Impacts of Higher Premium Support Rates on ECO Performance

For 2025, the Risk Management Agency (RMA) has increased the premium support rate for the Enhanced Coverage Option (ECO) from 44% of the total premium to 65%. As a result, farmers will pay less for premiums in 2025 and the following years. We evaluate the impact of the increase in ECO’s subsidy rate on farmer-paid premiums and net payments using a historical analysis from 2015 to 2023. This updates a previous analysis published in farmdoc on July 23, 2024, that evaluated performance given the current 44% premium subsidy rate.

Background

ECO is a county-level product that can be used by farmers who purchase farm-level products through the COMBO insurance product, which includes Revenue Protection (RP), RP with Harvest Price Exclusion, and Yield Protection (see farmdoc daily, November 24, 2020). ECO mimics the coverage type of the underlying COMBO plan. Because most farmers purchase Revenue Protection (RP), the performance of ECO is evaluated assuming an underlying purchase of RP, a revenue product whose guarantee increases if the harvest price is above the projected price. ECO offers county coverage, making payments when county revenue falls below the county guarantee. ECO differs from RP in that RP’s coverage is based on farm-level revenue, not county results.

Farmers choose a 90% or 95% coverage level when using ECO. ECO then offers coverage from 90% or 95% down to 86%. Farmers can use another county product called the Supplemental Coverage Option (SCO) to provide coverage from 86% to the underlying coverage level chosen on their RP policy. Unlike SCO, there is no commodity title requirement for the purchase of ECO, meaning that a farmer can choose either Price Loss Coverage (PLC) or Agriculture Risk Coverage (ARC). In contrast, purchasing SCO requires PLC as the commodity title choice.

Evaluation of ECO-95% for Corn with a 65% Premium Support

We evaluated ECO as if it existed from 2015 to 2023. The analysis begins in 2015, as it was the first year SCO coverage was offered and the RMA calculated expected and actual yields used to administer the program. These yields also allow the calculation of ECO payments. ECO was first offered in 2021 and we thus use actual historical rates to calculate premiums for 2021 through 2023. ECO premiums for 2015 through 2020 are calculated using 2021 rates adjusted to the respective years’ projected prices and volatilities. ECO rates have declined slightly over time, meaning that actual ECO premiums from 2015 to 2020, had the program existed, could have been higher than those used in this analysis.

Both premiums and payments are calculated assuming the farm’s Trend-Adjusted Actual Production History (APH) yield on the RP product is the same as the expected yield for the county-level products. The protection level used for ECO is 1.0 when calculating premiums and payments. Farmers can select a lower protection level, thereby lowering both premiums and, when they occur, payments.

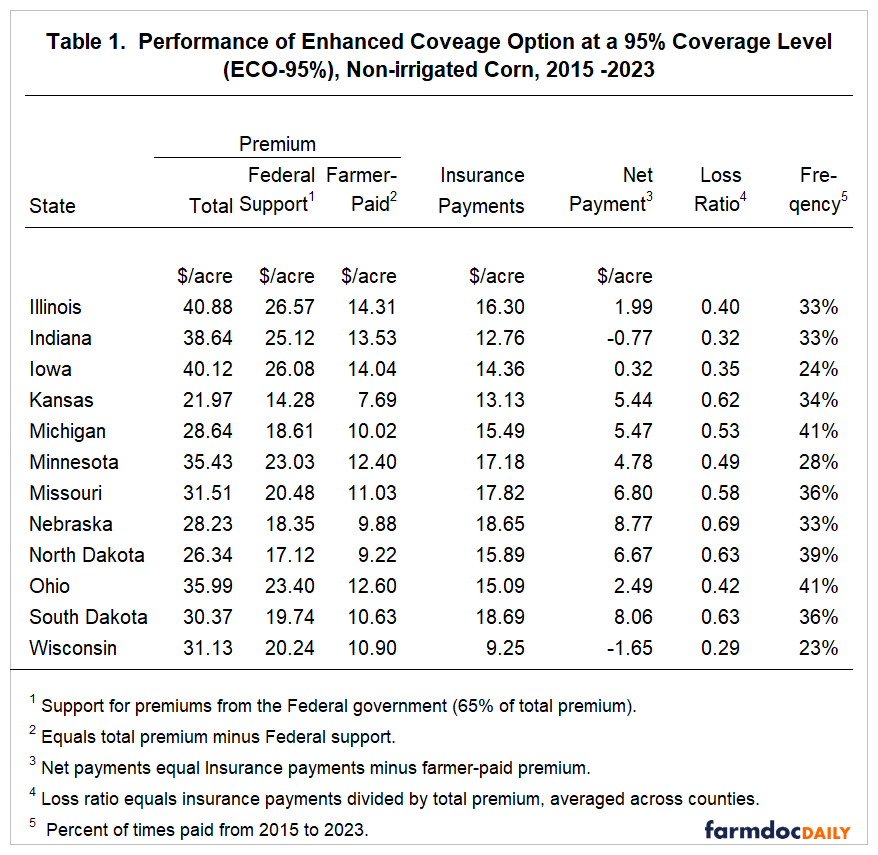

Table 1 shows the performance of ECO given a coverage level choice of 95% (ECO-95%) averaged across all counties in Midwestern states. As shown in the table, the total premium for Illinois averaged $40.88 per acre. The RMA is tasked with developing total premiums that are actuarially fair with a small loss reserve. As a result, insurance payments for ECO should be slightly lower than total premiums over time.

Crop insurance premium subsidies are provided to offset part of total premium costs, thereby encouraging use, and to help mitigate difficulties in precisely rating all cases. The subsidy rate for ECO was 44% in prior years but will increase to 65% beginning with the 2025 crop year. As shown in the table, the Illinois average premium would be $40.88 per acre and the Federal Subsidy support would be $26.57 per acre or 65% of the $40.88 total premium. The farmer-paid premium equals $14.31 per acre or 35% of the total premium. Had the rate remained at 44%, the average Federal support for Illinois would have been $17.99 or $8.58 per acre less than the $26.57 support at a 65% subsidy rate. And had the subsidy rate not changed, farmer-paid premiums would have been $8.58 higher, increasing from $14.31 to $22.89 per acre.

From 2015 to 2023, payments from ECO-95% averaged $16.30 per acre for Illinois. The $16.30 divided by the total premium of $40.88 results in a loss ratio of .40. If premiums are actuarily fair, then the loss ratio should be higher than .40. If RMA had a target loss ratio of .88 implying about a 12% reserve, then the total premium would have needed to be $18.52 rather than $40.88 to achieve that target, and the resulting farmer-paid premiums would be $6.48 per acre ($6.48 = $18.52 total premium x (1 – .65 subsidy rate).

Net payments equal insurance payments minus farmer-paid premiums. For Illinois, net payments equal $1.99 per acre, meaning farmers receive $1.99 more in insurance payments than in insurance premiums. Net payments should be positive if RMA is achieving its goal of setting premiums. If the loss ratio were at the target, then 35% of the total premium (after reserve) should be equal to the average net payment to the farmer which in this case would be $9.37 per acre instead of $1.99 per acre.

Loss ratios across all states were lower than the target with the lowest average loss ratio of .29 in Wisconsin and the highest of .69 in Nebraska.

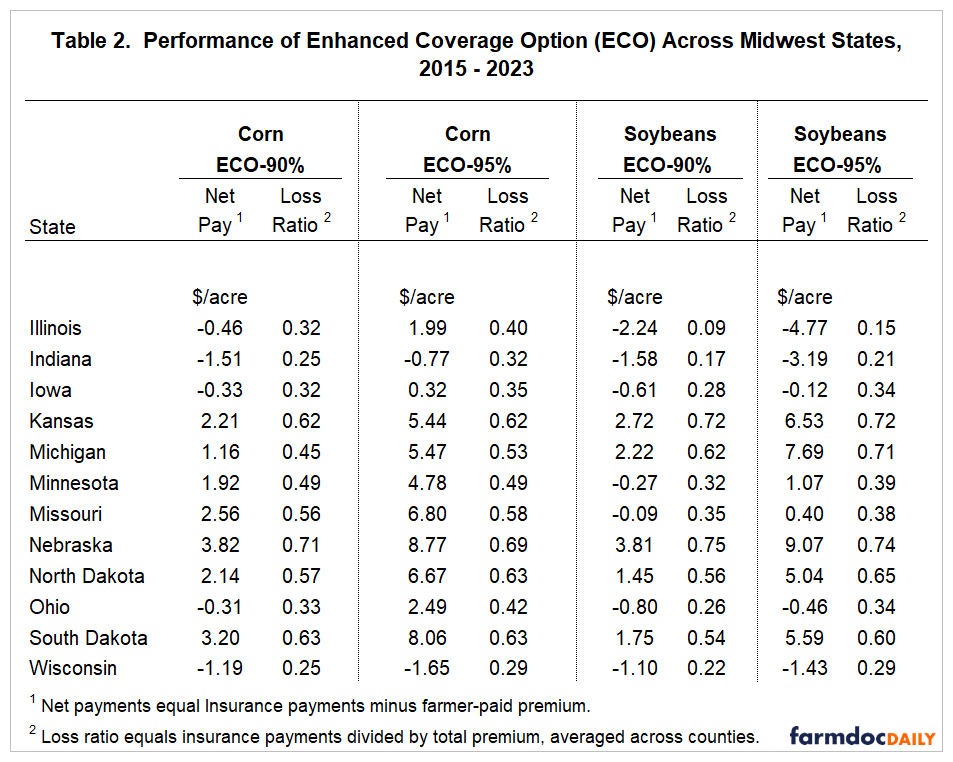

ECO Results for Corn and Soybeans

Table 2 extends this analysis, providing net payments for both 90% and 95% coverage levels for both corn and soybeans. All premiums are stated for non-irrigated practices. Overall results are similar across the two crops for EC0-90% and ECO-95%. Soybeans tend to have even lower net payments than for corn. In Illinois, for example, ECO-95% net payments are -$4.77 per acre for soybeans, lower by $6.76 than the $1.99 for corn. Note that the negative numbers in the table indicate that the implied overrating is greater than the subsidy rate and result in net losses from the purchase of the subsidized insurance in those cases.

County Maps of Net Payments

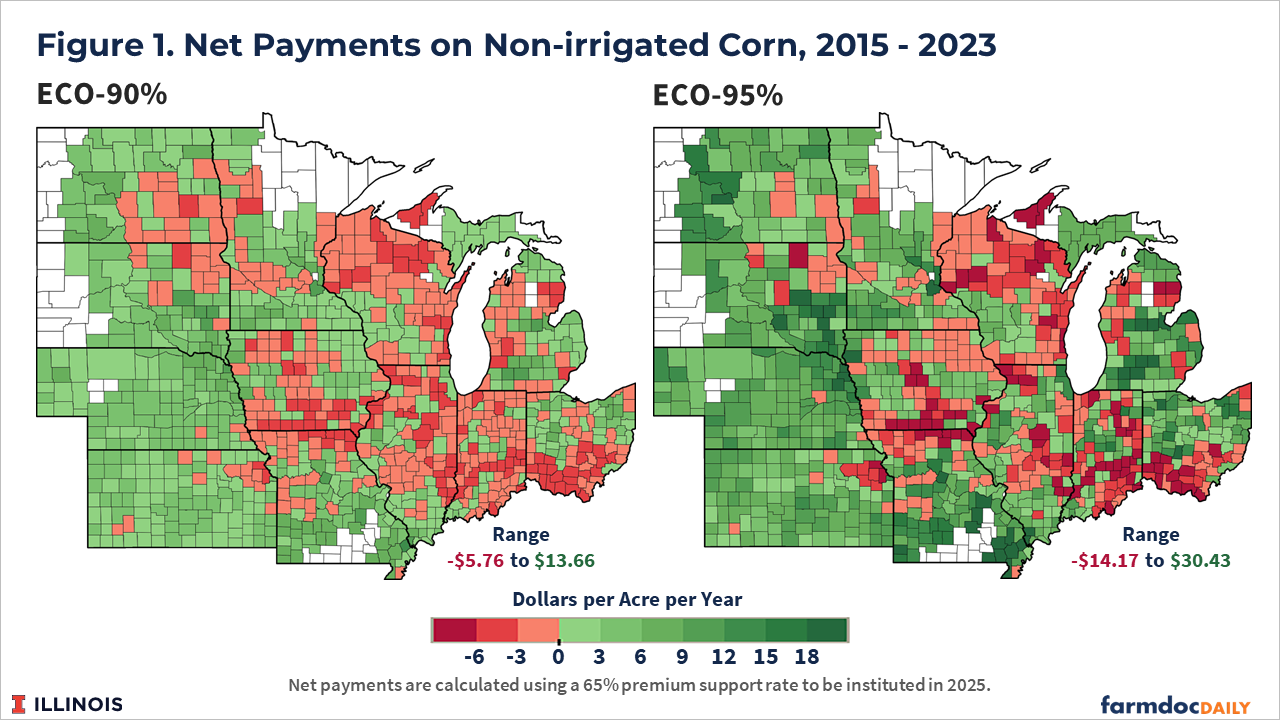

Net payments vary across counties based on the riskiness and the underlying ratings as illustrated for corn in Figure 1 which shows net payments for both ECO-90% and ECO-95%. Again, many counties have negative values, meaning farmers paid more premiums than they received. These regions are concentrated in the heart of the corn belt where production risks are lowest. Positive net payments are highest and concentrated in the regions with the greatest production risk.

The increase in premium support from 44% to 65% will increase net payments in all counties. As illustrated above, the increases in Illinois average $8.58 per acre for corn from the subsidy increase, but remain below the target loss ratios and in many cases are still negative emphasizing the overall low loss ratios for ECO in the Midwest in general.

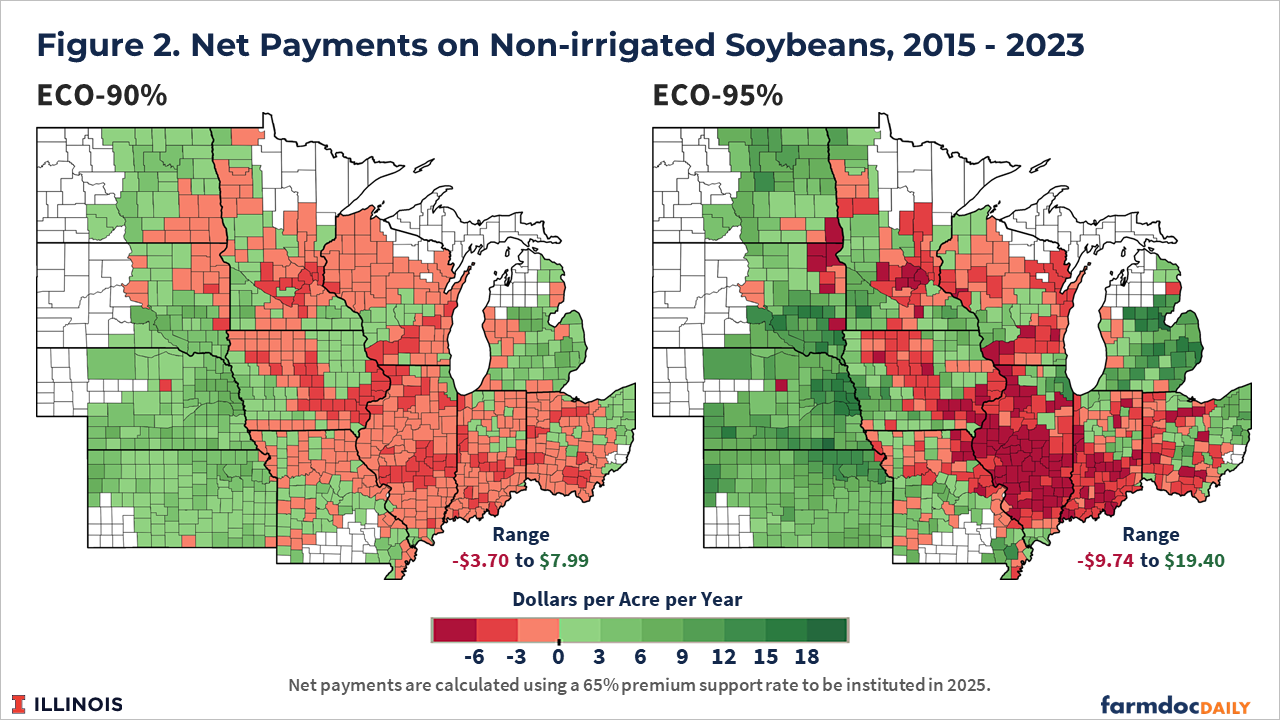

Figure 2 shows loss ratios for soybeans. More counties have negative net payments than for corn. At a 90% coverage level, almost all counties in Illinois and Indiana have negative net payments again implying that the overrating of premiums is greater than the subsidy. Many Missouri, Iowa, South Dakota, North Dakota, Minnesota, and Wisconsin counties also have negative net payments. Overall, the low loss ratio problem for soybeans (see farmdoc daily, January 17, 2023) extends to ECO.

Commentary

The increase in premium support from a 44% rate to a 65% rate will decrease the farmer-paid premium of ECO, making it more attractive to farmers as a risk management tool. Farmers may wish to consider ECO as part of their risk management alternatives. In evaluating crop insurance options, the following should be considered:

- If ECO is considered for one crop, corn would be the first crop to consider. Historically, net payments have been higher for corn than soybeans in the Midwest.

- ECO appears to perform better at a 95% coverage level rather than a 90% coverage level. Payments will occur more frequently and at higher revenues for a 95% coverage level than a 90% coverage level. If premium costs are the main concern, then the lower coverage could be considered. In fact, most acre are insured using ECO-95%. Of corn acres insured in Illinois using ECO, 85% were insured using a 95% coverage level.

- Farmers do not need to purchase an SCO policy to use ECO and we suggest considering an ECO purchase without SCO coverage, particularly if the underlying COMBO product coverage level is 85%. ECO policies, because of the 90% or 95% coverage levels, will pay before the SCO product triggers indemnities.

While increasing premium support rates will lower premiums, they do not impact overall loss ratios. Those loss ratios remain low and are remedied by reducing the total premium. Subsidy increases when loss ratios are not uniform, creating additional inconsistencies in implied subsidy support and income transfers. Corn and soybean loss ratios remain farm below those of rice and cotton STAX for example, which have much higher loss ratios (see discussion at the end of the farmdoc daily article from July 23, 2024). These low loss ratios cause the Midwest to be one area that benefits the least from the House Proposal to improve SCO by increasing the subsidy level and coverage level (see farmdoc daily, June 4, 2024).

References

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "The New Enhanced Coverage Option (ECO) Crop Insurance Program." farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Schnitkey, G., B. Sherrick, C. Zulauf, N. Paulson and J. Baltz. "Performance of SCO and ECO in the Midwest." farmdoc daily (14):136, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 23, 2024.

Schnitkey, G., B. Sherrick, C. Zulauf, N. Paulson, J. Coppess and J. Baltz. "Farm Bill Proposals to Enhance Supplemental Coverage Option (SCO)." farmdoc daily (14):104, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 4, 2024.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Crop Insurance for Soybeans: The Low Loss Ratio Concern." farmdoc daily (13):8, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 17, 2023.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.