Will Hedging 2011 Corn Now Reduce Downside Revenue Risk?

In this paper, graphs show how hedging different proportions of expected corn production impact the chance of having revenue below three benchmarks. Four analyses are presented: one for no insurance and three for Revenue Protection (RP) crop insurance policies with 65, 75, and 85 percent coverage levels. With no insurance, the chance of revenue below $850 per acre is minimized when 71 percent of expected production is hedged. Use of crop insurance lowers the amount hedged needed to minimize risk. Chance of revenue below $850 per acre is minimized with 61 percent hedged for a 65 percent RP policy, 42 percent with a 75 percent RP policy, and 7 percent for an 85 percent RP policy.

Chances of having revenue below benchmarks have been calculated by simulating different harvest-time revenues for a farm with an expected yield of 184 bushels per acre using May 13, 2011 prices. Revenue equals crop insurance payments, plus revenue from hedged production, plus revenue from un-hedged production. Hedged production revenue equals $5.95 per bushel — the May 13, 2011 forward contract price — times hedged production. Hedged production equals the 184 expected yield times proportion hedged. If 25 percent of expected production is hedged, then 46 bushels (184 x .25) are hedged. Grain not hedged is priced at harvest, yielding revenue from un-hedged production. More detail on how gross revenues have been generated is presented on the Appendix.

Without crop insurance and hedging, expected revenue is $1,073 per acre. Chances below $850, $750, and $650 are presented. The $850 revenue represents a case that covers non-land production costs of $500 per acre, typical farmland rental costs, and a profit for the farmer. Without crop insurance and hedging, there is a 32% chance than revenue will be below $850 per acre. The $750 and $650 revenues represent loss cases, with $650 a more severe loss than $750. Without hedging and crop insurance, chances are 22% of being below $750 per acre and 13% of being below $650 per acre.

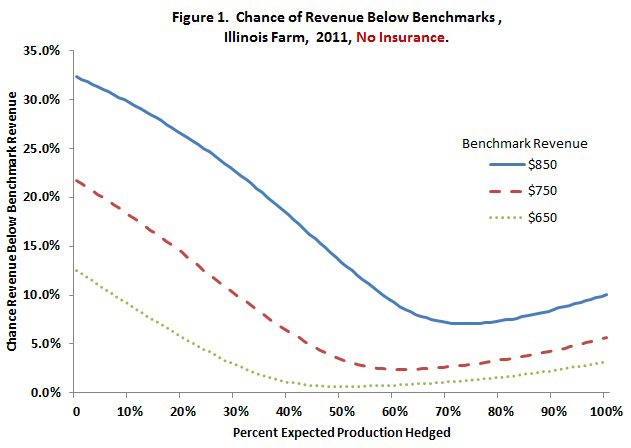

Impacts of hedging grain with no insurance policy

With no insurance, hedging reduces risks. The chance of revenue below $850 is reduced from 32 percent without hedging to 7 percent. The 7 percent chance is reached when 71 percent of expected production is hedged. Hedging more than 71 percent of expected production increases risk. This occurs because there is an inverse relationship between prices and yields: when yields are below average prices are more often above average. When yields fall, the un-hedged price often is higher than the hedged price. In these cases, more hedging reduces revenue, leading to the higher chances when large proportions of expected production are hedged.

Chance of revenue below $750 and $650 benchmark revenues also decrease with hedging. The chance of revenue below $750 is reduced from 21 percent without hedging to 2 percent chance when 59 percent of expected production is hedged. The chance of revenue below $650 per acre is minimized when 44 percent of expected production is hedged at a 1 percent chance.

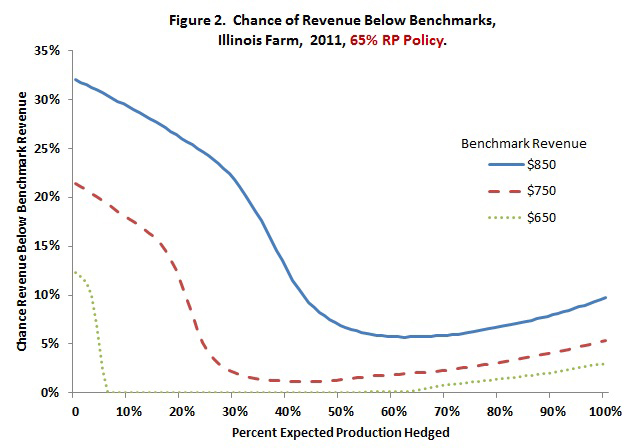

Impacts of hedging grain with a 65 percent coverage level RP policy

With a 65 percent RP policy, chance of revenue below $850 is reduced from 32 percent without hedging, to 6 percent. The 6 percent chance occurs when 61 percent of expected production is hedged. Lower amounts of hedging are required to reach the minimum with a 65 percent RP policy than with no insurance: 61 percent hedged with 65 percent RP compared to 71 percent with insurance. Also, the chance of revenue below $850 is lower for the 65% RP policy than for no insurance: 6 percent for the 65 percent RP policy compared to 7 percent for no insurance. Both the amount of hedging needed to reach the minimum and the percent chance below $850 continues to decrease as the coverage level declines.

The chance of revenue below $750 is reduced from 43 percent without hedging to 1 percent when 59 percent of expected production is hedged. The chance below $650 per acre is minimized at 1 percent when 7 percent is hedged.

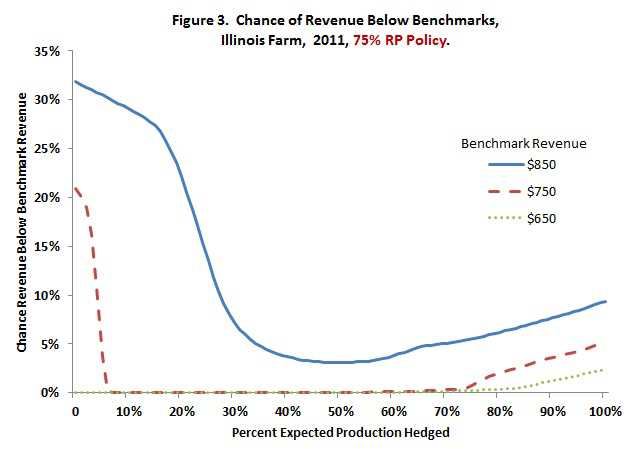

Impacts of hedging grain with a 75 percent coverage level RP policy

With a 75 percent RP policy, the chance of revenue below $850 is reduced from 32 percent without hedging to 3 percent. The 3 percent chance is reached when 42 percent of expected production is hedged. Again, both the amount of hedging to reach the minimum and the chance of revenue below $850 is lower for the 75% RP policy compared to the 65% RP policy.

The chance of revenue below $750 is reduced from 22 percent without hedging, reaching 0 percent when 6 percent of expected production is hedged. With a 75% RP policy, hedging is not required to achieve a 0 percent chance of revenue below $650.

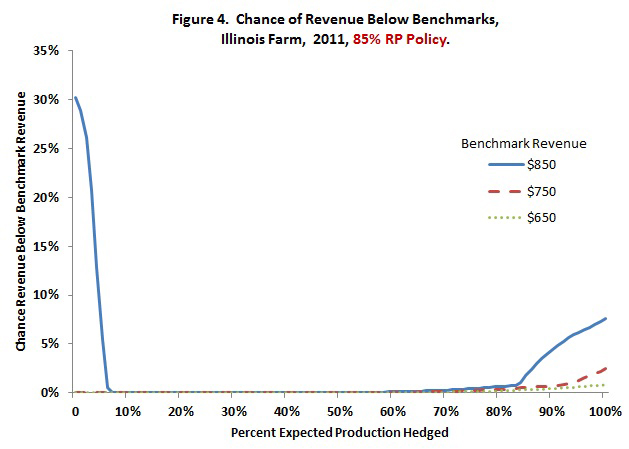

Impacts of hedging grain with an 85 percent coverage level RP policy

With an 85 percent RP policy, the chance of revenue below $850 is reduced from 32 percent without hedging to 0 percent when 7 percent hedged. With an 85 percent RP policy, hedging is not required to reach 0 percent chances of revenue below $750 and $650.

A large range of hedging gives 0 chances of revenue below the benchmark. For example, percent of expected production hedged from 7 percent to 71 percent give a 0 percent chance of revenue below $850. This large range gives farmers great attitude in pre-harvest hedging without impacting risk. Farmers can use this latitude to price grain without downside risk concerns.

Summary

Relative to no hedging, hedging will reduce risks of low revenue. With no insurance, hedging around 70 percent of expected production is needed to reduce downside risks to its minimum. At 75 percent and higher coverage levels, only modest amounts of hedging are needed to reduce risks.

Many farmers purchase crop insurance policies with 80 and 85 percent coverage levels. At these coverage levels, most gains of reducing downside risks are obtained when less than 10 percent of expected production is hedged. Perhaps just as important is that much higher levels of hedging do not impact downside risks. As a result, farmers with high coverage level insurance policies have large latitude in hedging grain without impacting risk.

Note that results in this article can change as growing season progress. The relationship of the forward contract price to the projected price for crop insurance is important. Forward contract prices above the projected price offer more possibilities or risk reductions than forward price below expected production.

Appendices

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.