Beware of the Increasing Level of Deferred Income Tax

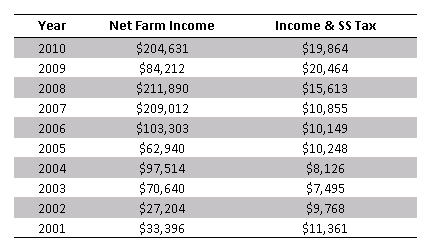

Average (accrual) Net Farm Income for the five year period 2006 to 2010 was $$162,609. Net Farm Income for the five years prior (2001 to 2005) was $58,339. This makes for an increase of $104,270 in average net farm income between the two five-year periods. This should surprise no one and is evidence of higher yields in most of Illinois and increased commodity prices.

Average Income and Social Security Tax paid for the five year period 2006 to 2010 was $$15,389. Net Farm Income for the five years prior (2001 to 2005) was $9,400. This makes for an increase of $5,989 in taxes paid between the two five-year periods.

It would seem that to add over $100,000 in net farm income while adding just under $6,000 in income and social security taxes doesn’t quite add up! We know that tax rates…even at their lowest…are not at the 6% level. What gives?

First of all, I will acknowledge that net farm incomes are accrual based and the taxes paid are based on Schedule F cash income. But, over time those differences should begin to wash out; it could be that ten years isn’t quite long enough.

Or, there could be a number of other reasons for these facts that seem at odds with each other.

- Effective tax policy. The Internal Revenue Service (IRS) Code Section 179 Expense Election has been available for 20+ years. There was a point in time that is only amounted to $10,000 per year. The rapid increase in the limit for the Code Section 179 Expense Election (currently $500,000) at the same time that incomes have been increasing make me wonder if there has been a rapid ‘write off’ of capital purchases especially if they were equipment and the IRS Expense Election and/or the Bonus Depreciation was used to create expenses that pushed the cash expenses up and the cash incomes down. Bonus Depreciation became available in the mid-2000’s. The calculation of accrual net farm income uses a slower ‘economic’ depreciation rate.

- The increased value of grain inventory. That value has increased in the recent past due to added bushels in some of those years and increased per bushel prices in some of those years.

- The increasing value of end-of-year prepaid expenses. Many of our farm inputs have increased in price over the time period in question – seed, fertilizer, chemicals, fuel. Year-end tax planning could have put into place a strategy to keep cash income lower (and pay less in tax) could have meant that one had to pre-pay increasing amounts of these inputs at the end of the year to keep those cash incomes down.

- More frequent and/or larger contributions to tax deferred retirement plans (IRA, SEP, 401K, Keogh plans). This defers the income tax until funds in these accounts are withdrawn.

This makes me think that there might be a ‘mountain’ of deferred income tax that has been built up. It would do one well to realize that this is something to be aware of. Maximizing after tax income year-after-year is the goal of many. Good financial management includes good tax management. In the current political lingo…this could be referred to ‘kicking the can (or the tax liability) down the road’. But, in many cases it is employing good financial and tax management to with the goal of maximizing after tax income.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.