Valentine’s Day and the Gains from Agricultural Trade: Cut Flowers in the US

Valentine’s Day is approaching, and floral bouquets are everywhere. However, cut flowers, a symbol of love and romance, are tied up in the ongoing tension in the United States over the benefits and drawbacks of international trade. The United States imports a significant share of the cut flowers purchased by US consumers and these imports contribute to the agricultural trade deficit that the incoming Trump administration seeks to eliminate. Recent tariff threats from the Trump administration have targeted major exporters of cut flowers and nursery plants such as Colombia and Canada. (Boak and Sherman, 2025; Boak, Sanchez and Gillies, 2025)

This article describes recent growth in US cut flower imports and the origins of these imports. Some countries, particularly the largest supplier of cut flower imports, Colombia, have a comparative advantage in cut flower production, especially certain types of flowers, so that US and imported flower production has become much more specialized over time. While the US could impose tariffs on foreign producers, doing so would impose significant costs on domestic consumers and do little to change the balance of agricultural trade because it would eliminate the gains to specialization. Importantly, increases in import values have been far larger than changes in the value of domestic production.

Cut Flower Imports in Context

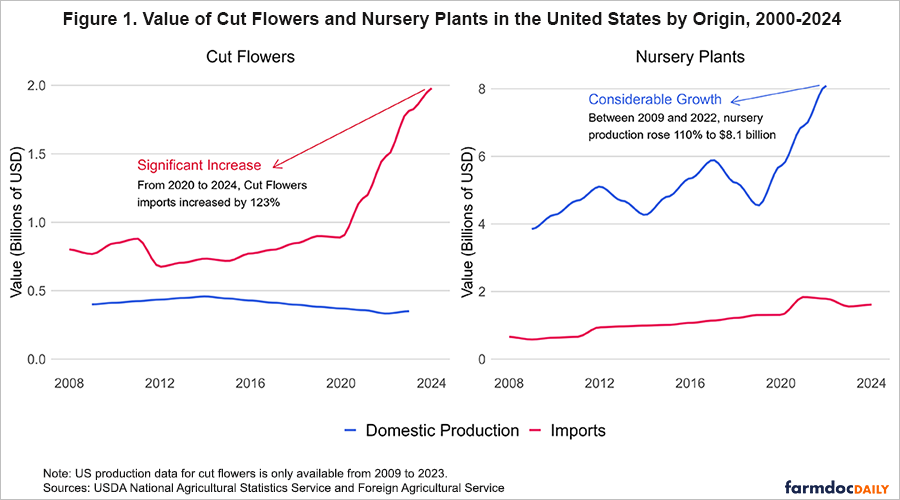

The popularity of cut flowers has increased in recent years. In 2023, the combined value of domestically grown and imported cut flowers reached $2.3 billion. Figure 1 compares the value of imports and domestic production for both cut flowers and nursery plants. The data show that cut flower imports have skyrocketed, more than doubling since 2020. US cut flower imports for calendar year 2024 will be a record, with calendar year imports reaching $1.98 billion, making up the lion’s share of flowers purchased by US consumers.

At the same time, the value and location of US domestic cut flower production has been relatively stable. US growers produce roughly $350 million of cut flowers in 2023, down slightly from a peak of $458 million in 2014. Approximately 70% of production occurs in California. A stable domestic industry plus rapid growth in cut flower trade mean that now nearly 80% of the value of cut flowers available in the U.S. market come from imports.

As cut flower imports have grown and domestic production stagnated, significant growth has occurred in the closely-related production of nursery plants with the value of domestic nursery plant production reaching more than $8 billion as of the most recent data from USDA NASS for 2022. Unlike cut flowers, the US produces most of its own nursery plants; imports, largely from Canada, make up just 18% of the value of nursery plants in the US. In general, production in this sector of the agricultural economy has become more regionally specialized.

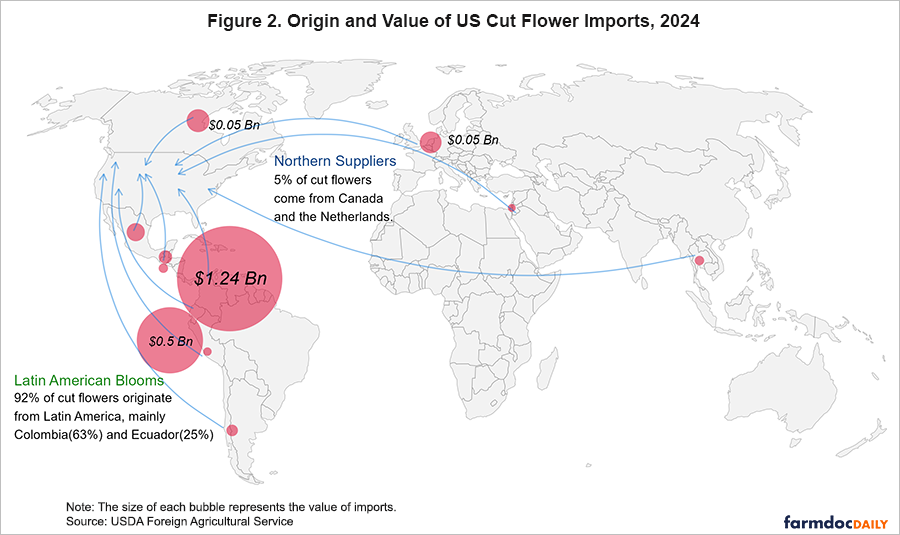

South America is the main source of US cut flower imports. The origin of 2024 US cut flower imports are shown in Figure 2. More than 60% of imports, or $1.24 billion, come from Colombia and a further 25%, or $491 million, come from Ecuador. While cut flowers are imported from various parts of the world, countries in close geographic proximity to the US are dominant. Latin America countries produce 92% of total imports. Canada and the Netherlands also play a role but represent only 5% of US imports.

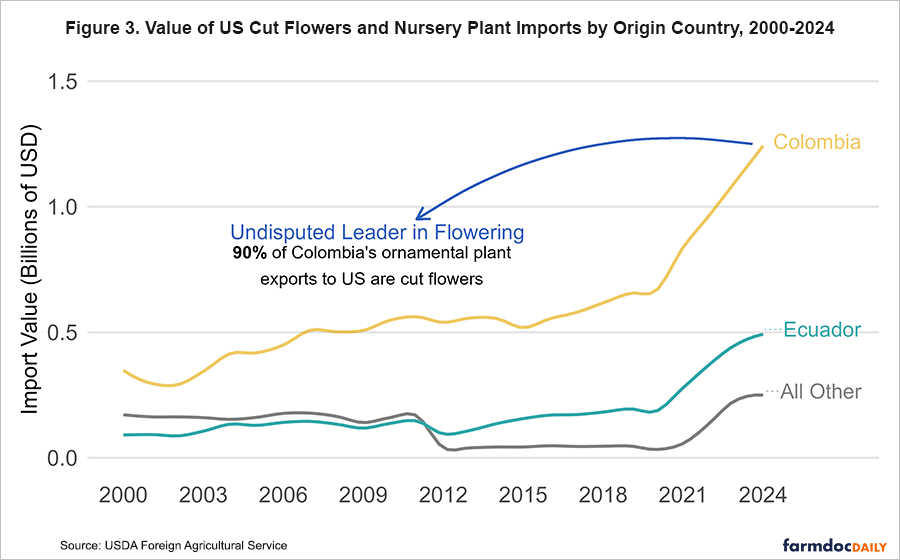

Figure 3 shows the history of US cut flower imports by origin. Most of the recent growth in import values comes from the two largest origins: Colombia and Ecuador. Over the past 20 years, these countries have steadily increased cut flower sales to the United States. In the past five years this growth has been especially impressive. Between 2020 and 2024, US imports from Colombia nearly doubled from $667 million to $1.24 billion and imports from Ecuador increased more than 2.5 times from $186 million to $491 million.

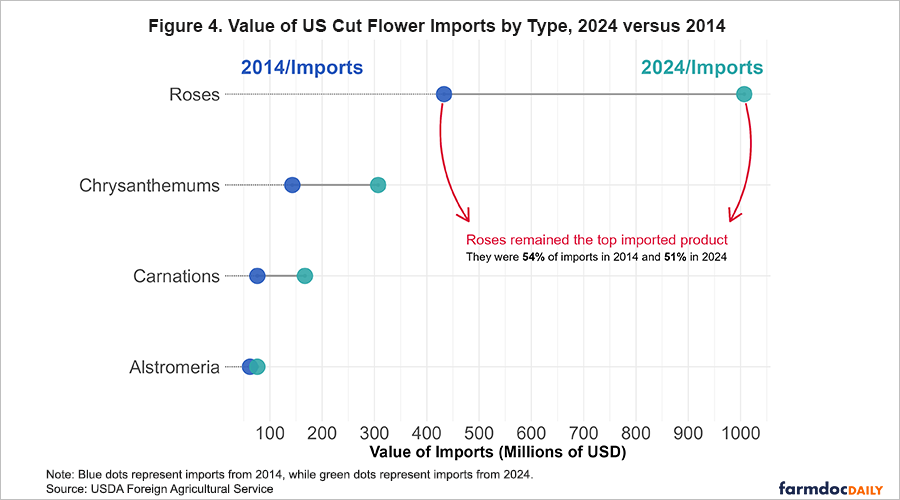

Much of the growth in the value of US cut flower imports has come from a few types of flowers. Figure 4 shows the change from 2014 to 2024 in import values for the most popular types of flowers. In 2014, rose imports were $433 million, representing 54% of the total value of cut flower and nursery imports. By 2024, this figure rose to $1.007 billion though the share declined slightly to 51%. Other popular categories such as chrysanthemums, carnations, and alstroemerias have also experienced similar growth, implying again that the cut flower industry has become more specialized over space. US producers have consequently focused on other types of specialty flowers that are higher value and more difficult to ship over long distances (Bergmann 2024).

Natural advantage leads to comparative advantage

Why do 88% of US cut flower imports come just two countries? Along with close proximity to the US, Colombia and Ecuador have near ideal production conditions. Stable climates allow for year-round flower cultivation. With average temperatures ranging from 55°F to 65°F, the main cut flower growing region are often referred to as the “eternal land of spring”. Mountainous terrain in both countries creates optimal growing conditions, characterized by warm days and cool nights. Traditional covered greenhouse production systems rely on relatively low cost natural ventilation rather than more energy intensive methods (Villagrán et. al, 2021). These factors make flowers so abundant in these regions that they are celebrated in cultural festivals.

The origins of export-oriented cut flower production go back more than 50 years. (Conlon 2015) Both US and South American firms recognized the natural advantages of production in Colombia and Ecuador and made investments necessary to establish efficient supply chains. (Patel-Campillo, A. 2010). In addition, the Colombian and Ecuadorian governments and local firms made significant efforts to develop and adopt technology to increase productivity in cut flower production (Fedesarrollo 2007).

Implications for future agricultural trade

The rise of US imports of cut flowers from South America is a part of a larger story about the US balance of agricultural trade. Since 2022, the US has been a net importer of agricultural products (USDA ERS 2025). Part of this story has been the growth in domestic consumption of high value agricultural products like cut flowers from abroad. Simply, domestic consumers have seen significant value in imported flowers and the relatively strong US economy has kept the US consumer spending.

Tariffs like those announced by the incoming Trump administration on January 26 for Colombia and February 1 for Canada – both later postponed or canceled – would limit imports of cut flowers and nursery plants. Prices for domestic consumers would likely rise. However, the impact of tariffs on domestic producers and the agricultural trade balance are less clear. The immense size of cut flower imports, plus the stability and specialization of domestic US cut flower production, suggest it may be difficult and expensive for domestic producers to resume production of particular types of flowers that the US currently imports. Existing gains from trade would simply be lost and next Valentine’s Day would feature fewer flowers than in recent years.

References

Bergmann, B. 2024. “A Brief History of Specialty Cut Flower Production” NC State Extension. https://cutflowers.ces.ncsu.edu/welcome/brief-history-of-specialty-cut-flower-production/

Boak, J. and Sherman, C. 2025. “Trump’s tariff threat worked on Colombia, but his plans for Canada and Mexico carry higher stakes.” Associated Press, January 28, 2025. https://apnews.com/article/trump-tariffs-canada-mexico-colombia-a5ee8bc89b7fbb459ee574c002c90df1

Boak, J. Sanchez, F. and Gillies, R. 2025. “Trump agrees to pause tariffs on Canada and Mexico after they pledge to boost border enforcement.” Associated Press, February 3, 2025. https://apnews.com/article/trump-tariffs-canada-mexico-china-sheinbaum-trudeau-017efa8c3343b8d2a9444f7e65356ae9

Conlon, M. 2015. “The History of the Colombian Flower Industry and Its Influence on the United States.” USDA Foreign Agricultural Service GAIN Report. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=The%20Colombian%20flower%20industry%20and%20its%20partnership%20with%20the%20U.S._Bogota_Colombia_2-6-2015

Fedesarrollo. 2007. ‘The Emergence of New Successful Export Activities in Colombia’, IABD Project – Latin American Research Network. http://hdl.handle.net/11445/1447

Patel-Campillo, A. (2010). Rival commodity chains: Agency and regulation in the US and Colombian cut flower agro-industries. Review of International Political Economy, 17(1), 75–102. https://doi.org/10.1080/09692290903296094

USDA Economic Research Service. 2025. “Foreign Agricultural Trade of the United States (FATUS) - U.S. Agricultural Trade Data Update” https://www.ers.usda.gov/data-products/foreign-agricultural-trade-of-the-united-states-fatus/us-agricultural-trade-data-update

Villagrán, E., Flores-Velazquez, J., Bojacá, C., & Akrami, M. (2021). Evaluation of the Microclimate in a Traditional Colombian Greenhouse Used for Cut Flower Production. Agronomy, 11(7), 1330. https://doi.org/10.3390/agronomy11071330

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.