2014 Farm Bill: Overlap between PLC and Crop Insurance

Overview

This article addresses the potential for overlap that can exist between crop insurance and the Price Loss Coverage (PLC) program option in the 2014 farm bill. To provide perspective, the historical overlap that existed between target prices and crop insurance prices from 1974 through 2006 is examined. The article ends with summary observations including implications for policy and the upcoming farm program decision by farmers.

Policy Background

Target prices began with the 1973 farm bill. They have existed ever since except for the 1996-2001 crop years when the 1996 farm bill replaced target price payments with direct payments. PLC is the latest version of target price programs. It refers to target prices as reference prices. All target price programs have made payments when the market price is below the target price, although different farm bills have used different measures of market price.

Price Decline Overlap

PLC and crop insurance can make payments for the same price decline if

- price declines between the insurance pre-plant and harvest price discovery periods, and

- the price decline continues throughout the ensuing crop marketing year resulting in a crop year average price that is less than the PLC reference price.

Analysis

The potential for this overlap is examined using target prices for the 1974-1995 and 2002-2006 crop years for the economically and politically important crops of corn, rice, sorghum, soybeans, upland cotton, and wheat. This period was selected in part because market prices exhibited no sustained upward or downward trend. Trends affect the probability of payment by target price programs.

The target prices are from Agricultural Statistics, an annual U.S. Department of Agriculture (USDA) publication (see here.) Crop year average prices are from the USDA, National Agricultural Statistics Service (NASS) Quick Stats database (see here). Consistent with PLC, per unit deficiency payment is calculated as the Target Price minus the U.S. crop year average price.

Insurance prices for 2000 and forward are from the Risk Management Agency (RMA) website. For earlier years, a data set created by Art Barnaby of Kansas State University is used (see here). RMA did not compute harvest insurance prices prior to the introduction of revenue insurance, which began with Crop Revenue Coverage (CRC) in 1996. However, Art estimated harvest prices for prior years using RMA methods. Note that crop insurance was not offered for rice until the 1987 crop year and the insurance price used for wheat is the price based on the Chicago futures market.

Findings

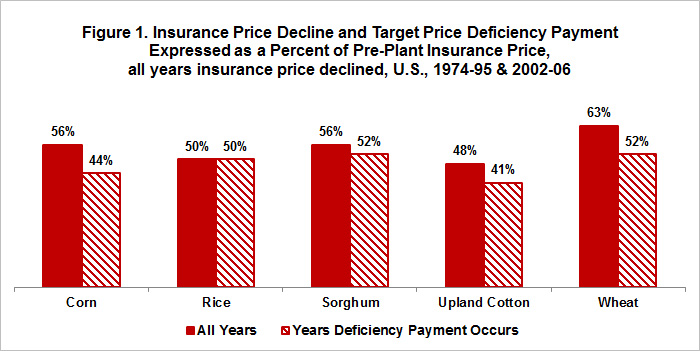

The insurance price declined between the pre-plant and harvest price discovery periods in about 50% of all years as well as during only those years in which a deficiency payment occurred (Figure 1). Such a finding was expected because insurance prices for the examined crops are based on futures prices. It is widely-accepted that futures prices are unbiased price estimates and that new bullish and bearish price information is generated randomly. Hence price increases and decreases about 50% of the time.

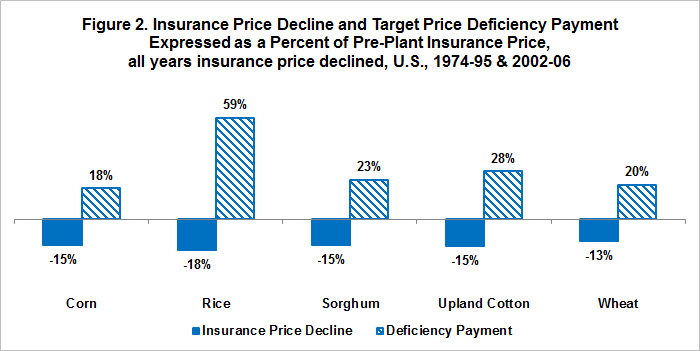

During the years a deficiency payment was made and insurance price declined, average per unit deficiency payment expressed as a percent of the pre-plant insurance price exceeded average decline in insurance price for all crops (Figure 2). The smallest difference is for corn: a -15% decline in insurance price vs. a per unit deficiency payment that averaged 18% of the insurance pre-plant price. The largest difference is for rice: a -18% decline in insurance price vs. a deficiency payment that averaged 59% of the insurance pre-plant price. It should be noted that the average decline in insurance price is similar among crops, ranging from -13% for wheat to -18% for rice. Again, this finding was expected for reasons discussed in the previous paragraph.

Summary Observations

- An overlap can exist between target price deficiency payments and declines in crop insurance price between the pre-plant and harvest price discovery periods.

- The exact degree of overlap expected between PLC and crop insurance is difficult to calculate because PLC pays on 85 percent of FSA farms’ base acres while insurance pays on 100% of acres planted on the insured unit. Nevertheless, this overlap has the potential to be large as illustrated by the historical experiences during the 1974-1995 and 2002-2006 crop years.

- A policy issue is whether the deficiency payments that coincide with the insurance deductible is an overlap. Farmers will not likely view this part of PLC payments as an overlap. However, the social contract which underpins public subsidies for farm insurance is that a partnership exists between society and farmers in managing farm production and revenue risk. The farmer’s share of this partnership involves the insurance deductible and payment of a premium. PLC payments alter the deductible component of the social contract.

- Given that crop revenue insurance is a key, if not the key, component of the crop safety net, an obvious policy question is whether the overlap between PLC reference prices and crop revenue insurance prices should be considered when designing the crop safety net? More specifically, should the overlap be eliminated by integrating the prices of the two programs?

- A related, interesting historical policy question is whether the elimination of target prices between 1996 and 2001 by the 1996 farm bill allowed revenue insurance products to gain traction, thereby altering the future path of farm policy debates?

- Farmers should consider the insurance – PLC overlap when making their farm program choice. Overlapping payments would provide additional government assistance if prices decline and stay below the PLC reference prices. Electing PLC also creates the potential for substituting PLC for crop revenue insurance in providing assistance against price declines when a PLC payment is expected. This substitution allows farmers to replace revenue insurance with cheaper yield insurance.

- Because the new insurance Supplemental Coverage Option is only available if PLC is elected, insurance companies and agents have an economic self-interest in promoting PLC as the farm program choice. However, the potential to replace higher premium revenue insurance with lower premium yield insurance when deficiency payments are expected blunts this economic self-interest. It will be interesting to see how these competing impacts play out.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.