Higher Wheat Crop Insurance Premiums and the 2022 Crop Insurance Decision Tool

The 2022 Crop Insurance Decision Tool is now available to quote premiums for 2022 wheat policies. In Illinois and much of the Midwest, the deadline for changing wheat policies is September 30. Wheat premiums likely will be much higher than in 2021 because of a higher projected price and a higher volatility.

2022 Crop Insurance Decision Tool

Rates for wheat have been released by the Risk Management Agency (RMA), allowing quotes for wheat to be generated. As a result, the 2022 Crop Insurance Decision Tool has been released policies. At this point, corn and soybean rates have not been released. A revised tool will be made available in December when corn and soybean rates become available.

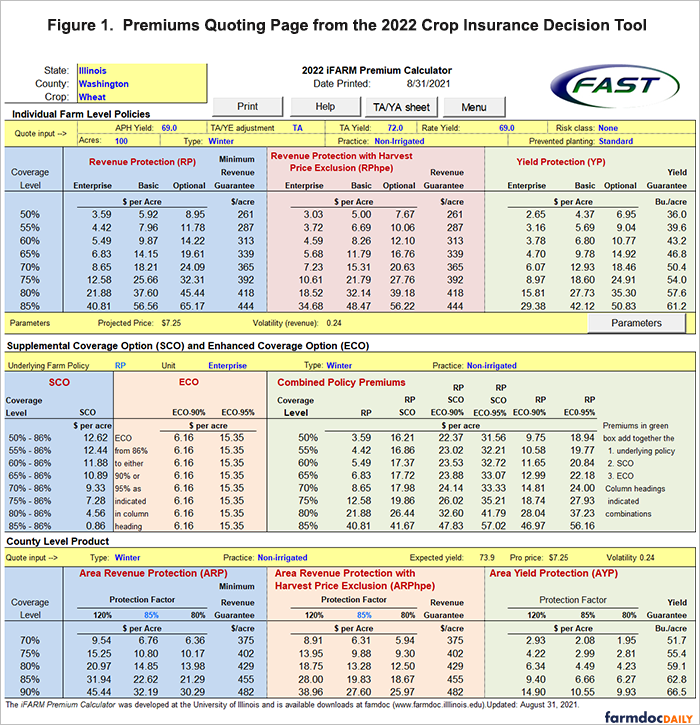

Figure 1 shows the premium quoting page from the 2022 Crop Insurance Decision Tool for wheat policies in Washington County, Illinois. Three panels containing premiums are given:

- Individual Farm Level Policies are shown in the first panel for the COMBO plans: Revenue Protection (RP), RP with the Harvest Price Exclusion (RPhpe), and Yield Protection (YP). These quotes are given for coverage levels ranging from 50% to 85% in five percent increments. Quotes are given for Enterprise, Basic, and Optional Units.

- The Supplemental and Enhanced Coverage Options (SCO and ECO) are available as add-ons for wheat policies this year. A user can choose between RP, RPhpe, and YP products as the underlying product, and the quoter will give premiums for the optional SCO and ECO policies.

- County Level Products that include Area Revenue Plan (ARP), ARP with the Harvest Price Exclusion (ARPhpe), and Area Yield Protection (AYP).

At this point, the 2022 projected price and 2022 volatility are not known as the discovery period is not over. The projected price will be the average of settlement prices of the September 2022 wheat contract traded on the Chicago Mercantile Exchange (CME) for trading days from August 16 to September 14. Quotes in Figure 1 are given for the average from August 16 to August 27, or $7.25 per bushel. The volatility used in Figure 1 is .24, the average volatility from August 23 to August 27. The final volatility will be based on volatilities for the last five trading days from September 8 to September 14.

Higher Premiums in 2022

Premiums will be much higher in 2022 as compared to 2021, primarily because projected prices and volatilities will be higher in 2022:

- The 2021 projected price was $5.60 compared to the $7.25 level likely for 2022.

- The 2021 volatility was .15 compared to the .24 level likely for 2022.

For RP at an 85% coverage level, the 2022 parameters result in a $40.81 per acre premium compared to a $27.73 per acre premium for the 2021 parameters, a difference of $13.08 per acre (see Table 1). Those differences decline as coverage levels are reduced: $7.12 per acre for 80% coverage level, $4.16 per acre for 75% coverage level, and $2.90 for a 70% coverage level (see Table 1).

Choices

Farmers may face sticker shock when first viewing premiums, particularly if 75% and higher coverage levels were selected last year. Although premiums are higher, this year’s coverage levels will also provide higher guarantees for the same coverage level and guarantee yield. For a farm with a 70 bushel per acre trend-adjusted Actual Production History (APH) yield, the minimum guarantee last year for a 80% coverage level was $313 per acre (.80 coverage level x 70 APH Yield x $5.60). This year, the minimum guarantee given a $7.25 projected price will be $406 per acre (.80 coverage level x 70 APH yield x $7.25), almost $100 greater than last year. Farmers can maintain a similar dollar value coverage to 2021 at a lower coverage level.

Farmers looking to combine a layer of farm protection with a layer of county level protection may consider SCO and ECO. For the Washington County case shown in Figure 1, an ECO providing coverage from 90% to 86% has a $6.16 farmer-paid premium while a 95% to 86% has a projected $15.35 per acre premium. Those quotes are at the highest protection level. Lower the protection level will lower the premium, as well as payments when they occur.

An individual could purchase a combination of individual and supplemental area revenue policies with a 90% coverage level for close to $24 per acre if the RP coverage level is below 70%. For example, RP 70% plus SCO plus ECO-90% has a total premium of $22.17 per acre (see middle panel of Figure 1). Lowering the protection level on ECO 90% could further lower the premium. A 90% county guarantee could be of some value in this year of high projected prices.

Summary

Wheat premiums will be much higher in 2022 compared to 2021. Some of the reason for the higher premiums is a higher projected price, leading to higher guarantees in 2022. Few alternatives exist to lowering premiums other than to lowering coverage levels.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.