How Historic Were Fertilizer Prices in 2022?

The increase in production costs has been a main concern for crop producers over the past two years, with the rapid rise in fertilizer prices from the fall of 2021 into the second quarter of 2022. The higher fertilizer prices and shortage of fertilizer supply caused mainly by the Ukraine-Russia conflict resulted in expectations for record fertilizer expenditures per acre in Illinois for the 2023 crop year. But how historic were the fertilizer price levels reached in 2022? This article continues our series on fertilizer costs (see farmdoc daily articles from June 13, August 1, and August 15, 2023) by taking a longer historical view of fertilizer prices in nominal, real, and relative terms.

Historical Perspectives on Fertilizer Prices

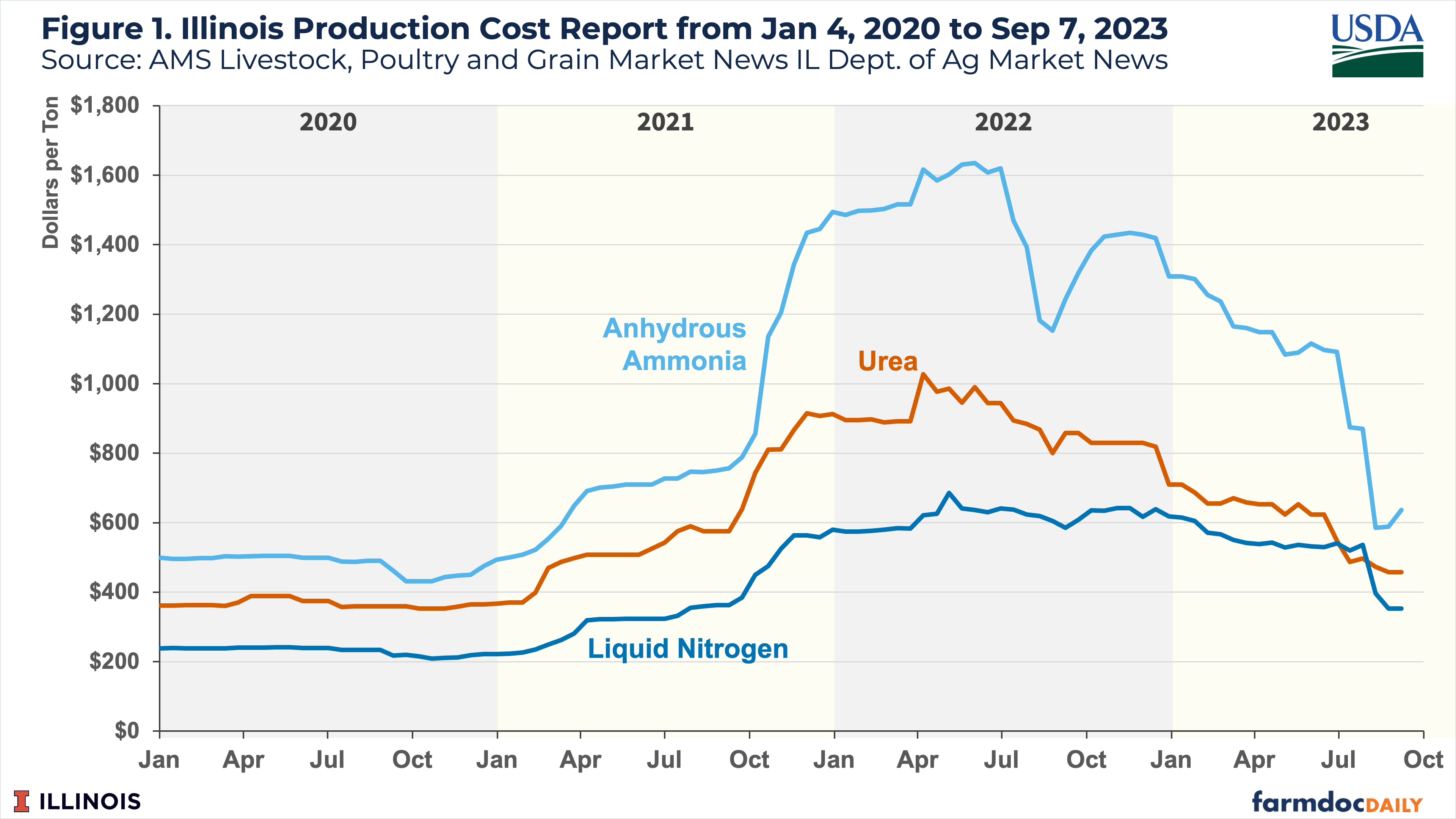

The average price of anhydrous ammonia in Illinois was reported at $637/ton as of September 7, 2023, up about $50 per ton over the past month, an increase of 7% (see Figure 1, based on data from USDA-AMS). In contrast, average prices for urea and liquid nitrogen have further declined over the past month. The average urea price was $458/ton, down $16/ton from the previous month, a decrease of 3.4%. The average liquid nitrogen price declined nearly $44/ton from August to September, a decline of 11%, reaching $353/ton as of September 7th.

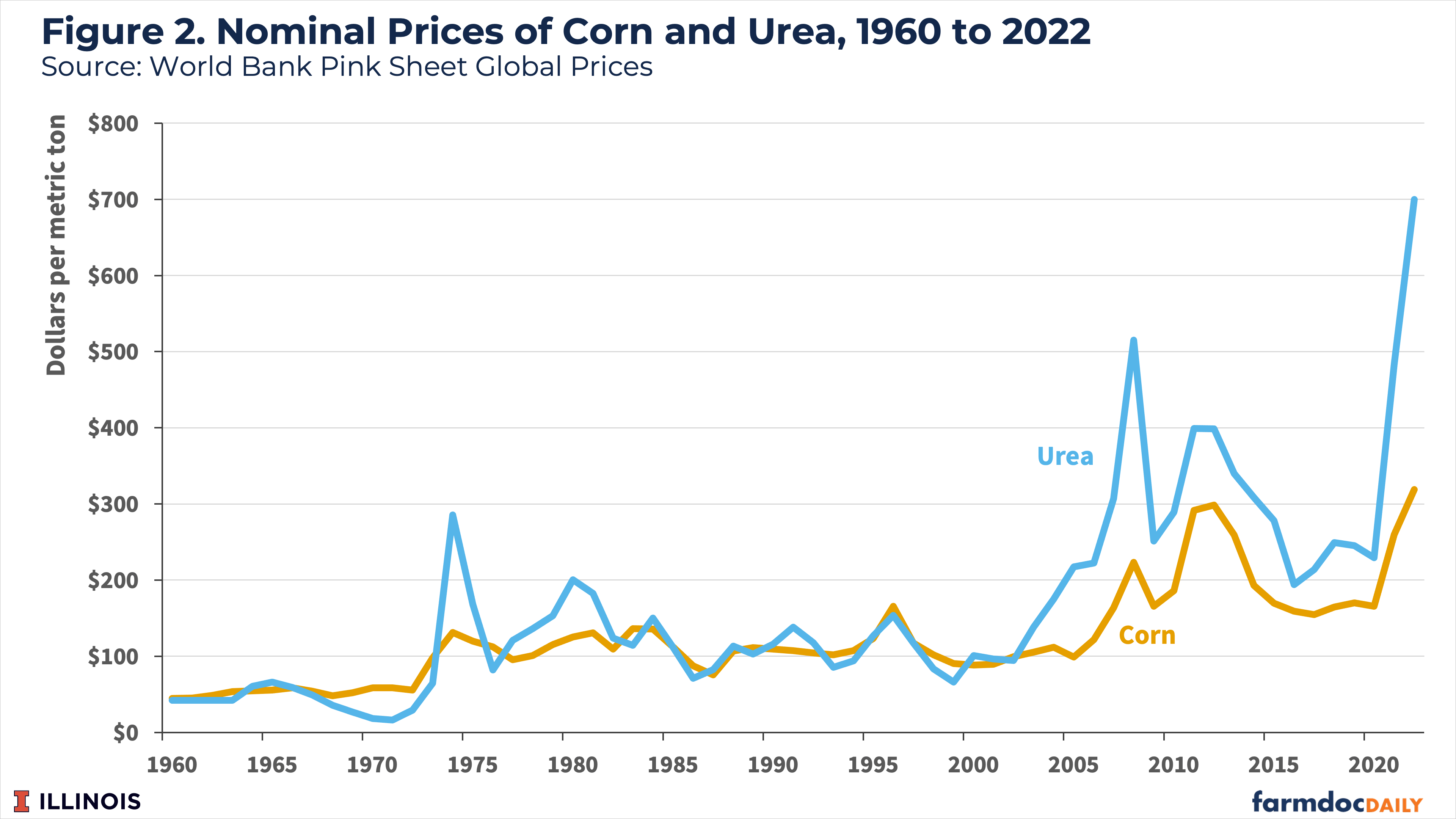

Current prices for all three forms of nitrogen are down considerably from their 2nd quarter of 2022 peaks (over $1,600/ton for anhydrous, and over $1,000/ton for both urea and liquid nitrogen). The price levels reached in 2022 represented historic highs in nominal terms. Previous notable spikes in nominal fertilizer prices include the mid-1970s and 2008, as shown from World Bank data on global commodity prices in Figure 2.

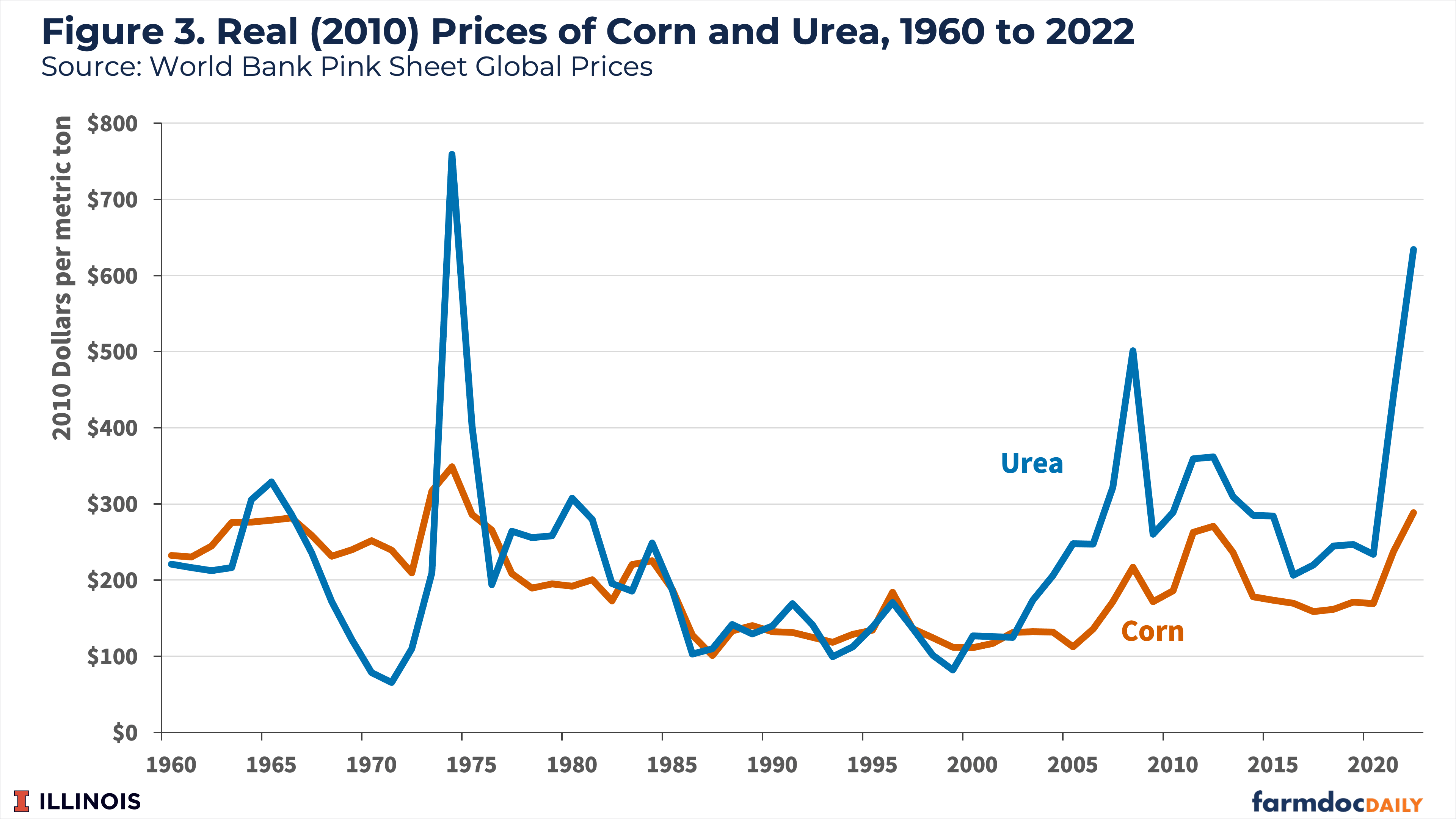

Figure 3 illustrates the World Bank’s global fertilizer and corn price series in real terms (based on constant 2010 dollars). When adjusted for inflation, the price spike for nitrogen fertilizers around the mid-70s exceeds what was experienced in 2022. The Energy Crisis of the 1970s was the primary factor for the sharp rise in fertilizer prices in that time period. The crisis resulted in negative shocks to agricultural production levels and high commodity prices, as farmers faced difficulties procuring and paying high prices for fertilizers.

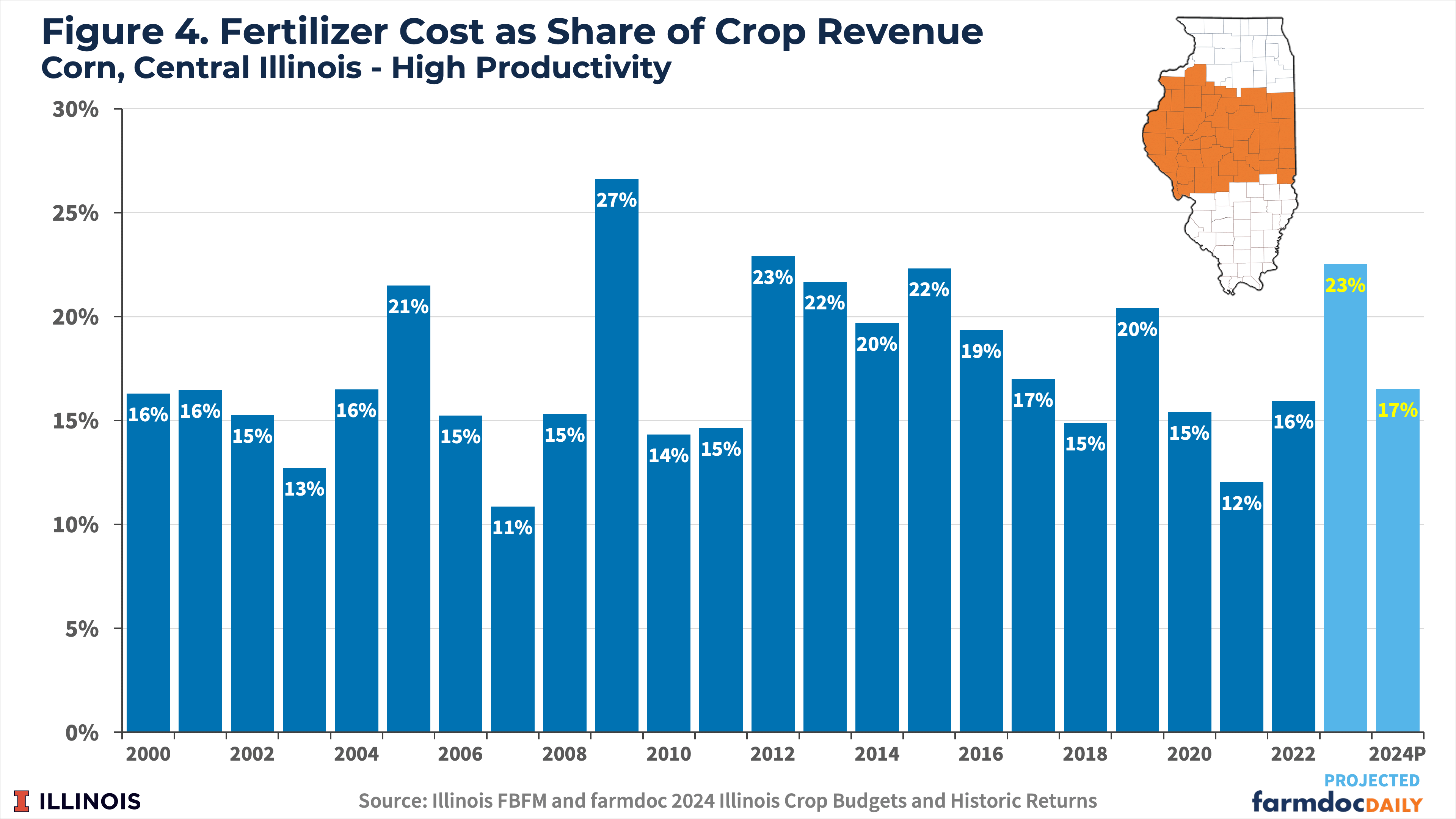

Examining fertilizer expenditures per acre as a percentage of crop revenue provides another perspective on relative fertilizer costs. Figure 4 shows fertilizer expenditure as a percentage of corn revenue in central Illinois on high-productivity farmland. These data are based on actual revenue and costs from Illinois Farm Business Farm Management (FBFM) from 2000 to 2022, and projections from the most recent Illinois crop budgets for 2023 and 2024 (see farmdoc daily from August 29, 2023).

From 2000 to 2022, fertilizer expenditures per acre averaged 17% of corn revenue in central Illinois. Current projections for 2023 are for fertilizer costs to represent 23% of crop revenue. This represents the second-highest fertilizer revenue share since 2000, surpassed only by the 27% revenue share in 2009. Both 2023 and 2009 represent crop years where fertilizer prices spiked during typical pricing windows in the previous year.

Conclusions

The prices of fertilizer products reached record highs in nominal terms in 2022. However, the price spikes in the mid-1970s exceeded those of 2022 in real terms and fertilizer expenditures relative to crop revenues were higher in central Illinois for the 2009 crop year than what is currently projected for 2023.

Average Illinois fertilizer prices have declined consistently from the peaks reached in the second quarter of 2022. Current projections from 2024 Illinois crop budgets suggest a return to the historical average for fertilizer expenses as a share of expected corn revenue.

While this represents some optimism regarding fertilizer expenditures and corn production costs more broadly for the coming crop year, current projections for farmer returns are negative due to increases in costs of other production inputs and high cash rents to persist into 2024 (see farmdoc daily from August 29, 2023). Furthermore, projected per acre fertilizer expenses for the 2024 crop year are above the fertilizer costs experienced during the most recent extended period of lower commodity prices and farm returns experiences from 2014 to 2019.

References

Paulson, N., G. Schnitkey, C. Zulauf, J. Colussi and J. Baltz. "Fertilizer Prices Continue Decline and May Impact Farmers’ Nitrogen Decisions." farmdoc daily (13):150, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 15, 2023.

Paulson, N., C. Zulauf, G. Schnitkey and J. Baltz. "Fertilizer Prices Continue Year-Long Decline from 2022 Peak." farmdoc daily (13):142, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 1, 2023.

Schnitkey, G., N. Paulson, C. Zulauf and J. Baltz. "2024 Crop Budgets." farmdoc daily (13):157, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 29, 2023.

Schnitkey, G., N. Paulson, C. Zulauf and J. Baltz. "Nitrogen Fertilizer Prices Stabilize at High Levels in Spring 2023." farmdoc daily (13):108, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 13, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.