The Liquidity of Illinois Grain Farms: Working Capital to Operating Expense Ratio by Farm Size

In our previous article (see farmdoc daily, December 18, 2024), we examined the trends in the ratio of median reported working capital to operating expense ratio across three regions of Illinois. Our findings indicate that Central Illinois has shown the least variability in liquidity across multiple liquidity measures at the median. In contrast, Southern Illinois frequently faces liquidity challenges. These issues are primarily due to the region’s greater fluctuation in crop yields, which results in more significant income swings. We now consider how the size of gross farm returns relates to the liquidity of grain farms. In this article, we will examine the working capital to operating expense ratio by farm size using data from the Illinois Farm Business Farm Management (FBFM).

The working capital to operating expense ratio is a measure of liquidity that assesses a farm’s ability to cover normal operating expenses with working capital instead of revenue. Liquidity refers to a farm business’s ability to generate enough cash or quickly convert assets into cash to meet its financial obligations as they become due. These obligations include operational expenses, debt payments, family living expenses, and taxes. Working capital is defined as the difference between current assets (i.e., cash and assets that are expected to be converted into cash within the next 12 months, which includes accounts receivable, inventory, and prepaid expenses) and current liabilities (i.e., obligations due within the next 12 months, such as accounts payable, short-term loans, current portion of term debt payments, and upcoming taxes). Operating expenses are all costs for the farm business, excluding interest, taxes, depreciation, and amortization. A working capital to operating expense ratio of 0.50 means the farm business has enough “cash” from working capital to cover 50 percent of the year’s operating expenses.

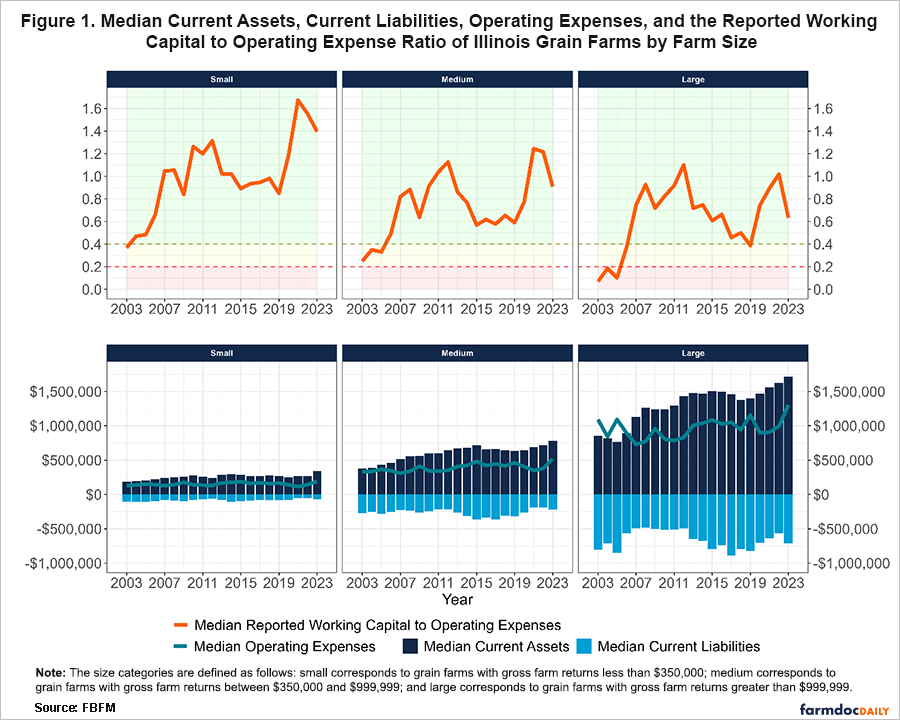

According to the Farm Financial Scorecard developed by the Center for Farm Financial Management, a farm with a working capital to operating expense ratio that is less than 0.2 is categorized as vulnerable, a ratio between 0.2 and 0.4 is categorized as cautionary, and a ratio that is greater than 0.4 is categorized as strong.[1] Therefore, the higher the ratio, the more liquid the farm is. We report this ratio by the size of their gross farm returns—small, medium-sized, and large. Small farms are defined as those with gross farm returns less than $350,000, medium-sized farms as those with returns between $350,000 and $999,999, and large farms as those with returns greater than $999,999. Lastly, in our figure below, we use the color-coding system of the Farm Financial Scorecard to indicate the category under which the median grain farm’s ratio belongs. The region shaded in red indicates a vulnerable ratio, while yellow indicates a cautionary ratio, and green indicates a strong ratio.

Figure 1 shows the median current assets, liabilities, and reported working capital to operating expense ratio of Illinois grain farms, categorized by the size of their gross farm returns. Over the past two decades, at the median, grain farms with higher gross farm returns have been less liquid than those with lower returns. In 2003, the reported working capital to operating expense ratio of the median small grain farm was 0.368 (cautionary), compared to medium-sized and large farms, which had a ratio of 0.250 (cautionary) and 0.069 (vulnerable), respectively. At that time, the median working capital of small farms was $48,430, $82,264 for medium-sized farms, and $112,054 for large farms, while their respective operating expenses were $130,944, $328,056, and $1,091,675.

At the median, small farms’ reported working capital to operating expense ratio increased by 185% from 2003 to 2007, rising from 0.368 (cautionary) to 1.05 (strong). Similarly, the ratio for medium-sized farms increased by 228% in the same period, rising from 0.250 (cautionary) to 0.819 (strong). Although the median large farm was in the vulnerable range in 2003, it managed to increase its ratio by 978%, reaching a ratio of 0.745 (strong) by 2007. When examining the individual components of the ratio, large grain farms experienced the most significant percentage changes over the period at the median. Large grain farms’ median value of working capital increased by 436%, while median operating expenses decreased by 33.3%. In contrast, medium-sized farms saw a 228% increase in working capital and a 6.14% decrease in operating expenses. On the other hand, small farms experienced a 143% increase in working capital and a slight decrease of 1.69% in operating expenses.

There was a further improvement in liquidity across all farm sizes from 2007 to 2012, despite the brief drop in 2009. This improvement occurred during a period when grain prices rose substantially. For example, the federal mandate set in 2005 and 2007 to increase ethanol production contributed to an increased demand for corn. Higher prices led to higher ending inventory, thus increasing current assets. These higher prices also increased net farm incomes, resulting in a lesser need for farm operating loans. Small farms’ median working capital to operating expense ratio increased by 25.5%, rising from 1.05 (strong) in 2007 to 1.31 (strong) in 2012. For medium-sized farms, the median ratio grew by 37.5%, increasing from 0.819 (strong) to 1.13 (strong). In comparison, large farms experienced a 47.8% increase in their median ratio, rising from 0.745 (strong) to 1.10 (strong). During this period, the median working capital for small farms rose by 32.8%, from $117,905 to $156,550. Medium-sized farms saw a larger percentage increase in their median working capital, which rose by 46.8%, from $269,602 to $395,662. Large farms experienced the greatest increase of 49.0%, with their median working capital going from $600,893 to $895,101. Interestingly, small farms reported the smallest percentage change in median operating expenses during this time, with an increase of only 2.53%, from $128,734 to $131,986. Medium-sized farms saw a larger increase of 13.8%, rising from $308,868 to $351,618. Similarly, the median operating expenses for large farms increased by 14.2%, rising from $728,586 to $831,859.

Between 2012 and 2019, the liquidity of grain farms across all sizes decreased during a period of declining grain prices and farm incomes. Grain farms with higher gross farm returns experienced more significant drops in their working capital to operating expense ratio. The median ratio for small farms fell by 35.4%, from 1.31 (strong) to 0.849 (strong). In contrast, medium-sized farms saw a larger decline of 47.6%, dropping from 1.13 (strong) to 0.590 (strong). Large farms experienced the largest decline of 64.8%, with the median ratio falling from 1.10 (strong) to 0.387 (cautionary).

Farm liquidity across all farm sizes improved in subsequent years. However, it has recently started to trend downward. Following the onset of the COVID-19 pandemic, grain prices rose due to trade-related disruptions alongside rising energy and fertilizer costs. From 2021 to 2023, median operating expenses increased significantly for small, medium-sized, and large grain farms, increasing by 64.9%, 47.9%, and 43.9%, respectively. During the same period, the median working capital for small farms rose by 22.3%, while it increased by only 6.89% for medium-sized farms and 5.18% for large farms.

Conclusion

The liquidity of Illinois grain farms has significantly improved over the past two decades. However, when we examine the size of the farms, we notice distinct differences in liquidity trends. We find that larger grain farms, as measured by their gross farm returns, have historically been less liquid than smaller farms. As of 2023, small grain farms’ median working capital to operating expense ratio was 1.40 (strong). In contrast, the median ratio for medium-sized grain farms was 0.908 (strong), and 0.633 (strong) for large grain farms. While the quality of these ratios is positive, they have been on a downward trend. Given the USDA’s projected decline in farm incomes for 2024 and the uncertainties yet to be determined in 2025, it will be important for farm operations to maintain strong liquidity positions.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Note

[1] The Farm Financial Scorecard adheres to the guidelines set by the Farm Financial Standards Council.

References

Mashange, G., B. Zwilling and D. Raab. "The Liquidity of Illinois Grain Farms: Working Capital to Operating Expense Ratio by Region." farmdoc daily (14):229, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 18, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.