Seed Corn Costs: How Do Discounts Work with Seed Company Financing?

Introduction

To manage input costs, many producers take advantage of early pay and other discounts offered by input suppliers. Seed and chemicals often have complex pricing, with a range of pre-pay discounts, volume discounts, rebates and other incentives. On top of that, financing options are almost always available, with their own schedule of discounts and fees. This series addresses the following aspects of seed corn costs: (1) early cash payment and volume discounts (2) discounts under seed company financing options, and (3) the cost of seed company financing relative to traditional financing. In our first article (farmdoc daily October 10, 2019), we created a hypothetical discount schedule based on published discount schedules to show that seed discounts can easily reduce costs by over 20 percent of the base price with early cash payment and volume discounts. In this article, we use this information to consider how discounts work under seed company financing.

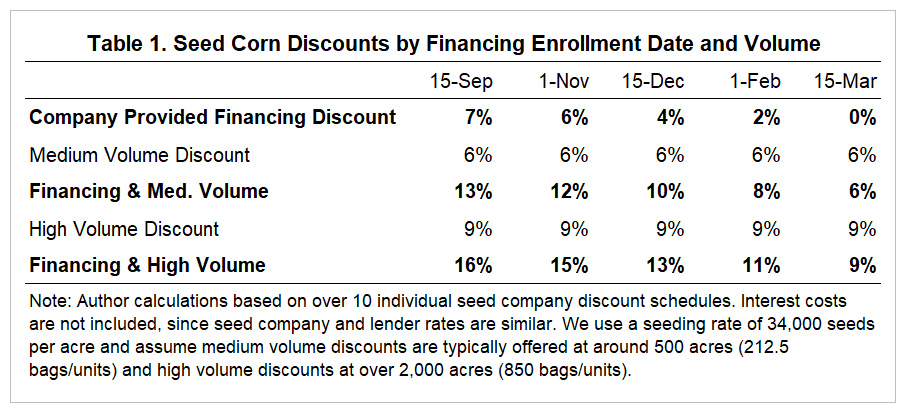

Most seed companies offer financing under a separate discount schedule, which we summarize in Table 1. As we discussed in our previous article, we do not account for base price, but consider only the potential range of prices across an individual company, holding base price constant. Locking in financing early and obtaining a volume discount can lead to discounts from the base price in the range of 15 percent, which offers meaningful cost savings.

Table 1 does not include interest costs. We found that interest costs for seed companies (often prime to prime plus 1 percent) are comparable to those currently being offered on operating lines from Farm Credit and commercial banks. However, the discount is typically lower on the seed base price, which is the main difference between financing terms offered by the seed company and the financing a producer procures from a lender like Farm Credit or commercial banks for seed purchase.

While the difference between early pay cash discount and early financing discount appears to narrow when comparing the results from our previous analysis with Table 1, this is an artifact of averaging. If you look at an individual seed company, the difference between the early pay cash discount and the early financing discount is the same in each time period. We observe this distance to be close to 5 percent for most seed companies. This differential may help cover the costs companies pay to offer financing. Table 2 provides a hypothetical firm-level schedule to illustrate this point.

Our analysis does not consider base price and the assortment of other discounts available, which are also important for management decisions. Further, negotiation is possible in nearly any business transaction. Given how straightforward it is to show a 20 percent differential relative to base price, it is not difficult to envisage the range reaching one third, but this is beyond the scope of our analysis. Nor does our analysis consider incentives such as trips or merchandise, which may factor into some decisions. For farm operators who have trouble “spending money on themselves,” such incentives may have meaningful non-cash value. A general understanding of the costs underlying the rewards may be a useful thought exercise as a grower seeks to understand the true price of their seed.

Concern has been raised by Abendroth et al. (2006) about the possible yield gains sacrificed by a hurried decision on hybrid selection. We agree that a producer needs to be prudent in their selection of hybrids—the higher cost of high-yielding varieties may pay for itself. Often there are at least two or three years of commercial trials for most hybrids, so even new hybrids can be evaluated prior to the early pay discount period. Additionally, depending on the seed corn company’s order flexibility, the producer may still be able to make slight alterations to the hybrid variety mix after the initial selection.

We do not believe discounts are an elaborate strategy designed to befuddle producers. Supply chain management is a major challenge facing the seed corn industry, as discussed in Jones et al. (2003). Hybrid seed corn must be grown in a previous season or in different geographic areas to ensure seed that can be sold and planted in a timely manner. Ultimately, seed corn inventory management is expensive. The practice of early pay discounts could be explained by the desire of seed companies to lower their costs, becoming the industry norm over time. The strong industry competition highlighted in MacDonald (2017) should keep the pricing of seed corn competitive. Some firms, such as the Farmers Business Network, have begun to offer “transparent pricing” as a part of their business strategy. It will be interesting to see how the industry evolves over the next decade.

In this article, we showed typical discounts under seed company financing and discussed industry trends related to discounts. Early enrollment and volume discounts are often 15 percent lower than the base price under seed company financing. In our next article in this series, we will use this information to compare the cost of seed company financing with financing inputs using traditional lenders.

References

Abendroth, Lori, Roger W. Elmore, and Jim R. Rouse. “Early seed discounts don’t always pay.” (2006). Iowa State University Extension and Outreach: Integrated Crop Management. Available https://crops.extension.iastate.edu/early-seed-discounts-dont-always-pay. Accessed 10 August 2019.

Fiechter, C. and J. Ifft. “Seed Corn Costs: How Large Are the Discounts?” farmdoc daily (9): 190, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 10, 2019.

Jones, Philip C., Greg Kegler, Timothy J. Lowe, and Rodney D. Traub. “Managing the seed-corn supply chain at Syngenta.” Interfaces 33, no. 1 (2003): 80-90.

MacDonald, James M. “Mergers and competition in seed and agricultural chemical markets.” Amber Waves Magazine. USDA Economic Research Service. Issue 3, April 2017.

Schnitkey, G. “Crop Budgets, Illinois, 2019.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. Accessed October 9, 2019. https://farmdoc.illinois.edu/assets/management/crop-budgets/2019_crop_budgets.pdf.

Acknowledgements: We are grateful to friends and family who shared information on seed pricing and common industry practices. Jason Karzses encouraged us to work on this general topic and Gary Schnitkey provided helpful feedback. This work was supported by the USDA National Institute of Food and Agriculture, Hatch-Multistate project 1016791.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.