Assessing Your Working Capital

Much has been written about working capital and its vital role in managing farm finances. Today, we explore from a practical and pragmatic perspective, things that can change – increase or decrease one’s working capital. The list isn’t all that long, but to understand the impact of each on farm liquidity puts you in position to better understand your farms’ financial position.

Liquidity is a measure of ability to meet current cash-flow needs. Working capital (current assets minus current liabilities) is one of two pertinent measures of liquidity and is measured in dollars. The other pertinent measure of liquidity is the current ratio (current assets divided by current liabilities). Both certainly have a place in measuring and evaluating liquidity.

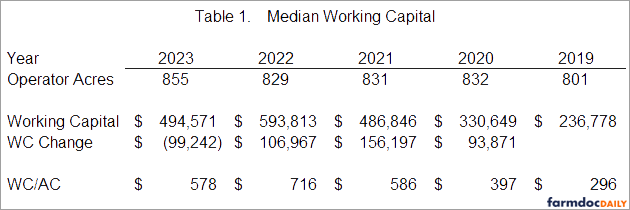

See Table 1 for a five-year history of working capital from a group of participating Illinois FBFM farms. This group of over 2,000 farms are largely grain farms with just over 800 operator acres. With the general good economic environment (better corn and soybean prices) of the past five years, the data show a buildup of working capital. 2019 shows $236,778 of median working capital increasing to $593,813 in 2022; an increase of $357,035 of working capital. Attractive commodity prices leading to good profitability account for much of this buildup in working capital.

For this period, we learn good farm profitability positively impacts working capital. In general, the things impacting working capital are: farm profitability, family living expenses, state/federal income tax liabilities, and debt service.

Think about these four things as either ‘adding to’ or ‘subtracting from’ your working capital since that is exactly how they function. The 2019 to 2022 period with its good commodity prices leading to excellent farm profitability saw farm profitability adding to working capital at a rate greater than family living expense, state/federal income tax and debt service were subtracting from working capital…thus, the net effect is an increase in working capital.

Now, go back to Table 1 to see the change in working capital from 2022 to 2023. That change is a negative $99,242 confirming that a lesser amount of farm profitability has the effect of decreasing available working capital. It is also apparent from the data that family living expense, state/federal income tax and debt service all negatively influence working capital – subtracting from working capital. Just over 25% of the working capital added in the 2019 to 2022 period was offset as the we made our way to the end of 2023. If the 2023 change in working capital continues, working capital could be near zero in five years.

So far, 2024 is continuing with similar commodity markets meaning that for 2024, most farms cannot count on farm profitability to ‘add to’ working capital. The prudent farm operator might focus on the things that subtract from working capital in an attempt to control them and lessen decreases in working capital.

- Do what you can to reduce family living expense – the prior good economic times give the ability to spend more freely – poorer economic times provide the chance to review that spending.

- Schedule a tax planning appointment to assess state and federal income tax liabilities for 2024 and beyond with the goal of being income tax efficient over time. If possible, plan to not create losses. Losses do carry back/forward but do not offset self-employment tax in the carryback/forward period. Plan to make optimal use of standard deduction amounts. Bring income into 2024 if needed and delay paying expenses. In general (and to your ability), plan to lessen the amount paid for state/federal income tax.

- Review your loan documents for covenants requiring a minimum amount of working capital or minimum current ratio. Debt repayment schedules can be difficult to change but your lender would much rather see you proactively tell them about your reduced working capital now rather than after the end of the year. Your lender may have means to re-finance and lessen the level of debt service to help preserve your working capital.

Summary

As we approach the end of the year and gather financial facts to document farm financial performance including working capital, it is also a good time to plan for cash flow and liquidity needs for 2025…and beyond. If you don’t already use an accrual income statement and balance sheet to mark that financial performance…..times like these are a good time to start. Be a good steward of your financial resources. Dollars you don’t spend on family living, state/federal income tax and debt service are dollars that will remain in your working capital and that working capital is a means to enduring through time of low profit.

The author would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.