Updating your Estate and Succession Plan

The American Taxpayer Relief Act of 2012 (ATRA) addressed many of the tax issues concerning taxpayers. ATRA made permanent many of the tax provisions that were scheduled to expire. For example, it provided a permanent exemption amount for the alternative minimum tax (AMT) and, more importantly, it indexed it for inflation.

In the estate tax area, ATRA made a $5 million federal exemption permanent and also indexed the exemption for inflation. For deaths in 2013, the exemption amount is $5.25 million. This provides relief for many farm families and will mean the farm can pass to the next generation. It also made the portability permanent. Portability allows an estate to pass through any unused federal exemption to the surviving spouse. The following example illustrates how portability works.

- Oliver and Lisa owned a farm in Hooterville. Oliver had an estate valued at $1 million and Lisa has an estate valued at $7 million due to an inheritance from her Hungarian parents. Oliver died in 2013. His estate will have no federal estate tax and has a $4.25 million excess federal exemption amount. If the executor of Oliver’s estate files an estate return, they can elect the portability provision and pass the unused $4.25 million exemption amount to Lisa. Assuming Lisa has not remarried before her death, she can have a federal estate of $9.5 million ($5.25 million + $4.25 million) without having an estate tax liability.

Many taxpayers mistakenly believe they no longer need to prepare an estate plan because of the lack of any federal estate tax liability (FET). This may be flawed thinking on their part. First, they may have state transfer tax. This is the estate tax assessed by the state in which they live. Many states do not have an exemption amount as large as the federal exemption. For example, Illinois only has a $4 million exemption for 2013.

The second reason to remain concerned about estate planning is that Congress may change the rules at any time. Beginning in 2019, the President’s 2014 budget would return FET to 2009 levels. This would mean a $3.5 million exemption and a top tax rate of 45%.

Many farm families have estate plans that were drafted years ago. Unless these are amended to comply with the current laws, they can create serious problems for the surviving spouse as shown in the following example.

- Ted and Rhota Tiller’s attorney drafted a trust for them in 1985. The trust was a standard AB trust. At the death of the first spouse, their assets up to the federal exemption amount will go into the B trust or “bypass trust.” The remaining assets will go into the A trust, or “marital trust”. Because the B trust utilizes the federal exemption amount, there will not be any FET on those assets. The assets going into the A trust are also exempt. These assets are available to the surviving spouse and consequently qualify for the unlimited marital deduction. However, they will be subject to FET on the spouse’s death.

This was an excellent planning tool in 1985 when the federal exemption amount was $400,000. If Ted had a $900,000 estate at the time of his death, $400,000 would go to the B trust and $500,000 to the A trust. Any appreciation on the B trust assets would not be taxed at Rhota’s death.

However, Ted dies in 2013. His assets are now valued at $3 million. Under the old trust document, all $3 million will go into the B trust, leaving no assets for Rhota. This may not leave Rhota with enough assets to maintain her lifestyle.

A person that dies with no will is said to die “intestate.” Only assets that would normally transfer under a will are included in the intestate succession laws. These include the following:

- property owned in joint tenancy or tenancy by the entirety

- real estate held by a transfer-on-death deed

- funds in a retirement plan

- life insurance proceeds

- property in a living trust

- payable-on-death bank accounts

- securities held in a transfer-on-death account

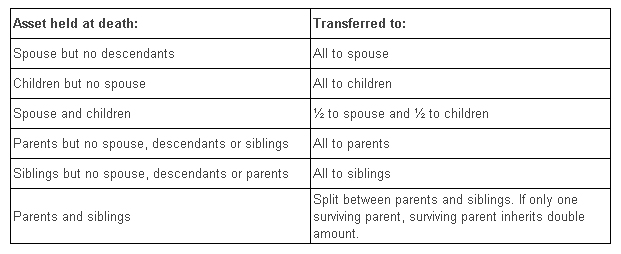

In Illinois, the deceased’s assets, other than those listed above, are transferred as follows if there is no will:

- Chuck and Pat Rost reside in Illinois and have no estate plan or will. Chuck’s only asset is $800,000 in a savings account. Chuck has a son Arthur from a former marriage but has not had contact with him for 40 years. When Chuck dies intestate, Pat will inherit $400,000 and Arthur will inherit $400,000. This may not be the result Chuck wants, but the only solution would be to have a will drafted and executed before his death.

A will is important for more reasons than the distribution of assets. If both parents of a minor child are deceased and custody has not been stated in a will, the court decides who will have custody.

This article has discussed only a few of the possible adverse results from having no estate plan or an old plan. Families should have their estate or succession plan reviewed by a competent attorney on a regular basis or whenever there is a major change in the law.

The University of Illinois Tax School and Farm Credit are holding an estate and succession planning conference, Protecting the Family Farm Legacy, in Normal, Illinois, on June 24, 2013. If you want to learn more about dealing with both farming and nonfarming heirs, selection of the best entity for a succession plan, financing your retirement, understanding estate terminology and various types of trusts, you are encouraged to attend this upcoming conference. Details are available at: http://www.taxschool.illinois.edu//legacy

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.