The State of Soybean in Africa: Soybean Yield in Africa

USAID’s Feed the Future Lab for Soybean Value Chain Research, aka the Soybean Innovation Lab (SIL), is a research for development project begun in 2013. The team of 45 US researchers work in 17 countries, most of which are in Sub-Saharan Africa. The University of Illinois is the lead institution, accompanied by the University of Missouri and Mississippi State University. Recently, farmdoc asked SIL to provide a series of articles describing the state of soybean development in Sub-Saharan Africa. This series of articles describes the current state of soybean in Africa from the multiple disciplines that comprise the Soybean Innovation Lab. Peter Goldsmith is the Principal Investigator at the Soybean Innovation Lab. Feel free to reach out to Amy Karagiannakis at the Soybean Innovation Lab at soybeaninnovationlab@illinois.edu for more information on any of the topics, or if you would like to collaborate with the team.

A list of all articles published in the series can be found at: https://farmdocdaily.illinois.edu/category/areas/other/soybean-africa-series

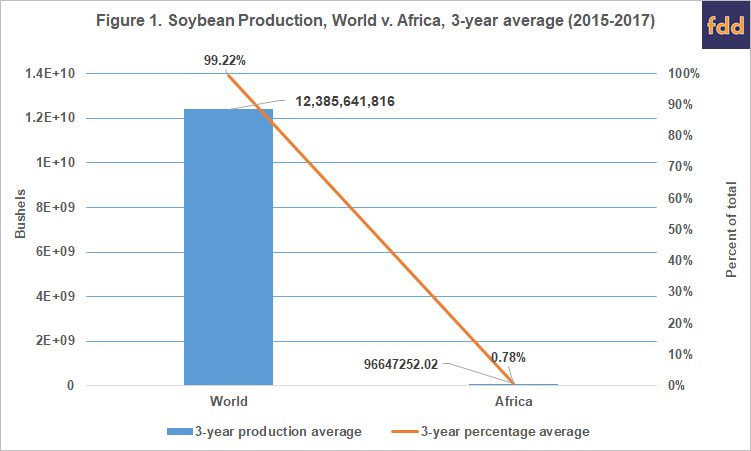

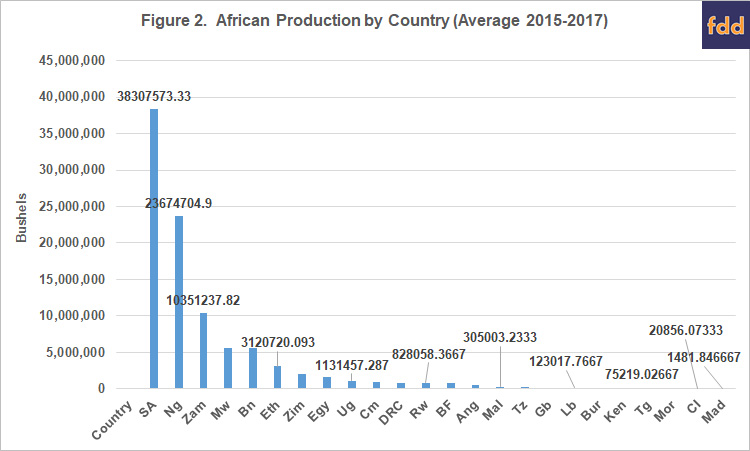

African producers supply less than 1% of the world’s soybeans (Figure 1). Worldwide production of soybean has grown at a compound annual growth rate (CAGR) of 4.68% since 1961, while African production levels are rising 48% faster at a rate of 6.84% per year. Both world and Africa’s growth in production mostly result from an increase in soybean acres planted and not from yield. South Africa, Nigeria, and Zambia are the top three soybean producers on the African continent. South Africa’s 3-year (2015-2017) production average was 38.3 million bushels, which is 39% of the African continent’s production (Figure 2). Nigeria’s 3-year production average was 23.7 million bushels, which is 25% of the continent’s production. Zambia’s 3-year average was 10.4 million bushels, which is 11% of the continent’s production. The other 21 countries, where data are available, together produced 25% of Africa’s total soybean production. The average national production is 4,026,969 bushels, and the smallest producer is Madagascar, whose three-year production average is 1,470 bushels. Annual production remains below 1,000,000 bushels for 15 of the 24 countries for which data exists.

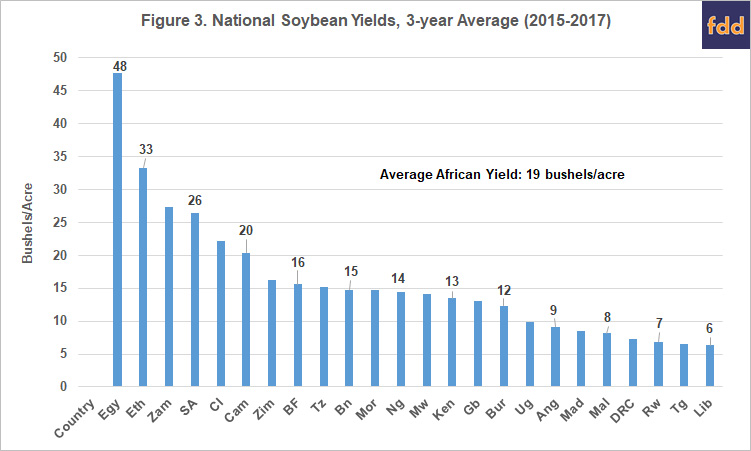

Global average yield per hectare is 41 bushels per acre, while African producers produce less than half the yield at 19 bushels per acre (Figure 3). Egypt, using irrigation, leads all of Africa in terms of average soybean yield at 48 bushels per acre, while Ethiopia and Zambia, the number two and three yield leaders average 33 and 27 bushels per acre, respectively. South Africa, Africa’s soybean leader, averages 26 bushels per acre. Yields remain below 15 bushels per acre for 15 of the 24 African countries for which data exist.

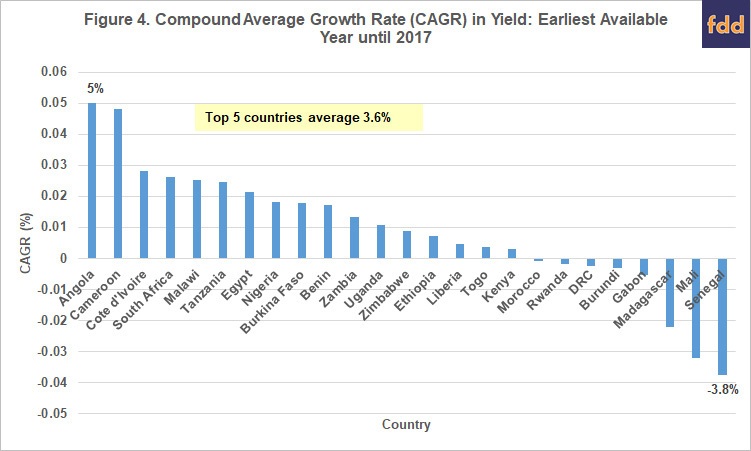

The 24 African countries for which official yield data exist have an average CAGR in yield of 0.9%, while the top five producing countries have an average CAGR of 2.0%. Globally average production per hectare has risen at a rate of 1.64% since 1961. The five leading countries in Africa produce 86% of the region’s soybean. Forecasted addition supply from these leaders by 2030 would only see an increase in supply of a little over 18 million bushels, or less than .15% of current global production. Angola has the highest CAGR for soybean yield at 5.3% per year. Cameroon and Cote d’Ivoire follow at 4.92% and 2.88%, respectively (Figure 4). These three countries, though achieving relatively high annual growth rates in yield, are advancing from a low base producing less than 1.4 million bushels combined. South African, Nigeria and Zambia, the regions leaders in terms of total production achieve CAGR’s of 2.6%, 1.8%, and 1.3 % respectively, thus still maintain low productivity growth.

In conclusion, Africa remains a minor player within the global soybean production scene. Levels of production are low, as are growth rates in yield. Total soybean supply presents a minimal effect on global markets. Not only are levels of production low, but growth rates in yield also show slow growth. Total production in the region though is rising faster than the world as a whole, but that increase originates from a very low base of production. Forecasts using currently available data portend a continent where domestic demand for soybean will continue to outstrip domestically produced supplies in the medium term, and imports will remain an important feature for meeting Africa’s soybean, soybean meal, and soybean oil needs.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.