Cost Management: Interest Rates & Refinancing

An increase in cash prices for corn and soybeans brightens the outlook for Illinois farm income in 2021, but continued uncertainty in the economy and market factors means careful farm budgeting is still important. As always, cost management is key on farms. Because of historically low interest rates, we review interest rate and refinancing opportunities as a cost management strategy. Several other strategies have been presented in previous articles related to fertility (farmdoc daily August 25, 2020), tillage (farmdoc daily August 18, 2020), and harvest equipment (farmdoc daily September 1, 2020).

Background

Market prices for both corn and soybeans increased more than 30% in the three-month period from mid-August to mid-November (farmdoc daily December 29, 2020) and have continued to increase since then. Current cash prices in central Illinois are around $5 per bushel for corn and $13 per bushel for soybeans. Fall delivery bids for 2021 crop are near $4 per bushel for corn and $11.40 per bushel for soybeans, higher than averages since 2013, but much lower than current bids. Actual farm income for 2021 crop will be dependent on yields and prices throughout the 2021/22 marketing year. Although the price increases are a welcome change in economic prospects, continued volatility in the grain markets is expected with many influencing factors and it is unknown whether these prices will be stable through the next marketing year. As always, there is a possibility of much lower prices in fall, perhaps near 2013-2020 averages. Careful farm budgeting with management of costs remains important. In this article we evaluate interest rate and refinancing opportunities as a cost management strategy considering the impact of interest expense in a farm budget.

Farm Debt & Interest Rates

Interest owed on debt makes up a notable portion of total farm operating expenses. These interest costs vary by farm and are dependent on use of debt. In 2019, interest costs accounted for over 10% of farm operating costs on nearly 20% of grain farms enrolled in Illinois Farm Business Farm Management Association (FBFM). More than 45% of FBFM grain farms have interest costs exceeding 5% of total farm operating costs (see Figure 1). Though interest expense is not a large share of operating costs for most farms, on farms where it is a major expense it should be carefully managed. Even farms where interest is not a major expense can benefit from careful management of debt and interest costs.

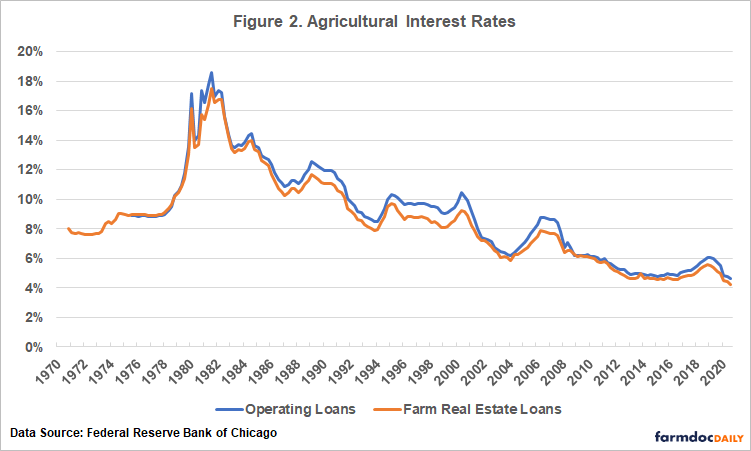

The interest rate at which the debt is financed can have an impact on interest costs. Currently, farmers with fixed interest rates on term debt secured in previous years are likely paying higher interest rates than what could be secured on a new loan today. The Federal Reserve Bank of Chicago reports quarterly agriculture interest rates for the seventh Federal Reserve District states of Illinois, Indiana, Iowa, Michigan, and Wisconsin. For the third quarter of 2020, the posted rate was 4.65% for operating loans and 4.24% for farm real estate loans. For both, these are the lowest reported rates dating back to fourth quarter of 1969 when the data series begin (see Figure 2).

Interest in the Farm Budget

Interest rate impacts on interest costs are shown in Table 1 for a farmland real estate loan with a $500,000 beginning balance and a 30-year term. Three interest costs are shown:

- Total Interest Expense Over the Life of the Loan. This is the sum of the interest costs over the 40-year period.

- Average Annual Interest Payment. This is the average interest payment over the 30-year life. Interest costs will be higher in earlier periods and lower in later periods. Refinancing now will have a larger impact on interest costs in the next several years.

- Interest Cost Compared to 2020. This is the difference in annual interest payment compared to the 4.24% average rate in 2020.

At 4.24%, interest owed over the life of the loan is $392,906 with an average annual interest payment of $14,461. Two years ago, the same loan, with the 5.46% average interest rate at the time, would result in $527,526 interest owed over the life of the loan and an average annual interest payment of $24,234. The 122-basis point difference in the average interest rates of 2020 versus 2018 results in an increase of $6,731 in average annual expense.

Also included is the highest interest rate in the last two decades, 9.21% in the second quarter of 2000. A farmer who took out a loan in 2000 would still be making payments on a thirty-year loan. At the average interest rate at that time, the total interest owed over the life of the loan would have been almost $1M with average interest payments near $50,000, approximately $30,000 per year higher than the same loan in 2020.

If interest rates continue the downward trend in the coming years, interest costs on this loan would decline. A farmer would save more than $5,000 in annual interest costs if the average interest rate dropped 100 basis points from 4.24% to 3.24%.

Interest Related Cost Management Strategies

Farmers currently have a unique opportunity to lock in historically low interest rates on new loans, which is an important consideration in a new purchase decision. Eligible farmers could also consider United States Department of Agriculture (USDA) Farm Service Agency (FSA) programs. FSA offers both direct loans and guaranteed loans through various programs some farmers can qualify for. These programs generally have low interest rates and more favorable terms than alternative options. Though FSA programs require additional steps, the cost savings can be considerable.

Farmers may also be able to lower operating interest costs through non-traditional methods. Some agriculture technology and data ventures offer operating financing at low interest rates. Similarly, some input suppliers and equipment dealer offer low interest rate or interest free financing for a period of time. Although such programs may provide interest cost savings, it is important to be aware of terms in these agreements. For example, interest rates may rise to a much higher level is full payment is not made by the specified deadline.

For those with existing term debt at higher interest rates, refinancing debt may be an option. A refinance is replacing existing debt with debt that has more favorable terms. Debt consolidation, in which multiple debts are consolidated into a single loan, may be another method by which to secure more favorable terms. Fees associated with these procedures are to be expected, but often long-term savings are greater than the initial fees. Terms of the original loan may also have penalties for prepayment that could add cost. Lenders may have differing requirements and methods for evaluating qualifications for farmers seeking lower interest rates. It is best to work with a lender to determine the best option for an individual situation.

Loan Refinance Example

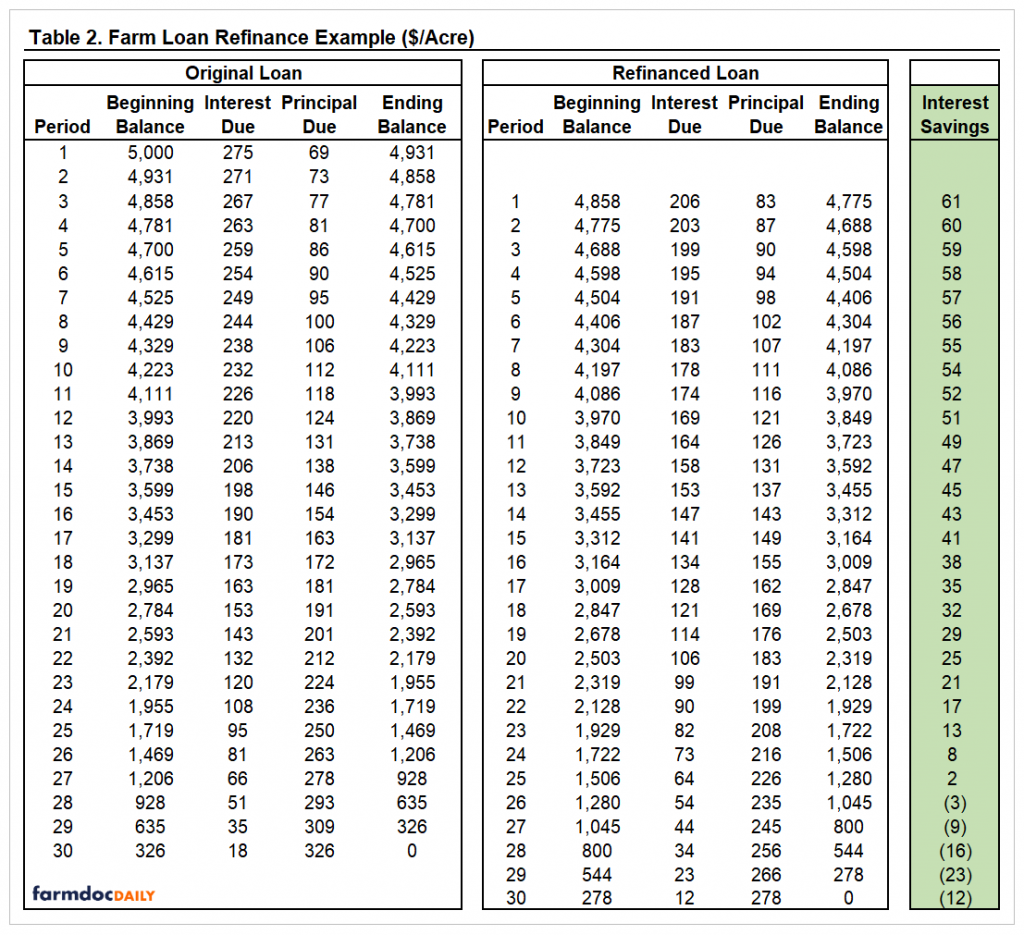

As an example, to show the value of a refinance, assume a farmer takes out a loan for $5,000 per acre on a new land purchase in 2018. The note has a 30-year term with annual payments and a 5.5% interest rate, representative of interest rates in 2018. The farmer makes the payments in the first two years. In 2020, the farmer can refinance the remaining principal balance at 4.25%, representative of interest rates at the time. The refinanced loan also has a 30-year term and annual payments, meaning payments will extend two additional years past the maturity of the original loan. The calculations in this example are estimates of amortized payment amounts using formulas for interest and principal payments in Excel.

For the first payment on the refinanced loan, $206 per acre of interest is due, $61 per acre less than the $267 per acre interest payment that would have been due at the same time for the third payment on the original loan as shown in Table 2.

Due to the nature of amortized payments in which the principal portion gradually increases over time and the interest portion gradually decreases over time, the margin of interest savings gradually drops as the interest portion of the payment declines. Eventually the interest owed on the refinanced loan is slightly higher than the original loan as it approaches and passes maturity. However, the value of the refinanced loan is significant over the entire period. The net present value of the interest savings is $668 per acre, not accounting for refinancing fees or closing costs.

Fees associated with refinancing will vary by lender. As an example, assume a refinancing fee equal to 1.5% of the principal balance refinanced. In this example the remaining balance at the time of refinance was $4,858 per acre which would result in a fee of about $73 per acre. This is $12 per acre higher than the interest savings in that initial period. By the second period the savings would far outweigh the costs. More than $30 per acre savings in interest costs would occur for 16 years thereafter, with smaller savings occurring in most of the remaining year. When those are converted to net present value, the refinance still results in interest cost savings of nearly $600 per acre over the life of the loan. Also note that this example showed a refinance with a 125-basis point improvement. For a five-year old loan refinanced in 2020, the marginal improvement in interest rate would be greater and the relative remaining principal balances would presumably be relatively lower. Even greater cost savings could be achieved in that situation.

Conclusion

Although the recent increases in corn and soybean prices have improved economic prospects, uncertainty in the economy persists and prudent cost management is still important for the 2021 crop year. Virtually all farmers have some level of debt and debt related interest costs can be very large. Farmers can take advantage of historically low current interest rates as a cost management strategy when making new purchases or through refinancing or debt consolidation. These methods do come with an initial cost, but often result in long-term savings. Farmers are encouraged to work with a lender to determine their best option.

References

Schnitkey, G., L. Gentry and S. Sellars. "Cutting Fertilizer Rates to Save Costs." farmdoc daily (10):155, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 25, 2020.

Swanson, K., G. Schnitkey, N. Paulson, C. Zulauf and J. Coppess. "Cost Management: Tillage Operations." farmdoc daily (10):151, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 18, 2020.

Swanson, K., G. Schnitkey, N. Paulson, C. Zulauf, J. Coppess "Cost Management: Harvest Operations." farmdoc daily (10):158, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 1, 2020.

Irwin, S. and J. Janzen. "IFES 2020: 2021 Market Outlook for Corn and Soybeans." Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 29, 2020.

Agricultural Interest Rates at Seventh District Agricultural Banks. Federal Reserve Bank of Chicago. Update November 12, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.