Farm Payments by Countercyclical and Insurance Programs Since 2002

Payments by countercyclical and insurance programs are examined for the 2002-2015 crops of barley, corn, oats, peanuts, rice, sorghum, soybeans, and wheat. These two type of programs comprise the current crop safety net. Each program type accounted for 50% of payments across the 8 crops and 2002-2015 crop years. However, the role of each program type varied by crop and over time. These variations are discussed as background for the soon-to-commence debate over the next farm bill.

Background

Insurance covers yield and revenue losses during the planting and growing season. Payments by insurance to farmers are calculated as net insurance payments, which equals insurance indemnity payments to farms minus the premiums paid by farms. Source for this data is the US Department of Agriculture (USDA) Risk Management Agency, which has oversight authority for farm insurance contracts.

Countercyclical programs are enacted in the commodities title of the farm bill. They make payments when either price or revenue are low. The definition of low varies by program. Over time, commodity title programs have moved to a countercyclical orientation. Current countercyclical programs are ARC (Agricultural Risk Coverage), Marketing Loan, and PLC (Price Loss Coverage). Other countercyclical programs since 2002 are ACRE (Average Crop Revenue Election) and CCP (Counter Cyclical). Source for countercyclical payments is the USDA Commodity Credit Corporation, which funds most programs in the commodities title of the farm bill. Note, countercyclical payments do not include direct fixed payments, which by policy design do not vary with market conditions.

The analysis starts with the 2002 crop year. It is the first crop year covered by the 2002 farm bill, which initiated CCP. It also postdates the introduction of crop revenue insurance, which occurred in the late 1990s, and the Agricultural Risk Protection Act of 2000, which enacted major changes in the US crop insurance program. Last, the 2002-2015 crop years are about evenly split between a period of higher prices (crop years 2007-2013) and crop years with normal to low prices (2002-2006 and 2014-2015). We divide payments out by these periods because the nature of payments should change.

Entire Time Period (2002-2015): Countercyclical program share of countercyclical plus net insurance payments ranged from 84% for peanuts and rice and 70% for cotton to 18% for wheat and 25% for soybeans (See Figure 1). The latter can be restated as the insurance share being 82% for wheat and 75% for soybeans. For the other crops, countercyclical program share was 49% for corn, 43% for barley, 39% for oats, and 37% for sorghum. As noted above, across all crops and crop years, each program accounted for half of all payments.

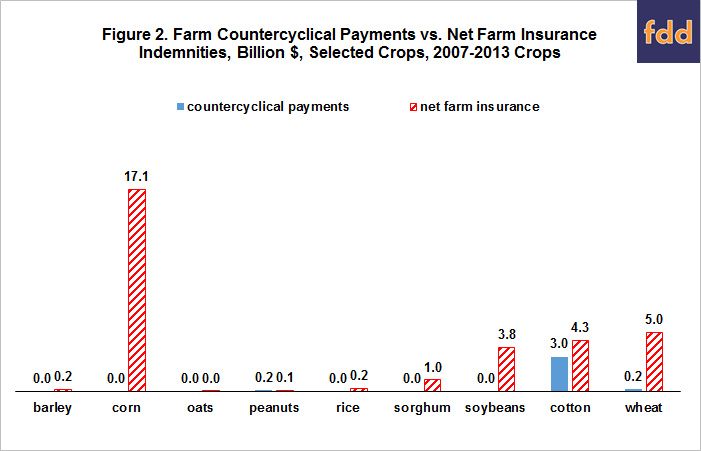

Price Run Up (2007-2013): Crop insurance dominate payments during this high price and revenue period (See Figure 2). Except for peanuts (52%) and cotton (41%), countercyclical payments were near zero and thus close to a 0% share of countercyclical plus net insurance payments. The general lack of countercyclical payments is consistent with the design of such programs, which is to make payments when prices or revenue are in notable decline over several years or when price or revenue is low. In contrast, crop insurance payments are driven by declines in yield or price during the planting and growing season.

Lower Prices (2002-2006) and (2014-2015): During these periods that bracket the price run up, countercyclical payments dominate, but by less than insurance during 2007-2013. Countercyclical payments exceed 55% of countercyclical plus insurance payments except for the following crops by period (countercyclical share in parenthesis): 2002-2006 — soybeans (29%), oats (15%), wheat (11%); 2014-2015 — wheat (44%), cotton (42%), barley (22%) (See Figures 3 and 4). The countercyclical share will increase for most crops when the 2016 crop year is added. Due to high yields, early indications are that the 2016 crop may be the first since the 1994 crop for which premiums paid by farms exceed insurance indemnity payments aggregated across all farms and crops. Early indications also suggest that, if prices remain at late 2016 levels, ARC plus PLC payments for these 8 crops could exceed $8.5 billion, with corn and wheat having payments above $4.5 and $2.0 billion, respectively.

Summary Observations

- Examination of payments by countercyclical programs authorized in the commodities title of the farm bill and by insurance indemnity payments net of premiums paid by farms since 2002 reveals that both types of risk management programs have provided sizable assistance to crop farms.

- Both programs have provided payments to all 8 crops, but their relative size varies by crop. Payments by countercyclical programs are larger for the southern crops of cotton, peanuts, and rice. Payments by crop insurance are larger for soybeans and wheat. For corn, each program type accounts for about half of total payments.

- Relative size of the programs also varies by crop period. Insurance is more important when prices and revenue are high. Countercyclical programs are more important when prices and revenue are declining or low.

- The preceding observation is consistent with the design objective of each program. Countercyclical programs are designed to make payments when prices or revenue are in notable decline over several years or when price or revenue is low. In contrast, crop insurance is designed to make payments for yield or price declines during the planting and growing season.

- In short, unless the future can be predicted with 100% accuracy, each program is important to farmers since each program addresses a different type of risk that is common to farming.

References

US Department of Agriculture, Farm Service Agency (USDA-FSA). CCC Budget Essentials. December 2016. http://www.fsa.usda.gov/FSA/webapp?area=about&subject=landing&topic=bap-bu-cc

US Department of Agriculture, Risk Management Agency (USDA-RMA). Summary of Business Reports and Data. December 2016. http://www.rma.usda.gov/data/sob.html

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.