Margin Protection: Description and a Review of Experience

Margin Protection (MP) is multi-peril crop insurance that provides coverage against unexpected decreases in operating margins. Given the expectation for higher costs and lower returns for 2023 (see farmdoc daily August 2, 2022 ), there may be more interest in MP as the September 30 decision deadline for 2023 approaches. In this article, we provide an overview of MP and evaluate performance since 2018. A Microsoft Excel spreadsheet is available here to show its performance for non-irrigated corn.

Background

MP is an area plan of insurance that is available for corn and soybeans in Midwest states (see MP factsheet for details on states). MP also is available for rice in major producing states and for wheat in the northern states. MP provides protection against changes in operating margins, including measures of both revenue and costs. Revenues are based on county yields and prices set using futures contracts. Costs of four major inputs are calculated in the fall and in the spring.

MP comes in two forms: MP without the harvest price option and MP with the harvest price option (MP-HPO). With the harvest price option, the guarantee can increase if the harvest price for the crop is above the projected price for the crop. MP-HPO functions in a similar manner to Revenue Protection (RP), while MP without the harvest price option is much like RP harvest price exclusion (RP-HPE).

MP can be used in conjunction with an underlying COMBO product (RP, RP-HPE, or Yield Protection (YP) policy). The combined MP and COMBO premium will be lower than adding the individual MP and COMBO premiums together to reflect that indemnity payments from one policy can offset payments from the other. However, the premium credit cannot be calculated until all information needed to establish liability under the base policy is known, likely by March or April.

MP Timeline

Premiums for 2023 MP policies will be available in mid-September 2022 after the August 15 to September 14 price discovery period for setting expected values closes (see Figure 1 for a MP timeline). The deadline to purchase MP for 2023 is September 30, 2022. This leaves a very short, approximately two-week window to make a purchase decision knowing expected values and premium costs. Although the decision must be made at that time, the premium is due at the same time as premiums for other 2023 policies on September 30, 2023.

For corn and soybeans, the September 30 MP deadline is much earlier than the March 15 date for the other multi-peril products such as RP, other COMBO products, as well as other area plans of insurance. MP uses an August 15 to September 14 time period to determine projected prices for both revenue and costs. As a result, the projected price for MP will differ from the projected price for the insurance contracts with a March 15 deadline, which base the projected price on futures prices during February. Moreover, the premium credit if purchasing MP and a COMBO product is not known until rates for the COMBO products are set at the end of February.

MP Mechanics

MP uses an expected margin, trigger margin, and harvest margin in its calculation. Expected margin is used to set guarantees with all but one term known by the September 30 deadline. The MP-HPO expected margin equals:

Expected revenue (higher of projected and harvest price x expected yield)

-Expected Costs

= Expected margin

The expected margin for MP without HPO is the same as MP-HPO, except that only the projected price is used in calculating expected revenue.

The trigger margin equals expected margin minus expected revenue multiplied by the deductible (1.00 minus coverage level):

Expected Margin – (Expected Revenue x (1 – Coverage Level))

Coverage levels can range from 70% to 95%.

Harvest margin equals:

Harvest Revenue (harvest price x harvest yield

-Harvest costs

= Harvest margin

Payments occur when harvest margin is less than the trigger margin.

The following sections describe terms in more detail.

Determining Expected Margin

Expected County Yield: The expected county yield is published by RMA. It is the same expected county yield that is used for Area Risk Protection Insurance (ARPI) plans.

Expected Commodity Prices: The expected commodity prices for 2023 are based on December 2023 contracts for corn and November 2023 contracts for soybeans during the August 15, 2022 to September 14, 2022 price discovery period.

Expected Input Costs: Production inputs are divided into two groups: those subject to price changes and those not subject to price changes. Inputs subject to price changes by crop are:

Corn: diesel, interest, diammonium phosphate (DAP), urea, potash

Soybeans: diesel, interest, DAP, potash

Fixed-price inputs are seed, machinery operating costs (besides fuel), and similar expenses. Input costs are set during the August 15 to September 14 price discovery period. Input costs are based on a formula for calculating the quantity of the input used in the total costs. During the price discovery period, costs are published daily at www.marginprotection.com. Interest rates also enter into the calculation, based on the November contract for 30 Day Federal Funds in the same price discovery period as the other inputs subject to change (see here for more detail).

Determining Harvest Margin

Harvest Yield: Harvest yield is calculated based on crop insurance records and will be released in June of the year following production. For 2023 MP, indemnities will not be calculated until after RMA publishes 2023 county yields in June 2024. If an indemnity is due, payments will be issued within 30 days after the final county yield is published.

Harvest Commodity Prices: The harvest price is based on the December 2023 contract for corn and the November 2023 contract for soybeans during the month of October in the crop year. This is the same as the harvest price used for other crop insurance policies.

Harvest Input Costs: Aside from interest costs, the costs of the inputs subject to change are again calculated using the price over the month of April of the year in which the crop is harvested. Harvest costs is the official term used for the final input costs, but it can be a confusing term because these figures are based on prices set in April. For MP on the 2023 crop, final “harvest” input costs are set in April 2023, following the same formula as used to set the expected input costs. Harvest interest costs are based using the November contract for 30 Day Federal Funds during October.

Example of MP-HPO for Corn in Mercer County, Illinois

Historical results for MP-HPO from 2018 through 2021 will be illustrated for non-irrigated corn in Mercer County, Illinois. Other counties’ results for non-irrigated corn are available from a Microsoft Excel spreadsheet available for download here. This spreadsheet can be used to replicate Tables 1 and 2 for other counties.

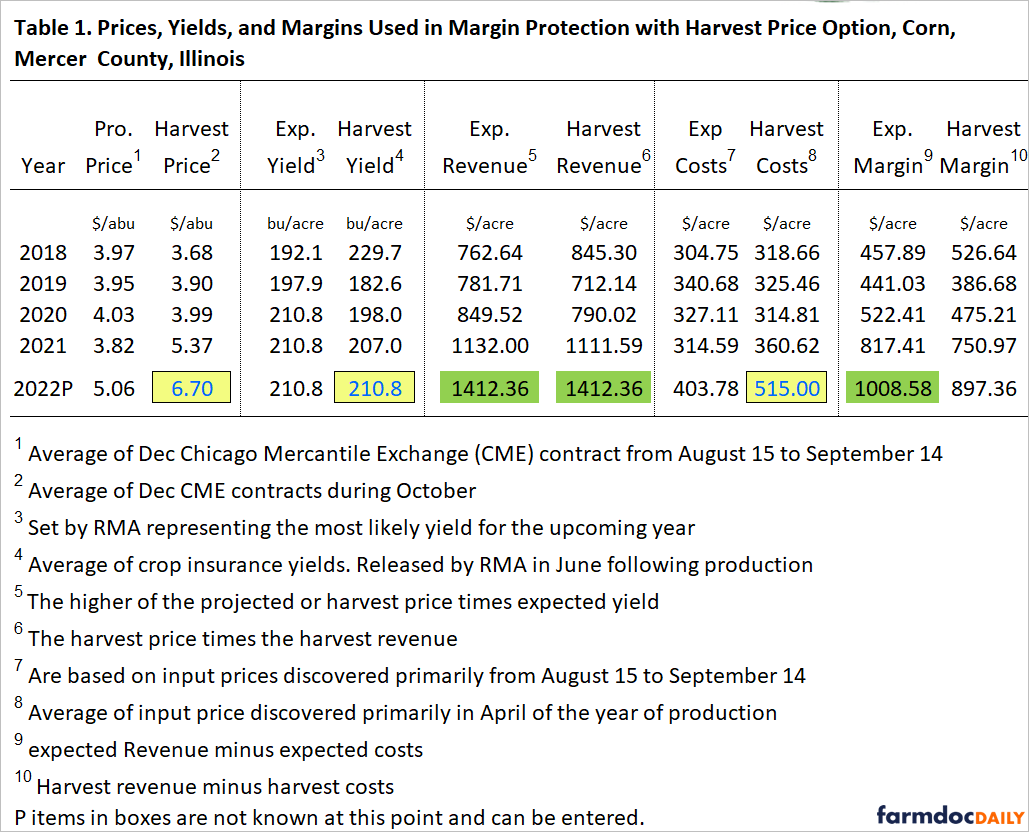

Table 1 shows prices, yields, and margins for non-irrigated corn in Mercer County, Illinois. Table results will be illustrated using 2021 as the example.

- The projected price in 2021 was $3.82 per bushel based on settlement prices of the December 2022 Chicago Mercantile Exchange contract from August 15 to September 14, 2020. The $3.82 projected price for MP compares to a $4.58 projected price for policies for March 15 closing.

- The harvest price in 2021 was $5.37 per bushel based on settlement prices during October. The $5.37 price is the same as used for 2021 COMBO products.

- The expected yield in 2021 was 210.8 bushels per acre. This expected yield is based on historical yields and is released by RMA prior to the September 30 purchase deadline for MP. The 210.8 yield also is used in the Area Risk Protection Insurnace (ARPI) plans.

- The harvest yield in 2021 was 207.0 bushels per acre and represents the county yield based on crop insurance records. The 207.0-bushel yield was released in June 2022, allowing MP and MP-HPO payments to be made.

- The 2021 MP expected revenue is based on the harvest price ($5.37) as it is higher than the projected price ($3.82), giving expected revenue of $1,132 per acre ($5.37 x 210.8)

- Harvest revenue is $1,111.59 ($5.37 harvest price x 207.0 harvest yield)

- Expected costs for 2021 MP were $314.19

- Harvest costs for MP were $360.62, which was $46.03 higher than the $314.59 in expected costs. MP-HPO at 95% made a payment in 2021. This payment would not have occurred had expected costs not increased,

- Expected margin of $817.41 equals $1,132.00 expected revenue minus $314.59 in expected costs

- Harvest margin of $750.97 equals $1,111.59 harvest revenue minus $360.62 in final “harvest” costs.

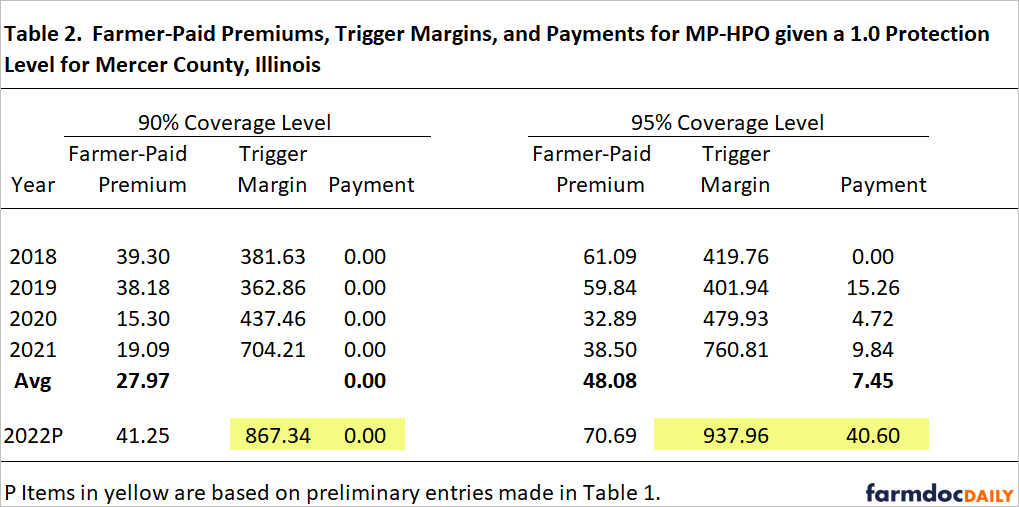

Farmer-paid premiums, trigger margins, and payments are shown in Table 2 for the Mercer County example for a protection level of 1.0. Protection levels above 1.0 will increase farmer-paid premiums and payments. For a 1.2 protection level, multiply farmer-paid premiums and payments by 1.2. Protection levels below 1.0 will reduce values from those shown in Table 2.

Table 2 results are explained for a 95% coverage level for 2021. In 2021, the trigger margin was $760.81 based on:

$1,130 Expected Margin – ($1,132 Expected Revenue x (1 – .95))

Harvest margin in 2021 was $750.97 per acre, below the expected margin of $760.81 by $9.84 per acre. A 1.0 protection level would result in a payment of $9.84 per acre.

Expectations for 2022

MP-HPO policies insuring 2022 production will not pay until June 2023, but some expectations on payments can be formed. The harvest costs determined in April 2022 are higher than expected costs. An estimate of harvest costs is $515.00 per acre, which is $111.22 per acre higher than the $403.78 per acre of expected costs (see Table 1) This is the largest increase in the five years of MP’s operation.

Current CME contracts are near $6.70 per bushel, providing a good estimate of harvest price. A yield of 210.8 bushels per acre will be used as estimated harvest yield, the same as the expected yield. Given these expectations, MP-HPO will make a payment of $40.60 per acre. That $40.60 payment results because of increased costs (see Table 2).

It seems likely that the harvest price will be above the $5.06 projected price. If this is the case, any harvest yield below the expected yield will increase the payment, and any harvest yield above the expected yield will reduce the payments. At a $6.70 harvest price, a harvest yield at or above 217 bushels per acre would result in no MP-HPO payment.

Historic Performance

The average premium for an MP-HPO policy at a 95% coverage level and a 1.0 protection factor for corn in Mercer County, Illinois, was $48.08 per acre for the years from 2018 to 2021 (see Table 2), not including any premium credit producers may have received when purchasing in conjunction with another policy. The average yearly payments for 2018 to 2021 were $7.45 per acre. From 2018 to 2021, payments minus premium averaged -40.83, meaning that the average premium exceeded the payment by $40.83.

Most MP-HPO policies in other counties had a similar experience with premiums exceed payments (see Figure 2). A few counties had payments exceeding premium, including four in Iowa: Benton (payments exceeded premium by $85 per acre), Tama ($83 per acre), Marshall ($102 per acre), and Dallas ($73 per acre) Counties. All four of these counties were adversely impacted by the derecho in 2020 and received large payments in that year because of large yield losses.

The four-year period is a short period to judge the performance of crop insurance. MP-HPO average payments are below premiums in most counties. However, large payments are possible. For example, large payments could occur if a 2012 magnitude drought occurred in an upcoming year.

Observations

- MP allows a farmer to set the projected price earlier based on settlement prices from August 15 to September 14. Farmers who do not choose MP will have to wait for the February settlement period to have a crop insurance guarantee in place if they do not choose MP. Given current high prices, MP may be more attractive this year.

- Fairly large cost increases occurred in 2022. Those cost increases could trigger payments in many cases. For the Mercer County, Illinois case, the current estimated payment would be $40 for MP-HPO. Revenue changes could either increase or decrease that payment.

- Large payments from MP could be generated by changes in revenue. For example, a drought year could generate large payments exceeding $400 per acre.

- Premiums are high for MP-HPO, particularly at the higher coverage levels.

Summary

MP is a crop insurance alternative that farmers may consider for 2023 to mitigate margin risk. Projected prices are set based on settlement prices from August 15 to September 14. Given current high prices, setting prices then may be of some benefit as compared to the February period used to set projected prices for other crop insurance products. MP also includes costs in its calculations. Costs changes will have a large impact on harvest margins for 2022 policies. The change in select input costs between now and next April will influence the impact on margins for 2023 policies farmers may be considering before the September 30 deadline.

References

FAST Tools: Margin Protection Tool. Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 30, 2022. https://farmdoc.illinois.edu/fast-tools/margin-protection-tool

Schnitkey, G., K. Swanson, C. Zulauf and J. Baltz. "2023 Crop Budgets: Higher Costs and Lower Returns." farmdoc daily (12):113, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 2, 2022.

U. S. Department of Agriculture, Risk Management Agency. Margin Protection for Federal Crop Insurance, May 2017. https://www.rma.usda.gov/en/Fact-Sheets/National-Fact-Sheets/Margin-Protection-for-Federal-Crop-Insurance

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.