Forecasting 2024 Cash Rents: An Analysis of Farming Returns and Trends

Cash rents typically follow agricultural returns. In 2021 and 2022, agricultural returns set record highs, and cash rents increased. The level of 2023 returns is still uncertain. Still, average 2023 cash rents likely will be above operator and land returns for 2023, leading to losses on cash rent farmland and putting downward pressures on 2024 cash rents.

Cash Rents and Operator and Land Returns

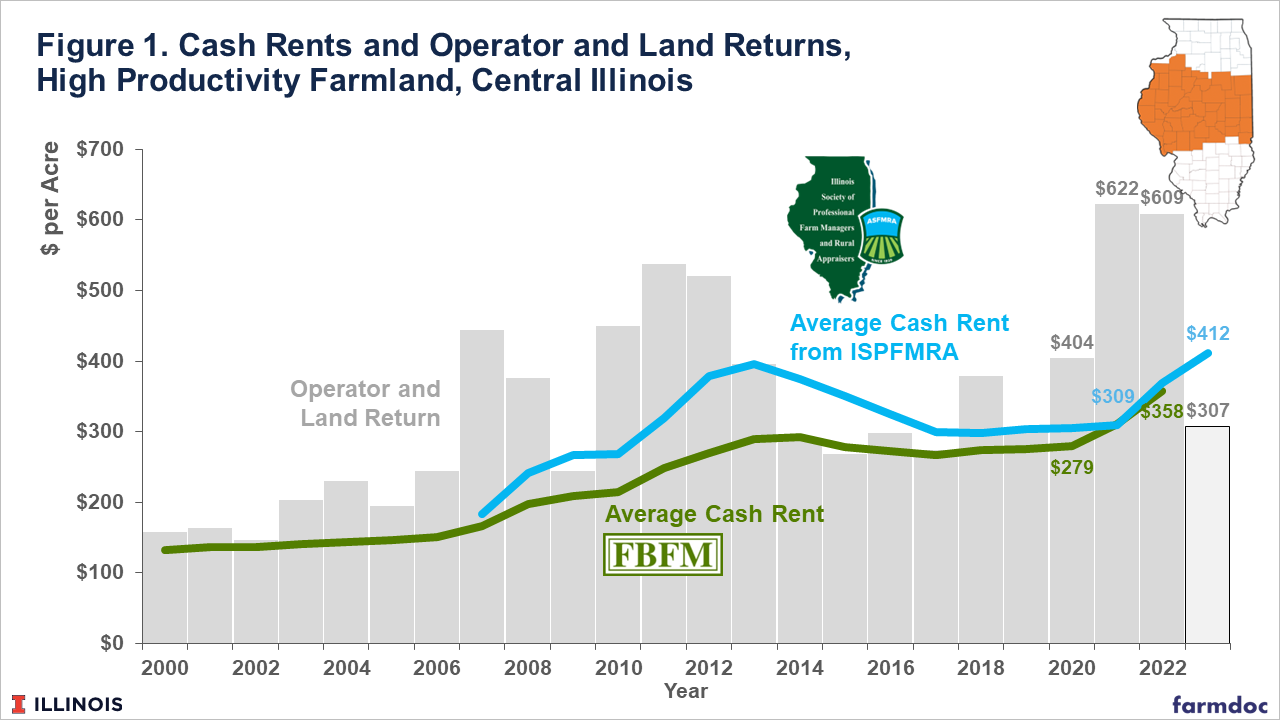

Figure 1 shows two sources of average cash rents for high-productivity farmland in central Illinois:

- Farm Business Farm Management (FBFM). These rents represent the average cash rents paid by central Illinois farmers with high-productivity farmland. From 2018 to 2022, these farms had average corn yields of 223 bushels per acre and average soybean yields of 69 bushels per acre.

- Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA). The Illinois Society annually surveys its membership for cash rents. These cash rents represent the average rent for professionally-managed farmland.

Also shown are operator and land returns, representing returns to crop farming. Operator and land return equals gross revenue minus non-land costs and is shared between the farmer and landowner. Under a cash rental arrangement, the farmer return equals the operator and land return minus the cash rent. In 2022, operator and land return was $609 per acre, and average FBFM cash rent was $358 per acre, leaving a farmer return of $251 per acre ($251 = $609 – $358). Relative to the entire 2000 to 2022 period shown in Figure 1, the 2022 return was high.

Both FBFM and ISPFMRA rents increase with changes in operator and land returns. Relative to the period from 2000 to 2006, operator and land returns were higher from 2007 to 2013 (see Figure 1). Increasing use of corn in the production of ethanol played a role in these higher returns. FBFM average cash rents increased from $166 per acre in 2007 to $290 per acre in 2013. Similarly, ISPFMRA rents rose from $183 per acre in 2007 to $396 in 2013.

Then, operator and land returns were relatively low from 2013 to 2019. Average FBFM cash rents decreased from $293 per acre in 2014 to $267 in 2016 before rising slightly to $274 in 2017 and $275 per acre in 2018. ISPFMRA rents showed similar trends, decreasing from $396 per acre in 2013 to $298 in 2018.

Differences between FBFM and ISPFMRA rents became the greatest in 2012 and 2013. In 2012, for example, the $270 FBFM cash rent was $109 below the $379 ISPFMRA rent. Those differences narrowed during the 2014-2019 period of low returns. In 2020, the $279 FBFM cash rent was $26 below the $309 ISPFMRA rent. Likely because they are professionally managed, ISPFRMA rents rose more during the high return period from 2007 to 2013.

Recent Trends in Operator and Land Returns and Cash Rents

Midwest grain farm profitability reached record levels in 2021 and 2022, rebounding from the low-return period of 2014-2019. From 2014 to 2019, operator and land returns averaged $302 per acre. Operator and land returns increased to $622 in 2021 and $609 in 2022, more than doubling the return from the 2014-2019 period.

Cash rents also increased. FBFM cash rents were $279 in 2020, increasing to $311 in 2021, again rising to $358 in 2022. From 2020 to 2022, average FBFM cash rents increased by $79 per acre. Similarly, ISPFMRA rents increased from $305 in 2020 to $369 per acre in 2022, an increase of $64 per acre. FBFM average cash rents are not available for 2023. ISPFMRA rents increased from $369 per acre to $412, an increase of $43 per acre. FBFM cash rents likely increased in 2023, perhaps not as much as the ISPFMRA average.

Outlook for 2024 Cash Rents

The average 2023 operator and land return is projected at $307 per acre, near the average for 2014 to 2019 and well below the 2021 and 2022 records (see farmdoc daily, May 23, 2023). Actual returns could vary from the $307 projection. Perhaps there is more uncertainty than usual in returns this time of year. As of this point, yields are uncertain. Corn and soybean crops appear in good condition, but little rain fell from mid-May to the end of June across the Midwest, perhaps negatively impacting yields. Yields could be significantly below trend, and crop prices could vary from projected levels. The Ukraine-Russia war could play a significant role in expectations, and input costs likely will come down. Still, it seems reasonable to expect operator and land returns to be below both the FBFM and ISPFMRA cash rent for 2023.

If operator and land returns are below FBFM and ISPFMRA rents, downward pressures will be placed on cash rents. The FBFM and ISPFMRA cash rents exceeded operator and land returns in 2014 and 2015. Rents in the next year decreased. During this period, FBFM rents decreased an average of $10 per year. The ISPFMRA rents decreased by $25 per year. Similar declines are possible for 2024.

The next several months will be important as 2023 and 2024 returns come into clearer focus. Discussions between landowners and farmers on the economic situation may be useful. The higher returns of 2021 and 2022 will not continue into the future. Lower returns will cause the need to adjust some cash rents down. Depending on the cash rent level, those adjustments may need to occur for 2024 cash rents.

References

Schnitkey, G., C. Zulauf and N. Paulson. "Back to Normal: Revised 2023 Budgets with Lower Prices." farmdoc daily (13):94, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 23, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.