The Liquidity of Illinois Grain Farms: Working Capital to Operating Expense Ratio by Region

Farm liquidity is the top concern for lenders according to the 2024 joint survey conducted by the American Bankers Association (ABA) and Farmer Mac (see ABA-Farmer Mac Agricultural Lender Survey, August 2024). In our previous farmdoc article, we discussed the median reported working capital to operating expense ratio based on data from all grain farms in Illinois (see farmdoc daily, December 16, 2024). Our analysis indicated that this ratio has been steadily declining since 2021. In this article, we further examine this liquidity measure by comparing trends across the three regions of Illinois, using data obtained from the Illinois Farm Business Farm Management (FBFM). Recall that liquidity refers to a farm business’s ability to generate sufficient cash or quickly convert assets into cash to meet its financial obligations as they come due. These obligations include operational expenses, debt payments, family living expenses, and taxes. Our primary focus here is to relate working capital to accrual operating expenses for grain farms and illustrate the quality and trends of this ratio in each of the state’s three regions.

The working capital to operating expense ratio is a measure of liquidity that assesses a farm’s ability to cover normal operating expenses with working capital instead of revenue. Working capital is defined as the difference between current assets (i.e., cash and assets that are expected to be converted into cash within the next 12 months, which includes accounts receivable, inventory, and prepaid expenses) and current liabilities (i.e., obligations due within the next 12 months, such as accounts payable, short-term loans, current portion of term debt payments, and upcoming taxes). Operating expenses are all costs for the farm business, excluding interest, taxes, depreciation, and amortization. A working capital to operating expense ratio of 0.30 means the farm business has enough “cash” from working capital to cover 30 percent of the year’s operating expenses.

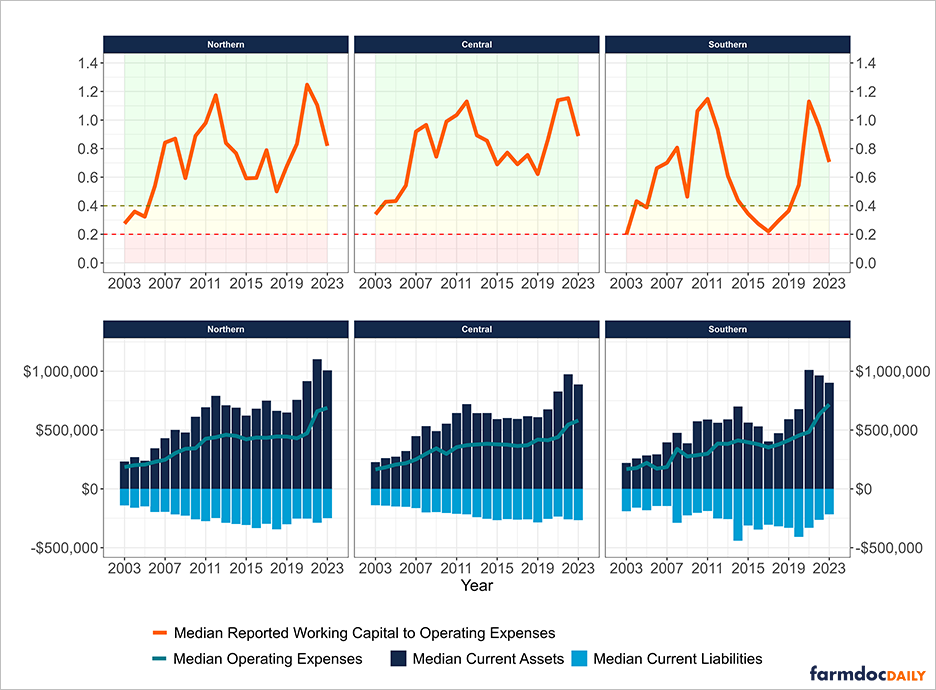

According to the Farm Financial Scorecard developed by the Center for Farm Financial Management, a farm with a working capital to operating expense ratio that is less than 0.2 is categorized as vulnerable, a ratio between 0.2 and 0.4 is categorized as cautionary, and a ratio that is greater than 0.4 is categorized as strong. Therefore, a higher ratio indicates greater liquidity for the farm. In our analysis, we will examine the trends in the working capital to operating expense ratio across three regions—Northern, Central, and Southern Illinois. In our figure below, we use the color-coding system of the Farm Financial Scorecard to indicate the category under which the median grain farm’s ratio belongs. The region shaded in red indicates a vulnerable ratio, while yellow indicates a cautionary ratio, and green indicates a strong ratio.

Figure 1 illustrates the median values of current assets, current liabilities, operating expenses, and the reported working capital to operating expense ratio for grain farms across the three regions of Illinois. The observed trends vary due in part to differences in soil quality and the types of farming operations. Northern Illinois, which has a higher concentration of livestock operations, typically experiences heavier corn rotations and has a greater proportion of cash-rented farmland. In contrast, Central Illinois primarily utilizes a 50/50 rotation of corn and soybeans and has a higher percentage of crop share arrangements. Most of the wheat acres are located in Southern Illinois and are often followed by double-crop soybeans. On average, operations in this region tend to have higher owned acres as a share of total acres. Furthermore, the greater variability in crop yields in Southern Illinois can be attributed to the presence of lower-quality soils. Notably, Southern Illinois reported the lowest median working capital in most years.

Another observation is that Southern Illinois has experienced more extreme deteriorations in liquidity than Northern and Central Illinois. The largest of which was a sustained decline in the median reported working capital to operating expense ratio from a value of 1.15 (strong) in 2011 to 0.220 (cautionary) in 2017, a decline of 80.87%. This was then followed by an uninterrupted rise in the ratio, climbing to 1.13 (strong) in 2021. Only Central Illinois reported an increase in the ratio in 2022, although it was a modest rise from 1.14 (strong) to 1.15 (strong). The median reported working capital to operating expense ratio has been in decline in Northern and Southern Illinois since 2021. Additionally, from 2020 to 2023, median operating expenses have increased by 58.11% in Southern Illinois, 60.20% in Northern Illinois, and 40.71% in Central Illinois. As of 2023, the median reported working capital to operating expense ratio in Southern Illinois was 0.706 (strong), 0.819 (strong) in Northern Illinois, and 0.888 (strong) in Central Illinois.

Conclusion

In conclusion, our analysis of the median reported working capital to operating expense ratio across Northern, Central, and Southern Illinois highlights notable regional differences in liquidity trends. Since 2003, Southern Illinois, in particular, has faced more severe declines in liquidity compared to the other two regions. The most significant decline occurred between 2011 and 2017, where the median reported working capital to operating expense ratio fell from 1.15 (strong) to 0.22 (cautionary), representing a decline of 80.87%. These liquidity challenges primarily stem from the greater variability in crop yields in Southern Illinois, which results in wider swings in income. For example, the drought in 2012 impacted Southern Illinois a lot more than any other region. While all three regions reported a strong liquidity classification in 2023, the median ratio has been on a downward trend since 2022. Given the USDA’s projected decline in farm incomes for 2024 and the ongoing uncertainties as we head into 2025, maintaining strong liquidity positions will be important for farm operations. Know that working capital is seldom only spent on operating expenses. Family living expenses, principal payments and unfinanced capital purchases made in 2025 are all competing ‘uses’ of your 2024 working capital. Prudent management of working capital is especially vital in this time of low farm profitability.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

References

American Bankers Association-Farmer Mac. “2024 Agricultural Lender Survey Results”. August 2024. Retrieved from https://www.farmermac.com/wp-content/uploads/2024-Farmer-Mac-Ag-Lender-Survey-Results.pdf

Mashange, G., B. Zwilling and D. Raab. "The Liquidity of Illinois Grain Farms: Working Capital to Operating Expense Ratio." farmdoc daily (14):227, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 16, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.