Important PRF-RI Insurance Decisions: Which Months to Insure?

Pasture, Rangeland and Forage Rainfall Index Insurance (PRF-RI) is an underutilized insurance product by livestock and forage producers in the Midwest (see farmdoc daily article from October 9, 2024). One aspect of PRF-RI that sets it apart from traditional crop insurance is that producers choose the months they want to insure against low rainfall. This allows for flexibility in insuring different types of forage production systems that may benefit from rainfall at different times during the year. Enrolling in different months throughout the year affects the total premium paid by the producer, the amount and frequency of indemnities collected, and ultimately how much forage production risk is managed through PRF-RI.

Background: Determinants of PRF-RI Premiums

PRF-RI insurance premiums are set by the USDA Risk Management Agency (RMA) with the goal of being actuarily fair, or in other words on average over time the indemnities paid out from PRF-RI approximately equal the premiums collected. Premiums typically will increase as the frequency and size of indemnity payments increase. Thus, PRF-RI premiums vary depending on the per-acre value insured, two-month intervals selected, and coverage levels chosen which each impact the size and likelihood of an indemnity payment.

PRF-RI is subsidized, so even though total premiums are meant to approximately equal indemnities over time, on average producer-paid premiums (premium less subsidy) will be lower than indemnities. Subsidy levels depend on the coverage level selected as follows: 70% and 75% policies receive a 59% premium subsidy, 80% and 85% policies receive 55%, and 90% policies receive 51%.

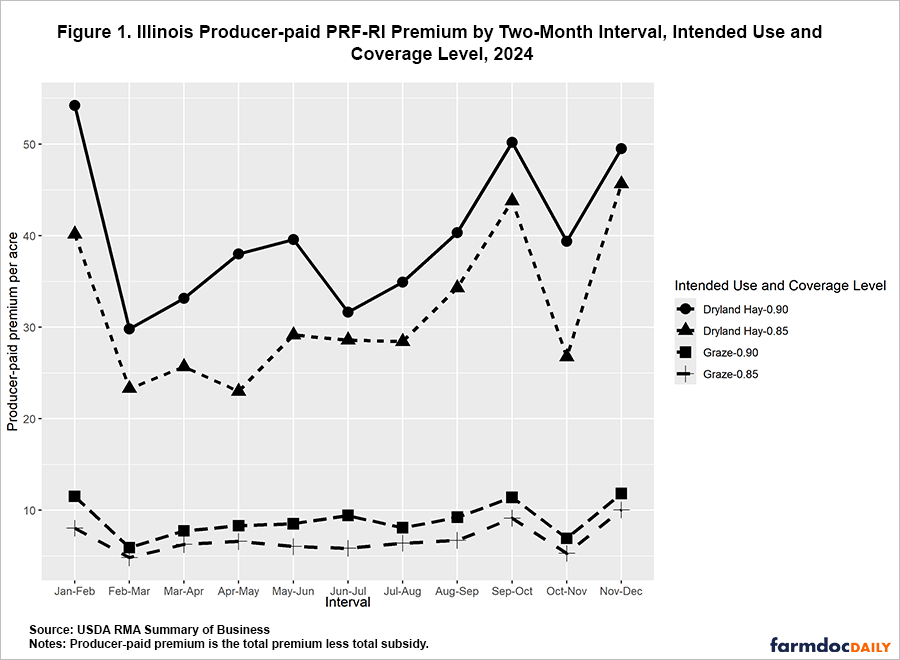

Figure 1 displays the average Illinois producer-paid premium for two PRF-RI intended uses in 2024:

- Hay (Non-irrigated, conventional)

- Grazing

For each, premiums are shown for a 90% coverage level and 85% coverage level, with premiums varying by two-month interval. Dryland Hay-0.90 means the producer-paid premium is for hay at the 90% coverage level.

Hay acreage tends to have higher premiums per acre compared to grazing due to higher values of production which increase the total value of protection of the policy. Additionally, higher coverage levels have higher premiums due to the higher probability an indemnity will be triggered, as well as a higher value of protection. Two-month intervals have different premium amounts due to differences in the variability of rainfall: more variable months will have higher premiums due to the increased likelihood an indemnity payment will occur. In Illinois, January/February, September/October and November/December intervals have the highest producer-paid premiums per acre across uses and coverage levels indicating they are on average the intervals with the highest rainfall variability (Figure 1).

Exploring PRF-RI Interval Enrollment Strategies

Looking at PRF-RI from a pure profit-maximization strategy, some may recommend enrolling in months with the highest variability in rainfall to take advantage of the subsidy and maximize the chance of collecting an indemnity. Recall on average in Illinois these high variability intervals are Jan-Feb, Sept-Oct and Nov-Dec (Figure 1), though the specific high variability intervals will vary by location. When considering such a strategy, one must also consider what this does to the overall risk related to rainfall and forage production. If a lack of rainfall in the most highly variable months has little to no impact on forage growth, enrolling in only those months will increase the risk that a producer receives no indemnity when they have a loss in forage growth.

To illustrate this, I used the PRF-RI decision tool to outline the outcomes from two potential enrollment strategies. One I call the “Profit Maximization” strategy, where I spread the percentage of value insured across the three intervals with the most variability in rainfall on average in Illinois: 33% in Jan-Feb, 33% in Sept-Oct, and 34% in Nov-Dec. The second is the “Risk Management” strategy, where I spread the percentage of value across intervals coinciding with the typical growing season in the Midwest: 33% in Mar-Apr, 33% in May-Jun and 34% in Jul-Aug. It is important to note that I am not claiming that either of these strategies is the optimal profit-maximization or risk management strategy for all of Illinois or even a specific grid. They were only selected for illustration purposes. I explore the PRF-RI policy outcomes of these strategies using Grid ID 24168 in Champaign County for non-irrigated and conventional hay production at a 90% coverage level. Other policy selections include insurable interest of 100% and a productivity factor of 100% (for an explanation of policy selections see farmdoc daily article from October 9, 2024).

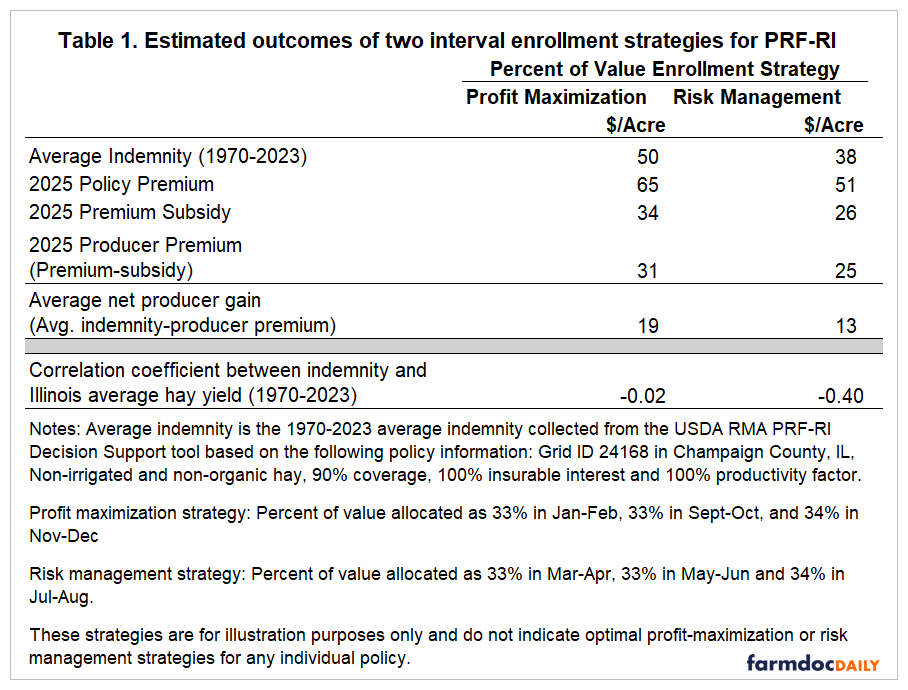

Table 1 shows a summary of the average indemnities from each of these strategies over years 1970-2023. As expected due to the higher rainfall variability and likelihood of an indemnity payment, the “Profit Maximization” strategy leads to a higher average indemnity of $50/acre compared to $38/acre for the “Risk Management” strategy. Similarly, the 2025 premiums are higher for the “Profit Maximization” strategy due to the higher expected indemnity. When 2025 premiums and subsidies are factored in, this leads to an average net gain to the producer of $19/acre for the “Profit Maximization” strategy and $13/acre for the “Risk Management” strategy. Thus, because of the subsidies, both strategies lead to expected positive net returns from participation.

PRF-RI is intended to provide risk protection against loss of forage growth from low rainfall, so it is also important to explore how much risk is managed by each strategy. Table 1 also displays the correlation coefficient between indemnities each year and the Illinois state-level average hay yield. Correlation coefficients range from -1 to 1, with values further from 0 meaning two variables are more correlated, and values close to zero meaning the two variables are not correlated. For the relationship between insurance indemnity payouts and yields, one would expect the two to be negatively correlated: when yields on average are high, indemnities are low and vice versa. The correlation between the indemnities of the “Profit Maximization” strategy and state-level hay yields are close to zero, so there is virtually no relationship between the “Profit Maximization” indemnities and hay yields. In other words, the “Profit Maximization” strategy provides little protection against downside risk in forage production. On the other hand, the “Risk Management” strategy indemnities are much more correlated, with a coefficient of -0.4. So, when an indemnity occurs from the “Risk Management” strategy, it is most likely occurring in years with low yields.

Another way to look at this is to explore the outcomes of these strategies in a particularly low yield year when indemnities would be most needed by a livestock or forage producer. For this, I look at 2012, one of the worst drought years in recent history, and not coincidentally, the lowest average Illinois hay yield on record since the late 1980s. During 2012, the “Profit Maximization” strategy provided a $50/acre indemnity, while the “Risk Management” strategy provided more than double that with $116/acre. Thus, selecting months that align more with when rainfall is beneficial for forage growth will provide more risk protection.

PRF-RI Interval Enrollment in Illinois

Figure 2 shows the proportion of Illinois grazing and dryland hay acreage enrolled in each two-month interval in 2024. The two most popular intervals across both types of forage are August/September and November/December. Though there is significant variation with at least some coverage placed in all of the intervals.

Concluding Thoughts

PRF-RI should be considered by livestock and forage producers. Overall, use of PRF-RI is a way to reduce forage and hay production risk associated with inadequate rainfall. Due to premium subsidies, over time indemnity payments should be greater than the producer-paid premium. The “best” enrollment strategy for a given producer will depend on their preferences toward risk aversion, overall risk exposure from a lack of rainfall, types of forage systems, and many other factors. I encourage producers to take advantage of USDA RMA’s interactive decision tool for PRF-RI to explore policy options and historical outcomes to find the best policy option that meets their specific needs.

For those interested in enrolling in PRF-RI for the first time, the enrollment deadline for the 2025 year is December 1, 2024. PRF-RI insurance can be purchased through any authorized crop insurance agent. The premium payment deadline is September 1 of the following year, so premiums do not need to be paid up front.

References

Goodrich, B. "Pasture, Rangeland and Forage Rainfall Index Insurance: An Insurance Product for Illinois Livestock and Forage Producers." farmdoc daily (14):184, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 9, 2024.

USDA RMA. Agent Locator. https://public-rma.fpac.usda.gov/apps/AgentLocator/#!/#%2F

USDA RMA. Pasture, Rangeland Forage Support Tool. https://public-rma.fpac.usda.gov/apps/PRF

USDA RMA. Rainfall Index. https://www.rma.usda.gov/policy-procedure/general-policies/rainfall-index

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.