intrinsic to this exercise. To the best of our knowledge, none of these projects have yet broken ground and started construction. The lack of progress in these projects is not all that surprising on the other side of the “RIN cliff.” Until there is confirmation of actual construction activity, we believe it is prudent to exclude these announced projects in projections of renewable diesel capacity for 2027 or later. This represents a significant change from our previous work, where we projected that total renewable plant capacity after 2025 could be as large as 7.4 billion gallons.

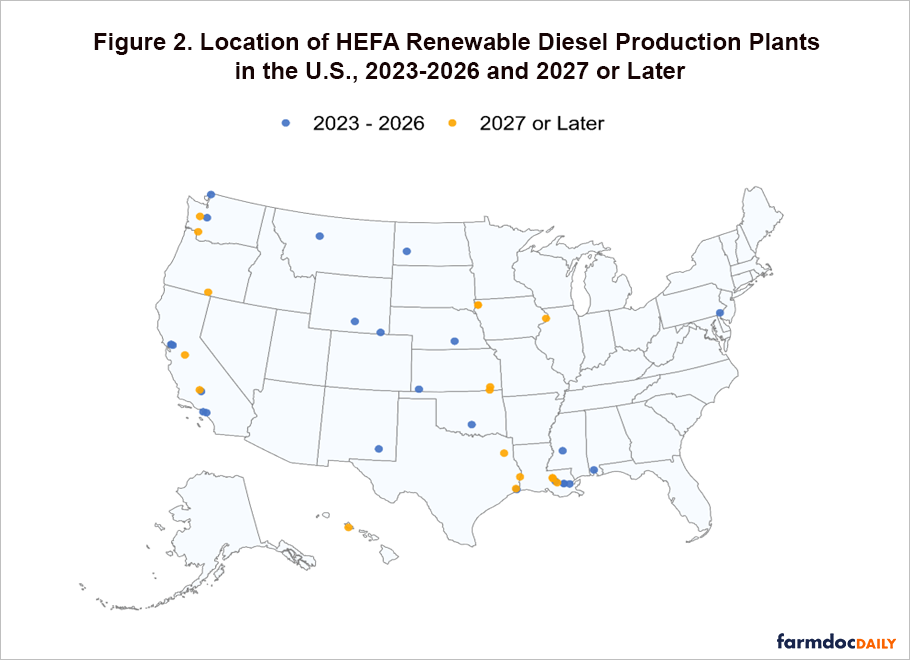

We now turn to the location of renewable diesel plants in the U.S. Figure 2 shows the locations of existing plants as of 2023-2026 and announced projects for 2027 and later. We include the location of the proposed plants for 2027 and later to determine if location decisions might change in the future. The production facilities for 2023-2025 are spread among 13 states but are concentrated in California and Louisiana. As we noted in a previous article (farmdoc daily, March 8, 2023), the California Low Carbon Fuel Standard (LCFS) incentivizes consumption of renewable diesel because it receives a relatively low carbon intensity (CI) score in terms of greenhouse gas reduction. Additional incentives are provided by similar programs in Oregon and Washington. Further, since renewable diesel plants use petroleum refining technology, the plants tend to be located within existing petroleum refining complexes or in areas with abundant petroleum refining to ensure access to the necessary technical expertise and equipment for large-scale hydrotreating (Brown, 2020). Finally, renewable diesel plants are often located to benefit from existing transportation infrastructure, such as pipelines and ports, much like existing petroleum refineries. In general, the location of proposed plants for 2027 and later follow the geographic pattern of existing plants.

Implications

The bloom is off the renewable diesel boom that started in 2021. Less than two years ago, we projected renewable diesel capacity would reach 6 billion gallons in 2025. We now project capacity in 2025 to be 5.1 billion gallons, nearly a billion gallons lower. While we were circumspect in our earlier appraisal of capacity expansion after 2025, we left open the possibility that capacity could eventually exceed 7 billion gallons. The list of announced projects is still long and could eventually add substantially to renewable diesel capacity. However, none of these projects have yet broken ground and started construction. Until there is confirmation of actual construction activity, we now believe it is prudent to exclude these announced projects in projections of renewable diesel capacity for 2027 or later.

In sum, our earlier estimates reflected more optimism about the future profitability of renewable diesel production. The experience of going over the “RIN cliff” has essentially capped the nameplate capacity of renewable diesel plants in the U.S. at a little more than five billion gallons. If policy incentives and/or market conditions turn in a more positive direction, renewable diesel projects can regain forward momentum. The next article in this series will examine the potential capacity for producing sustainable aviation fuel (SAF) at HEFA renewable diesel plants.

Disclaimer: The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy. This work was supported in part by the U.S. Department of Agriculture, Economic Research Service.

References

Brown, T.R. “Biomass-Based Diesel: A Market and Performance Analysis.” Fuels Institute, March 2020. https://www.fuelsinstitute.org/Research/Reports/Biomass-Based-Diesel-A-Market-and-Performance-Anal

Gerveni, M., T. Hubbs and S. Irwin. "Is the U.S. Renewable Fuel Standard in Danger of Going Over a RIN Cliff?" farmdoc daily (13):99, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 31, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Overview of the Production Capacity of U.S. Renewable Diesel Plants for 2023 and Beyond." farmdoc daily (13):57, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 29, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Overview of the Production Capacity of U.S. Renewable Diesel Plants through December 2022." farmdoc daily (13):42, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 8, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Biodiesel and Renewable Diesel: What’s the Difference?" farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023.

Khan, S., and N. Jao. “Renewable Diesel Glut Hits US Refiner Profits, Threatens Nascent Industry.” Reuters, May 14, 2024. https://www.reuters.com/markets/commodities/renewable-diesel-glut-hits-us-refiner-profits-threatens-nascent-industry-2024-05-13/

Troderman, J., and E. Shi. “Domestic Renewable Diesel Capacity Could More Than Double through 2025.” Today in Energy, U.S. Energy Information Administration, February 2, 2023. https://www.eia.gov/todayinenergy/detail.php?id=55399

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.