Potential Crop Insurance Payments for 2023

The 2023 U.S. corn and soybean harvest is in full swing with farmers now getting a better sense of crop yields following a growing season characterized by extended periods of dry weather across much of the Corn Belt. Anecdotal evidence suggests significant variability with some farmers reporting yields well below trend and others being pleasantly surprised with yields exceeding expectations given the challenging growing conditions.

October is the price discovery period for the harvest price for revenue insurance products. Harvest futures prices for corn and soybeans are currently trading well below the projected prices used to set crop insurance guarantees. Through October 9th, December futures settlement prices for corn have averaged $4.90 compared with the $5.91 projected price set in February. A harvest price of $4.90 is 83% of the $5.91 projected price. For soybeans, November futures have averaged $12.72 through October 9th, compared with the $13.76 projected price set in February. A $12.72 harvest price is 92% of the $13.76 projected price.

Harvest prices below projected prices combined with poor yields could result in substantial crop revenue insurance payments for 2023. In today’s article we outline some revenue insurance payment scenarios for both corn and soybeans and provide a simple payment calculator which can be used to consider specific farm situations.

Corn Payment Scenarios

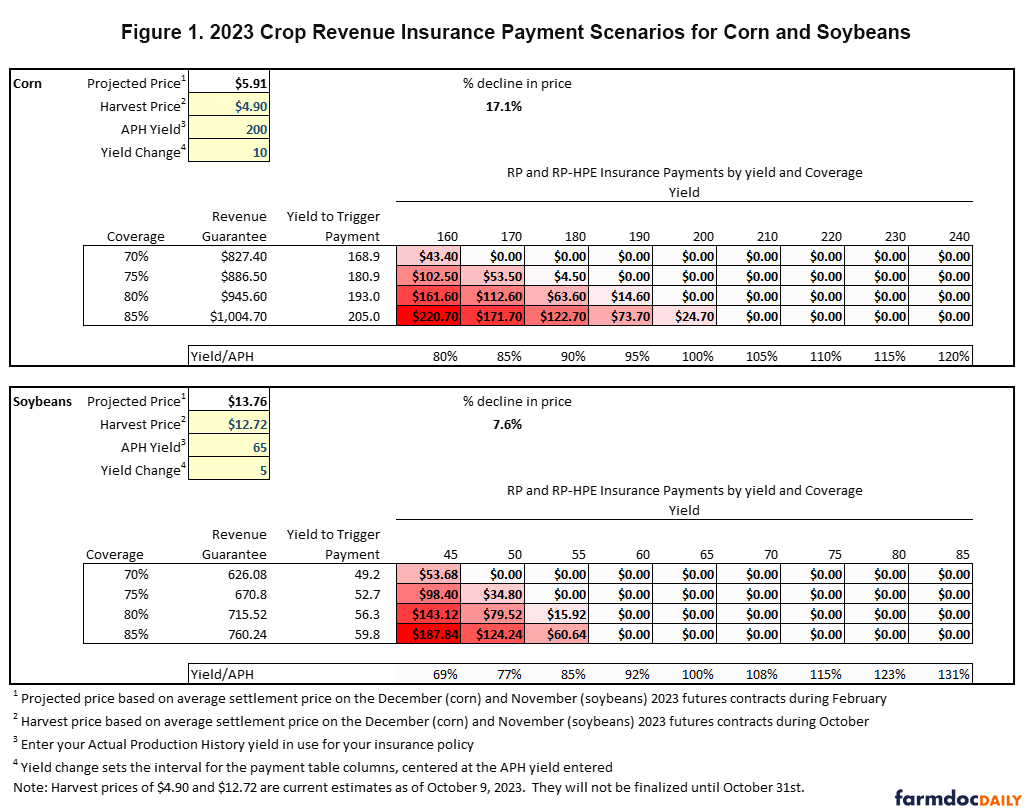

A harvest price for corn of $4.90 would represent a 17.1% price decline from the projected price of $5.91. A harvest price below the projected price means that revenue products with the harvest price option (i.e. revenue protection or RP) will operate the same as policies without the harvest price options (i.e. revenue protection with the harvest price exclusion or RP-HPE).

This price decline would be sufficient to trigger 85% revenue coverage payments even with yields slightly above a producer’s guaranteed actual production history (APH) yield. Specifically, payments on 85% coverage policies would be triggered with yields at 102.5% of the farm’s APH yield. Coverage levels below 85% would require a small to moderate yield loss, relative to the farm’s APH, to trigger payments. At 75% coverage, corn yields would need to be at least 10% below the farm’s APH to trigger payments.

As an example, consider a farm with a 200 bu/acre APH yield. The revenue guarantee on an 85% revenue insurance policy would be $1,004.70 per acre (0.85 x $5.91 x 200 = $1,004.70). A $4.90 harvest price implies insurance payments would begin to be triggered at a corn yield of 205 bu/acre and increase and yield fall below this level. The indemnity on an 85% policy would be $24.70 per acre at a yield of 200 bu/acre and $220.70 per acre if yields were 160 bu acre.

The payment scenarios for lower coverage levels at various corn yields are shown in the upper panel of Figure 1. An 80% coverage level would require yields at or below 193 bu/acre to trigger payments with a $4.90 harvest price. The trigger yields on 75% and 70% coverage policies would be 180.9 and 168.9 bu/acre, respectively.

Soybean Payment Scenarios

A harvest price of $12.72 for soybeans would represent a 7.6% decline from the $13.76 projected price. This price decline would require yields below a farmer’s APH to trigger revenue insurance payments. At 85% coverage, yields would have to be less than 92% of a farm’s APH to trigger insurance payments (i.e. yield losses exceeding 8%). A 75% coverage policy would trigger losses with yields at or below 81% of the farm’s APH (i.e. yield losses at or exceeding 19%).

Consider a farm with a 65 bu/acre APH yield for soybeans. The revenue guarantee on an 85% revenue policy would be $760.24 per acre (0.85 x $13.76 x 65 = $760.24). The revenue insurance payment would be $60.64 per acre at a yield of 55 bu/acre and increase to $187.84 per acre at a yield of 45 bu/acre. Payments for lower coverage levels at different yield levels are reported in the lower panel of Figure 2. For 80% coverage policies, payments would begin to be triggered with yields at or below 56.3 bu/acre. For 75% and 70% coverage payments would be triggered with yields at or below 52.7 and 49.2 bu/acre, respectively.

Payment Calculator

The payment scenarios for corn and soybeans outlined above in Figure 1 were generated from the 2023 Payment Calculator, a simple Excel file that can be modified to analyze payment scenarios for individual farms. Users can enter their own APH yields, as well as look at alternative harvest price levels, to examine potential payment scenarios (select the cells highlighted in yellow to enter user-specific values).

Summary

With harvest in full swing, farmers are gaining a better sense of their crop yields for 2023. The price discovery period for the harvest prices for corn and soybeans is currently underway. Through October 9th, settlement prices for the harvest contracts for corn (December) and soybeans (November) suggest harvest prices will be below projected prices. Lower harvest prices combined with yields at or below APH yield levels could result in substantial crop insurance indemnities for revenue products.

The size of crop insurance payments should be considered for 2023 tax planning. With relatively high prices on old crop sales likely for many farm situations, tax liabilities could be large, and crop insurance payments could further contribute to high tax payments without offsetting expenses.

The harvest prices for corn and soybeans used in the examples in today’s article will continue to change throughout the October discovery period.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.