Crop Insurance Premiums for 2017

Many producers are seriously evaluating their crop insurance budgets and coverage options in light of changing prices and premiums. Crop insurance premiums are determined each year based largely on several factors including the indemnity price of the insured commodity, on the user’s yield and risk characteristics, and on a large number of actuarial factors established by the Risk Management Agency (RMA) based on prior loss experiences. The premiums are determined in a manner intended to be “actuarially fair”, or to result in a loss ratio that equates premiums paid in and premiums paid out over time. The RMA applies a farmer-based subsidy that varies by coverage type and coverage election level, and offers both farm-level and area products for either revenue or yield. In addition to the already long list of options, the unit type and practice also influence both effective coverage and subsidy. As a result of all the possible combinations, a farmer could have well over a hundred combinations of inputs and premiums to evaluate each year. Most of the policies sold through time have gravitated toward higher coverage revenue products, but it remains important to understand the options available and evaluate the coverage offered by each combination for a producer’s situation.

The Crop Insurance section at farmdoc includes a convenient premium calculation tool to quickly estimate premiums and understand coverage options for corn and soybean farmers over a large section of the Cornbelt. It is meant to provide an easily understood initial view of the crop insurance options and to help farmers plan for one of the largest risk management decisions typically made each year.

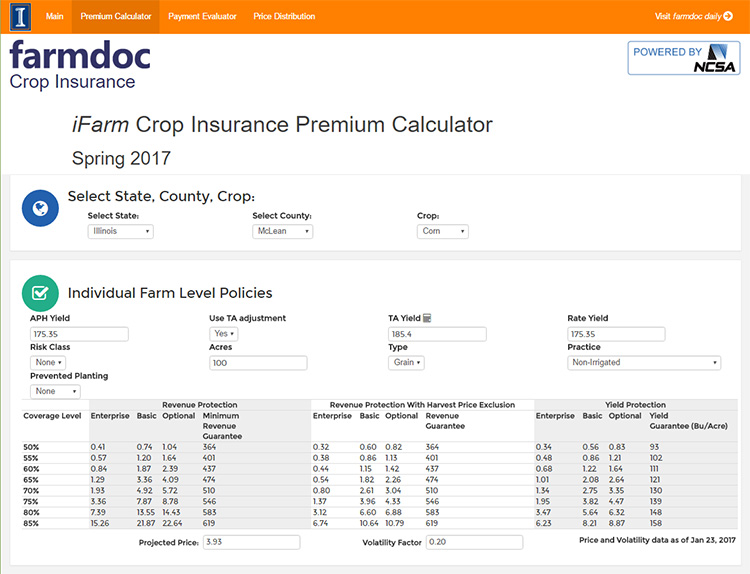

The following materials show some examples and discuss navigation and interpretation of the iFARM Crop Insurance Premium calculator.

The user first selects the State, County, and Crop of interest and then provides farm-level information describing the yield rating information, along with acreage, type and practice information. If the user is unsure about the impact of the Trend Adjustment and the associated TA Yield, there is a convenient calculator available by clicking on the calculator icon which takes the user to a spreadsheet that allows a quick calculation of the impact of the Trend Adjustment option in case needed. The case shown is for McLean County, Illinois, on a farm with a 185 TA yield, and a 175 APH and rate yield for non-irrigated production. The outputs are organized in three sections corresponding to Revenue Protection (RP), Revenue Protection with the Harvest Price Exclusion (RP-HPE), and Yield Protection (YP). Coverage level options are provided in rows from 50% to 85% coverage levels across all three types of policies. Within each block of outputs, farmer paid premiums per acre are provided for the three different unit designations of Enterprise (all acres of same crop in a county); Basic (all acres owned or rented in which you have a financial interest, or each landlord share-type); or Optional (each farm unit or distinct practice insured separately). Under RP insurance, the Minimum Revenue Guarantee is established as the projected price times coverage times the TA APH – for example the 85% coverage at a $3.93 initial price and 185 bushels coverage guarantees a minimum of $619 per acre, but that coverage will increase if the harvest price is greater than the projected price. This insurance is designed to help offset extreme bushel losses by allowing the indemnity price to increase along with market prices typical of stressed production years. Under RP-HPE, the initial coverage is identical to RP and will be the same at the end of the season regardless of the harvest price that occurs. The cost differences directly reflect differences in the actuarial costs of providing insurance and the differential subsidy across units and coverage levels. In the example shown, 85% Enterprise coverage could be purchased for $15.26 per acre guaranteeing a minimum revenue index of $619 per acre. If harvest price turns out to be $4.93 instead, the guarantee would increase to $777. Under RP-HPE, the coverage would remain $619 if prices increased to a $4.93 harvest price. Whether the difference in premium is worth it to a farmer or not depends on many factors including the organization of the units and their similarity in yield risk in particular. If the farmer were interested in only covering yield risk, the YP policy provides a relatively less expensive option to simply cover yield shortfalls below the associated guaranteed bushels shown in the table.

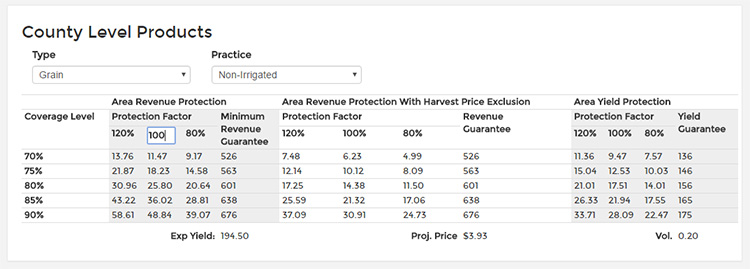

In the lower part of the webpage, Premiums are provided for Group or Area products. These products have their payments tied to the experience of a county rather than of an individual producer, and have different multipliers on coverage to allow producers to “make up” their risk of having a different outcome than the county in which they are located since the average in a county is likely to vary less than an individual producer. A screen shot of the McLean County group case is shown below. Analogous to the farm-level products, the options include insuring revenue at the county level with (ARP) or without (ARP-HPE) the Harvest Price Exclusion, or simply insuring county-level yield (AYP). While the premiums are higher relative to the same coverage options for farm-level products, the potential payments are higher as well. As has been discussed in previous farmdoc daily articles, there tends to be less correlation in the payments received and the producer’s actual revenue within a given year, so the group policies, while resulting in higher payment rates, may not do as much to reduce risk or offset revenue shortfalls as the payments are sometimes received when not needed, or not received when needed.

Importantly, the price patterns are relatively similar in different counties with similar production or yield potential but can vary dramatically in levels from location to location. Further, as more information becomes available about the actual starting indemnity or Projected Price, the scale of insurance and the resulting premiums will change accordingly.

Crop insurance is increasingly viewed as providing the cornerstone for active risk management programs, and its importance is elevated in environments with greater margin risk. The differences in underlying rates and starting price and volatility conditions can substantially impact the relative performance of the alternatives from year to year, and across different operations within a given year. Future articles will describe a tool to examine price risk, and an on-line tool to help evaluate the implications for risk mitigation of alternative crop insurance choices. Hopefully the iFARM Crop Insurance Tools will provide producers with insights needed to make informed crop insurance decisions most suitable for their own operations. As always, these tools are designed to provide information that is as accurate as possible, but a qualified crop insurance agent should be contacted for final cost calculations. Final price information will be available after March 1, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.