The Liquidity of Illinois Grain Farms: Working Capital to Operating Expense Ratio

According to the 2024 joint survey conducted by the American Bankers Association (ABA) and Farmer Mac, lenders are most concerned about producers’ liquidity and farm income levels (see ABA-Farmer Mac Agricultural Lender Survey, August 2024). The USDA’s Economic Research Service is projecting farm commodity cash receipts to decline by $16.6 billion (3.1%) to $516.9 billion in 2024, mainly driven by lower crop receipts. However, lower production expenses are expected to cushion the overall decline in farm incomes (see USDA-ERS, December 3, 2024). In this article, we will examine the trends in liquidity of Illinois grain farms by measuring the working capital to accrual operating expense ratio, using Illinois Farm Business Farm Management (FBFM) data. We expect 2025 to be riddled with uncertainty, from domestic policy to international trade and relations. Therefore, having ample working capital to weather potential adverse shifts is recommended.

The working capital to operating expense ratio is a measure of liquidity that assesses a farm’s ability to cover normal operating expenses with working capital instead of revenue. Working capital is defined as the difference between current assets (i.e., cash and assets that are expected to be converted into cash within the next 12 months, which includes accounts receivable, inventory, and prepaid expenses) and current liabilities (i.e., obligations due within the next 12 months, such as accounts payable, short-term loans, current portion of term debt payments, and upcoming taxes). Operating expenses are all costs for the farm business, excluding interest, taxes, depreciation, and amortization. A working capital to operating expense ratio of 0.55 means the farm business has enough “cash” from working capital to cover 55 percent of the year’s operating expenses.

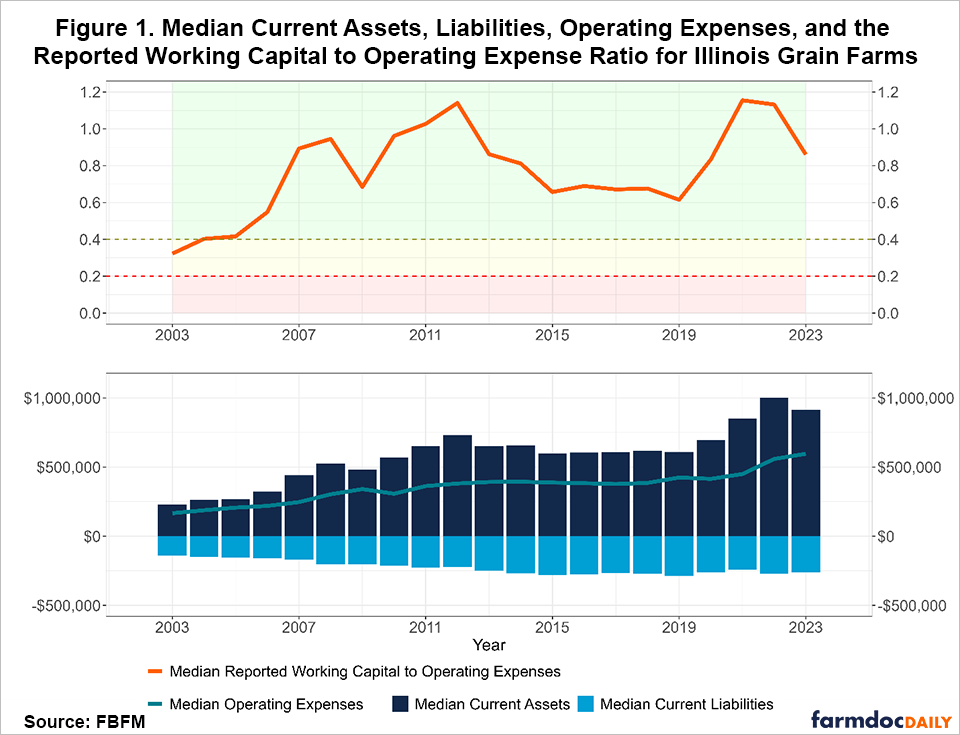

We will also present the financial quality of the ratio. According to the Farm Financial Scorecard developed by the Center for Farm Financial Management, a farm with a working capital to operating expense ratio that is less than 0.2 is categorized as vulnerable, a ratio between 0.2 and 0.4 is categorized as cautionary, and a ratio that is greater than 0.4 is categorized as strong.[1] Therefore, the higher the ratio, the more liquid the farm is. Lastly, in our figures below, we use the color-coding system of the Farm Financial Scorecard to indicate the category under which the median grain farm’s ratio belongs. The region shaded in red indicates a vulnerable ratio, while yellow indicates a cautionary ratio, and green indicates a strong ratio.

Figure 1 presents the median current assets, liabilities, operating expenses, and the reported working capital to operating expense ratio for Illinois grain farms. Overall, liquidity, as measured by this ratio, has improved since 2003 for the median grain farm. Between 2003 and 2008, the reported working capital to operating expense ratio substantially increased from the cautionary to strong range. In 2003, the median reported ratio was 0.323 (cautionary), and by 2008, it had risen to 0.945 (strong), marking an increase of 192.57%. During this period, median operating expenses increased by 82.02%, median current assets increased by 130.31%, and median current liabilities increased by 45.05%. The median reported working capital increased by 431.48%!

The ratio sharply dropped in 2009. The drop illustrates how sensitive this ratio can be to changes in working and/or operating expenses; however, it was high enough to avoid falling back into the cautionary range. The upward trend of the ratio continued the following year until 2012 reaching a value of 1.14 (strong). Rising commodity prices at the time, driven by the increased demand for soybeans for export and corn for ethanol production, resulted in higher ending inventory values and, thus, higher current asset values. Looking at the individual components of the ratio, median operating expenses rose by 11.88%, while median reported working capital rose by 91.94% from 2009 to 2012.

The ratio had a downward trend from 2012 to 2015, as median current assets declined while current liabilities continued to increase. The median reported working capital to operating expense ratio was relatively stable from 2015 to 2019. Median operating expenses rose by 9.45%, while median reported working capital only declined by 4.01%. We also saw lower net farm incomes during this period, with 2015 having the lowest average net farm income since the 1980s.

Between 2019 and 2021, the median reported working capital to operating expense ratio increased significantly, rising from 0.614 (strong) to a peak of 1.15 (strong). However, this ratio has been declining since then. Although the highest income on record was reported in 2022, leading to stronger working capital positions, operating expenses surpassed those of 2021, resulting in a decrease in the ratio. By 2023, the ratio stood at 0.860 (strong). Median operating expenses have continued to rise from 2020 through to 2023. In contrast, median current assets peaked in 2022 at $1,000,946 and fell by 8.49% to $915,934 in 2023. Additionally, the median reported working capital decreased from $594,966 to $497,687 during the same period, a 16.35% decline.

Conclusion

While the median reported working capital to operating expense ratio has improved since 2003, recent data shows a shift in the liquidity measure. This ratio closely mirrors the trend of accrual net farm income over the same period. It peaked at 1.15 in 2021 but has since declined to 0.860 in 2023, although it remains within the strong range. This recent downward trend, combined with rising operating expenses and decreasing working capital, suggests potential liquidity pressures. With the USDA projecting a decline in farm incomes for 2024 and continuing uncertainties as we move into 2025, it will be essential for farm operations to maintain strong liquidity positions.

Acknowledgment

The authors would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.

Note

[1] The Farm Financial Scorecard adheres to the guidelines set by the Farm Financial Standards Council.

References

American Bankers Association-Farmer Mac. “2024 Agricultural Lender Survey Results”. August 2024. Retrieved from https://www.farmermac.com/wp-content/uploads/2024-Farmer-Mac-Ag-Lender-Survey-Results.pdf

U.S. Department of Agriculture, Economic Research Service. “Farm sector profits forecast to fall in 2024”. December 3, 2024. Retrieved from Economic Research Service website. https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=110528

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.