Overview of the Production Capacity of U.S. Renewable Diesel Plants through December 2022

Renewable diesel production in the U.S. is booming, driven by federal and state policies, including the Low Carbon Fuel Standard in California (farmdoc daily, February 15, 2023). The future trajectory of renewable diesel production is the subject of much discussion. In this article, we provide an overview of renewable diesel production capacity through 2022 in order to establish a baseline for projecting renewable diesel capacity over 2023-2025 in the next article in the series. We also compare and contrast renewable diesel production capacity with biodiesel capacity, which was discussed in our most recent article (farmdoc daily, February 22, 2023). This is the fourth in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

The two main types of biomass-based diesel fuels used to comply with the U.S. Renewable Fuel (RFS) mandates are “FAME biodiesel” and “renewable diesel.” Although FAME biodiesel and renewable diesel are produced with the same organic oil and fats feedstocks, their production process differs substantially, resulting in the creation of two fundamentally different fuels (for details see farmdoc daily, February 8, 2023). Renewable diesel is fully refined and cracked using petroleum refining technology. This results in a “drop-in” hydrocarbon fuel that meets the same performance specifications as petroleum diesel. Thus, it can be blended at any level, making it a complete replacement for petroleum diesel. In contrast, FAME biodiesel must be blended with petroleum diesel to be used in modern diesel engines.

The Economic Information Agency (EIA) of the Department of Energy recently published estimates of the production capacity of renewable diesel plants in the US going back to 2010 (Troderman and Shi, 2023). Staff from the EIA generously shared the data presented in the article with us, and it is reproduced in Figure 1. The data in the figure represent the nameplate capacity of all renewable diesel production facilities in the U.S. at the end of the calendar year and are collected from several sources. First, the EIA conducted annual surveys of nameplate production capacity as of January 2021 and 2022. Second, this data was supplemented by company announcements and trade press reports. Note that “nameplate” capacity is the maximum output that a renewable diesel plant can produce.

Figure 1 shows that the first commercial-scale renewable diesel refineries in 2010 were able to produce only a total of 100 million gallons. Thereafter, capacity increased steadily with the addition of new plants, reaching 800 million gallons in 2020. The renewable diesel boom began in earnest during 2021, with production capacity doubling to 1.6 billion gallons. An even bigger increase—one billion gallons—occurred in 2022. According to this EIA data, renewable diesel production capacity in just the last two years grew by 1.8 billion gallons, or 225 percent, and stood at 2.6 billion gallons at the end of 2022. In a particularly telling development, total renewable diesel capacity of 2.6 billion gallons at the end of 2022 surpassed that of FAME biodiesel for the first time (2.3 billion gallons, see the farmdoc daily article of February 22, 2023).

We now turn to the location of renewable diesel plants in the U.S. In order to have a complete list of plants as of the end of 2022, we start with the data collected by the EIA in January 2022 as part of its annual survey of nameplate production capacity. We supplement this with data collected from Render and Biodiesel magazines over February 2022 to December 2022. The location of the 16 renewable diesel plants in our list is shown in Figure 2. The production facilities are spread among 10 states and mostly in the western half of the U.S. This contrasts with the geographic concentration of FAME biodiesel plants in the eastern half of the country (farmdoc daily, February 22, 2023).

There are two main reasons for the tendency of renewable diesel plants to be located in the western half of the U.S. First, the California Low Carbon Fuel Standard (LCFS) incentivizes consumption of renewable diesel because it receives a relatively low carbon intensity (CI) score in terms of greenhouse gas reduction. Additional incentives are provided by similar programs in Oregon and Washington. Second, since renewable diesel plants use petroleum refining technology, the plants tend to be located within existing petroleum refining complexes or in areas with abundant petroleum refining to ensure access to the necessary technical expertise and equipment for large-scale hydrotreating (Brown, 2020). Third, renewable diesel plants are often located to benefit from existing transportation infrastructure, such as pipelines and ports, much as existing petroleum refineries are.

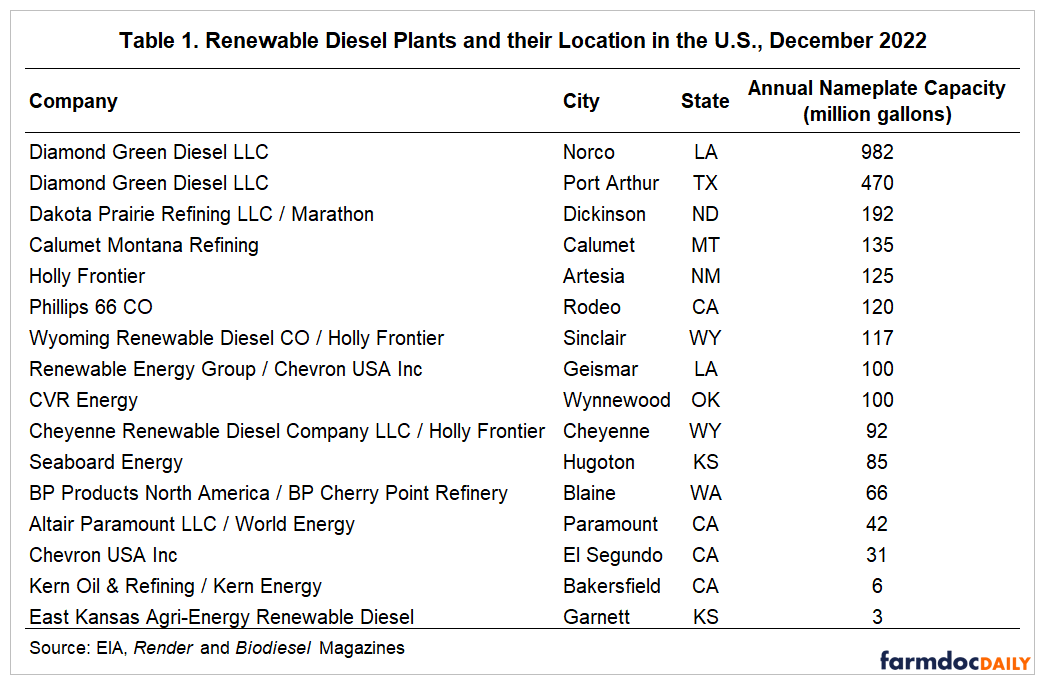

Table 1 lists the 16 renewable diesel plants operating in the U.S. in December 2022, along with their location and nameplate capacity. It should be noted upfront that there is some debate regarding the production capacity of the Diamond Green LLC plant in Norco, Louisiana. The EIA estimates the production capacity as 982 million gallons, which is what we list in Table 1. However, other sources (Render and Biodiesel magazines) estimate a lower amount, 690 million gallons. We use the EIA capacity estimate in the remainder of the analysis but recognize that this estimate could be revised downward in the future.

As of the beginning of 2022, only 10 of the plants shown in Table 1 were in operation and these plants had a total nameplate capacity of 1.7 billion gallons. During 2022, six plants began operation, representing 38 percent of total current nameplate capacity. These new plants include Diamond Green Diesel LLC in Port Arthur, Texas; Calumet Montana Refining in Calumet, Montana; Holly Frontier in Artesia, New Mexico; CVR Energy in Oklahoma City, Oklahoma; Cheyenne Renewable Diesel Company LLC in Cheyenne, Wyoming; and Seaboard Energy in Hugoton, Kansas. The total nameplate production capacity of the 16 plants operating at the end of 2022 was 2.6 billion gallons (the same as the 2022 observation in Figure 1).

It is notable that most renewable diesel plants listed in Table 1 are conversions of existing petroleum refineries. Only three plants are completely new, or “greenfield,” facilities: Diamond Green Diesel LLC plants in Norco, Louisiana and Port Arthur, Texas; and Chevron USA, Inc. in Geismar, Louisiana. Of the remaining 13 plants, nearly three-quarters are complete refinery conversions to stand-alone renewable diesel facilities. This occurs because government policies, including the RFS and the LCFS, exclude partially or entirely co-processing of renewable diesel with petroleum products due to concerns about measuring the fossil carbon streams when assessing the carbon intensity of renewable diesel (Brown, 2020). Only two refineries are co-located with existing biodiesel or corn ethanol plants (Kern Oil & Refining in Bakersfield, California; and East-Kansas Agri-Energy Renewable Diesel, in Garnett, Kansas).

One issue that has been raised recently is the impact of renewable diesel conversions on aggregate petroleum refining capacity in the U.S. The EIA conducts an annual survey of petroleum refining capacity similar to that for renewable diesel and biodiesel. The EIA estimate of U.S. petroleum refining in January 2020—before the takeoff of the renewable diesel boom—was 291 billion gallons per year. The petroleum refining capacity converted to renewable diesel totals 1.114 billion gallons, or only 0.4 percent of aggregate petroleum refining capacity in January 2020. Hence, renewable diesel conversions have not reduced U.S. petroleum refining capacity by a large amount. However, even a reduction of this relatively small size may have a market impact when refining capacity in the U.S. is used at a historically high rate, as it was during much of 2022.

It is also interesting to note that the renewable diesel industry is dominated by large production facilities relative to the FAME biodiesel industry (farmdoc daily, February 22, 2023). Specifically, as seen in Table 1, the two largest plants (Diamond Green Diesel LLC in Louisiana and Texas) are capable of producing at least four times more fuel in comparison to the top two biodiesel plants (see Table 2 in the farmdoc daily article of February 22, 2023). This is not just limited to the very largest renewable diesel plants—the majority of renewable diesel facilities have higher nameplate production capacity than FAME plants. For example, over half of renewable diesel plants have annual nameplate capacity of at least 100 million gallons, whereas only two FAME biodiesel plants have capacities at least this size. The large size of most renewable diesel plants reflects the economies of size that are inherent in petroleum refining infrastructure and technology. In addition, the same large energy companies that operate massive petroleum refineries also own and operate most of the renewable diesel plants in the U.S. So, it is not surprising that renewable diesel plants tend to be much larger than FAME biodiesel plants.

Table 2 examines the distribution of nameplate renewable diesel capacity by company, rather than by individual plant, as of December 2022. Diamond Green Diesel is the largest renewable diesel producer in the U.S., with two plants and a total nameplate capacity of 1.4 billion gallons. It is a joint venture between subsidiaries of Valero Energy Corporation and Darling Ingredients Inc. The second largest renewable diesel producer is Holly Frontier, which operates three major renewable diesel production facilities, one in New Mexico and two in Wyoming, capable of producing up to 334 million gallons per year. The top two firms control 70 percent of total U.S. renewable diesel production capacity, a relatively high level of concentration.

Figure 3 shows that Louisiana is the top renewable diesel production state, with the two plants located there having a total production capacity of 1.1 billion gallons. Texas is the second-ranked state, with one plant having a nameplated capacity of 470 million gallons of production. Over half of renewable diesel capacity in the U.S. is located in these two states. The remainder is spread among eight states with an average production capacity of 86 million gallons per year.

Up to this point, the analysis has been focused on understanding trends in the “nameplate” production capacity of renewable diesel plants. The EIA conducts a monthly survey that also collects data on the “operable” capacity of renewable diesel plants. This is a measure of capacity that is in operation, and it can differ from the nameplate capacity. The EIA data are available from the Monthly Biofuels Capacity and Feedstocks Update for January 2021-December 2022. Note that the renewable diesel series in this report is combined with operable capacity for “other biofuels,” that include renewable heating oil, renewable jet fuel, renewable naphtha, renewable gasoline, and other biofuels and bio-intermediates. We are confident that all but a small part of the operable capacity in this series is associated with renewable diesel.

Figure 4 presents the available data over January 2021 through December 2022 on U.S. renewable diesel operating capacity, along with the same series for FAME biodiesel. Operable capacity for renewable diesel hovered around a billion gallons in 2021 before jumping very sharply in 2022, reaching a peak of 2.8 billion gallons in December 2022. It is interesting to observe that operating capacity in December 2022 exceeded nameplate capacity in that month (see Figure 1). While it is possible for operating capacity to exceed nameplate capacity by running plants overtime or pushing production above rated capacity, it is still surprising that this happened given how much new renewable diesel capacity came online in 2022. As recently as January 2022, nameplate capacity exceeded operating capacity by 19 percent.

The figure also clearly shows that renewable diesel operable capacity rose above that of FAME biodiesel for the first time in July 2022. By the end of the year, renewable diesel operable capacity was 764 million gallons higher than biodiesel. This was almost exactly the opposite of the situation at the beginning of the year, when FAME operable capacity was 777 million gallons more than that of renewable diesel. This historic switch in the dominant production role between renewable diesel and FAME biodiesel is unlikely to be reversed anytime soon.

Implications

The renewable diesel boom began in earnest during 2021, with production capacity doubling to 1.6 billion gallons. An even bigger increase—one billion gallons—occurred during 2022. In just the last two years, capacity grew by a total of 1.8 billion gallons, or 225 percent, and at the end of 2022 total capacity stood at 2.6 billion gallons. In a particularly telling development, total renewable diesel capacity surpassed that of FAME biodiesel for the first time in 2022. There were 16 renewable diesel plants in operation as of December 2022, spread out mainly in the western half of the U.S. This contrasts with the geographic concentration of FAME biodiesel plants in the eastern half of the country. The renewable diesel industry is dominated by large production facilities relative to the FAME biodiesel industry. The largest two plants are capable of producing at least four times more fuel than the top two biodiesel plants. Further, over half of renewable diesel plants have annual nameplate capacity of at least 100 million gallons, whereas only two FAME biodiesel plants in the U.S have capacities of at least this size. It is also important to recognize that nearly all renewable diesel plants are owned and operated by large energy companies, whereas ownership of biodiesel plants tends to be more locally focused.

The next article in this series will examine projections for renewable diesel production capacity for 2023 through 2025.

1The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy. This work was supported in part by the U.S. Department of Agriculture, Economic Research Service.

References

Brown, T.R. “Biomass-Based Diesel: A Market and Performance Analysis.” Fuels Institute, March 2020. https://www.fuelsinstitute.org/Research/Reports/Biomass-Based-Diesel-A-Market-and-Performance-Anal

Gerveni, M., T. Hubbs and S. Irwin. "Overview of the Production Capacity of U.S. Biodiesel Plants." farmdoc daily (13):32, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 22, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Biodiesel and Renewable Diesel: It’s All About the Policy." farmdoc daily (13):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 15, 2023.

Gerveni, M., T. Hubbs and S. Irwin. "Biodiesel and Renewable Diesel: What’s the Difference?" farmdoc daily (13):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 8, 2023.

Troderman, J., and E. Shi. “Domestic Renewable Diesel Capacity Could More Than Double through 2025.” Today in Energy, U.S. Energy Information Administration, February 2, 2023. https://www.eia.gov/todayinenergy/detail.php?id=55399

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.