2014 Farm Bill: The Supplemental Coverage Option

The Crop Insurance Title of the 2014 Farm Bill includes provisions for the creation of a new crop insurance program referred to as the Supplemental Coverage Option (SCO). SCO is an optional program which will be available starting in the 2015 crop year. SCO provides supplemental coverage which mimics the producer’s individual insurance program choice, covering a portion of the deductible using a county-level measure of yield or revenue. Today’s post outlines the details of the SCO program, its eligibility rules and linkages with the new PLC and ARC commodity program options, and offers some considerations for producers in making commodity and crop insurance decisions.

Program Description

The Supplemental Coverage Option offers loss coverage for a portion of the farmer’s insurance deductible on an area-wide basis only. SCO mimics the coverage offered by the producer’s individual insurance plan, measuring losses at the county-level where data is available, and at higher levels of aggregation (i.e. crop reporting district) when county-level data is insufficient. For example, if the producer purchases a yield protection (YP) policy, SCO would provide additional county-level yield protection. If the producer purchases a revenue protection (RP) policy, SCO would provide additional county-level revenue protection. The underlying plan of insurance also determines whether SCO offers harvest price protection or if it is excluded. For example, coupling SCO with an RP policy would result in the SCO guarantee being based off of the higher of the base and harvest prices. Coupling SCO with an RP policy with the harvest price exclusion (RP-HPE) would result in the SCO guarantee being based on the insurance base price. Figure 1 provides a visual illustration of the concept behind the SCO program.

Based on the language defining SCO in the 2014 Farm Bill, the yield component of the SCO guarantee will be based on the same yields used for other area plans of coverage (i.e. GRP/GRIP, or what is now referred to as the Area Risk Protection Insurance (ARPI) program). The price components of the SCO guarantee will be based on the same base price components used for other insurance programs. The base insurance price for corn is set as the average December futures contract price during the month of February. The base insurance price for soybeans is set as the average November futures contract price during the month of February. Harvest prices for corn and soybeans are averages of the same harvest futures contracts (December for corn, November for soybeans) in the month of October.

The key point to understand about SCO is that the amount of coverage it provides is dependent on the coverage level choice for the underlying insurance product. Coupling SCO with an 85% RP policy provides county-level revenue coverage ranging from 86% to 85%. Reducing the coverage level on the RP policy to a lower level would expand the band of county-level coverage offered by SCO. SCO with a 70% RP policy would provide county-level revenue coverage from 86% down to 70%.

Premium rates for SCO will set by the Risk Management Agency to reflect expected indemnities, allow for a reasonable reserve, and cover operating and administrative expenses. The subsidy rate for SCO plans is set at 65%. In general, SCO coverage will increase in cost as the coverage level on the underlying insurance program declines. This is because the band of coverage offered by SCO widens as the coverage level for the individual insurance policy it supplements declines.

SCO Payment Examples

The following examples illustrate SCO payment scenarios for corn. The examples are all based on an expected county yield level of 180 bushels per acre and a base insurance price of $4.60 per bushel. The farm is also assumed to have a trend-adjusted APH yield of 180 bushels per acre.

If the SCO program is being used to supplement a YP policy, SCO would offer county yield protection and trigger payments if the actual county yield fell below 154.8 bushels per acre (0.86 x 180 = 154.8). Table 1 illustrates payments across a range of actual county yield levels when SCO is coupled with YP at various coverage levels.

A YP policy with 70% yield coverage would trigger payments if actual farm yields fall below 126 bushels per acre (0.70 x 180 = 126). SCO coverage in this case would supplement that coverage by covering county yield losses in the range of 154.8 to 126 bushels per acre, resulting in a maximum SCO payment of $132 per acre ($4.60 x (154.8-126) = $132). At an actual county yield of 150 bushels per acre, SCO would make a $22 payment to cover the 4.8 bushel county yield loss (154.8 – 150 = 4.8 x $4.60 = $22).

As the coverage level for the underlying YP policy increases, the county yield at which SCO payments are triggered remains at 154.8 bushels per acre but the SCO coverage range becomes narrower and the maximum SCO payment declines. With an 80% YP policy, the maximum payment from the SCO coverage declines to $50 per acre ($4.60 x (154.8 – 144) = $50). Increasing the YP coverage level to 85% reduces the maximum SCO payment to $8 per acre for any county yield level below 153 bushels per acre (0.85 x 180 = 153). Thus there is a tradeoff between the coverage offered by SCO and the underlying individual insurance plan.

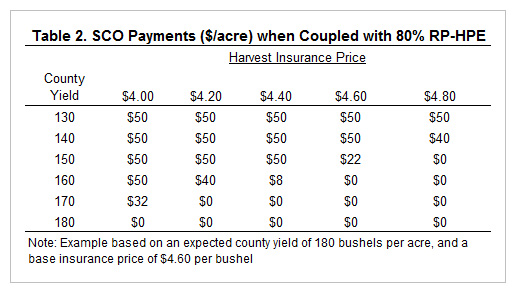

Tables 2 and 3 illustrate payment scenarios for SCO when coupled with RP-HPE and RP policies, respectively. Here a range of harvest prices and county yields are considered, but the coverage level for the underlying revenue insurance plan is set at 80%.

When coupled with RP-HPE, the SCO county revenue guarantee is $828 per acre ($4.60 x 180 = $828). SCO would trigger payments if actual county revenue levels fall below $712 per acre (0.86 x $828). With RP-HPE at an 80% coverage level, the maximum SCO payment would equal $50 per acre if actual county revenue fell below $681 per acre (0.80 x $828 = $662). With an actual county yield of 140 bushels per acre and a harvest price of $4.80, actual county revenue would be $672 per acre. This would result in an SCO payment of $40 per acre ($712 – $672 = $40) when coupled with an 80% RP-HPE policy.

Table 3 illustrates SCO payments at different county yield and price levels when coupled with an 80% RP policy. The only difference in payment outcomes in tables 2 and 3 occurs when the harvest price is above the base price of $4.60. When coupled with RP, SCO will also adjust the revenue guarantee if the harvest price is greater than the base price. At a harvest price of $4.80, the SCO guarantee increases to $864 per acre ($4.80 x 180 = $864). SCO payments would be triggered at an actual county revenue level of $743 (0.86 x $864 = $743), and the maximum SCO payment increases to $52 per acre when actual county revenues fall below $691 per acre (0.80 x $864 = $691). With an actual county yield of 150 bushels per acre and a harvest price of $4.80, actual county revenue would be $720 per acre. This would result in an SCO payment of $23 per acre ($743 – $720 = $23) when coupled with an 80% RP policy.

SCO and Commodity Program Choice

Eligibility to purchase SCO coverage is tied to the producer’s commodity program election. SCO can only be purchased for crops covered under the Price Loss Coverage (PLC) program. Enrolling a crop in county or individual ARC makes it ineligible for SCO coverage (more information on the PLC and ARC programs is available here). However, the crop continues to be eligible for other individual insurance plans (i.e. RP, YP, and ARPI) regardless of commodity program choice.

Since SCO will not be available until the 2015 crop year, crop insurance decisions for 2014 do not need to take this new program into consideration. However, since commodity program choice will likely be made in the upcoming months, considerations for future SCO eligibility should be made when deciding among the new commodity program options.

Future posts will provide more analysis, but some main points to consider include program costs, payment acres, payment limitations, and the form of price and yield protection. Since SCO is an insurance program, producers will be required to pay a portion of the premium. In contrast, the commodity programs are fully subsidized. The PLC and ARC commodity programs tie payments to a percentage of base acres while SCO, like other insurance programs, is tied to planted acres. Commodity program payments are subject to a $125,000 limit across all programs (PLC/ARC and marketing loan gains/LDPs) per entity, in addition to a $900,000 adjusted gross income limit for payment eligibility. Crop insurance programs, such as SCO, do not currently face payment limitations.

Finally, the type of price protection offered by SCO differs from that of the commodity program choices. The price protection offered by SCO is based on crop futures price movements within the crop year. The base and harvest insurance prices adjust annually with the futures markets. The PLC commodity program provides a fixed level of price protection over the life of the 2014 Farm Bill (through the 2018 marketing year). The ARC program options provide price protection based on a rolling historical average of cash prices received during the marketing year. Furthermore, yield risk protection under SCO differs from both the underlying plan of insurance (area vs farm yields) and the ARC commodity programs. County ARC and SCO both use county yields, but the county ARC guarantee is based on a rolling average of historical county yields while SCO uses an expected area trend yield measure. Individual ARC’s guarantee is based on a rolling average of historical farm yields compared with the area trend yield used for SCO.

Summary

The 2014 Farm Bill creates a new insurance program called the Supplemental Coverage Option (SCO). SCO will be available starting in the 2015 crop year and provides area-based coverage to supplement the producer’s individual insurance plan coverage. SCO will be rated by the Risk Management Agency and have its premium subsidized at a rate of 65%. While 2014 crop insurance program decisions should not be impacted by the new SCO program, commodity program choices that will have to be made this year will impact a producer’s eligibility to use SCO in future crop years. Specifically, acreage planted to crops that are enrolled in the county or individual ARC commodity programs will not be eligible for SCO coverage. Only crops enrolled in the PLC program will be eligible for SCO.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.