Tracking Crop Exports

The USDA expects that exports of U.S. corn, soybeans, and wheat will be adversely impacted by the increased supply of these crops in the rest of the world. Corn production outside the US in the 2011-12 marketing year is projected to be 6.6 percent larger than production of a year ago. Argentina, Brazil, China, and the Ukraine are all expected to have larger crops than those of last year. Of the larger producers, only Mexico is expected to have a smaller crop. Foreign wheat production is expected to be up 6.8 percent, led by a 39 percent increase in production in the countries that make up the former Soviet Union as that area recovers from the drought of 2010. Foreign soybean production is expected to increase by 1.4 percent.

While the outcome of the southern hemisphere crops is far from certain, crops of the magnitude currently forecast will likely result in smaller US exports. The question centers on the magnitude of the declines. The USDA projects year-over-year declines of 12.8 percent for corn, 24.4 percent for wheat, and 11.7 percent for soybeans. The US share of world exports of these crops in 2010-11 and projected for 2011-12 are as follows:

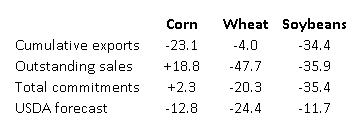

The USDA provides weekly estimates of exports and export sales so that the progress of exports can be monitored. As of November 3rd, current marketing year exports relative to those of last year were as follows (percentage change):

Early in the corn marketing year (beginning September 1), shipments are off to a slow start relative to those of last year. Unshipped sales, however, are much larger than at this time last year so that total export commitments exceed those of a year ago by just over two percent. The year-over-year increase is led by larger sales to China and Mexico. Sales to Japan, the largest buyer of U.S. corn are down nearly 20 percent. Those sales, however, are expected to catch up to those of last year. The Census Bureau estimate of September corn exports released this morning was nearly 6 million bushels larger than USDA inspection estimate for the month. That difference typically gets larger as the year progresses. At this early stage of the marketing year, it appears that corn exports will reach and perhaps exceed the USDA forecast.

Wheat exports for the marketing year that started on June 1 got off to a very rapid start relative to the USDA projection for the year. Shipments during the first 22 weeks of the year were only 4 percent smaller than those of a year ago. Unshipped sales, however, are only about half as large as those of a year ago. Cumulative Census Bureau export estimates through September were about 6 million bushels less than USDA export inspection estimates. It appears that the pace of shipments will slow dramatically as the year progresses, with the USDA forecast looking pretty reasonable for the year.

Compared to the very rapid pace of a year ago, soybean exports and export sales have started very slowly for the year that began on September 1. Cumulative exports, sales, and total commitments are about 35 percent less than those of a year ago. The Census Bureau estimate of exports in September was very close to the USDA export inspection estimate. Of the major buyers of U.S. soybeans, only Mexico has committed to a larger quantity than that of last year. Last year, the pace of exports and export sales slowed dramatically after the first quarter of the marketing year. A steadier pace this year would suggest that the difference in total commitments between those of this year and last year will narrow going forward. Still there is a lot of uncertainty about the strength of export demand for soybeans in the face of expectations for another very large South American crop.

Conclusion

With the wheat marketing year well under way, export progress supports the USDA forecast of a substantial decline in exports for the year and suggests that prospects of ample year-ending stocks will persist with prices remaining weak in the near term.

Early in the corn marketing year, corn export progress offers some evidence that exports might exceed the USDA projection. The key may be the size of Chinese business. Good export progress, along with a smaller crop estimate and ideas that USDA projections for feed and residual use during the current marketing year may be too conservative should be supportive to corn prices.

The early pace of soybean exports relative to that of last year is not encouraging. Early progress relative to the USDA projection is more comparable to that of years prior to 2010 and 2009 so that the current projection may still be attainable. The larger sales for the week ended November 3rd are encouraging, but unless they are sustained soybean prices may remain under some pressure.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.