Financial Summary of Illinois Farms for 2022

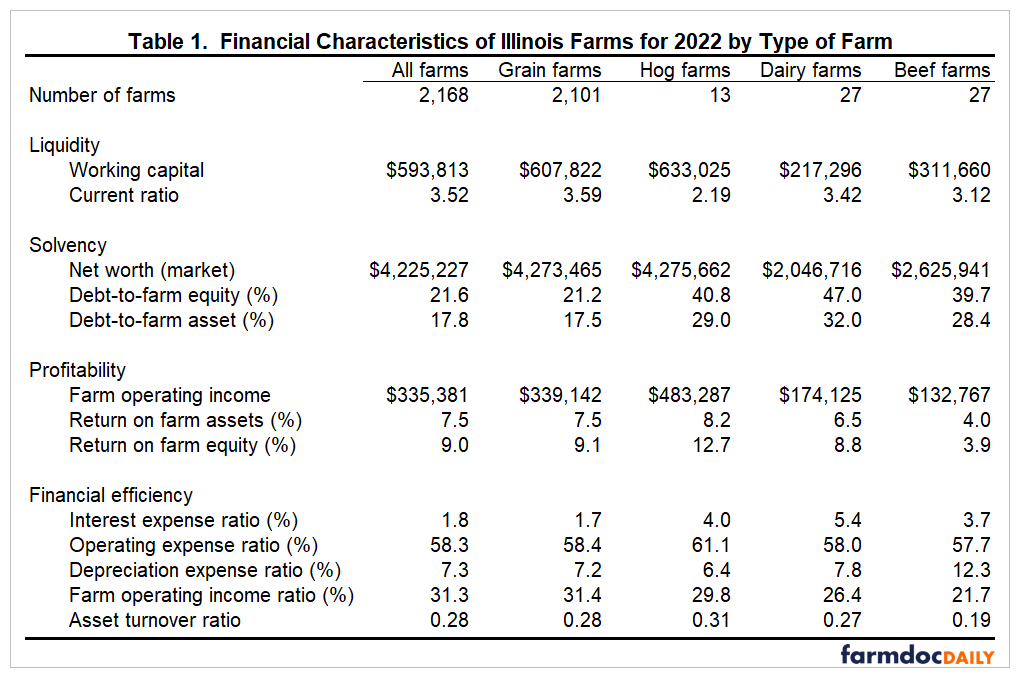

Farm incomes in 2022 were much higher than the year before leading to stronger financial positions on Illinois farms. The Farm Financial Standards Council has identified several key measures to analyze the financial strength of a farm business. These measures are in the areas of liquidity, solvency, profitability, and financial efficiency. The averages for these key measures for 2,168 Illinois farms enrolled in Illinois Farm Business Farm Management (FBFM) can be found in Table 1. These measures are also calculated by farm type. Due to the effects that weather and other outside factors may have on a farm business for any one year, it is better to monitor these measures over time and to identify trends than it is to rely too heavily on these measures for any one year when making business decisions. More detail and in-depth analysis of these financial characteristics can be found in Financial Characteristics of Illinois Farms, published by FBFM and the Department of Agricultural and Consumer Economics at the University of Illinois.

Liquidity is an assessment of a farm’s ability to meet current cash-flow needs. The amount of working capital and the current ratio (current assets divided by current liabilities) are two measures of liquidity. The average amount of working capital as of December 31 for the 2,168 farms was $593,813 up 22 percent from $486,846 a year earlier. Hog farms had the greatest working capital, averaging $633,025, while dairy farms had the least, averaging $217,297. Most of the assets of a dairy farm—the dairy herd, buildings, and land—are noncurrent assets. The average current ratio for all the farms was 3.52, up from 3.19 a year ago. Grain farms recorded the highest (most healthy) current ratio, and hog farms the lowest. The 2022 current ratio was the highest on recent record with 2021 being the second highest at 3.19.

Solvency is a measure of the farm’s overall financial strength and risk-taking ability. The average net worth of the 2,168 farms at the end of 2022 was $4,225,227, up from $3,745,893 the year before. Average farm and non-farm incomes in 2022 were well above family living requirements, thus enabling net worth increases. Hog farms had the highest net worth, followed by grain farms, with dairy farms recording the lowest. The debt-to-farm equity and debt-to-farm asset indicators show how debt capital is combined with equity capital. This is useful in looking at the risk exposure of the business. The average debt-to-farm asset percentage for all farms was 17.8. The debt-to-farm asset percentage ranged from 17.2 for grain farms to 32.0 for dairy farms. The average debt-to-farm asset level of 17.8 from 2022 was at its lowest level for at least 20 years.

A measure of a farm’s profitability is useful in examining its ability to meet family living demands and retire term debt. It is also useful in measuring the farm’s ability to utilize assets and equity to generate income. The average return on farm assets for the 2,168 farms was 7.5 percent, down from 7.8 percent a year earlier. Hog farms recorded the highest returns, averaging 8.2 percent, while dairy farms recorded the lowest, averaging 4.0 percent. Return on farm equity in 2022 ranged from 12.7 percent for hog farms to 3.9 percent for beef farms. The average was 9.0 percent, down from 9.3 percent in 2021.

The interest, operating, and depreciation expense ratios relate these various expense categories as a percentage of the value of farm production. The farm operating income ratio measures the return to labor, capital, and management as a percentage of the value of farm production. These measures can be used to evaluate the financial efficiency of the farm business. The interest–expense ratio averaged 1.8 percent for the 2,168 farms, ranging from 1.7 percent for grain farms to 5.4 percent for dairy farms. 1.8 percent was down from 1.9 percent in 2021. The 2022 figure of 1.8 percent was the lowest since at least 1995. The farm operating income ratio ranged from a high of 31.4 percent for grain farms to 21.7 percent for beef farms. The average for all farms in 2022 was 31.3 percent, down from 33.6 percent in 2021. The 2018 through 2022 5-year average farm operating income ratio is 22.5 percent. The 2022 farm operating income ratio was well above the 5-year average.

The financial results on all Illinois farms show that on average 2022 was another good year. The average farms for these groups are in strong financial positions which will be needed with projected much lower incomes for 2023 and 2024. Careful monitoring of trends in these numbers are needed to help make sound farm financial decisions for your operation.

The author would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.