Information for Setting 2023 Cash Rents

Information relative to cash rents levels is now relatively complete. The National Agricultural Statistics Service (NASS) recently released state and county rents for 2022. The Illinois Society of Professional Farm Managers and Rural Appraisers released their projections of 2023 rents on professionally managed farmland. Overall, cash rents rose between 2021 and 2022. Results from the Illinois Society suggest rising cash rents in 2023, though at lower rates than occurred in 2022.

Average 2022 Cash Rents in Illinois

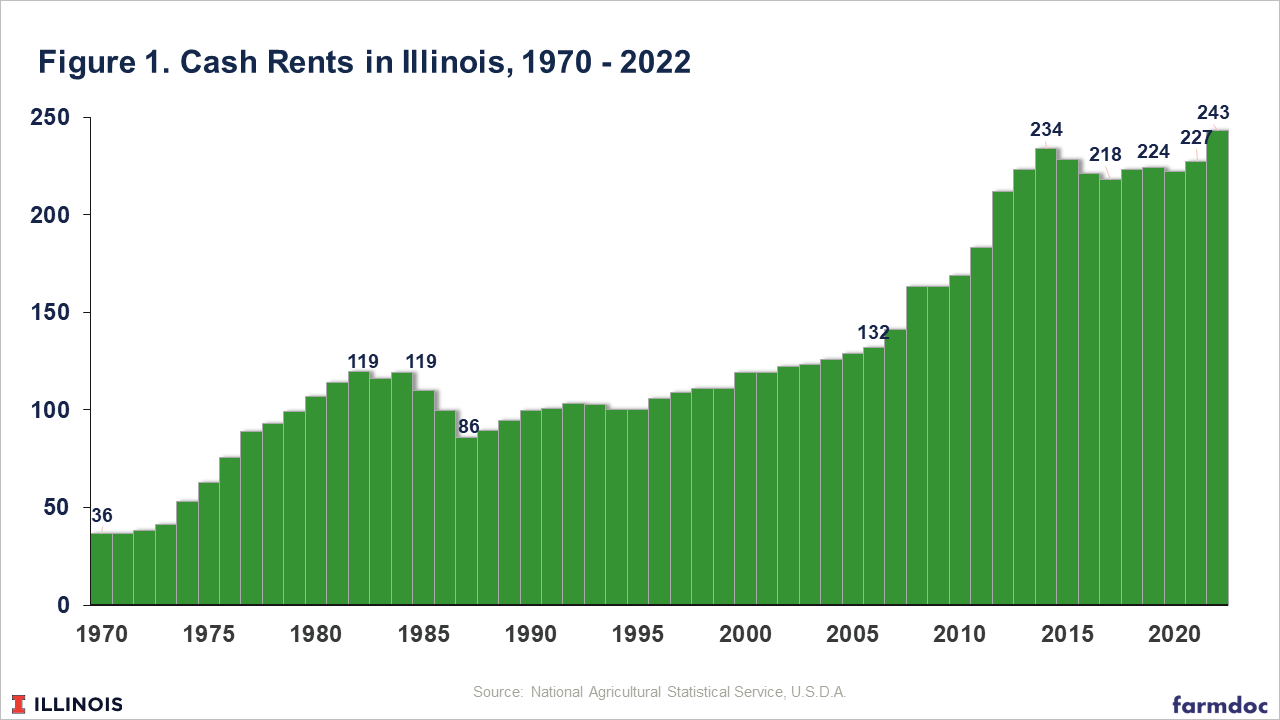

The National Agricultural Statistics Service (NASS) reported the average cash rent for Illinois in 2022 at $243 per acre, up by $16 per acre from the 2021 level of $227 per acre (see Figure 1). The 2022 rent is a record for Illinois, surpassing the previous high of $234 set in in 2013.

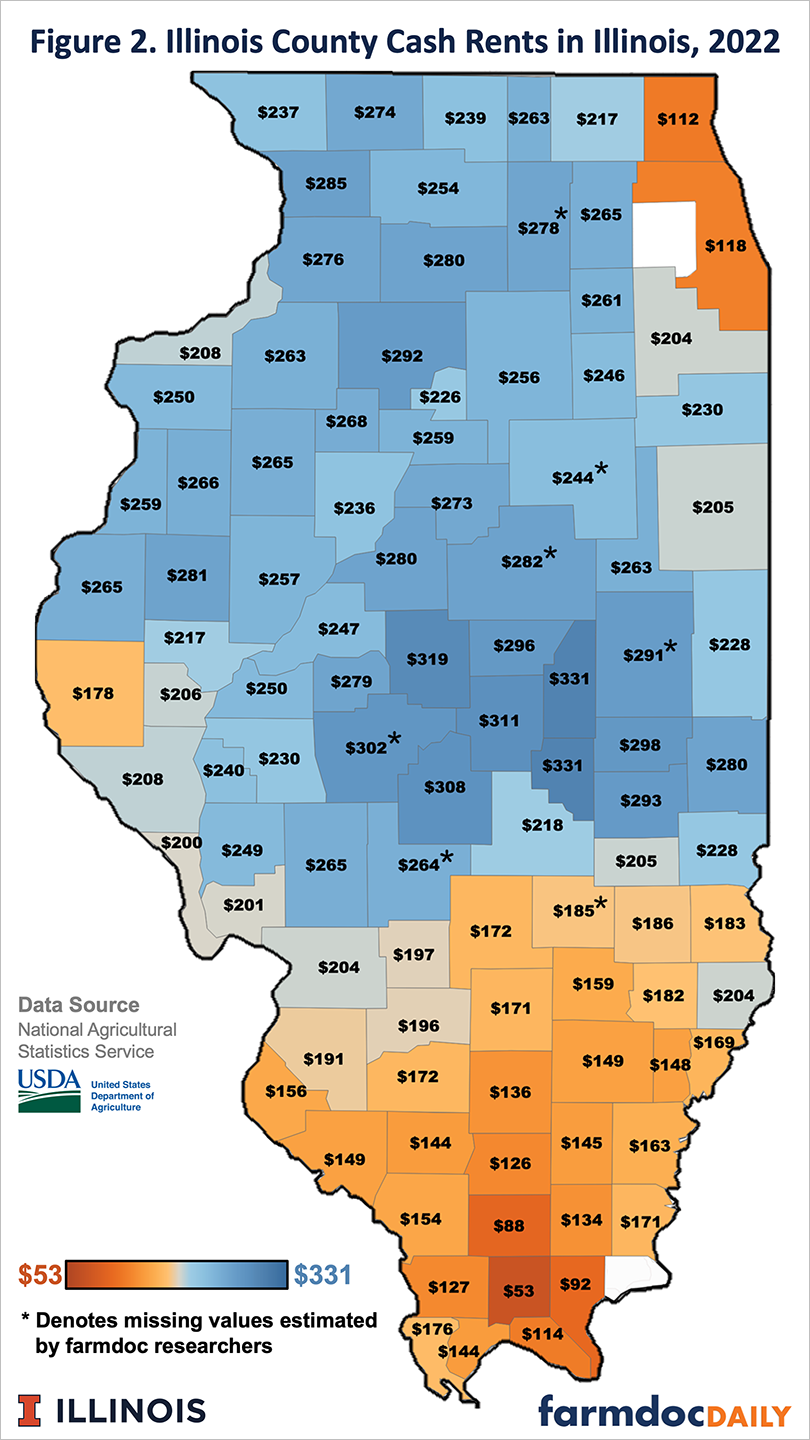

Cash rents vary across Illinois, as illustrated in Figure 2, which shows average county cash rents for non-irrigated cropland released by NASS on August 27. This year, NASS did not report cash rents for some major agricultural counties in Illinois. In Figure 2, rents for unreported counties were estimated based on a regression analysis relating rent changes between 2021 and 2022 to average cash rent in 2021.

As is typical, cash rents are the highest in the central part of the state while cash rents are lower in southern Illinois. The highest cash rent of $331 per acre occurred in Piatt and Moultrie Counties, counties adjacent to each other in central Illinois. The lowest cash rent of $53 per acre occurred in Johnson County, a county in southern Illinois.

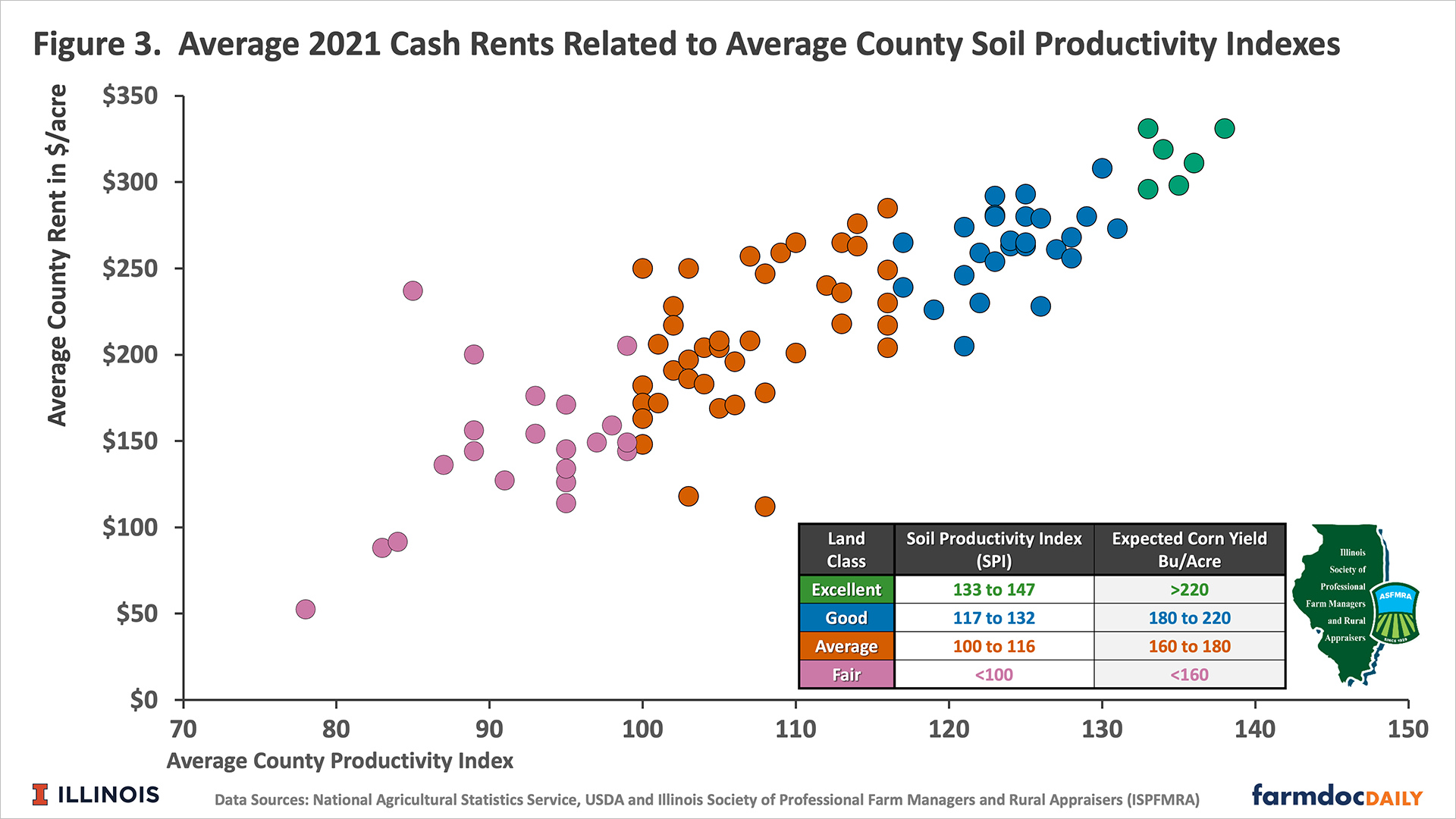

Differences in soil productivity explain a large part of the variations in cash rents. Figure 3 shows a scatter graph of average 2022 county cash rents related to the average county soil productivity index (SPI). The SPI is published for Illinois soils by the Department of Natural Resources and Environmental Science at the University of Illinois (click here for more information).

Higher SPIs are correlated with higher yields. Figure 3 shows the average county SPI and average 2022 cash rents, with the two series having a strong, positive correlation coefficient of .85. Higher SPIs tend to be located in central and northern Illinois (see farmdoc daily, November 7, 2017 for a map).

The SPI of farms within a county can vary from the county average. Based on the above relationship, an “average” cash rent projection for a farm in a particular county can be calculated with the following equation (see farmdoc daily, November 7, 2017 for a discussion):

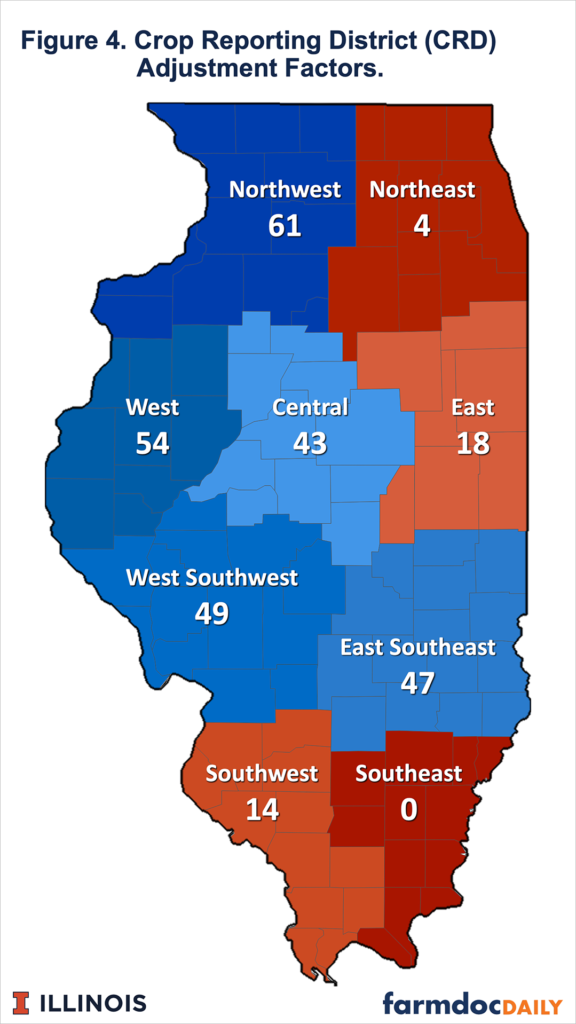

“Average” cash rent = -167 + (3.20 x SPI) + CRD adjustment

where CRD is the crop reporting district. CRD adjustment values are shown in Figure 4.

To illustrate, take a farm with a 134 SPI located in Champaign County. Champaign County is in the East CRD with a CRD adjustment of $18 (see Figure 4). Given this information, the average cash rent is estimated at $280 per acre (-167 + 3.20 x 134 PI + $18 CRD adjustment).

Variability in Cash Rents

Actual farm-level cash rents exhibit large variations from the above averages. For example, 60% of the rents on McLean County farms enrolled in Illinois Farm Business Farm Management (FBFM) in 2019 were within a range from $214 to $287 per acre. Note that the remaining 40% of the rents were outside that $73 per acre range. Rent variations often are due to the farm’s characteristics, including soil productivity, drainage, land access, land terrain, field size, and field obstructions. The desires of landowners and characteristics of the relationship between the landowner and tenant also play a large role in rent levels.

Professionally Managed Farmland

Annually, the Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA) conducts a mid-year survey to ask its members about cash rent expectations in the upcoming year. This mid-year survey is part of the Society’s land value effort, which produces a land value booklet each year, giving farmland prices and rental information by regions of the state (click here for an archive of reports).

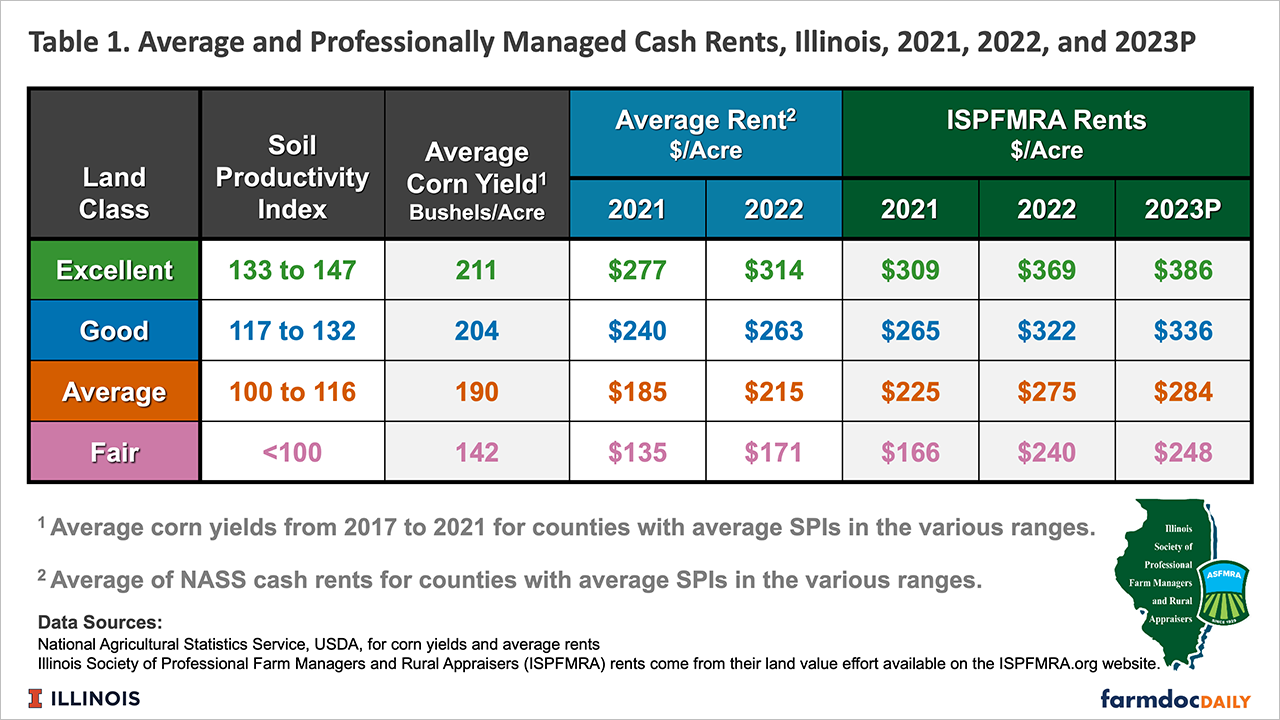

The ISPFMRA reports cash rents by four land classes: excellent, good, average, and fair. Land class divisions are made based on SPI ratings, with excellent farmland having SPIs ranging from 133 up to 147. SPI ranges for the remaining classes are shown in the first column of Table 1. Average corn yields vary by land class. For example, corn yield averaged 211 bushels per acre from 2017 to 2021 for counties that had average SPIs over 133 (see Table 1). The average corn yields were lower for other classes: 204 bushels per acre for the good land class, 181 for the average land class, and 156 for the fair land class.

In 2022, the ISPFMRA reported an average rent for excellent quality farmland that is professionally managed of $369 per acre. As with all rents, there is a considerable range around the average. For counties with SPI’s above 133, the average of cash rents reported by NASS was $314 per acre. Professionally managed farmland had a $55 higher per acre cash rent. Similar relationships exist for other land classes:

- $69 for good quality ($322 ISPFMRA – $263 NASS),

- $60 for average land class ($275 ISPFMRA – $215 NASS), and

- $69 for fair land class ($240 ISPFMRA – $171 NASS).

Overall, professionally managed farmland has higher cash rents than NASS averages. A variety of reasons can be given for this difference, including the desires of farm owners who seek professional management for higher returns.

ISPFMRA rents increased between 2021 and 2022. For the excellent land class, cash rent went from $309 per acre in 2021 to $369 in 2022, an increase of $60 per acre. For the other land classes, increases from 2021 to 2022 were:

- $57 for good land class ($322 – $265),

- $50 for average land class ($275 – $225), and

- $74 for fair land class ($240 – $166).

Outlook for 2023 Cash Rents

Professional managers of farmland are indicating that cash rents will rise in 2023. Increases by land class are:

- $17 per acre for excellent land class ($386 projected for 2023 – $369 for 2022),

- $14 per acre for good land class ($336 projected for 2023 – $322 for 2022),

- $9 per acre for average land class ($384 projected for 2023 – $275 for 2022),

- $17 per acre for fair land class ($248 projected for 2023 – $240 for 2022),

Note that increases for 2023 are less than those for 2022.

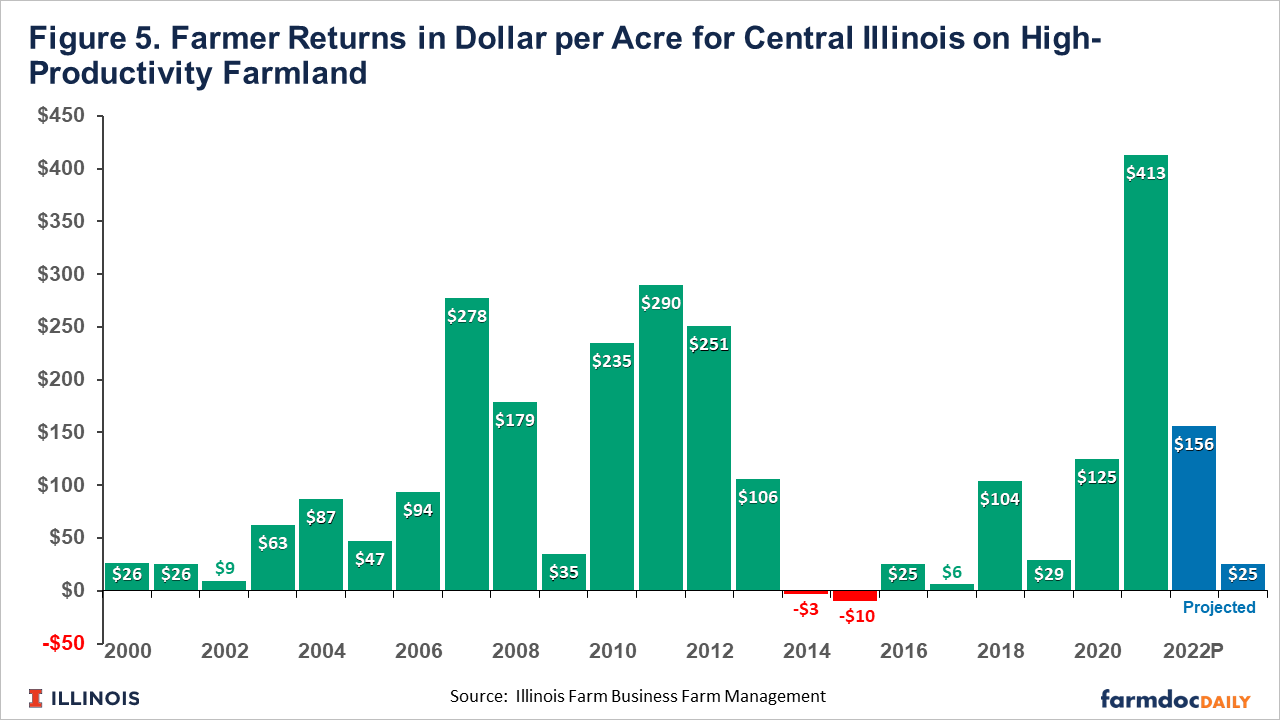

Increasing rents occur because average returns to farmland have exceeded average cash rents in recent years, leading to relatively high farmer returns (see Figure 5, reproduced from farmdoc daily, August 2, 2022). The complication for farmers with basing future cash rents on high returns in past years do not necessarily translate to high returns in future years, as is evidenced in Figure 5.

Summary

The USDA recently released 2022 cash rents by county. Those rates, along with recent farm returns, can aid in setting 2023 cash rents. Typically, periods of higher returns lead to higher cash rents that quickly move following high return years but are generally “sticky” or slow to decline in periods of lower cash returns. The projected 2023 farmer return is positive, but much lower than farmer returns in 2020, 2021, and 2022. The professional farm managers expectation for higher cash rents in 2023 presents risks to farmers who are facing projections for much lower returns. At trend yields, break-even prices are near $5.00 per bushel for corn and $12.50 per bushel for soybeans. A return to lower prices could easily lead to negative returns for farmers.

References

Illinois Society of Farm Managers & Rural Appraisers, Land Values Archive. https://ispfmra.org/land-values-archive/

Illinois Soil Productivity Publications: Soil Productivity Index Ratings for Illinois Soils, Office of Research, College of Agricultural, Consumer and Environmental Science, University of Illinois. http://soilproductivity.nres.illinois.edu/

Schnitkey, G., K. Swanson, C. Zulauf and J. Baltz. "2023 Crop Budgets: Higher Costs and Lower Returns." farmdoc daily (12):113, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 2, 2022.

Schnitkey, G. "Determining the Average Cash Rent Based on Productivity Index." farmdoc daily (7):205, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 7, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.