Is Sustainable Aviation Fuel the Future of Ethanol?

U.S. ethanol consumption has been stagnant for almost a decade. Limitations on the blending of ethanol with gasoline and EPA discretionary waivers have prevented any large-scale demand growth for corn-starch ethanol, and cellulosic ethanol has failed to catch fire because of technological, economic, and regulatory hurdles. Low carbon fuel standards in Western states like California provide additional sources of revenue, but these markets may not provide long-term growth opportunities as the same policies provide greater subsidies for electric vehicles and other biofuels that compete with corn-based ethanol. The aviation industry, on the other hand, is an untapped market seeking alternatives to fossil fuels.

Aviation provides a large fuel market that currently has no feasible prospects for electrification. U.S. airlines consumed roughly 16.7 billion gallons of fuel in 2022, and consumption totals for 2023 are projected to be higher (BTS, 2024). Airlines like other large energy consumers are experiencing pressure from their customers, investors, and regulators to reduce green-house gas emissions. However, there are currently no commercially viable electric airplanes. The energy demands of commercial cargo and passenger jets are simply far too great for contemporary battery technology. As a result, airlines and regulators are pushing for alternative liquid fuels that have lower emissions than petroleum jet fuel. These alternative fuels are called sustainable aviation fuels or SAFs for short, and they are produced from plant biomass, vegetable oils, sugars, and alcohols including ethanol.

Could SAF be the next big market for ethanol? Possibly. Aviation fuel presents growth opportunities but also challenges. Whether ethanol producers can overcome these challenges will depend on the decisions of regulators and the ability of ethanol producers to measurably reduce their emissions. This article summarizes the current state of affairs for a prospective ethanol-to-jet-fuel pathway with a focus on public policy incentives and hurdles for corn ethanol to land in the jet fuel market.

Current Policy

SAFs are liquid hydrocarbons made from non-petroleum sources including ethanol. SAFs currently represent less than 1% of the jet fuel market, but they do not require major modifications to current jet engines or fueling infrastructure. The lack of modifications makes SAF an easier technological transition than other fuels. SAFs can be produced through a variety of different processes and feedstocks, and the blend ratios vary by type (DOE-AFDC, 2024). Proposed feedstocks include vegetable oils, beef tallow, and municipal waste. Ethanol can also be converted into jet fuel through additional processing. Since jet fuel has a higher energy density than ethanol, 1 gallon of SAF requires 1.7 gallons of ethanol. So, SAF presents even larger demand growth than simply increasing ethanol consumption by an equal number of gallons.

Despite low current consumption, the SAF Grand Challenge by several government agencies could spur a roughly 200-fold increase of SAF by 2030. SAFs generate multiple types of RINs under the Renewable Fuels Standard, but the Department of Energy estimates that domestic airlines consumed only 15.8M gallons of SAF in 2022 (DOE-AFDC, 2023). The SAF Grand Challenge aims to domestically consume 3B gallons of SAF by 2030 with a long-term goal of 35B gallons by 2050. That is, the Biden Administration wants to increase SAF consumption by almost 200 times within 8 years, and President Biden stated in the summer of 2023 that he expects 95% of SAF to come from biofuels (Renshaw, Kelly, and Douglas, 2023). SAF could become the long-term demand growth that ethanol producers have been seeking for almost a decade, and every billion gallons of SAF supplied is more than a 10% increase from current ethanol consumption.

To accomplish this goal, policymakers have placed their money where their mouth is through the Inflation Reduction Act of 2022 (IRA). The IRA is a comprehensive infrastructure package, designed to improve domestic supply chains, and it provides billions of dollars to programs that directly impact agriculture. Under the IRA, qualifying producers of SAF can earn a minimum $1.25 tax credit per gallon, and this tax credit could increase to as much as $1.75 per gallon. These tax incentives are in addition to any fuel credits earned under the RFS or California’s LCFS, so stacking these subsidies could be a lucrative opportunity for biofuel producers if they invest in jet fuel conversion processes.

However, there is a catch, and it hinges on the IRA’s emissions requirements. To receive these tax credits, a fuel must have 50% less emissions than petroleum jet fuel. This stipulation is like the advanced biofuel requirements under the RFS. Conventional ethanol from corn starch, on the other hand, only needs to have 20% less emissions than petroleum gas to qualify for the RFS. The IRA also states that the process of calculating a fuel’s emissions must comply with the standards set by the International Civil Aviation Organization (ICAO). ICAO has its own calculator for determining the emissions of SAFs called CORSIA. According to CORSIA, SAF from corn-starch ethanol has higher emissions than petroleum jet fuel (ICAO, 2024), and ethanol producers do not currently qualify for IRA tax credits. Ouch.

All is not lost for ethanol producers, however. The Biden Administration formally stated in December that the Treasury Department will adopt a different model to calculate ethanol’s emissions for SAF (DOT, 2023). This model is called GREET, and the Treasury and Energy Departments plan to make GREET compliant with ICAO standards. Details on the changes are expected in March. According to GREET, corn ethanol represents a 43% reduction in emissions from petroleum gasoline (Lee et al., 2021). So, while the final numbers have not been released, using GREET will certainly reduce the emissions gap between ethanol SAF and the 50% threshold-if not eliminate it completely. Moreover, exploring how GREET determines the emissions of ethanol will reveal how ethanol producers could surpass the 50% threshold.

The Emissions of Ethanol and Means to Reduce Them

Ethanol green-house gas emissions are calculated using a life-cycle analysis that accounts for emissions in the entire production and consumption life of ethanol. This is a farm-to-fumes measurement that includes everything from nitrogen fertilizer use by corn to emissions from consumers’ tailpipes. The tailpipe emissions of corn-ethanol form a closed-carbon loop because the corn initially pulled the CO2 from the atmosphere during photosynthesis, and ethanol’s emissions only come from the production of the fuel and feedstock.

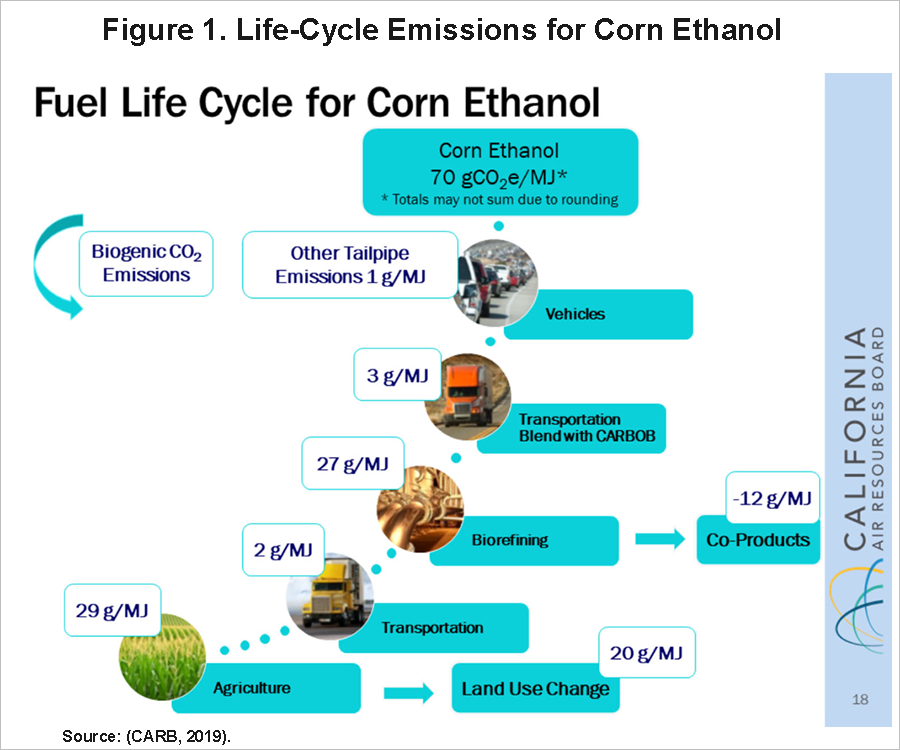

Life-cycle emissions are much more difficult to measure than the amount of carbon in a barrel of oil, so many government agencies use their own favored models. Most models for calculating fuel emissions use units called carbon intensity measured in gCO2e/MJ. gCO2e/MJ measures the grams of carbon dioxide equivalent per megajoule of energy consumed. The GREET model developed by the Department of Energy’s Argonne Laboratory is one model as is the ICAO’s CORSIA model. The EPA used its own carbon intensity model for implementing the RFS. California uses a form of the GREET model for their Low Carbon Fuel Standard with some adjustments that give corn ethanol a higher emissions rating than the DOE model. Figure 1 below shows an example of the life-cycle emissions of ethanol for a typical ethanol plant selling to fuel blenders in California.

As can be seen from Figure 1, the three largest sources of emissions for corn ethanol are corn production, biorefining, and land use change. Emissions from corn production largely occur from the application of nitrogen fertilizers that can volatize into nitrous oxide. Emissions from biorefining include the use of fossil fuel energy and CO2 created during the distillation of corn starch. Ethanol by-products like distillers grain and corn oil help to negate part of the emissions from distilling corn into ethanol through displacing other livestock feed and vegetable oils.

Land use change, the third largest piece, is the most difficult to measure, and the biggest discrepancy between CORSIA and GREET models. Land use change arises from higher corn prices causing farmers to bring new land into production. For example, millions of acres of Conservation Reserve Program land were converted into corn ground following the passage of the RFS (Lark et al., 2022). This land conversion releases soil carbon stocks and reduces plant biomass. California estimates land use change emissions at 20 gCO2e/MJ (CARB, 2015), but estimates can vary widely on the amount of carbon in soils and perennial vegetation and how much land conversion is caused by increasing ethanol demand. CORSIA’s land use change is 25 gCO2e/MJ while GREET’s is close to 7 gCO2e/MJ (ICAO, 2022; Lee et al., 2021). Using the GREET land use change estimate would reduce the emissions of corn-ethanol SAF by almost 20% from the CORSIA estimate.

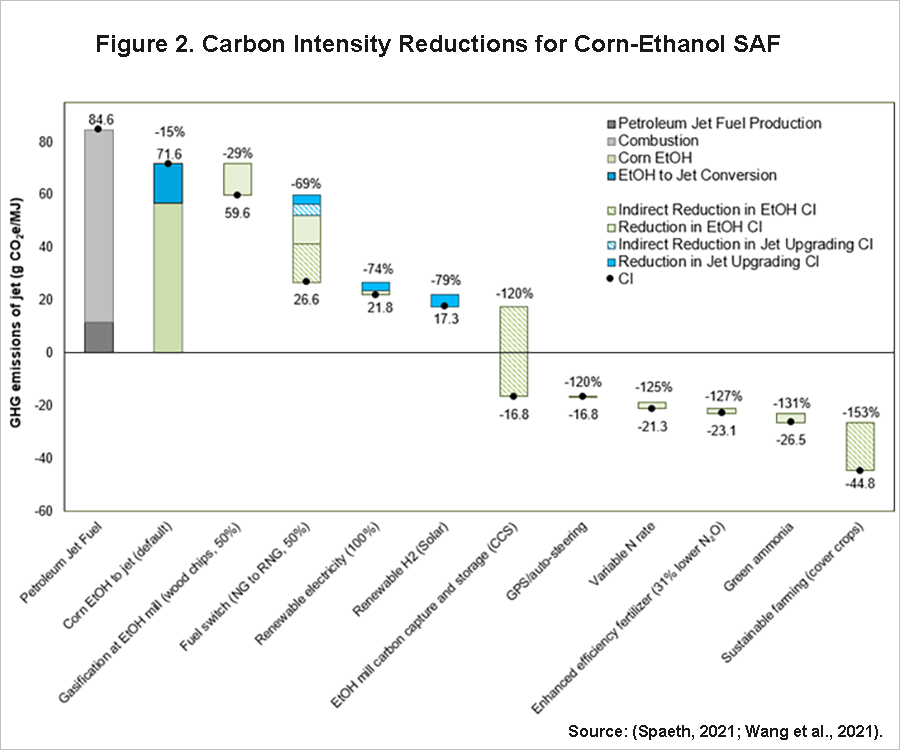

While using GREET should reduce estimated land use change emissions, ethanol plants may also need to reduce emissions from biorefining and agriculture. According to CARB, biorefining and agriculture represent almost 65% of ethanol emissions (CARB, 2019). If corn-ethanol does not qualify for IRA tax credits after the adoption of GREET, then producers must find a way to reduce the emissions of corn farming and the biorefining of ethanol. Researchers at the Department of Energy’s Argonne Laboratory have laid out a path for these reductions, and Figure 2 shows a prospective plan to reduce the emissions of ethanol converted to jet fuel using the 2021 version of the GREET calculator. The 2021 version of GREET may not exactly match the model for the Treasury Department, but it should provide a useful approximation.

GREET’s baseline for petroleum jet fuel is 84.6 gCO2e/MJ (Wang et al., 2021). Since a fuel must have a 50% emissions reduction to qualify for IRA tax credits, a fuel must have a carbon intensity no greater than 42.3 gCO2e/MJ. The baseline for jet fuel made from ethanol is 71.6 gCO2e/MJ with over 10 gCO2e/MJ coming from converting ethanol to jet fuel. This carbon intensity is only a 15% reduction from petroleum jet fuel, but as the figure shows, reductions from there are possible. Switching from natural gas (NG) to renewable natural gas (RNG), carbon capture and sequestration (CCS), and carbon farming each reduce the carbon intensity of corn ethanol by over 15 gCO2/MJ. In fact, switching from NG to RNG and CCS offer a 30-point reduction. These changes alone would reduce the carbon intensity of ethanol SAF below the 42.3 gCO2e/MJ threshold.

However, these technologies are just beginning, and economic and regulatory hurdles could push ethanol plants towards simpler means of reducing their emissions. The largest means of reduction require extensive capital investment and cooperation with third parties such as landowners, farmers, and local utilities. These arrangements could prove to be quite difficult. For example, ethanol producers in multiple states have delayed construction of CCS facilities because of local and regulatory resistance to the construction of CO2 pipelines (Douglas and Sanicola, 2023). Adjustments like increasing the mix of wet distillers grains relative to dry distillers grains, using more efficient yeasts, and converting corn fiber into ethanol offer smaller but easier to implement reductions in ethanol carbon intensity (Emery, Joyce, and Salles, 2022). So, while ethanol producers wait for expensive, time-consuming investments to pan out, these smaller adjustments could provide a bridge to lower carbon ethanol.

Conclusion

The expected adoption of GREET by the Treasury Department is a welcome sign for ethanol producers wanting to enter the jet fuel market. The IRA provides lucrative tax credits, and the SAF market is expected to experience tremendous growth by 2030. Corn-ethanol producers do not currently qualify, but the door to a corn-ethanol-to-jet-fuel pathway could open by March. Investments in emissions reduction technologies may be necessary to receive the SAF tax credits, though.

The ethanol industry is well aware of its need to decrease its emissions to remain eligible for future programs. The Renewable Fuels Association commissioned the report Pathways to Net-Zero Ethanol: Scenarios for Ethanol Producers to Achieve Carbon Neutrality by 2050 (Emery, Joyce, and Salles, 2022). This report lays out detailed plans for ethanol plants to reduce their emissions with a goal of being carbon neutral by 2050. Ethanol plants have dozens of means to reduce their emissions. The IRA and SAF may provide the impetus they need to start on this path.

References

California Air Resources Board (CARB). 2019. LCFS Basic with Notes. Arb.ca.gov. https://ww2.arb.ca.gov/resources/documents/lcfs-basics

California Air Resources Board (CARB). 2015. Staff Report: Calculating Carbon Intensity Values from Indirect Land Use Change of Crop-Based Biofuels. Arb.ca.gov. https://ww2.arb.ca.gov/sites/default/files/classic/fuels/lcfs/peerreview/050515staffreport_ca-greet.pdf

Douglas, L. and L. Sanicola. 2023. US drive to make green jet fuel with ethanol stalled by CO2 pipeline foes. Reuters.com. https://www.reuters.com/sustainability/climate-energy/us-drive-make-green-jet-fuel-with-ethanol-stalled-by-co2-pipeline-foes-2023-11-14/

Emery, I., E. Joyce, and C. Salles. 2022. Pathways to Net-Zero Ethanol: Scenarios for Ethanol Producers to Achieve Carbon Neutrality by 2050. Informed Sustainability Consulting, LLC. Accessed at: Ethanolrfa.org. https://ethanolrfa.org/media-and-news/category/news-releases/article/2022/02/new-study-corn-ethanol-can-achieve-net-zero-carbon-emissions-well-before-2050

Lark, T.J., N. P. Hendricks, A. Smith, N. Pates, S. A. Spawn-Lee, M. Bougie, E. Booth, C. J. Kucharik, and H. K Gibbs. 2022. Environmental Outcomes of the U.S. Renewable Fuel Standard. Proceedings of the National Academy of Sciences 119 (9): e2101084119. https://doi.org/10.1073/pnas.2101084119

Lee, U., Kwon, H., Wu, M. and Wang, M. 2021. Retrospective analysis of the U.S. corn ethanol industry for 2005–2019: implications for greenhouse gas emission reductions. Biofuels, Bioproduction. Biorefining., 15: 1318-1331. https://onlinelibrary.wiley.com/doi/10.1002/bbb.2225

International Civil Aviation Organization (ICAO). 2022. CORSIA Default Life Cycle Emissions Values for CORSIA Eligible Fuels, The 4th Edition. ICAO.int. https://www.icao.int/environmental-protection/pages/SAF_LifeCycle.aspx

Renshaw, J., S. Kelly, and L. Douglas. 2023. Biden administration split over ethanol’s role in aviation fuel subsidy program. Reuters.com. https://www.reuters.com/sustainability/biden-administration-split-over-ethanols-role-aviation-fuel-subsidy-program-2023-08-02/

Spaeth, J. 2021. Sustainable Aviation Fuels from Low-Carbon Ethanol Production. Energy.gov. https://www.energy.gov/eere/bioenergy/articles/sustainable-aviation-fuels-low-carbon-ethanol-production

U.S. Bureau of Transportation Statistics (BTS). 2024. Airline Fuel Cost and Consumption (U.S. Carriers – Schedule) January 2000 – November 2023. Transtats.bts.gov. https://www.transtats.bts.gov/fuel.asp

U.S. Department of Energy, Alternative Fuels Data Center (DOE-AFDC). 2024. Sustainable Aviation Fuel. Afdc.energy.gov. https://afdc.energy.gov/fuels/sustainable_aviation_fuel.html

U.S. Department of Energy, Alternative Fuels Data Center (DOE-AFDC). 2023. Sustainable Aviation Fuel Estimated Consumption. Afdc.energy.gov. https://afdc.energy.gov/data/10967

U.S. Department of the Treasury (DOT). 2023. U.S. Department of the Treasury, IRS, Release Guidance to Drive Innovation, Cut Aviation Sector Emissions. Home.treasury.gov. https://home.treasury.gov/news/press-releases/jy1998

Wang, M., A. Elgowainy, U. Lee, A. Bafana, S. Banerjee, P.T. Benavides, P. Bobba, A. Burnham, H. Cai, U. Gracida, T.R. Hawkins, R.K. Iyer, J.C. Kelly, T. Kim, K. Kingsbury, H. Kwon, Y. Li, X. Liu, Z. Lu, L. Ou, N. Siddique, P. Sun, P. Vyawahare, O. Winjobi, M. Wu, H. Xu, E. Yoo, G.G. Zaimes, & G. Zang. 2021. Greenhouse gases, Regulated Emissions, and Energy use in Technologies Model® (2021 Excel). USDOE Energy Systems and Infrastructure Analysis, Argonne National Laboratory. https://www.osti.gov/doecode/biblio/63044

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.