Fixing Holes in the Current Crop Safety Net

The overarching policy narrative of this article is that holes exist in the current design of commodity programs, including an expected lack of commodity program payments of notable size until Fall of 2026 (farmdoc daily, October 22, 2024). Instead of passing ad hoc economic assistance, this article proposes a new multiyear risk program (MYR) as a better use of the funds and as more likely to fix holes in the crop safety net. As proposed, MYR would replace the current ARC (Agriculture Risk Coverage) commodity program and offer an alternative to ad hoc assistance. MYR payments are estimated to exceed $4 billion to 2024 crops and $10 billion to 2025 crops if current low prices continue through 2025 and all acres are in MYR. These MYR payments can be made in the Fall of 2024 and Fall of 2025, respectively; or nearly two years and one year earlier than ARC and the other commodity program, PLC (Price Loss Coverage), are expected to make sizable payment. No presumption exists that MYR is the only design of a multiyear risk program, thus another objective of this article is to encourage discussion of needed changes to the crop safety net.

Multiyear Revenue Risk Program (MYR) Design

For this study, MYR is designed to address multiyear systemic revenue risk for the US market. Specifically, MYR revenue equals US average yield per harvested acre of a crop, times the higher of the crop’s projected or harvest insurance price for the year. MYR pays when current year US MYR revenue is below the average of US MYR revenue for the five immediate preceding crop years. For example, MYR’s covered revenue for a 2024 crop is the average of the crop’s MYR revenue for crop years 2019-2023. In contrast, ARC, the commodity program MYR would replace, uses an average of 2018-2022 crop year prices. MYR is thus more likely to reflect current economic conditions than ARC.

MYR payment can be calculated once the harvest insurance price is finalized and a yield estimate is available. For the crops in this study (corn, sorghum, soybeans, and upland cotton); a payment can be calculated for the US on November 1 using the US yield from the USDA, NASS (US Department of Agriculture, National Agricultural Statistics Service) October production report. This payment timeline is nearly one year earlier than the payment timeline for ARC and the other commodity program, PLC (Price Loss Coverage).

The MYR design used in this study is assumed to pay farmers 80% of the shortfall in MYR revenue and caps per acre payments at 10% of current year MYR revenue. The 80% payment rate is based on the current farm bill proposal to provide an 80% subsidy for SCO (Supplemental Coverage Option) area crop insurance. An 80% subsidy means farmers pay 20% of the premium. The equivalent in commodity programs is that farmers receive 80% of payments. The 10% payment cap is the current ARC payment cap. As with any program, many other options exist for payment parameters.

The preceding discussion translates into the following set of payment formulas:

MYR payment/acre = MAX[0, MIN[(MYR covered revenue – MYR revenue) * 80%), 10% * MYR revenue]]

MYR revenue for crop year = US yield * MAX[projected insurance price, harvest insurance price]

MYR covered revenue = average MYR revenue for the 5 immediate preceding crop years

MYR revenue includes an estimate of secondary product revenue. This adjustment is discussed in Data Note 1. Including secondary product value creates equality across program crops since seed cotton includes cottonseed. The data used to calculate MYR payments are discussed in Data Note 2.

2024 Estimated MYR Payments, Corn, Sorghum, Soybeans, and Upland Cotton

As an illustration, MYR 2024 payments are estimated for four large acreage program crops that have an October discovery period for harvest insurance prices: corn, sorghum, soybeans, and upland cotton. The specific price and yield data used to make the calculations are discussed in Data Note 2. Payments are reported as $/acre in Figure 1a and as a percent of 2024 MYR revenue in Figure 1b. Corn, sorghum, and upland cotton have estimated MYR 2024 payments. Payments for sorghum and upland cotton are at the 10% maximum. These payments can be made as soon as November 2024 since crop insurance harvest prices become final once futures trading ends in October. For an example of MYR 2024 payment calculations, see Data Note 3.

Payments can be made on base acres or planted acres. Estimated 2024 MYR payments for the three crops total $4.7 billion using the latest estimate of 2024 planted acres and $4.5 billion using the crop’s base acres enrolled in 2024 commodity programs (ARC plus PLC). Note that the three MYR payment crops are grown in different regions, implying 2024 MYR payments would be spread across the US and not concentrated in a few states.

2025 Estimated MYR Payments, Corn, Sorghum, Soybeans, and Upland Cotton

A current policy concern is that current low prices could continue through 2025 (farmdoc daily, October 22, 2024). Reinforcing this concern is that ARC and PLC are expected to make minimal 2024 crop payments and, their 2025 crop payments, while likely much larger, will not occur until October 2026. MYR payments were therefore estimated for the 2025 crop year assuming 2024 harvest insurance prices and US yields. All four crops are estimated to receive a 2025 MYR payment. Each crop’s payment is at the 10% cap (see Figure 2). Estimated 2025 MYR payments total $12.5 billion using the latest estimate of 2024 planted acres and $10.5 billion using the crops’ base acres enrolled in 2024 commodity programs. These 2025 MYR payments could be made in November 2025, nearly a year before existing commodity programs likely make any sizable payments.

1979-2023 MYR Payments, Corn and Soybeans

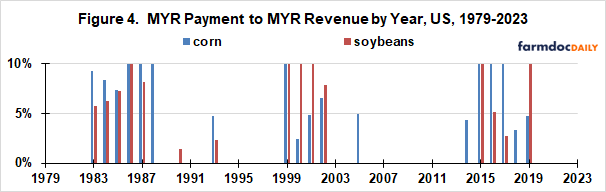

To put the 2024 and 2025 estimated MYR payments in perspective, MYR payments were estimated for the 1979 through 2023 corn and soybean crops. Payment per acre is calculated as a percent of MYR revenue per acre because revenue per acre has increased since 1979. Because October yield estimates were first reported in 1990 for sorghum and 1999 for upland cotton, this historical analysis is conducted only for corn and soybeans in order to have the largest variety of market conditions.

Corn and soybean MYR payment per acre averaged 2.9% and 2.3%, respectively, of corn and soybean MYR revenue per acre across the 45 years (see Figure 3). MYR made a payment in 33, or 37%, of the 90 crop-year observations (2 crops times 45 years) (see Figure 4). Thirty-nine percent of the payments were at the 10% maximum. A payment was made to corn in 18 years and to soybeans in 15 years. At least one crop received a payment in 19, or 42%, of the years.

The proposed MYR program in this article is a national systemic risk program, with the specific risk being a decline in a crop’s average US market revenue that continues for multiple years. The 1979-2023 analysis reveals that the occurrence of this risk is not rare. Large corn and soybean MYR payments would have occurred during the middle 1980s, the turn of the century, and the last half of the 2010 decade. The large payments by the proposed MYR program in the mid-1980s and late 1990s/early 2000s coincide with periods when large ad hoc assistance was provided to the US crop sector (farmdoc daily, July 29, 2020).

Discussion

Existing commodity programs (ARC and PLC) do not make payments until after the crop year is over, increasing the likelihood that payments are disconnected from need. This disconnect is likely to be particularly troublesome when cost of production are increasing, as has happened since 2020.

This hole in the current crop safety net can by addressed by using crop insurance prices to calculate commodity program payments. This change allows payments to be calculated approximately one year earlier, i.e. beginning instead of end of the crop year. This change also allows the use of moving averages that are contemporary, not lagged; further making commodity program payments timelier and more responsive to current crop economic conditions.

The MYR design used in this article would provide immediate, notable assistance to 2024 corn, sorghum, and upland cotton. Since these crops are grown in different regions, the payments would be spread across the US and not concentrated in a few states. The payments would supplement self-insurance resulting from strong crop returns over the last few years.

The proposed MYR design will also make large payments in the Fall of 2025 should current low prices continue until then and yields are similar to 2024 yields, in which case many believe the US crop sector would be in tenuous financial condition. Existing commodity programs are not currently expected to make sizeable payments until the Fall of 2026 (farmdoc daily, October 22, 2024).

This study clearly finds that a timelier, more responsive commodity program design can materially help farmers manage profit squeezes resulting from lower prices and higher cost of production.

In short, rather than spend money on ad hoc economic assistance in 2024 that could be followed by more ad hoc economic assistance in 2025, funds can be better used to fix holes in the existing crop safety net while improving its efficacy and making appropriately timed payments to help crop farmers navigate the current cost-price profit squeeze.

Data Note 1: Secondary Products

Many crops have a secondary product(s), such as straw for wheat, oats, and barley and cottonseed for cotton. At present, no secondary product for the crops in this study have an insurance contract. Value of secondary products is thus estimated using the ratio of secondary product value to primary product value as reported in the USDA, ERS (Economic Research Service) cost and return data set for the 2014-2023 crops (i.e. last 10 years of data). Total MYR revenue per acre for a crop equals its estimated secondary product value plus its primary product value.

Data Note 2: Data Sources

Projected and harvest insurance prices are from USDA, RMA (Risk Management Agency) price discovery tool for crop years 2011 and later. Earlier years are from a data set compiled by Professor Emeritus Art Barnaby of Kansas State University. The prices are specifically for conventional crop practice in the state with the largest production of a crop: Illinois / Iowa for corn and soybeans, Kansas for sorghum, and Texas for upland cotton. The latest sales closing date is used. Harvest insurance prices for 2024 corn, upland cotton, sorghum, and soybeans are currently in discovery. The latest available harvest insurance price is used. Professor Barnaby’s data set starts with the 1974 crop year. Since MYR uses a five year average, the analysis in this study starts with the 1979 crop year.

Yield is the yield per harvested acre reported in the USDA, NASS October Crop Production report, as compiled in the USDA, NASS Quick Stats electronic database. October yield estimates do not start until 1990 for sorghum and 1999 for upland cotton.

Data Note 3: Numerical Example, MYR Payment Calculation, 2024 Corn

Secondary product value for corn averaged 0.3% of primary product value over the 2014-2023 crop years.

References

Schnitkey, G., J. Coppess, C. Zulauf, and N. Paulson. October 22, 2024. Potential Federal Policy Responses to Negative Grain Farm Incomes. farmdoc daily (14):192. Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign.

US Department of Agriculture, Economic Research Service. October 2024. Commodity Costs and Returns. https://www.ers.usda.gov/data-products/commodity-costs-and-returns/

U.S. Department of Agriculture, National Agricultural Statistical Service. October 2024. Quick Stats. https:///quickstats.nass.usda.gov

US Department of Agriculture, Risk Management Agency. October 2024. Price Discovery Reporting. https://prodwebnlb.rma.usda.gov/apps/PriceDiscovery

Zulauf. C., G. Schnitkey, J. Coppess, N. Paulson, and K. Swanson. July 29, 2020. Ad Hoc Payments: A Leading Indicator of Farm Policy Change. farmdoc daily (10):140. Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. http://www.farmdoc.illinois.edu/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.