Wheat Insurance and the Crop Insurance Decision Tool

In Illinois and other Midwestern states, September 30th is the sales closing date for 2012 crop insurance coverage on winter wheat. By this date, farmers must buy, change, or cancel their Federally-insured crop insurance products for winter wheat, otherwise they will get the same product and coverage level as they received in 2011. The 2012 Crop Insurance Decision Tool is available for download from the FAST section of farmdoc . This tool will give premium quotes for the COMBO product as well as Group Risk Plan (GRP) and Group Risk Income Plan (GRIP) products.

The price discovery period for wheat runs from August 15th through September 14th. Because the price discovery period is not over, the 2012 projected prices and volatilities are not known with certainty. If the price discovery period ended on September 8th, the projected price would be $8.28 per bushel and the volatility would be .29. The projected 2012 price of $8.28 is above the $7.19 projected price for 2011. The .29 projected volatility for 2012 is below the .32 volatility for 2011. As far as farmer-paid premiums between 2011 and 2012, changes in projected prices and volatilities counteract one another: The higher projected price raises premiums while the lower volatility lowers premiums.

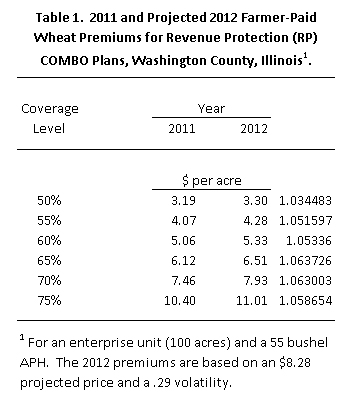

Table 1 shows Revenue Protection (RP) premiums for 2011 and 2012. The actual projected price and volatility is used for 2011 while the estimated $8.28 projected price and .29 volatility is used for 2012. The farmer-paid premiums are for Washington County, Illinois, an enterprise unit, a unit size of 100 acres, and a 55 bushel APH yield. Premiums come from the 2011 and 2012 Crop Insurance Decision Tools.

Projected 2012 premium are higher than 2011 premium. At a 75 percent coverage level, the 2011 premium is $10.40 and the projected 2012 premium is $11.01. The 2012 premium is 6 percent higher than the 2011 premium.

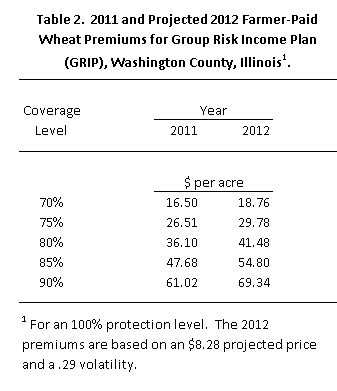

Table 2 shows 2011 and projected 2012 premiums for Group Risk Income Plan (GRIP) products. The projected 2012 premiums are above 2011 premiums. At a 90 percent coverage level, the 2011 premium is $61.02 per acre and the project 2012 premium is $69.34 per acre. The 2012 premium is 13 percent higher than the 2011 premium.

GRIP premiums have a higher percent increase between 2011 and 2012 than RP premiums. Between 2011 and 2012, underlying rates used to calculate premiums were changed. For the same projected prices and volatilities in 2011 and 2012, GRIP premiums would have gone up in 2012 because underlying rates were revised up in Washington County, Illinois. On the otherhand, RP premiums would have gone done with the same projected price and volatility.

After September 14th, projected prices and volatilities will be revised in the 2012 Crop Insurance Decision Tool to reflect final values. The tool can be downloaded from the farmdoc website at that point. Alternatively, the new parameters can be placed in the “parameter” section of the downloaded tool.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.