Resiliency in World Grain and Oilseed Production and the Ukraine-Russia War

International concern about supply disruption and spikes in crop prices accompanied the outbreak of the Ukraine-Russia War, the largest armed conflict in Europe since World War II. However, world grain and oilseed production has largely exceeded trend estimates based on the pre-war 2017-2021 period, underscoring the resiliency of the world crop sector in confronting untoward events.

Data and Procedures

Data for production of grains and oilseeds are for 2017/2018 (hereafter, first year is used) through 2023 crop years obtained from the Production, Supply, and Distribution Online database (US Department of Agriculture, Foreign Agriculture Service) after the release of the November 9, 2023 World Agriculture Supply and Demand Estimates (WASDE). Feed grains are barley, corn, millet, oats, and sorghum. Food grains are rice (milled), rye, and wheat. Oilseeds are copra, cottonseed, palm kernel, peanuts, rapeseed, soybeans, and sunflowerseed.

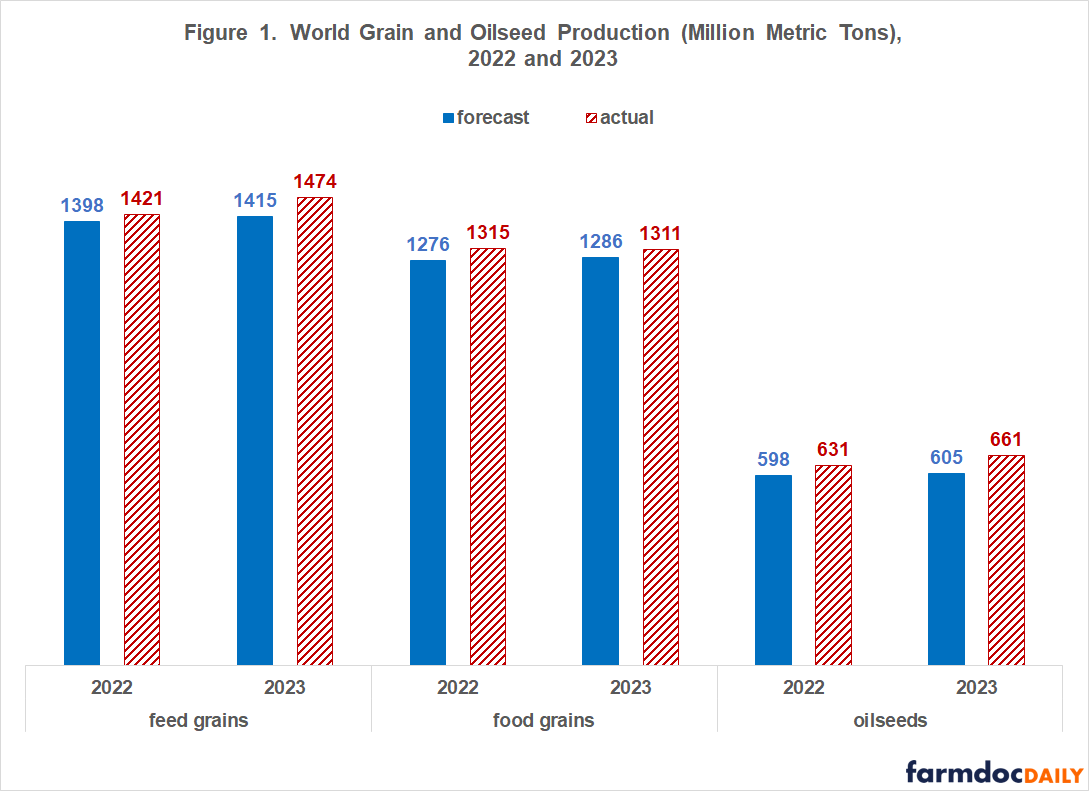

An estimate of production expected without the war is needed to provide a baseline. We chose a simple metric to estimate this value. Average production is calculated for the five crop years that immediately preceded the war (i.e. 2017-2021). A five-year moving average is often used to provide a simple estimate of expected production in the upcoming year, in part because it smooths the recent fluctuations in crop production due to weather and other factors. Also calculated is the average annual percentage change from the prior year for each year from 2017 through 2021. This average percent change is used to increase average 2017-2021 production to provide the forecast of trend production for 2023 without the war. To illustrate, average 2017-2021 world production of feed grains was 598 million metric tons. This is the forecast for 2022 production without the war. The forecast for 2023 production is 605 million metric tons (596 ● (1 + 1.2%), or 2022 production increased by the 1.2% average annual rate of increase in world feed grain production for each year from 2017 through 2021.

World: Compared to forecast production based on the 2017-2021 pre-war period, 2022 and 2023 world production is +2% to +4% higher for feed grains, +2% to +3% higher for food grains, and +6% to +9% higher for oilseeds (see Figure 1). Because world production trended up during 2017-2021, forecast production is higher for 2023 than 2022 for all three crop categories. It is important to note that southern hemisphere 2023 production largely remains uncertain as their fall harvested crops are currently being planted.

Russia: One reason world production exceeds forecast production is that Russia’s production exceeds forecast production for all three crop categories (see Figure 2). Russia’s food grain production above forecast production accounted for 36% to 41% of world food grain production above forecast production [calculation for 2022 is ((95-81) / (1315-1276)) = 36%]. The comparable shares are 5% to 20% for feed grains and 11% to 20% for oilseeds.

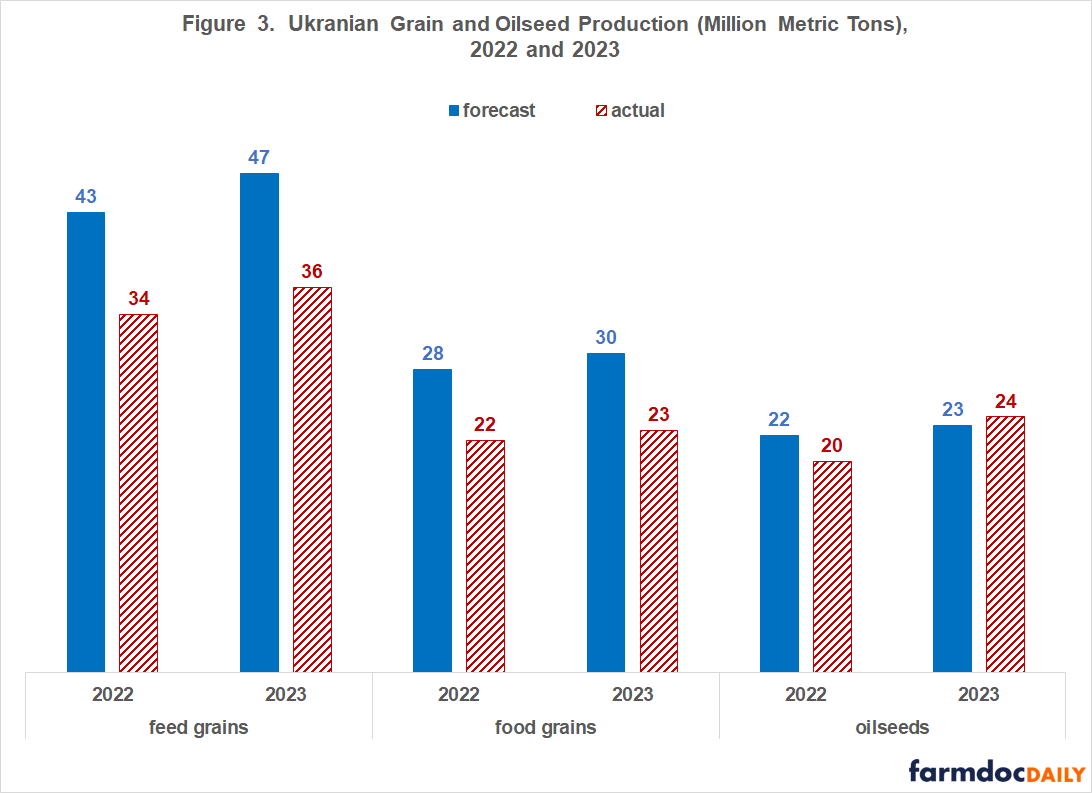

Ukraine: To complete the picture of the war’s impact using comparable measures, Ukraine’s 2022 and 2023 crops of feed and food grains are 22% to 24% smaller than forecast production based on the 2017-2021 pre-war period. Oilseed production is -11% below forecast production for 2022 but 3% above forecast production for 2023. Rapeseed and soybean production have increased while sunflower production has fallen short. For more in-depth discussion of the impact of the war on Ukraine’s production see farmdoc daily, October 11, 2023.

Discussion

So far, the Ukraine-Russia War has had limited impact on total world-wide production of grains and oilseeds. In fact, world production has exceeded forecasts based on the five years prior to the war.

Consistent with previous wars, production declines are centered in the area of fighting, i.e. Ukraine. Areas not in the fighting zone increase production, which includes Russia in this situation.

The Ukraine-Russia War has so far been an example of the resiliency of the world crop sector, although the potential role of favorable weather can never be dismissed.

More broadly, the maintained hypothesis should be that the world crop production system will adjust to untoward shocks in a timely manner, until evidence exists to the contrary.

This article examines only production. Other impacts, such as higher fertilizer prices and new trade flows, exist. Many of these other impacts depend on what happens to trade restrictions imposed as a result of the war (farmdoc daily, November 2, 2023).

Last, an interesting speculation is whether an unintended consequence of the Ukraine-Russia War will be to incentivize Russia to more aggressively develop its crop production sector, just as an unintended consequence of the Russian-US grain deal of the early 1970s was to incentivize Brazil to develop its soybean production sector.

References and Data Sources

Tetteh, I, J. Colussi, and N. Paulson. “Exploring New Export Routes for Ukrainian Grain.” farmdoc daily (13): 201, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 2, 2023.

Tetteh, I, J. Colussi, and N. Paulson. “The Second Harvest Under Missiles: Update on the Situation in Ukraine.” farmdoc daily (13): 186, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 11, 2023.

US Department of Agriculture, Foreign Agriculture Service. August 2023. Production, Supply, and Distribution Online. https://apps.fas.usda.gov/psdonline/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.