Cost Management: Tillage Operations

Farming is a capital intensive venture with specialized equipment needed for various field operations, including several different implements used for tillage. Machinery ownership and labor can be costly. Two methods for managing tillage costs are to 1) reduce tillage passes and 2) outsource tillage operations.

Background

Recently released crop budgets (farmdoc daily, August 4, 2020) project losses for corn and soybeans on Illinois farms, given current assumptions for 2021. Improvement in outlook could come from higher prices, above trend yields without lower prices, additional government aid, cuts in costs, or some combination of those. Farmers evaluating how costs may be cut in the upcoming year have several options, including reducing cash rents (see discussion in farmdoc daily, August 11, 2020). Several options exist for reducing non-land costs, with this article focusing on tillage related costs.

A farmer evaluating costs and returns may consider whether to own specialized equipment for a tillage operation versus outsourcing the task. With tillage practices, not performing the task may also be the option providing maximum returns. These decisions are complex because a decrease in one type of expense may be offset by an increase in other costs, or a change in expected yield. These decisions may also be dependent on requirements of a landlord or business owner for certain practices to be done and concern over the ability to outsource in a timely manner when the task needs completed. Moreover, to fully obtain all cost saving from reduced tillage, the amount of equipment on a farm must be reduced. This reduction generally will come from long-run decisions on replacement of equipment.

Cost Comparison Resources

The University of Illinois farmdoc machinery costs estimates are intended to represent costs associated with buying new machinery and owning the machinery for ten years (links provided in farmdoc daily, August 6, 2019). Most machinery cost estimates are based on a 1,400 acre farm. The machinery cost estimates include four categories of costs associated with operating the machinery: tractor overhead, implement overhead, fuel charges, and labor. Machinery cost estimates for 2019 are available in the management section of farmdoc in five publications.

Estimated machinery costs can be useful when performing a field operation for another individual. For example, a generational family farm may have different levels of ownership, own separate pieces of machinery, or have acreage shares that don’t align with ownership, and these costs can be used as a resource for settling with other farm members. Or if a farmer is assisting a neighbor or seeking custom work, knowing their own cost of operation provides a baseline level for which to add a profit margin when setting a custom rate.

The estimated machinery costs can also be useful when determining what equipment has the greatest economic return to the farm as compared to what it would cost to outsource the associated task. Iowa State University custom farming surveys are useful for outsourcing decisions.

Annually, Iowa State University surveys those who hire and/or perform custom farm services and compiles a report of results. Unlike the farmdoc machinery cost estimates which represent actual economic cost of performing the field operation, the custom rate survey reports actual rates expected to be charged or paid in 2020. Understanding the difference in the intent of the two reports, and acknowledging some differences in general assumptions (for example, fuel rate of $2.50 versus $2.63 per gallon), explains the potential differences in rates reported from each source. A comparison of the two sets of rates provides a baseline that can be used to evaluate costs of owning equipment and performing field operations versus outsourcing. Although the actual costs will vary from farm to farm, and are dependent on the number of acres and the size or capacity of the equipment used, the averages presented here can be used as a guide.

Considerations for Tillage Operations

Tillage operations are typically used to prepare a desirable seedbed, reduce weed growth, incorporate fertilizer, or improve soil conditions. Although tillage can provide value, there is a cost associated with each tillage operation. In certain weather and field conditions, tillage operations may be necessary to prepare the field, while other times tillage may not be necessary. Often, tillage operations are an option for a farmer to consider, carefully weighing costs and potential benefits.

Data collected through the Precision Conservation Management from 2015 to 2019 indicates that light to moderate tillage is associated with higher returns than heavier tillage (farmdoc daily webinar, June 22, 2020). This indicates that some level of tillage is resulting in yields that offset costs, while repeated tillage operations add costs beyond attained value.

In situations, where a farmer determines it is cost effective to perform a tillage operation, the next step in a cost management approach is to determine whether it is more cost effective to own and operate the tillage implement or to outsource the operation.

Farm implements for tillage can be costly to own and operate, particularly when purchased new or relatively new. Many farms may have tillage implements that have been on the farm for generations, are fully paid for and fully depreciated. For farms in that situation, the cost of retaining that equipment to use as needed is comparatively lower than the economic cost of a newer implement because depreciation and interest make up a large portion of the economic costs. The following comparisons are relevant to farms who already own newer tillage equipment or those who are considering a purchase while aiming to manage costs effectively.

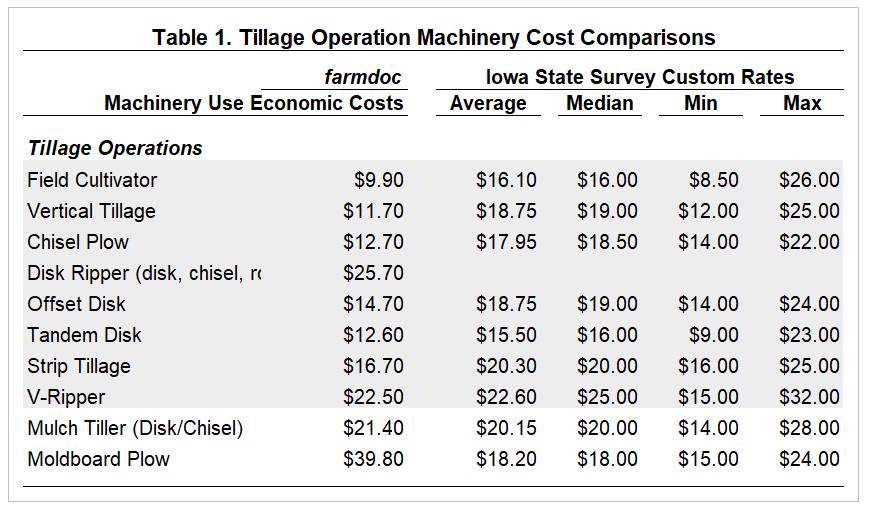

For several common tillage operations, the average farmdoc machinery use rate is shown in Table 1 next to the corresponding average, median, minimum and maximum custom rates from the Iowa survey responses.

For seven of the nine tillage operations compared, the economic cost of owning the machinery and performing the task is less than the average custom rate cost per acre, with all but one considerably lower than the average custom rate cost. For vertical tillage and chisel plow, the economic cost is lower than the lowest custom rate reported. Conversely, the economic cost of owning and operating a mulch tiller and moldboard plow are both higher than average reported custom rates, indicating it would likely be less expensive to outsource these tasks than owning and operating the equipment to complete the task. Note that the higher cost, heavier tillage operations are the ones where economic costs are above the corresponding custom rates.

The average farmdoc machinery use economic costs are calculated for use on approximately 1,400 acres. When the tillage equipment is used on fewer acres, the cost of operation would rise. As indicated in the farmdoc machinery cost estimates publication, acreage decreases of 50% result in 80% increases in costs, on average. The average is representative of a 35-foot chisel plow used on 1,470 acres. With that level of use, owning a chisel plow is clearly more cost effective than outsourcing the job. If the same chisel plow were used on only 735 acres (50% less acres), the cost would increase about 80% to $22.86 per acre (see Table 2). That cost is higher than the maximum custom rate reported. It would be more cost effective to outsource the task than owning an implement of that size for 735 acres.

Costs rise dramatically with lower use because much of the tillage related cost is associated with depreciation and interest on owning the equipment. Unlike fuel and labor costs which vary with use, depreciation and interest costs vary little with use. Therefore, as use increases, costs generally go down. Strategies then for lowering costs are to use equipment on the maximal acres. If acres are not maximized, options include 1) outsource the operation or 2) reduce the size of the equipment.

A farm utilizing a piece of tillage equipment on fewer acres could purchase a smaller, less expensive implement and reduce cost per acre. As shown in Table 2, a 15-foot chisel plow used on 630 acres has an economic cost of $14.50 per acre and a 21-foot chisel plow used on 882 acres has an economic cost of $16.00 per acre. A chisel plow in that size range would be cost effective to own and operate on 735 acres.

The following two comparisons drawn from Table 2 further highlight the importance of implements sized for acreage use when managing costs on the farm. A 21-foot chisel plow used on 882 acres has a cost of $16.00 per acre, while a 27-foot chisel plow used on 1,134 acres has nearly the same cost at $15.90 per acre. A 40-foot chisel plow used on 1,680 acres has a cost of $11.90 per acre, while a 47-foot chisel plow used on 1,974 acres has nearly the same cost at $12.10 per acre.

Management Suggestions

Based on the above comparisons, the following suggestions result:

- Consider reducing tillage operations. Results from several studies suggest that expected yields are maintained with a relatively low number of passes.

- Consider outsourcing certain field tillage passes. The most likely candidates for outsourcing are tillage operations that are not performed on all acres, and require specialized, costly tillage equipment. Tillage passes that may fall in this category are those associated with heavier, deep tillage that are not performed on all acres in every year. A way for reducing these costs is outsourcing the equipment, thereby allowing the individual performing the operation to perform the operation over more acres, and thereby lower total costs.

Further note that that these decisions are longer run in nature as well. Eliminating a tillage pass in a single year will reduce fuel, labor, and repair costs for the given year, but the ownership costs will remain. To fully obtain the benefits of reduced tillage passes, the pieces of equipment on a farm must be reduced. Some farms may have other factors to consider, such as requirements of land or business owners, and the ability to outsource, and timeliness of completing the task.

Conclusion

There are many types of tillage operations, some of which perform overlapping tasks, while others are used for more specific purposes. It would likely not be cost effective for an average sized farm to own all types of tillage implements, aside from situations where the equipment is older and fully depreciated. For most farms, the best cost management practice would be to own tillage implements that provide the greatest economic value for the farm, including which operations are expected to be used most frequently on the greatest number of acres. Another consideration is owning tillage implements that are sized appropriately for acres of expected use rather than total farm acres. For tillage operations that are not expected often, it is likely more cost effective to outsource those tillage operations when needed as opposed to purchasing or owning relatively new equipment.

References

Schnitkey, G., K. Swanson and N. Paulson. "Release of 2021 Crop Budgets." farmdoc daily (10):143, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 4, 2020.

Schnitkey, G., K. Swanson, C. Zulauf, N. Paulson and J. Coppess. "Cash Rents in 2020 and 2021." farmdoc daily (10):147, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 11, 2020.

Plastina, A., A. Johanns and O. Massman. "2020 Iowa Farm Custom Rate Survey." Ag Decision Maker A3-10, Iowa State University Extension and Outreach, Department of Economics, March 2020.

Lattz, D. and G. Schnitkey. "Machinery Cost Estimates for 2019." farmdoc daily (9):144, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 6, 2019.

Gentry, L. and G. Schnitkey. “Tillage, Nitrogen Use, and Cover Crop Impacts of Corn and Soybean Returns.” farmdoc webinar, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 22, 2020.

Lattz, D. and G. Schnitkey. “Machinery Costs: Field Operations.” farmdoc Business Management, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.