Farm Commodity Programs Given the Existence of Crop Insurance

The design of farm commodity programs will come into focus as the 2012 Farm Bill is written. Due to budgetary pressures, commodity programs likely will face lower funding levels in future years compared to funding levels resulting from the 2008 Farm Bill. Given lower funding, scrutiny likely will be given to the farm safety net provided by commodity program as well as from crop insurance. In particular, emphasis on making the commodity programs integrate with crop insurance likely will receive attention, with the goal of providing farmers a safety net while at the same time reducing program costs.

Crop insurance has become a much larger program over recent decades. In Illinois, over 80% of corn and soybean acres are insured, with many farmers using revenue insurance at high coverage levels (see here). Much of this increase in use is due to insurance enhancements, such as the introduction of revenue insurances, and to increases in subsidy levels. While continued improvements to crop insurance are possible through improved actuarial performance and through new methods to more closely match guarantees to expected revenue, crop insurance has emerged as an important risk management tool.

Crop insurance provides coverage for events that causes revenues to decline within year. Guarantees are set based on projected prices derived from futures markets before planting. Similarly, revenue is based on harvest prices derived from futures markets near harvest. Given these price mechanisms, revenue insurance will provide protection for price declines during a growing season.

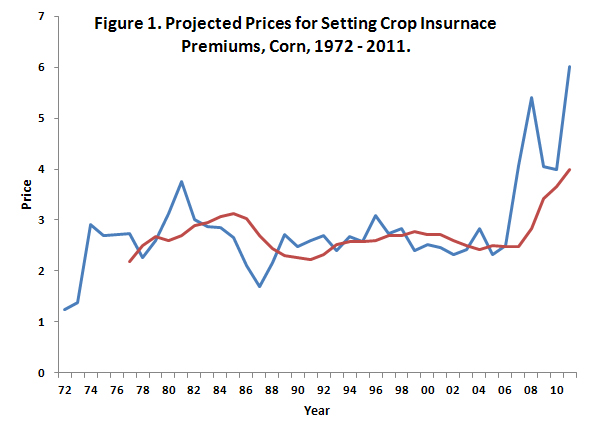

Crop insurance will not provide protection against price declines that occur across years that typically persist across multiple years. Historical examples of these situations are shown in Figure 1, which shows yearly projected prices from 1972 through 2011. Also shown in this figure is the five-year average price. Generally, prices below the five-year average are signals of financial stress. Two periods stand out: the mid-1980s and the 1998-2002. During both of these periods, prices were below the five-year average and many farms faced financial stress.

Crop insurance would not have provided protection for the decline in price from the earlier period because the projected price is reset each year. This suggests that a role for commodity program is in providing protection against low prices that persist over several years. This would require a commodity program that does not base its guarantee solely on current year prices.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.