Is There a Transaction Tax in Your Future?

A financial transaction tax – collected each time a futures or options contract is traded – is under serious consideration in Europe. In September 2011 the European Commission proposed a 0.01 percent on derivatives trades (including futures and options), along with a separate tax on stock and bond trades. Together these two taxes are expected to raise 57 billion Euros ($89 billion) in new revenues. Britain, which is home to a thriving global financial center in London, would bear the brunt of this tax and has vowed to veto it. Other countries with much smaller financial sectors, led by France and Germany and joined by Austria, Belgium, Finland, Greece, Italy, Portugal, and Spain, strongly support this tax. These nine countries claim to be prepared to implement some version of this tax on a country-by-country basis if the EU-wide effort fails.

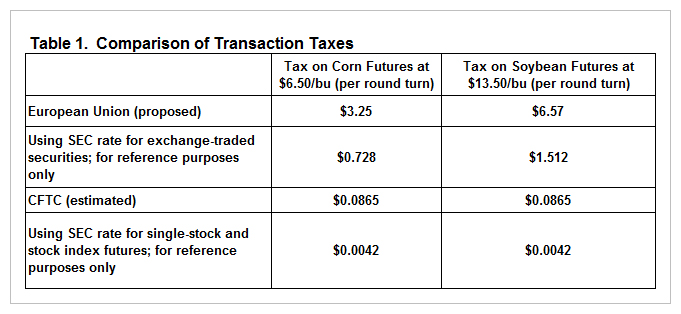

The amount of this EU tax on a per-contract basis would vary from one commodity to the next and from one time to the next because it would be calculated on the value of each particular contract at the time it is traded. For example, for corn at $6.50 per bushel, the value of a 5,000-bushel futures contract is $32,500, so a 0.01 percent tax would amount to $3.25 per round-turn. For soybeans at $13.50 per bushel, the value of a 5,000-bushel futures contract is $67,500, so a 0.01 percent tax would amount to $6.75 per round-turn.

One reason behind Britain’s objections is that it already charges a “stamp tax” of 0.5% of the value of transactions involving securities, but not futures or options. This is five times the proposed EU transaction tax rate on stock and bond trades and is the highest such tax in Europe, so imposing a new EU transaction tax on top of the existing stamp tax is viewed as excessive. Stamp taxes date back to the late 1600s, and originally referred to a “stamp” required on all paper and printed materials. The Stamp Act of 1765, which extended this tax to the American colonies, was highly unpopular. Although it was repealed the following year, it was one of the grievances that caused the colonies to declare their independence from England.

Here in the US, a so-called “user fee” on all futures and options transactions is outlined in the Administration’s proposed budget for fiscal year 2013. The Commodity Futures Trading Commission (CFTC) has requested $308 million for fiscal year 2013, a 50% increase from the $205 million enacted for the current fiscal year that ends September 30. According to the Administration’s proposal, all funding for the CFTC’s budget – the entire budgeted amount, not just the year-over-year increase – would come from user fees.

Transaction taxes are sometimes referred to as a “Tobin taxes,” after James Tobin, the Nobel Prize-winning economist. In 1972 Tobin proposed a tax on short-term currency trades as a way to stabilize exchange rates and prevent a “run” on foreign currencies. A transaction tax also is the basis for the “Let Wall Street Pay for the Restoration of Main Street Bill” that was introduced in Congress in 2008 and 2009 but both times died in committee, as well as the so-called “Robin Hood Tax” proposals that have been promoted by various groups. Supporters point out that in addition to raising new revenues to reduce the federal budget deficit, a transaction tax might also curb speculation, particularly the high-frequency or “algorithmic” trading that is often blamed for creating market volatility. However, a number of studies have found that increasing the cost of trading does not necessary reduce volatility, and in some cases might actually result in greater volatility as liquidity in the market is reduced.

If a transaction tax is enacted, how much might it be? In the Detailed Budget Estimates here the CFTC states that a fee-based source of funding “would bring the CFTC into line with all other Federal financial regulators, which are funded in whole or in part through user fees” (page 1302). For example, the Securities and Exchange Commission (SEC), a sister agency which is responsible for regulating the securities markets, currently charges a fee of $22.40 per $1 million of exchange-traded securities transacted, and $0.0042 for each transaction involving single-stock futures and stock-index futures.

The budget explanation does not provide any details on how the CFTC’s user fee would be determined, but the most straightforward approach would be a uniform amount per futures or options contract traded, regardless of the contract value or price of the underlying commodity. Using data from calendar year 2011, there were 3.559 billion futures and options contracts traded by US exchanges. Dividing the CFTC’s proposed $308 million budget by 3.559 billion contracts equals an estimated tax of 8.65 cents per contract traded.

This is far less than the proposed amount per contract in the EU model, and substantially less than the amount currently charged by the SEC on exchange-traded securities. For example, the SEC’s current $22.40 per $1 million rate, if applied to our earlier corn and soybean examples, would result in taxes of $0.728 per corn futures contract and $1.512 per soybean futures contract, respectively. However, the CFTC’s estimated 8.65 cents per contract is more than 20 times the 42/100 of 1 cent currently charged by the SEC on single-stock and stock-index futures. The range of possibilities is quite large, as shown in the comparison of transaction taxes in Table 1. These figures do not reflect any volume decreases that may result as market participants adjust their trading behavior in response to these new taxes.

Who would bear the burden of a transaction tax, if it is enacted? Economic theory is useful in predicting how much of a price increase would be borne by the seller (in this case, exchanges and brokerage firms) and how much would be passed on to the buyer (in this case, futures/options customers). In a competitive market with many suppliers, there is a tendency for sellers to absorb a large portion of any price increase. However, since most futures and options contracts are offered by just one exchange, one would expect the majority of any transaction tax to be passed along to end-users.

What are the chances of a transaction tax being imposed on futures and options trades in the United States? It is important to remember that we are at the very early stages in the budget process, so nothing is certain at this point. The process begins with the President submitting a proposed budget (which has happened), and then Congress responds with its own views on taxes and spending for the upcoming fiscal year (which has not yet happened).

Over the years there have been a number of attempts at implementing a transaction tax, all of which failed. Although some observers have called this latest effort “dead on arrival,” already it has progressed farther than any previous attempt. In addition, never before has there been a federal government with such a need to find new sources of tax revenue, coupled with lingering public anger at the financial sector from the 2008 meltdown. At this point anything is possible, or as Yogi Berra said it best, “It ain’t over ’til it’s over.”

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.