Revisiting the Merits of Variable Cash Leases for 2025

Recent articles have outlined the negative returns facing producers with lower corn and soybean prices and production costs which have only partially adjusted down from highs in 2023. The variable cash lease design has been gaining traction in recent years as a way for farmer tenants to achieve some risk-sharing while also avoiding some of the inconveniences associated with asking landlords to be involved with managerial decisions as is required by a traditional share lease. Today’s article highlights how revenue-based variable leases can still result in large negative farmer returns in the current economic environment where cost adjustments are lagged and smaller in size than the revenue reductions facing producers.

Recent Performance of Variable Cash Rent

A number of previous articles have outlined a relatively simple design for a variable cash lease (see farmdoc daily articles from October 24, 2023 and September 20, 2022 for the most recent examples). This design applies a rent factor to crop revenues to determine the cash rent level for the year. The variable design also includes both minimum and maximum rent levels. The minimum establishes a meaningful base to ensure the lease is viewed as a cash lease by the Farm Service Agency. This provides the landowner with a minimum rental return and eliminates the need to be involved with commodity programs such as ARC and PLC. The maximum rent establishes a cap on the rent paid by the farmer tenant in any given year.

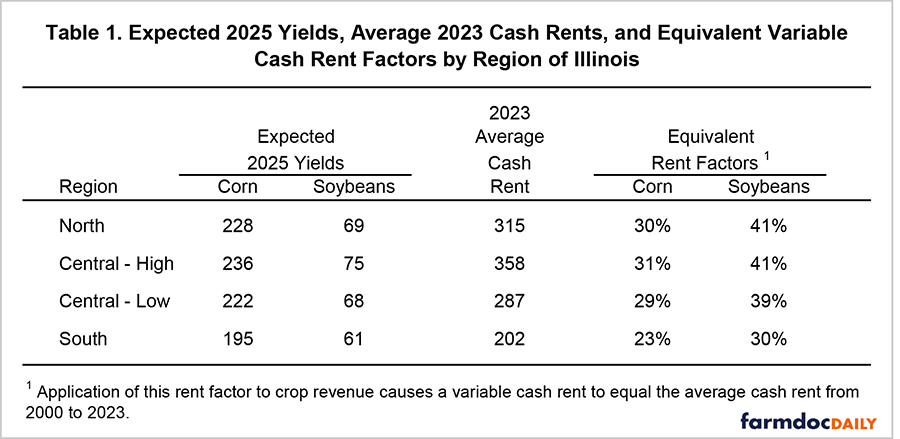

Crop- and region-specific rent factor suggestions for Illinois have been provided, being set at levels which result in variable cash rent levels being equal to fixed cash rent levels, on average, over time using historical return information. Table 1 provides an update to those rent factors, utilizing historical corn and soybean returns in Illinois from 2000 through 2023. The updated rent factors are very similar to those based on 2000 to 2022 returns (see farmdoc daily from October 24, 2023). For northern and central Illinois regions they are around 30% for corn and 40% for soybeans. Rent factors for southern Illinois are lower at 23% for corn and 30% for soybeans.

The variable cash lease strikes a balance between risk sharing and managerial convenience for the farmer tenant and landlord. Rent levels adjust to changes in crop revenues, reflecting the effects of changes in price and yield, while keeping managerial decisions under the purview of the farmer.

However, the economic conditions facing producers since 2023 have resulted in potentially large negative farmer returns under the variable lease design. This is because it is based on crop revenues and, unlike the traditional share rent, does not include production costs in determining rent levels.

Both corn and soybean prices have been on a declining trajectory from the record highs experienced during the 2022 crop year. Costs have also started to show signs of downward adjustments or plateaus but, as is typical, those adjustments lag those of crop revenues and have been smaller in magnitude. Thus, adjustments in revenue-based variable cash leases have been insufficient in avoiding negative farmer returns on variable cash rented land for 2023 and this is expected to continue for 2024 and into 2025.

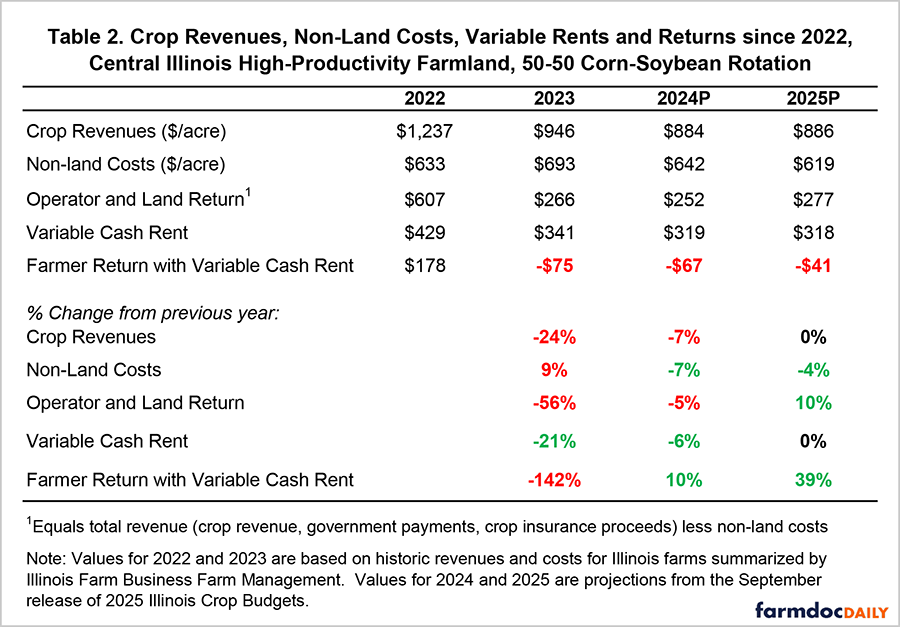

Table 2 illustrates the situation for a 50-50 corn-soybean rotation in central Illinois for high-productivity farmland. Crop revenues declined by 24% in 2023 compared with 2022 and are projected to be another 7% lower for 2024 and then holding steady for 2025. Non-land costs continued to increase by 9% in 2023 and are projected to decline by 7% in 2024 and another 4% in 2025. Variable cash rent adjusted down proportionally with revenues in 2023, but the higher costs resulted in negative farmer returns in 2023. Farmer returns under a variable cash lease are currently projected to improve relative to the previous year in 2024 and 2025 but remain at negative levels.

Discussion

Lower commodity prices have led to significantly lower crop revenues since 2022. Non-land production costs have begun to adjust downward but have lagged and been smaller than the revenue declines. This has resulted in negative farmer returns under revenue-based variable cash lease designs in 2023, and projected for 2024 and 2025.

The variable cash lease design has been gaining traction in recent years as farmer tenants seek to achieve more risk-sharing without the managerial headaches that can be introduced with traditional share leases. Relative to a fixed cash rent situation the variable cash lease is projected to result in better farmer returns when revenues decline, as variable rents adjust more quickly than fixed cash rents. However, the economic situation facing producers since 2023 highlights the risk-sharing gap that remains if variable lease designs adjust only to changes in crop revenues.

Development of a strategy for approaching farmland rents is critical for farm operations seeking financial sustainability and viability. This is particularly true during periods of low returns (see farmdoc daily from October 8, 2024). As the balance between corn and soybean prices and productions costs continues to adjust, producers may need to propose further adjustments to rents determined through variable cash lease designs to minimize losses during highly negative farmer return periods (see farmdoc daily from October 1, 2024).

A simple adjustment could be a one-time reduction in the rent from variable leases by a set amount per acre. While individual situations can vary greatly, the 2025 Illinois crop budgets suggest reductions of $40 per acre, or more, might be needed to result in break-even farmer returns for the higher productivity soils in northern and central Illinois. Budgets suggest even larger adjustments may be needed on lower productivity soils in central and southern Illinois. Smaller rent adjustments would help to reduce projected losses in 2025, while recognizing the landowner’s perspective and desire to earn a return on their land asset as well as the fact that volatility in returns to crop production should be expected and considered in producers’ overall financial risk management plans.

References

Paulson, N., G. Schnitkey and C. Zulauf. "Farmer Returns Under Different Lease Designs." farmdoc daily (14):178, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 1, 2024.

Paulson, N., G. Schnitkey, C. Zulauf and J. Baltz. "Comparing Fixed Cash, Variable Cash, and Share Rents for 2024." farmdoc daily (13):195, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 24, 2023.

Schnitkey, G., N. Paulson, B. Zwilling, B. Goodrich, C. Zulauf and J. Baltz. "Perspectives and Strategies for Dealing with Low Farm Incomes in 2024 and Beyond." farmdoc daily (14):183, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 8, 2024.

Schnitkey, G. and N. Paulson. 2025 Illinois Crop Budgets, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. September 25, 2024.

Schnitkey, G. and N. Paulson. Revenue and Costs for Illinois Grain Crops, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign. September 25, 2024.

Schnitkey, G., C. Zulauf, N. Paulson, K. Swanson, J. Coppess and J. Baltz. "A Straight-Forward Variable Cash Lease with Revised Parameters." farmdoc daily (12):145, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 20, 2022.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.