Final Thoughts on the 2021 ARC/PLC Decision

March 15th is the deadline for producers to make their farm program election decisions for the 2021 crop year. With just a week remaining, today’s article highlights a few final points and factors to consider for those yet to make their elections. Producers who have not yet made their elections are urged to contact their local Farm Service Agency offices to do so as soon as possible.

Decision Overview

Farmers have three program options when making their election decisions.

- Price Loss Coverage (PLC) is a crop specific fixed price support program that triggers payments if the marketing year average (MYA) price falls below the commodity’s effective reference price. Payments are made on 85% of historical base acres.

- Agricultural Risk Coverage at the county level (ARC-CO) is a crop specific county revenue program. ARC-CO triggers payments if actual revenue (MYA price times county yield) falls below 86% of the benchmark revenue (product of benchmark price and trend-adjusted historical yield for the county). Payments are made on 85% of historical base acres.

- Agricultural Risk Coverage at the individual level (ARC-IC) is a farm-level revenue support program. Like ARC-CO, payments are triggered if actual revenue falls below 86% of the benchmark. If an FSA farm unit is enrolled in ARC-IC, information for all commodities planted in 2021 are combined together in a weighted average to determine benchmark and actual revenues. If a farmer enrolls multiple FSA farms in the same state, all farm units are combined in determining the averages for actual and benchmark revenues. Payments are made on 65% of historical base acres.

Decisions are made for each FSA farm unit. PLC and ARC-CO are commodity specific and can be mixed and matched on the same FSA farm or across different FSA farms (i.e. PLC for one commodity, ARC-CO for another on the same FSA farm, or using different programs for the same crop on different FSA farms).

The election decision for 2021 is much different than the one made last year. In 2020, farmers were making election decisions for the 2019 and 2020 crop years. The 2019 harvest was complete and the marketing year was well underway, providing more yield and price information than is typically available during a program election period. Thus, decisions may seem more uncertain this year as the 2021 marketing year has not even begun for corn, soybeans, or wheat. In addition, planting of the 2021 corn and soybean crops have not yet begun. Producer’s expectations for the 2021 growing season, potential price movements, personal preferences for the type of coverage they desire from their commodity program, and the type of crop insurance coverage they might be using for 2021 are all factors which might drive the election decision.

Tools to do last minute analysis and comparisons of the program options are provided at the farmdoc and farmdoc daily websites:

- ARC/PLC Calculator (online web tool, login required)

- 2018 Farm Bill What-If Tool (excel spreadsheet)

Some recent farmdoc webinars have also covered the commodity program decision in more detail, with videos and slides archived here:

- Commodity Title Choices in 2021 (February 4th, 2021)

- Final Look at Commodity Title and Crop Insurance Decisions (March 4th, 2021)

The Case for PLC

- PLC is a single variable program that provides protection against low prices – if prices fall below the reference price payments are triggered based on the price shortfall.

- Acres enrolled in PLC are eligible for the Supplemental Coverage Option (SCO) area insurance program, which can be used to increase coverage above the individual farm insurance product purchased for a farm.

- If 2021 yields are at or above trend/benchmark levels (i.e. if 2021 is a normal or above average growing season), PLC will trigger payments at higher price levels than ARC-CO because the price needed to trigger ARC-CO payment with normal to above average yields would be lower than the effective benchmark price needed to trigger PLC payments. Note price declines from current projections for new crop corn and soybean prices would need to occur for PLC to trigger payments for the 2021 crop year.

The Case for ARC-CO

- ARC-CO is a two variable support program. It provides revenue – thus, both yield and price – risk protection. While PLC will only trigger support under low prices, ARC-CO could trigger payments at higher price levels than PLC if the county experiences sufficiently low yields.

- Among the revenue coverage options, ARC-CO pays out on a higher percentage of base acres if payments are triggered (85% vs 65% for ARC-IC).

The Case for ARC-IC

If revenue protection is desired, ARC-IC might be a good fit for an individual farm if it differs considerably in some way from the county average, or under other specific circumstances (see farmdoc daily article from October 29, 2019). As examples:

- Farms that typically have much higher yields than the county average may see better support from ARC-IC even with the lower 65% payment rate.

- Farms with a history of frequent prevent plant claims for the entire farm may find more value in ARC-IC than with ARC-CO.

Corn, Soybeans, and Wheat

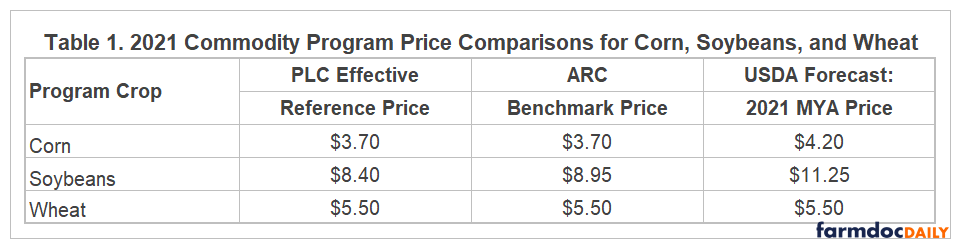

For 2021, the effective reference price for PLC and the ARC benchmark price are both at $3.70 for corn. The USDA’s latest projection for the 2021 MYA price is $4.20 (USDA, 2021). Thus, the most likely outcome for 2021 would be no support from any of the commodity program options. Since the reference and benchmark prices are equal, the likelihood of PLC payments is marginally higher for corn base acres in most counties. This, along with the fact that acres would remain eligible for SCO coverage, slightly favors PLC as the choice for corn. However, producers looking for some level of yield protection from their commodity program and not interested in using SCO for those acres in 2021 could easily rationalize the use of one of the ARC options.

The USDA projection for the 2021 MYA soybean price of $11.25 is well above both the PLC effective reference price ($8.40) and the ARC benchmark ($8.95) for 2021. As with corn, no support payment is the most likely outcome for all program options. PLC payments for soybeans are very unlikely, while ARC-CO, in most cases, has a marginally higher (but still low) likelihood of triggering support in 2021. If the farmer wants to use SCO, PLC will need to be elected. Both PLC and ARC-CO for soybean base could be justified based on the farmer’s county and preferences.

The 2021 MYA price for wheat is projected at $5.50, right at the level of the PLC reference and ARC benchmark prices. Thus, payments from PLC have a roughly 50% likelihood for 2021 and ARC-CO support would be estimated to have a slightly lower chance of being triggered due to the 86% trigger. Thus, for wheat base acres PLC is likely to be the favored choice across most situations.

Finally, the value of considering ARC-IC is going to be driven by characteristics of the individual farm as well as market considerations/expectations.

Summary

The March 15th deadline for ARC/PLC decisions is just one week away. Those producers who have yet to make their election decisions are encouraged to contact their local FSA offices as soon as possible. Failure to make program election changes by the deadline will result in farm units and base acres enrolled in what was elected last year for the 2019/2020 decision.

This year’s decision differs considerably from last year. In 2020, the decision covered both 2019 and 2020 and much more information was known about the 2019 crop and marketing years at the time of program election. This year decisions are for 2021 only and are being made prior to the beginning of the marketing year and planting for most crops. Producers are encouraged to consider 1) their expectations for potential price movements relative to current forecasts for 2021, 2) their expectations for the 2021 growing season and crop yields, and 3) their preferences for the types of risk(s) they would like their commodity program to cover and how their choice might impact their choice of and eligibility for crop insurance coverage.

References

USDA. 2021. “Grains and Oilseed Outlook.” USDA’s 97th Agricultural Outlook Forum, February 19, 2021.

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "The Case for Looking at the ARC-IC (ARC-Individual) Program Option." farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.