Outlook for Farmland Values in 2025

Lower returns to rented land and higher interest rates began to signal the potential for downward pressure on farmland values in 2023 (see farmdoc daily from August 8, 2023). Those signals continue, with current fundamentals suggesting land value reductions of around 3% in 2025. A 3% decline would be in line with observed adjustments since the 1980s as well as expectations from professional farm managers surveyed in 2024. On the other hand, valid arguments exist for continued strength in farmland values. In particular, strength in the average financial position of grain farms suggests declines in farmland values, if they occur, are not likely to be significant in the short term.

Average Illinois Cash Rents and Land Values in 2024

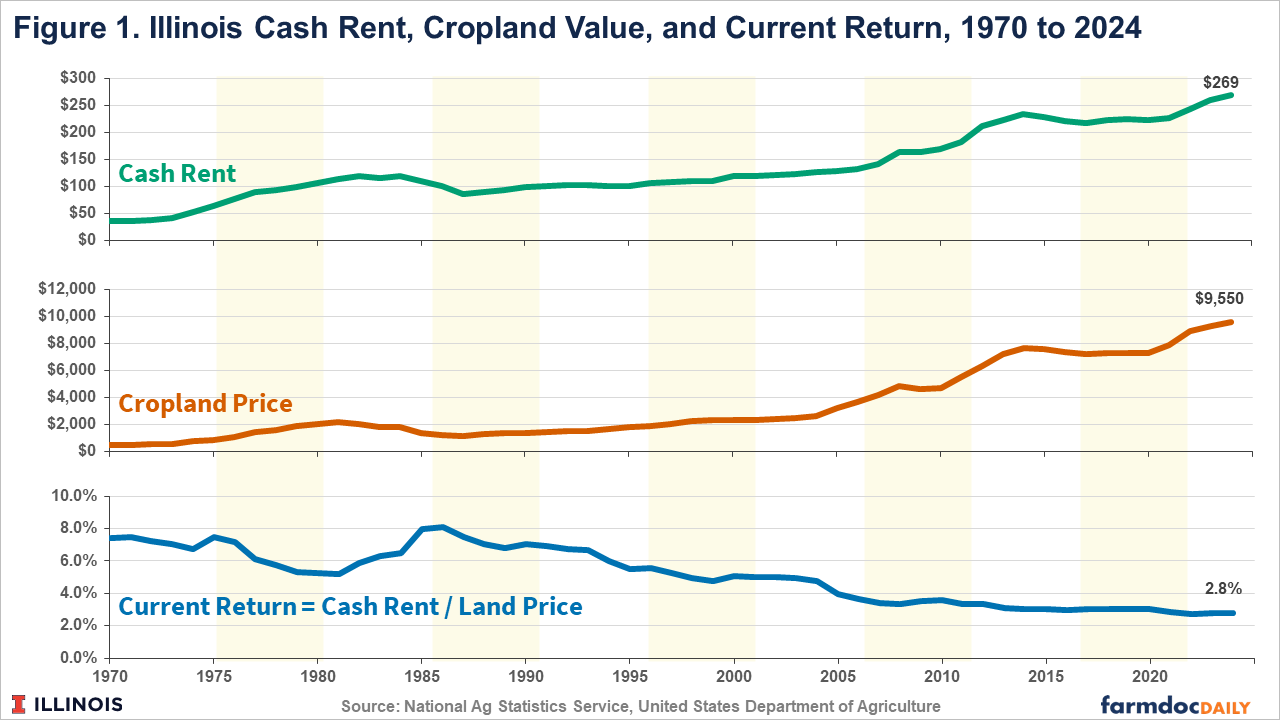

The average cash rent in Illinois was $269 per acre in 2024, an increase of $10 per acre (3.9%) from 2023 (see upper panel of Figure 1). Average Illinois cash rents have increased by 21% since 2020 after a period of relative stability from 2015 to 2020 (see farmdoc daily article from September 3, 2024).

Average Illinois land values have had the same trends as cash rents. The average farmland value in Illinois was $9,550 per acre for 2024, an increase of $250 per acre (2.7%) from 2023 (see middle panel of Figure 1). Average land values have increased by nearly 31% since 2020, following the stable period from 2015 to 2020.

The average current return to Illinois farmland, measured as cash rent divided by land value, was 2.8% for 2024 (see lower panel of Figure 1). The current return measure has averaged just over 2.8% since 2020.

Current Farmland Returns and Interest Rates

Current returns to farmland tend to track interest rates. Figure 2 illustrates this using the 10-year constant maturity US treasury (CMT) rate.

The annual average 10-year CMT was below the average current return for Illinois farmland from 2009 to 2022. Over this 13-year period, the current return to Illinois farmland slowly trended down from around 3.5% to around 2.8%. Lower alternative returns allowed land values to be bid up at a faster rate than cash rents.

The Fed continues to signal further reductions in the Federal Funds rate, with recent expectations for longer-run levels around, or just below, 3%. Based on historical relationships, this would be consistent with the current 10-year CMT rate of around 4%. While it has been common for the current return to farmland to be above or below the 10-year CMT for multiple years, one should expect farmland returns to eventually come back in line with the higher rates on government securities if they continue to persist.

What Does this Mean for Farmland Values?

Current Illinois Crop Budgets indicate negative per acre returns to cash rented farmland were realized in 2023, with continued negative returns projected for 2024 and 2025. Lower commodity prices coupled with production costs that have, thus far, been slow to adjust down to lower revenues have caused lower returns. Returns near or below break-even are also expected for land operated under share and variable cash lease arrangements (see farmdoc daily articles from September 3rd, October 1st and October 15th, 2024).

Multiple years of negative or low average returns to rented farmland will put downward pressures on cash rent levels. Cash rents stabilized and showed moderate declines over the 2015 to 2019 period with average return levels that were above those for 2023 and projections for 2024 and 2025. Lower cash rent levels then cause lower current returns to owning farmland, resulting in downward pressures on land values.

Higher interest rates indicate higher financing costs. Greater returns to safe assets, such as US government securities, also suggest higher opportunity costs of alternative assets. Both factors would tend to soften the values of assets such as farmland.

Quantifying the extent to which land values might adjust down is difficult. On average, Illinois land values have shown annual declines only 8 times since 1970, and just 4 times since 1988. Land values showed considerable declines during the 1980s farm crisis, ranging from -6.7% (1986 to 1987) to just over 25% (1984 to 1985). Since 1988, annual land value declines have ranged from 1% (2014 to 2015) to just over 5% (2008 to 2009).

Despite lower incomes, Illinois farms remained in a strong financial position at the end of 2023, on average, following strong income years from 2020 to 2022 (see farmdoc daily from October 18, 2024). Interest rates, while higher than levels in some recent years, remain at relatively low levels by historical standards, particularly compared with those of the 1980s farm crisis period. Thus, potential reductions in land values would be expected to be more similar in size to those experienced since the late 1980s (range of 1% to 5%).

A recent survey (August 2024) of professional farmland managers in Illinois suggested a decline in average cash rents of around $25 per acre from 2024 to 2025. Rents on professionally managed farmland tend to be higher than broader market averages, and they also tend to adjust to economic conditions more quickly.

An $8 per acre (3%) reduction in the average cash rent in Illinois, from $269 per acre down to $261 per acre, would match the largest relative reduction in average Illinois cash rents observed since the 1980s (reduction of $7 per acre from 2015 to 2016). This would imply an average land value of around $9,265 for 2025 (a 3% decline from the $9,550 value in 2024) assuming current returns remain around 2.8%. A reduction of this scale would be consistent with land value reductions since the late 1980s. This would also be in line with results from the Illinois farm manager survey, where 89% of respondents expected farmland prices to decline with that group roughly split between declines less than 3% and exceeding 3%.

Still, multiple arguments for continued strength in farmland values could also be made. First, farmland remains an attractive asset with total returns (current plus capital returns) that are competitive with other asset classes, particularly over longer holding periods. Second, turnover rates for farmland are expected to continue to remain low meaning that purchase opportunities are scarce. Finally, as farm operations continue to expand and alternative uses for farmland continue to grow, demand for an asset in fixed or declining supply will continue to remain strong.

References

Paulson, N., G. Schnitkey and C. Zulauf. "Farmer Returns Under Different Lease Designs." farmdoc daily (14):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 1, 2024.

Paulson, N., G. Schnitkey and C. Zulauf. "Revisiting the Merits of Variable Cash Leases for 2025." farmdoc daily (14):188, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 15, 2024.

Schnitkey, G., N. Paulson, C. Zulauf and J. Baltz. "Setting 2025 Cash Rents." farmdoc daily (14):159, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 3, 2024.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Downward Pressures on Farmland Prices in 2023." farmdoc daily (13):146, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 8, 2023.

Zwilling, B. "Financial Summary of Illinois Farms for 2023." farmdoc daily (14):190, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 18, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.