Why Every Farmer Should Consider ACRE

Many farms have not been enrolled in the Average Crop Revenue Election (ACRE) program, and instead still are receiving Federal commodity program payments in the traditional manner that includes a counter-cyclical program (see ACRE Program Enrollment in 2009 and 2010 for details). June 1st is the deadline for enrolling farms into ACRE that still are in the counter-cyclical program. Farmers and land owners may wish to consider ACRE as ACRE’s revenue protection is significantly better than price protection offered by the counter-cyclical program. Moreover, ACRE’s revenue protection differs from the protection offered by crop insurance.

ACRE basics

ACRE is a state-level revenue program that makes payments when state revenue fall below a state guarantee (a farm benchmark must also be met before a farm receives an ACRE payment). The traditional counter-cyclical program makes payments when national market year average (MYA) prices fall below trigger prices. Trigger prices are fixed at low levels — $2.35 per bushel for corn, $5.56 per bushel for soybeans, and $3.65 per bushel for wheat – resulting in very small chances of payments under the traditional program. On the other hand, ACRE’s guarantee is based on more recent yields and prices, resulting in much higher chances of payments. In Illinois for a typical year, ACRE is estimated to pay in one-third of the years for corn, 16% of the years for soybeans, and 26% of the years for wheat (see ACRE Will Likely Pay More than the Traditional Alternative).

In exchange for higher expected payments under ACRE, farmers must give up 20 percent of direct payments, which on many Midwest farms works out to be a reduction of between $4 and $5 per acre. Farms enrolling in ACRE also will have a loan rate 30 percent less than in the traditional program. The “costs” of having a lower loan rate are small, as the chance of receiving loan deficiency payments is near zero. National loan rates without the 30 percent reduction are $1.95 per bushel for corn, $5.00 for soybeans, and $2.94 for wheat. Moreover, current low interest rates cause the value of having of marketing loans to be very small.

In essence, enrolling in ACRE is similar to buying insurance. For $4 to $5 per acre, farmers receive revenue protection offered by ACRE (for more detail on ACRE see Questions and Answers about the ACRE Provisions of the 2008 Farm Bill).

2011 Benchmark Prices

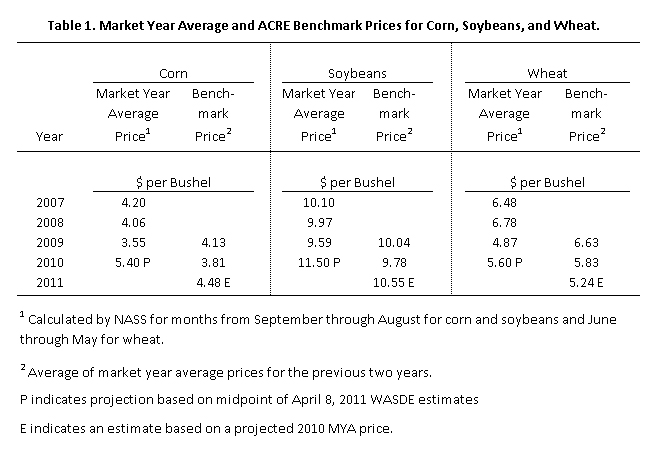

ACRE will make payments when state revenue is below a state guarantee. The state guarantee equals 90 percent times the 5-year Olympic average of state yields times a benchmark price. The benchmark price equals the average of the last two national MYA prices.

The 2011 benchmark prices are not known yet with certainty as the 2010 market year is not over. Using the midpoint of World Agricultural Supply and Demand Estimates (WASDE), benchmark prices can be estimated. Corn is projected to have a $4.48 benchmark price, $.67 higher than the 2010 benchmark price (see Table 1). Soybeans have a 2010 MYA price estimate of $11.55, $.77 higher than the 2010 price. Wheat’s benchmark price is projected at $5.24 per bushel, $.59 lower than the 2010 price.

ACRE’s Unique Protection

Current grain bids for harvest-time delivery are well above ACRE benchmark prices. In central Illinois, fall delivery bids are in the mid-$6 range for corn and mid-$13 range for soybeans. Wheat bids are in the mid-$7 range for summer delivery. This suggests that the chance of ACRE payment in 2011 are below their more typical probabilities of 33% for corn, 16% chance for soybeans, and 26% chance for wheat.

While the chance is lower than average in 2011, ACRE still is worth considering. The $4.48 corn, $10.55 soybean, and $5.24 wheat benchmark prices are above historical levels and well above trigger prices contained in the counter-cyclical program. While the price and revenue outlook currently is positive, events could occur that cause 2011 to be poor revenue year. While not likely, prices could fall causing ACRE payments. A low yielding year could also result in ACRE payments.

Moreover, ACRE offers different protection from crop insurance. Crop insurance prices for determining revenue on corn and soybeans will based on futures prices in October. For corn and soybeans, ACRE revenue will be determined by MYA prices which are averaged from September 2011 through August 2012. Because of the long period for determining prices, ACRE offers extended protection compared to crop insurance, whose protection ends after harvest prices and yields are determined.

Summary

ACRE offers revenue protection superior to price protection offered by the traditional counter-cyclical program. ACRE’s revenue protection differs from crop insurance. These features cause ACRE to be attractive alternative, even given the $4 or $5 per acre reduction in direct payments.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.