The Importance of Insurance Unit in Crop Insurance Policy Debates

This article explores the important role of the choice of crop insurance unit in the US crop insurance program. Farmers can choose from 4 insurance units: basic, optional, enterprise, and whole farm. Production risk and premium subsidy vary by unit type. Farmers can lower their premiums by choosing enterprise or whole farm units. Over the 2011-2022 crop years, these two units experienced lower insurance loss ratios and provided farmers more insurance indemnity payments per dollar of farm-paid premium. Use of enterprise unit has been increasing but varies by crop and region. Whole farm units are little used. When evaluating crop insurance policy proposals, it is important to keep in mind that farmers can choose from insurance units that have different performance features.

Data and Methods

The source for the data used in this study is the US Department of Agriculture, Risk Management Agency State/County/Crop Summary of Business. The data set also includes only the individual farm insurance products of revenue protection (RP), revenue protection with harvest price exclusion (RPHPE), and yield protection (YP). These products were introduced in the 2011 crop year and reflect the last major premium rating review. The 2011-2022 crop year study period also postdates the last major increase in premium subsidies — the 2008 farm bill increase in subsidies for enterprise units (Collins).

Insured Units

A farmer with more than one insured farm can choose from four insurance units.

- Optional Unit (OU): Each surveyed section is insured separately.

- Basic Unit (BU): Insurance is by farmer share of production, not by land section. Premiums are lower than for optional units as high production on one section can offset a loss on another section.

- Enterprise Unit (EU): All sections and shares planted to a crop in a county are combined. The farmer takes on more risk as more opportunity exists for offsetting changes in production. Multi-County Enterprise Unit is also available for farms that cover more than one county.

- Whole Farm Unit (WU): All insurable acres of all insured crops planted in a county can be combined into one unit. Since more than one crop is combined in a whole farm unit, the potential for indemnity payments is reduced due to offsetting changes in production of different crops. Whole farm unit is not the same as Whole Farm Revenue Protection (WFRP) insurance.

Federal premium subsidy rates are higher for enterprise and whole farm units than for basic and optional units (see Figure 1). Thus, policy favors use of insurance units that insure more aggregated or combined production risk across units of production. Importantly, subsidy rates are lower at higher coverage levels, but total premiums are higher at higher coverage levels which can result in higher dollars per acre of subsidy.

Insurance Unit Trends

The share of liability insured in enterprise units increased steadily from 46% in 2011 to 63% in 2022 (see Figure 2). The shares in optional and basic units declined from 35% to 24% and from 19% to 13%, respectively. Whole farm unit share rounded to 0% in every year.

Performance by Insurance Unit

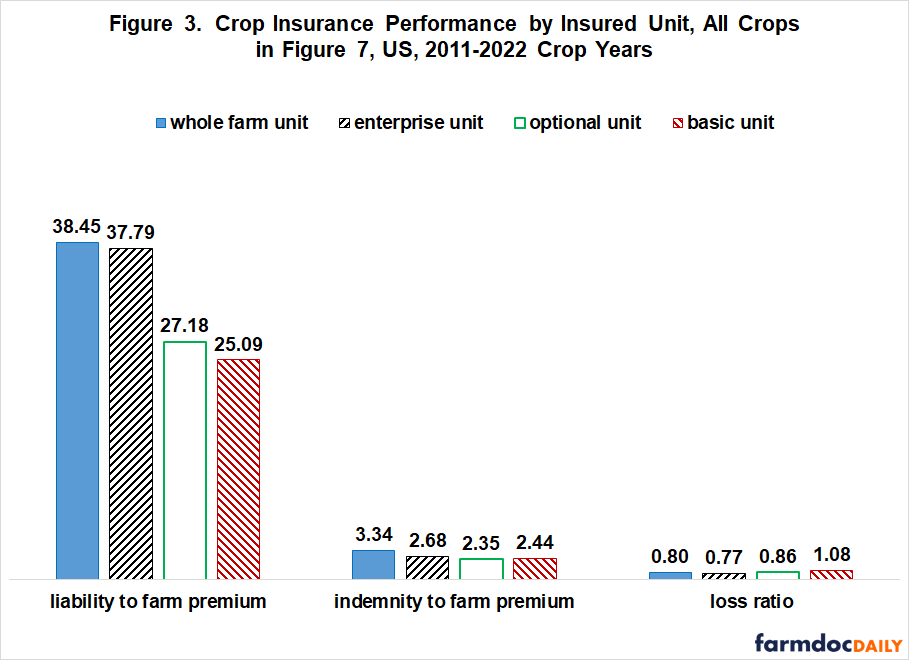

Compared to optional and basic units, enterprise and whole farm units had

- a higher ratio of liability to farm-paid premium, a measure of how much insurance protection the average farmer bought per dollar of premium paid; and

- a higher ratio of indemnity to farm-paid premium, a measure of average rate of return to farmers on the premium they paid (see Figure 3).

The favorable performance of enterprise units on these two farmer-related performance measures is consistent with the increasing use of enterprise units (see Figure 2).

A common measure of insurance performance used by insurance providers the loss ratio – was notably higher on average for basic units over the 2011-2022 crop years.

Note, for whole farm units these measures of insurance performance should be used and interpreted with caution as use of whole farm units is limited.

Enterprise Unit by Crop

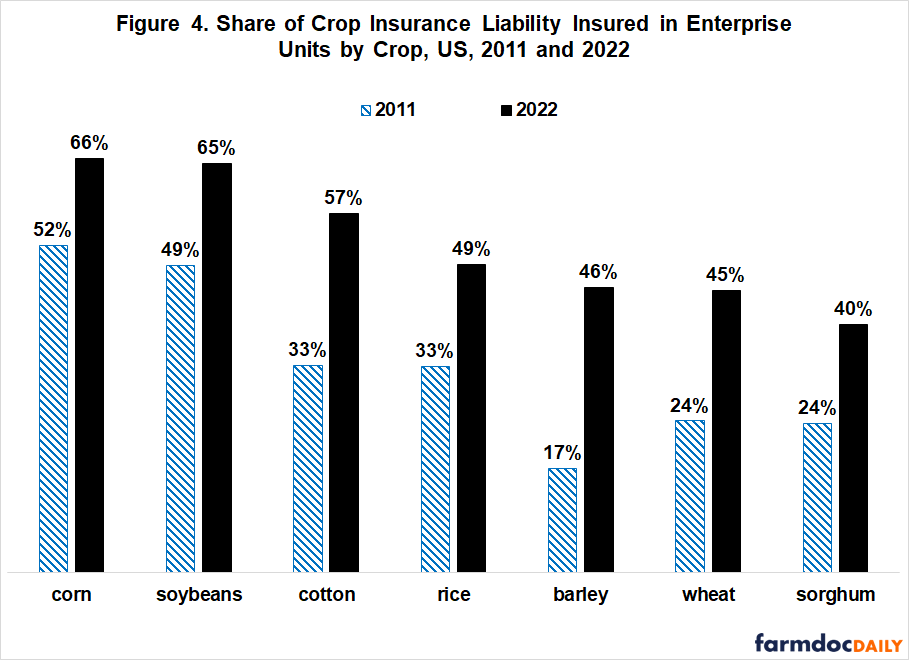

Use of enterprise units varies notably by crop (see Figure 4). For 2022, share of insured liability in enterprise units ranged from 66% for corn and 65% for soybeans to 40% for sorghum. However, for each of the 7 crops in Figure 4 use of enterprise units has increased since 2011. Corn has the highest usage and thus smallest increase of 14 percentage points (66% up from 52%). The crops included in Figure 4 are the 4 largest acreage field crops and the regionally important crops of barley (Northern Great Plains), rice (South plus California), and sorghum (Southern Great Plains).

Enterprise Unit for Corn by State

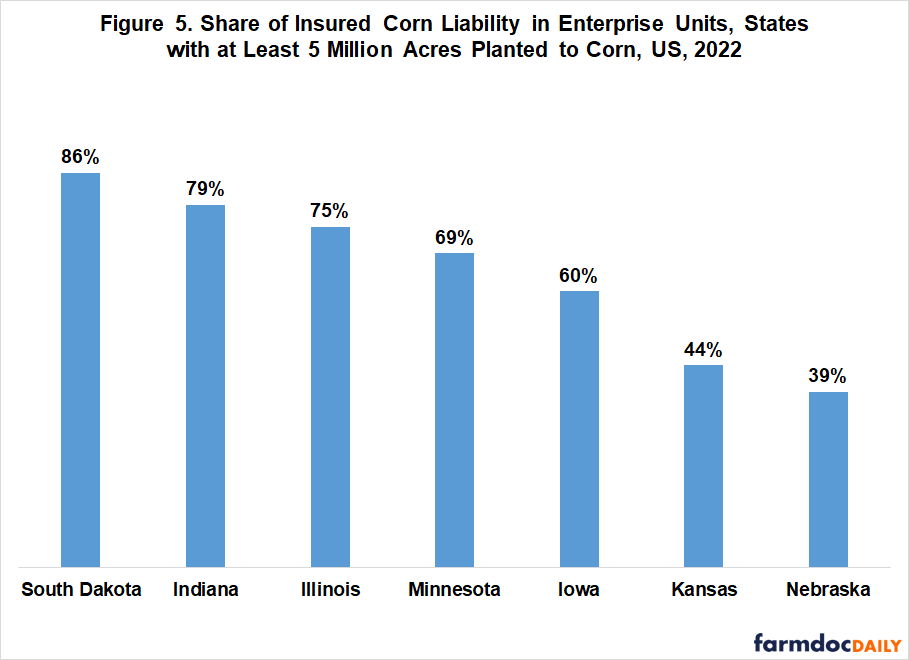

Figure 4 shows that the use of enterprise unit varies across states. To further investigate, we compute the share of insured liability in enterprise units for 2022 corn in states with at least 5 million acres planted to corn. Enterprise unit shares vary from 86% for South Dakota to 39% for Nebraska, or by more than a factor of 2 (see Figure 5). This large variation across states implies that farmer choice of insurance units impacts the net insurance premium paid by farmers.

Discussion

When discussing US crop insurance, it is important to consider the role of insurance unit. Premium subsidy and farmers’ share of production risks vary across the 4 types of insurance units. The realized loss ratio also vary by insurance unit (and coverage level). An implication is that the effective subsidy rate may differ from the program subsidy rates in figure 1.

A fundamental tenet of insurance theory is that insurance buyers know more about their risks than insurance providers. As a result, insurance premiums are usually lower when an insurance buyer is willing to take on more risk. This tenet is particularly relevant when the production function varies by site, as with crop production.

Another fundamental tenet of insurance theory is that Insurance can encourage buyers to engage in risky behavior if premiums and coverage are not aligned with the mitigation of losses from risky behavior. Economists call this effect moral hazard. Caps on premiums, such as that proposed in the June 5, 2023 farmdoc daily, would create more risk and result in higher loss ratios by further breaking the link between premiums and risk exposure. Higher risk production should be reflected in higher premiums in order to lead to similar loss ratios as required by crop insurance legislation.

Good crop insurance public policy requires balancing foundational tenets of private market insurance theory with the historical observation that, other than hail insurance, the private sector is unlikely to provide crop insurance while US society has decided to subsidize provision of crop insurance.

Given this balancing act, a policy rationale for the current, higher premium subsidy for enterprise and whole farm units is that production risk across multiple production sites is diversified compared to basic or optional units, and is more aligned with farmers’ actual total farm revenue risk. Combined outcome insurance also mitigates moral hazard.

Since 2011, enterprise and whole farm units have had lower insurance loss ratios, especially relative to basic units, and provided farmers with more liability coverage and more indemnities per dollar of farmer-paid premium. The latter two features likely help explain the increasing use of enterprise units.

A potentially important question for the US crop insurance program is whether the current premium subsidy schedule across the insurance unit options is good policy. Specifically, why is the premium subsidy the same for whole farm and enterprise units and the same for optional and basic units when risk is likely less for whole farm than enterprise unit and for basic than optional unit? Moreover, does the higher loss ratio for basic units since 2011 suggest its use should be further limited by reducing its premium subsidy, especially for crops with higher loss ratios?

Finally, it is common to hear complaints about differences in farm-paid premiums across states and crops. It is important to remember that farmer choice of insurance unit, along with actual loss experience, are likely factors in these differences. They need to be considered when assessing changes to crop insurance programs.

References and Data Sources

Bullock, D. and S. Steinbach. “Economic Consequences of Capping Premiums in Crop Insurance.” farmdoc daily (13):102, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 5, 2023.

Collins, K. July 23, 2017. The Use of Enterprise Units in Crop Insurance. Mississippi State University Extension Agricultural Economics Blog. https://blogs.extension.msstate.edu/agecon/2017/07/23/the-use-of-enterprise-units-in-crop-insurance/

US Department of Agriculture, Risk Management Agency. May 2023. State/County/Crop Summary of Business. Type/Practice/Unit Structure Data Files and Record Layout. https://www.rma.usda.gov/en/Information-Tools/Summary-of-Business/State-County-Crop-Summary-of-Business

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.