Downside Revenue Risk on 2012 Corn

The current settlement price on the December 2012 futures corn contract traded on the Chicago Mercantile Exchange (CME) is suggesting relatively high corn prices for the 2012 year, leading to high 2012 revenue expectations While expectations are high, there is downside risk. On central Illinois farmland, there is a 20 percent chance that crop revenue will be below $850 per acre.

The 20 percent below $850 per acre is arrived at by simulating 2012 revenue for different corn yields and different corn prices. The corn yield distribution is based on trend-adjusted historical yields. Yields are picked for a central Illinois farm having an expected yield is 187 bushels per acre. On the downside, 10 percent of yields are expected to be below 150 bushels per acre.

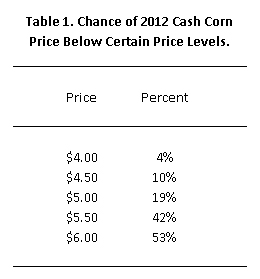

The likelihood of different prices is imputed from futures and options prices on September 2, 2011. The expected value at harvest of the December 2012 is $6.46 per bushel, the same as the price on September 2nd of the December 2012 corn contract. A $.35 cash basis is subtracted to arrive at a $6.11 expected cash price. CME options contract prices then are used to imply the distribution prices. Based on these procedures, 4 percent of the cash prices are expected to be below $4.00 per bushel at 2012 harvest-time, and 19 percent of the time below $5 per bushel. While futures markets are projecting relative high corn prices, there are significant chances of much lower prices.

Crop revenue then is projected for 2012 crop revenue using the generated using cash prices, farm yields, and a correlation between prices and yields of -.51. The mean crop revenue is about $1,150 per acre. There is a 4 percent chance of crop revenues below $650 per acre (see Table 2). The chance of revenue below $750 per acre is 10 percent and the chance below $850 per acre is 20 percent.

Revenues below $850 per acre likely would be associated with changes in a supply and demand factors that cause agricultural income outlook to decline substantially. Factors that could cause a reduction are difficult to predict. Options markets, however, indicate that there is roughly a one in five chance of such an event occurring. Absent such an event, corn revenues likely will be in the $1,000 range for farms in central Illinois.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.