Accumulating Assets

The March 15, 2019 farmdoc daily reviewed ‘Accumulating Liabilities’ in the balance sheet of a group of observations in the Illinois FBFM Association dataset from 2013 to 2017. While that article considered the changes to debt on the balance sheet of Illinois farm operators, this article reviews the corresponding structure of average assets measured at fair market value over the same period.

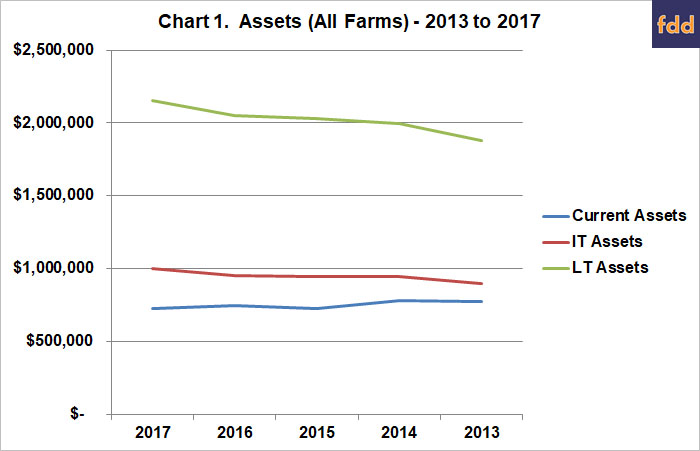

Chart 1 depicts the absolute dollar amount of average current, intermediate and long-term (fixed) assets from 2013 to 2017. Farms represented in this dataset are predominantly grain farms but include hog, beef and dairy operations. There is a 6% decrease in average current assets or $(47,726) over the five-year period. An 11% increase in average intermediate assets or $100,868 occurs as does a 15% increase in fixed assets or $274,456. The change in percentage terms masks the dollar amount change as the fixed assets are more than twice the level of current and intermediate term assets. Farm size did increase from an average of 730 tillable acres to 786 tillable acres in the intervening five years with a steady ‘percent owned acres’ which may explain some of the increase in fixed assets.

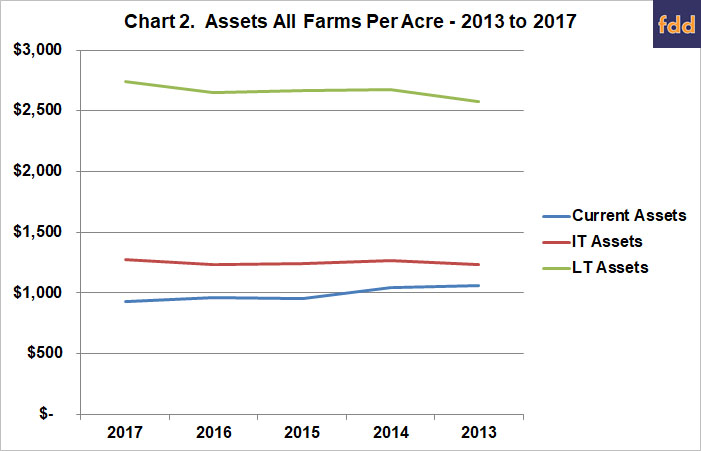

Chart 2 depicts the same information as Chart 1 except that it is on a ‘per acre’ basis which normalizes the fair market asset value by the number of acres in the farm. As noted previously, the average number of acres from this five-year span of time runs from a low of 730 acres in 2013 to a high of 786 acres in 2017 – so the range is fairly small. This tells just a bit different story in that there is a 13% decrease in average current assets or $(137)/acre over the five-year period. There is a 3% increase in average intermediate assets or $41/acre and a 6% increase in fixed asset or $166/acre. Both Chart 1 and Chart 2 show a trend to lesser levels of current assets and increasing levels of intermediate and fixed assets.

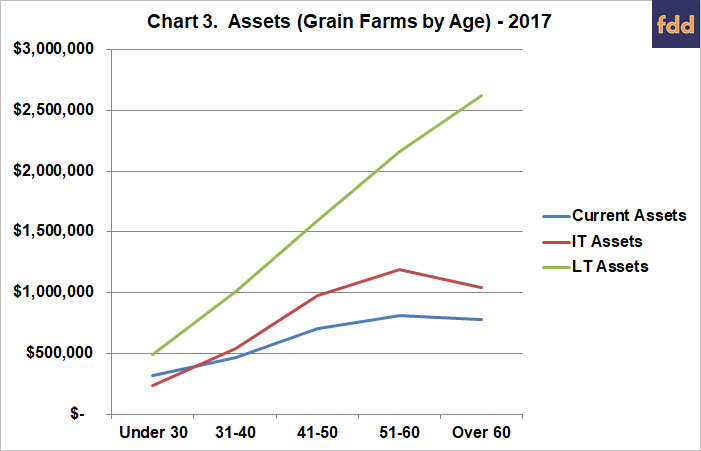

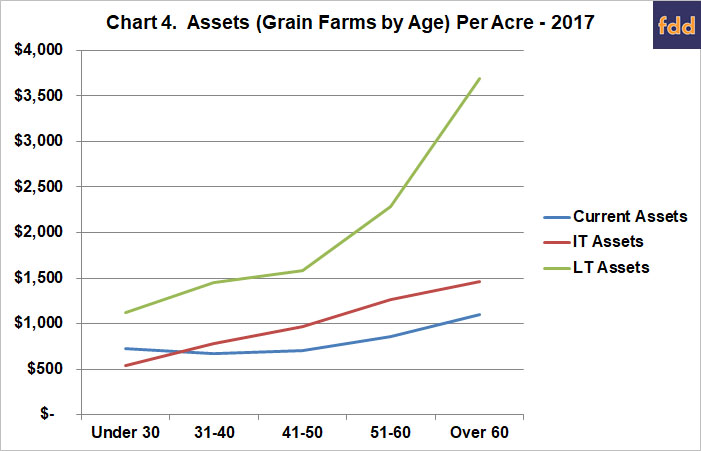

Charts 3 and Chart 4 consider grain farms exclusively and as such is a subset of the data used in the first two charts. Charts 3 and 4 use data from only 2017. Further, these two charts segment the three classes of assets into five age groups.

Chart 3 tells of current assets increasing as operator age increases. Intermediate assets show a similar pattern but increase at a bit more rapid rate than do current assets. The value of fixed assets increased markedly as operator age increases. Presumably as the result of the accumulation of a lifetime of earnings As noted in Chart 1, the dollar level of fixed assets in general are far greater than that of current or intermediate assets.

Chart 4 divides the three classes of assets by the number of acres operated and also segments the data into five age groups. The number of tillable operator acres in each of the age groups is: Under 30 – 434 acres, Age 31 to 40 – 693 acres, Age 41 to 50 – 1007 acres, Age 51 to 60 – 946 acres and Over Age 60 – 711 acres. Current assets are steady from the Under Age 30 group through the Age 41-50 group and then increase for the remaining two age groups. Average intermediate term assets per acre increase at a steady rate through the five age groups. Average fixed assets increase slightly from the Under 30 age group through the 41-50 age group and then increase dramatically into the 51-60 and Over 60 age groups.

Summary

Our Illinois FBFM data indicate a long term trend of asset value increases year over year. That increase is much accentuated for fixed assets especially when the farm operator has a period of years to create revenue and then presumably use that revenue to accumulate fixed assets that are increasing in fair market value.

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,500+ farmers and 65 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-5511 or visit the FBFM website at www.fbfm.org.

Reference

Zwilling, B., B. Biros, and D. Raab. “Accumulating Liabilities.” farmdoc daily (9):46, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 15, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.