Crop Insurance Unit and Adverse Selection

Among farmers’ crop insurance decisions is the unit of insurance. A key consideration is likely to be the insurance unit’s return to farmers, which in this study is measured as the ratio of indemnity payments to farm-paid premium. Since 2010, this payment-to-cost return has been higher for enterprise than for basic and optional units, the three most widely-used insurance units. This finding is consistent with the public policy decision to subsidize enterprise units at a higher rate and with the notable increase in its share of insured acres. Nevertheless, the study raises an important policy question, “Should public subsidy rates be more differentiated across insurance units?”

Insurance Unit Alternatives

- Optional Unit (OU): Each surveyed section is insured separately.

- Basic Unit (BU): Insurance is by farmer share of production, not land section. Premiums are lower than for optional units as farmers take on more production risk since high production in one section can offset a loss in another section (i.e., diversification across sections).

- Enterprise Unit (EU): All sections and shares planted to a given crop within a county are combined. The farmer takes on more risk as changes in production by location can offset (i.e., diversification across space), thus reducing indemnity payments. A Multi-County enterprise unit is available for farms that plant the same crop in more than one county.

- Whole Farm Unit (WU): All insurable acres of all insurable crops in a county are combined into one unit. The farmer takes on more risk as changes in production by crop can offset (i.e., diversification across crops), thus reducing indemnity payments. Whole farm units are not the same as Whole Farm Revenue Protection insurance.

Data

This study uses data from the Type, Practice, and Unit Structure Data File of the US Department of Agriculture, Risk Management Agency. Whole farm units are not included in this study. They accounted for less than 42,000 combined acres of corn, cotton, grain sorghum, rice, soybeans, sunflowers, and wheat in each of the 2011-2023 crop years. This study starts with 2011 because it was the year that (1) the last major rating of crop premiums was implemented and (2) the current individual farm insurance products were introduced [revenue protection (RP), revenue protection with harvest price exclusion (RP-HPE), and yield protection (YP)]. The crops in this study are those for which enterprise and whole farm units were an alternative in 2011.

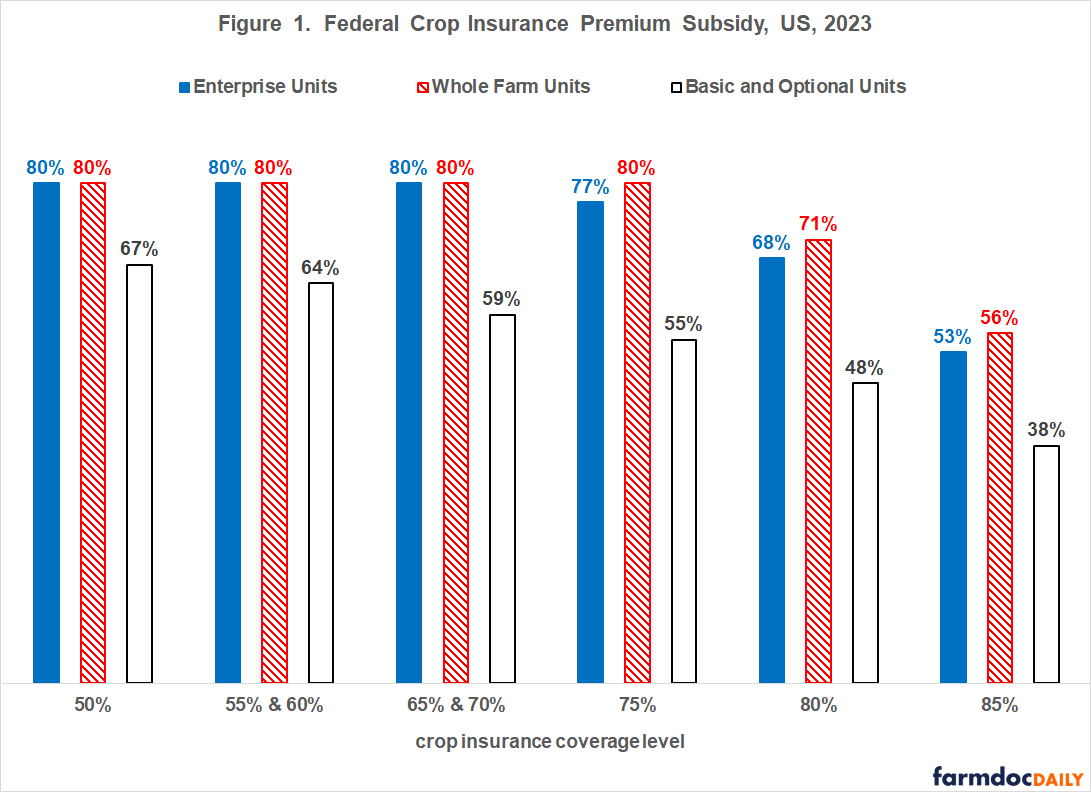

Premium Subsidy Rates

Federal subsidy rates are higher for enterprise and whole farm units (see Figure 1). US public policy thus favors more aggregated (combined) insurance units. This policy is consistent with a key operating goal of private insurance, to minimize adverse selection. Adverse selection occurs when buyers of insurance know more about their risks than sellers of insurance, allowing the buyers to increase indemnities received. Adverse selection in crop insurance is more likely on smaller insured units. One way to manage adverse selection is thus to increase incentives for crop farmers to insure at more aggregated, larger acreage units.

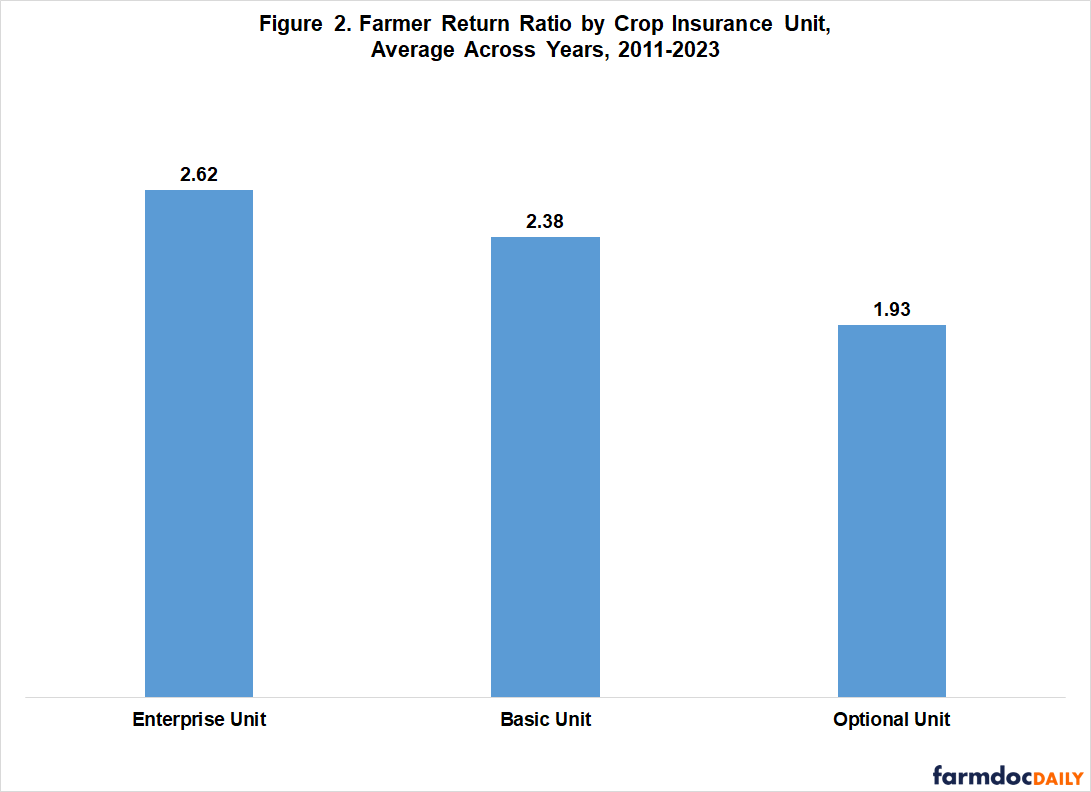

Farmer Return by Insurance Unit

The ratio of indemnities paid to farmers to premiums paid by farmers is a measure of the return to buying insurance. This return ratio has been highest for enterprise units (see Figure 2). Famers have received $2.62 for each dollar of premium paid, implying an average return of 162%. Farmer return was 138% for basic units and 93% for optional units. It is important to keep in mind that these are average returns for US farmers as a group over the 2011-2023 crop years. Some farmers paid more in premiums than they collected in indemnities, i.e. had a ratio less than 1.00. Others had a higher return on premiums paid.

Across all crops and years in this study, indemnities exceeded farm-paid premium on a per acre basis by $22.52 for optional units, $20.91 for enterprise units, and $20.29 for basic units. Given the closeness of average per acre return above farm paid premium, minimizing cost per acre and selecting the highest return ratio takes on added economic significance. Average per acre farm paid premiums (i.e. farmer cost) were $22.53 for optional units, $12.74 for enterprise units, and $14.25 for basic units. Farmer premium cost per acre roughly follows the same pattern as the farmer return ratios in Figure 2.

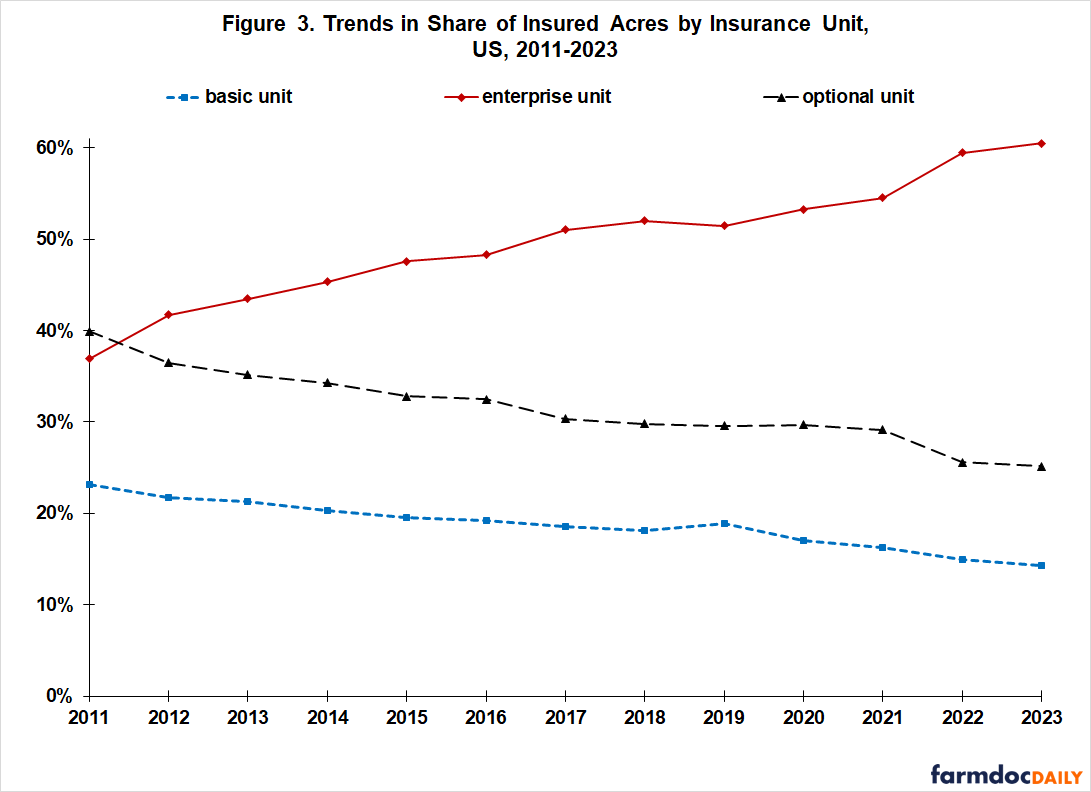

Trends in the share of insured acres by insurance unit suggest that the different farmer return ratios have economic significance. Share of insured acres has declined 15 and 9 percentage points for optional and basic units, respectively, while increasing 24 percentage points for enterprise units (see Figure 3). The trends show no obvious signs of slowing.

Discussion

Given the site specificity of crop production, adverse selection is a key crop insurance issue. Consistent with this issue, US public policy subsidizes premiums for the more aggregated enterprise and whole farm insurance units at higher rates than the less aggregated basic and optional insurance units.

Nevertheless, the data and discussion in this study prompt a policy question, “Why aren’t premium subsidy rates more graduated across insurance units to reflect potential adverse selection?”

More specifically,

- Why is the subsidy rate for basic units the same as for optional units when adverse selection is likely less for basic units since farmers take on more risk?

- Why is the subsidy rate for enterprise units nearly the same as for whole farm units when adverse selection is likely less for whole farm units since farmers take on more risk?

This study is conducted at the US level, aggregated across coverage levels, crops, and other insurance characteristics. Use of insurance units is known to vary by these characteristics (see farmdoc daily, June 12, 2023). It could be informative to policy to examine farmer returns by insurance unit across insurance characteristics.

References and Data Sources

US Department of Agriculture, Risk Management Agency. May 2024. State/County/Crop Summary of Business. Type/Practice/Unit Structure Data Files and Record Layout. https://www.rma.usda.gov/en/Information-Tools/Summary-of-Business/State-County-Crop-Summary-of-Business

Zulauf, C., G. Schnitkey, J. Coppess and N. Paulson. “The Importance of Insurance Unit in Crop Insurance Policy Debates.” farmdoc daily (13):107, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 12, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.