Will the Cost to Produce Corn Decrease after 2022?

Consumer costs in the U.S. have been increasing in a widespread incidence of inflation. Consistent with rising costs across many industries, the cost of producing corn will also increase in 2022. Although currently in a period of increasing costs, decreases in production costs could happen in years after 2022. Using history as a guide, one would expect cost decreases if corn prices decline, with fertilizer potentially being the area of most significant reductions.

Inflation

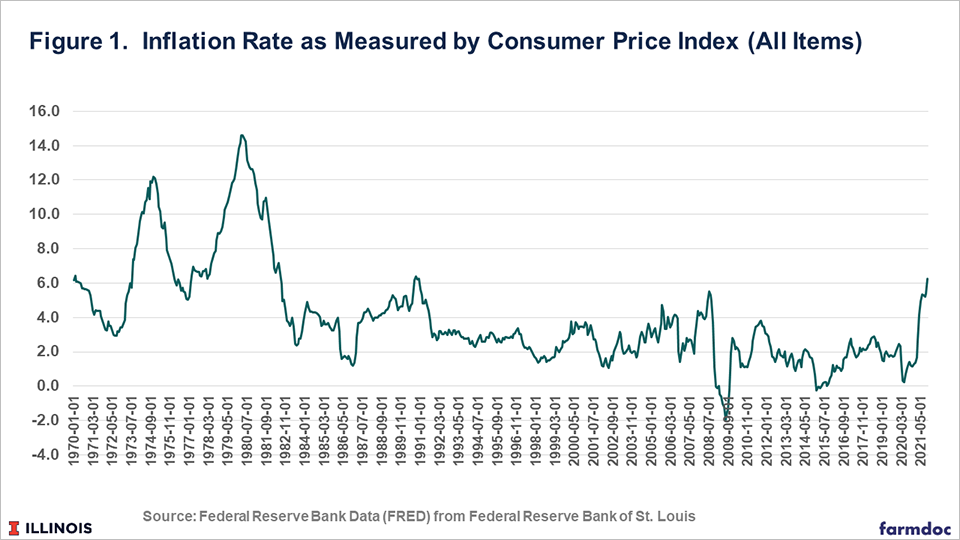

A period of increasing prices has occurred in the United States, with the Consumer Price Index rising 6.2% in October compared with a year ago, the largest annual increase in about three decades. Rising prices have impacted all industries, with agriculture being no exception.

Reasons for inflation include:

- Covid has impacted supply chains, changing the distribution of goods within the supply chain and causing shutdowns of essential plants producing important parts. Chips needed for cars, tractors, and other equipment are part of these Covid-induced delays. Delays and disruptions tend to increase prices.

- Fiscal stimulus injected into the system by the U.S. government has increased the demand for goods. In textbook fashion, an increase in demand can lead to higher prices. This stimulus includes Economic Impact Payments dispersed during President Trump’s administration and the stimulus packages passed during President Biden’s administration.

- Overall, the economy’s growth has been relatively high in the first half of 2021, exceeding 6% in both the first and second quarters. Expectations are for a robust fourth quarter, with good economic growth leading to the potential for upward price pressure.

- Monetary policy has generally been accommodative, with long-term bond purchase programs designed to lower interest rates. These accommodative policies can act to increase the money supply and may result in inflation.

- Covid caused a reduction in labor supply. Some older workers retired from the workforce due to Covid, and younger individuals are in high demand. Vaccine mandates also play a role in reducing labor supply. As a result, most employers are having difficulties finding employees, leading to increased wages. Wage increases then lead to higher production costs, which can lead to higher prices for final goods.

Current debate centers around whether this inflation is transitory or whether increasing price levels will continue into the future. If supply chain issues are the major reason for inflation, then price Inflation could be transitory, likely ending shortly. On the other hand, labor shortages could lead to longer-run inflation. John Deere recently resolved a strike with its workers, which included a provision that will increase wages with inflation (Wall Street Journal, “John Deere, Inflation Bellwether”, November 18, 2021), thereby building in cost increases if inflation continues. At this point, it is not clear whether price inflation is transitory or more permanent, and credible arguments can be made for each alternative.

Potential Declines in Production Costs in 2023

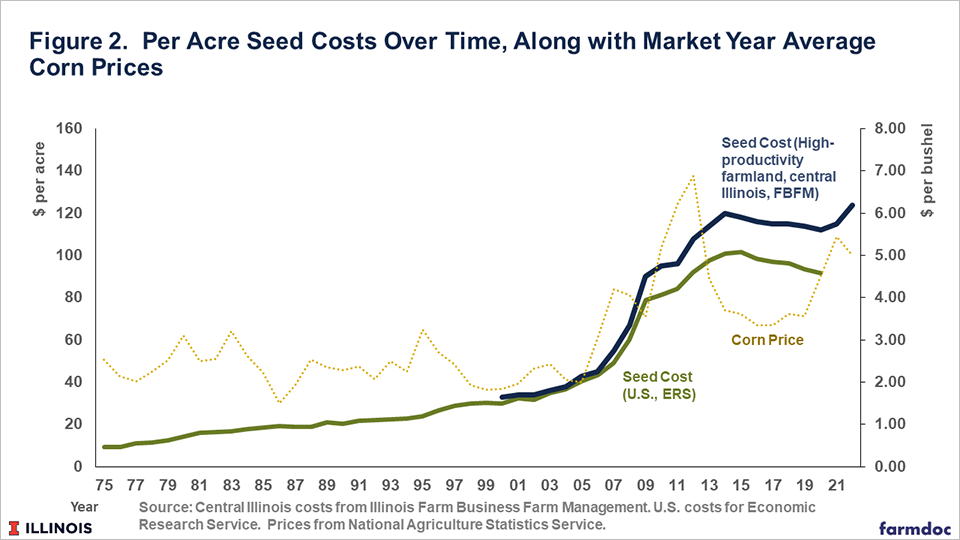

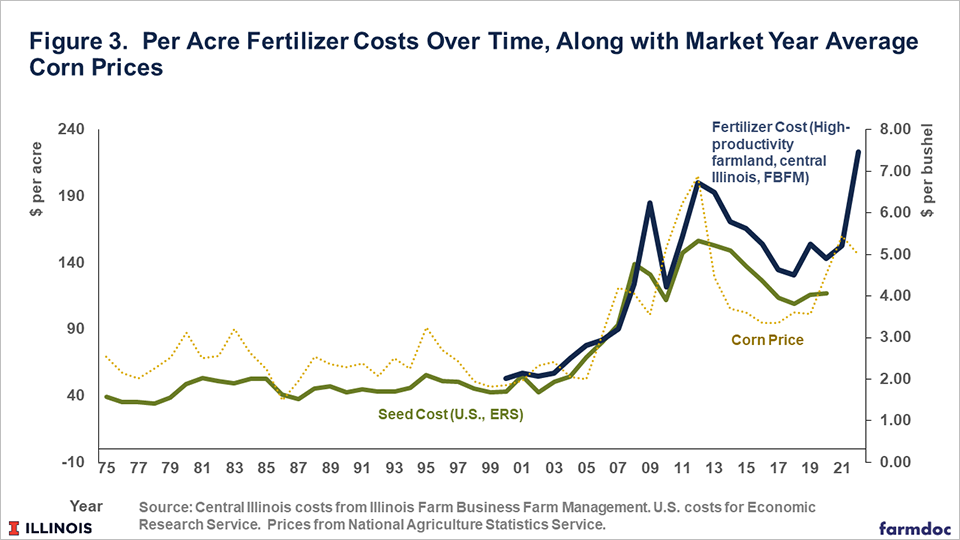

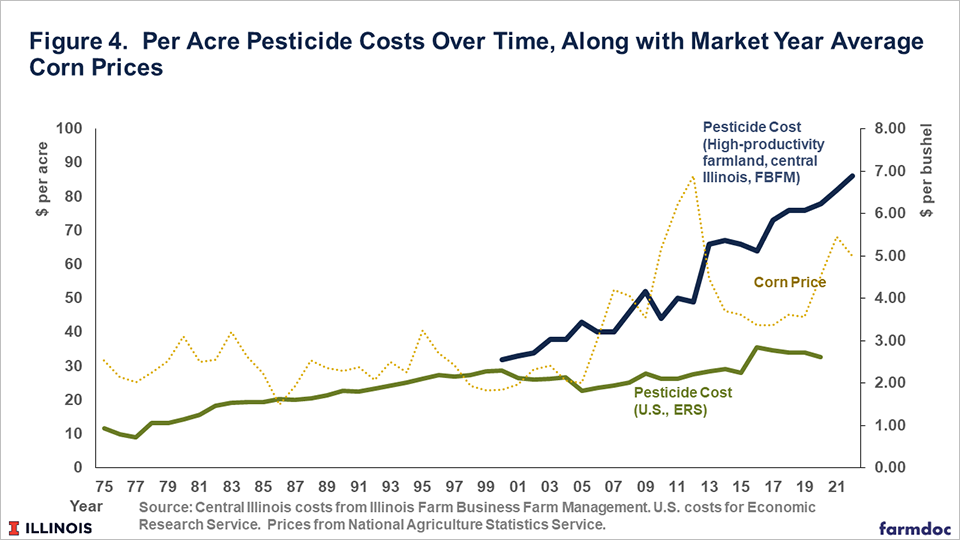

Record levels of non-land costs are projected for 2022. History would suggest that there is the possibility of decreases in future years. To illustrate, per acre costs for fertilizer, seed, and pesticides are shown in the following three sections for corn. These three costs account for about 50% of the total non-land costs of producing corn. Two series are shown. One gives costs for high-productivity farmland in central Illinois. These series has been available from 2000 on. Second, costs are reported for the U.S. and taken from the U.S. Department of Agriculture Economic Research Service (ERS). These costs are available from 1975, giving a longer time series. Per acre costs for the U.S. were statistically evaluated to understand relationships with corn prices, time, inflation. In the case of fertilizer, natural gas prices were also examined.

Seed

According to the ERS, seed costs in the U.S. increased gradually from 1975 to 2003 (see Figure 2). From 2003 to 2013, seed costs increased in both the U.S. and central Illinois. Central Illinois costs reached a high of $120 per acre in 2014. From 2015 to 2020, seed costs in both central Illinois and the U.S declined. For both 2020 and 2021, seed costs are projected to increase in Central Illinois. ERS has not released 2021 and 2022 projections as of yet.

Seed costs increased over time. Seed prices were related to corn prices, with rising corn prices leading to increased seed costs and vice versa. These relationships can be seen visually in Figure 2. After the decline in corn prices after 2012, seed costs also declined. Note, however, that the cost declines as much as it increased in the years before the drop in cost. Seed costs were not related to inflation rates, instead exhibiting a pattern of increases more related to time.

Fertilizer

According to the ERS, fertilizer costs in the U.S. remained relatively stable from 1975 to 2003 (see Figure 3). From 2004 to 2013, fertilizer costs increased in both the U.S. and central Illinois. Fertilizer costs declined from 2014 to 2015 before increasing again in 2019.

From year-to-year, fertilizer costs are more variable than seed costs. Fertilizer is a commodity whose price tends to vary from period-to-period, similar to most commodities.

Fertilizer costs tended to increase with time but also are highly related to corn prices. Similar to seed, the relationship between fertilizer costs and corn prices can be visually seen in Figure 4. In addition, fertilizer costs are influenced by the costs of fertilizer inputs, such as natural gas. Natural gas is a major input in the production of nitrogen fertilizers.

Pesticides

According to the ERS, pesticide costs increased from 1975 to 2003 (See Figure 4). Pesticide costs reported by FBFM have been increasing at a much faster rate than pesticide costs reported by ERS. In central Illinois, pesticides costs in recent years are growing as weed resistance to glyphosate and other chemicals have developed. Farmers also have increasing used fungicides in producing corn.

Pesticide costs have a strong relationship with time, tending to increase at a relatively stable rate.

Commentary

In recent months, non-land costs for corn have been influenced by supply disruptions, just as in other industries. One would expect those price increases to be temporary, likely receding after the 2022 planting season although it may depend on the underlying type of inflationary period we are in. Over time, fertilizer, seed and chemical costs have been more related to corn prices than to the inflation rate. If corn prices decline in future years, one would expect non-land costs to decline, but likely not as much as they have increased by in recent years. As in the past, fertilizer would likely be the category with the largest decreased. Seed could decrease as well, but not as much as they have increased since 2020. Pesticide costs are not related to inflation or corn prices, instead of showing a steady increase. This is important for planning, as budgeting in future years could be problematic if corn prices decline.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.