Secondary Impacts from Rising Used Cooking Oil Demand on Crop-Oil Prices

Renewable fuel policies like the national Renewable Fuel Standard (RFS) and California’s Low Carbon Fuel Standard (LCFS) have created a boom in the consumption of alternative diesels. These alternative diesels come in the form of biodiesel or renewable diesel, or biomass-based diesels (BBDs) as a group. National consumption of BBDs more than doubled from 2015 to 2023, and 70% of the diesel consumed in California comes from biofuels. BBDs hold the promise of emitting less greenhouse gas emissions than petroleum diesels without requiring major changes in heavy-duty engine technology like switching to battery technologies. Thus, BBDs could serve as a bridge technology away from petroleum fuels as battery and fuel-cell technology in the heavy-duty sector is not ready for mass adoption, and many industry leaders in agricultural states view the heavy-duty market as a growing source of demand for biofuels for decades to come.

BBDs can be produced from a variety of renewable oils, and the states with clean fuel programs provide incentives that can vary significantly by feedstock. BBD feedstocks primarily fall into two categories: crop-based vegetable oils like soybean and canola oil or by-product oils like rendered beef tallow or used cooking oil. By-product feedstocks are also called waste-based feedstocks or waste oils by some government organizations and industry analysts. Generally, BBDs made from crop oils are considered to have higher emissions than BBDs made from by-products because of the emissions from growing crops and because of induced land use change from increasing crop prices. In contrast, increasing the demand for byproducts is assumed not to impact the consumption and/or production of the source commodity such as vegetable oil use in restaurant kitchens and to have no secondary impacts on land used to grow crops.

Under the RFS, fuel producers must demonstrate that their product emits 50% less greenhouse gases to qualify for generating RIN credits. So, once meeting the threshold, crop-based and by-product BBDs are treated equally under the RFS, even though the EPA considers BBDs made from crops to have higher emissions than BBDs made from byproducts. However, in clean-fuel programs like the LCFS, BBDs from byproducts can earn significantly more subsidies per gallon than BBDs made from crop oils. Thus, while most BBDs consumed nationally come from crop-based oils, around 70% of BBDs in California come from byproducts.

Controversies, however, are emerging around the use of byproduct oils for BBDs. Increasing the domestic supply of beef tallow and used cooking oil (UCO) in response to biofuel demand has proved difficult. To bridge the supply gap, BBD producers now import millions of tons of UCO from Asia. The primary vegetable oil consumed in most Asian countries is palm oil, which is associated with far worse emissions from land use change than soybean and canola oil, and renewable fuel programs in the United States essentially ban the oil as a result. Thanks to biofuel programs in the United States and European Union, Asian UCO is often more expensive than virgin palm oil in UCO exporting countries. Thus, industry leaders have raised concerns about illicit mixing of cheaper palm oil with more expensive UCO and about the possibility of rising UCO demand causing higher palm oil prices as the two oils are close substitutes in animal feed and oleochemical production markets.

This article focuses on the potential spillover effects from increasing UCO biofuel demand on crop oil prices. We have written a companion article on the possibility of UCO being mixed with palm oil for the ARE Update journal, and we invite readers interested in that issue to refer to it. We lay out the close price relationships between UCO and crop oil markets with a special emphasis on how these price relationships can differ by country and region, and then we conclude by highlighting the importance of better understanding these price dynamics to fully understand the greenhouse gas emission implications of biofuel policies.

Rapidly Rising Biofuel Demand for Byproduct and Vegetable Oils

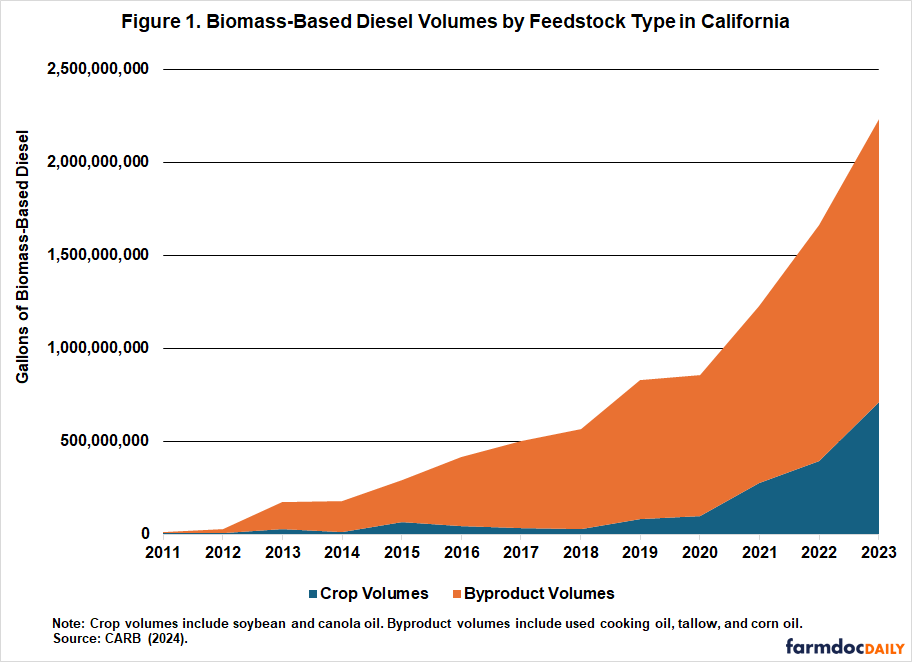

To understand the rising biofuel demand for byproduct oils like UCO, Figure 1 shows California consumption of byproducts and crop oils in millions of gallons of BBDs. California consumption of BBDs has grown steadily since the inception of the program in 2011 and since the program was revised following court settlements in 2015. Following the pandemic lockdowns in California, consumption of renewable diesel increased by over 50% from 2019 to 2021. This upward trend has continued through the present, and BBD volumes were four times larger in 2023 than in 2019. 2024 is on pace to set a record as well. Most of this growth has occurred with the use of byproduct feedstocks defined as UCO, tallow, and distillers corn oil. However, the share of BBDs from crop oils has also steadily increased, rising from 10% in 2019 to over 30% in 2023. The current volumes of crop oil BBDs almost match the entire consumption of BBD in 2019.

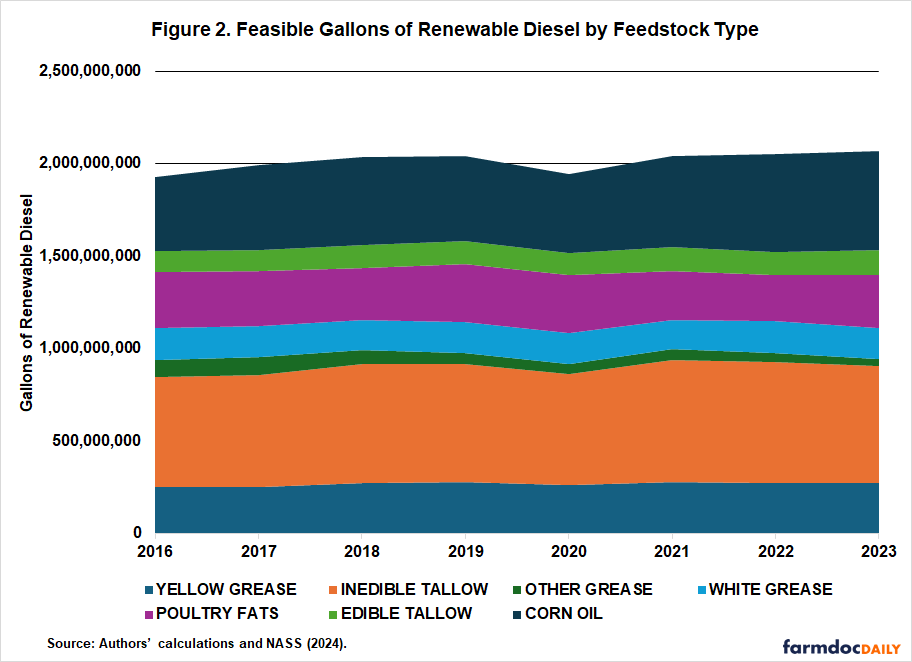

Yet, meeting any future growth in demand for byproduct feedstock from U.S. supplies could prove difficult. Figure 2 shows the maximum feasible gallons of renewable diesel that could be produced from the U.S. production of byproduct feedstocks under current rates of byproduct production per unit of the source commodity. The number of gallons for each feedstock is calculated using a simple fixed proportions of 8lbs of feedstock per gallon of renewable diesel (Xu et al., 2022), and the feasible gallons calculation exactly follows estimated production of feedstocks from NASS (2024). The feedstocks include different types of tallow, fats, greases, and distillers corn oil. As Figure 2 shows, the growth in demand for byproduct feedstocks has not been met with a sizeable growth in the supply of byproduct feedstocks from U.S. producers. The number of feasible gallons from U.S. grew from 1.9 billion gallons in 2016 to 2.1 billion gallons in 2023 with corn oil accounting for most of this growth. Corn oil is a byproduct of ethanol production and is removed from the leftover mash from distilling corn called distillers grains. The increase in corn oil production is coming from greater ethanol production and higher capture rate of corn oil from distillers grains. If all of U.S. byproduct feedstocks were used in renewable diesel production, this production would still not be enough to meet California consumption of BBDs, let alone the entire country. Therefore, rising demand for byproduct feedstocks is likely taking byproducts from other uses, causing vegetable oils to be substituted in for those uses.

Of particular importance is yellow grease. Yellow grease and UCO are often used interchangeably in government and industry reports, but unrefined UCO from restaurants can also include other greases like brown grease. White grease, which is rendered pig fat, and very little is used in biofuel production according to the EIA. California consumption of BBDs from UCO was nearly 600 million gallons in 2023, yet U.S. rendering of yellow and other grease only produced enough for roughly 250 million gallons per year from 2016 to 2023. This additional biofuel use of yellow grease is being met through imports of Asian UCO which exceeded in 200 million gallons in 2023, and 2024 numbers are on pace to far exceed 2023. However, Europe was already using large amounts of UCO in its biofuel programs, and rendered UCO has other uses in Asia such as oleochemical production. The major vegetable oil produced in most Asian countries is palm oil, which is associated with large land-use change emissions from deforestation to create palm plantations. Thus, understanding the global price relationships between UCO and vegetable oils is a key case study for determining if rising demand for byproduct oils has spillover effects onto crop oil prices. Similar concerns may also extend to tallow if meat demand were also to induce land use change associated emissions.

Price Relationships between UCO and Crop Oils

The surge in demand for byproduct feedstocks combined with a constraint on their domestic availability creates an urgent need to understand the price relationships between these feedstocks and vegetable oils. Clean fuel policies provide more incentives for byproducts under the assumption that consuming them in biofuels does not impact the production of crop commodities. However, the markets for byproduct and vegetable oils are all interconnected, and increasing demand for one type will likely have spillover effects onto others.

Refined UCO has a variety of uses outside of biofuels such as animal feed or oleochemical production. These industries will use crop oils instead of UCO if they are more profitable and easier to source. When UCO is diverted from use in these industries, it could simply be replaced by the use of virgin oils. Rising UCO demand from biofuels could be pulling on the demand for crop oils in other markets through input substitution. Moreover, crop oils are an input into the production of UCO via vegetable oil consumption. So, changes in one price could be passed through to changes in the other price through an input-output channel. This pass-through will depend on the share of UCO collected and the share of food consumption for crop oils. Thus, biofuel demand for UCO could affect vegetable oil prices through multiple channels.

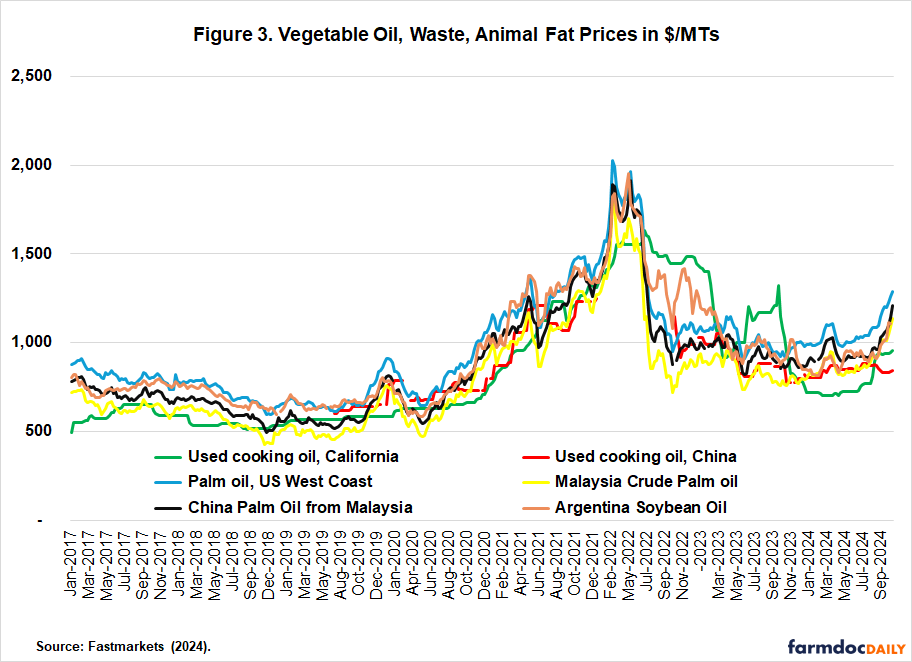

Figure 3 shows soybean oil, palm oil, and UCO prices across the globe. These prices all tend to move together and experience the same trends and shocks, particularly before the Russian invasion of Ukraine in February of 2022. This suggests these markets appear to be well integrated with each price moving with and affecting the others, and UCO and vegetable oil prices follow a pattern consistent with being close substitutes in consumption. This can be clearly seen after the Covid-19 pandemic in late 2020 when all prices trended upwards and then peaked in the early part of the Russian-Ukraine war. Moreover, these prices all surged in late 2020 and early 2021 during the end of pandemic lockdowns and the beginning of the latest boom in California BBD consumption, although prior to when more soybean oil was being used for biofuels. That is, demand for UCO and other waste feedstocks does not occur in a vacuum separate from crop oils, and overall, there does seem to be spillover effects from UCO prices to vegetable oil prices at the global level, as an increase in one price likely leads to increases in the other prices.

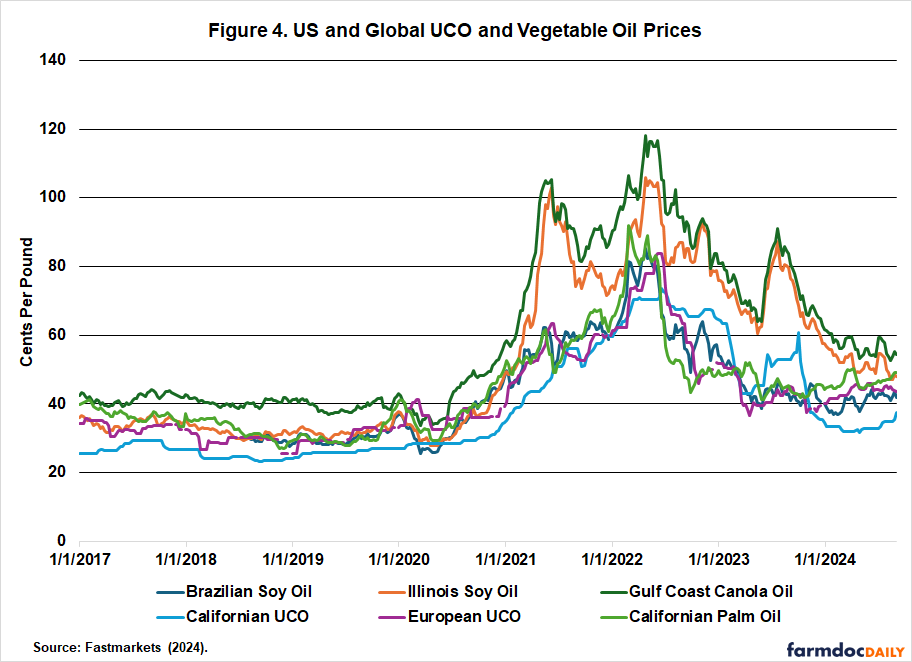

However, U.S.-based prices deserve further examination, as shown in Figure 4. Prior to 2021, U.S. soybean and canola oil prices followed the same patterns as UCO prices and other vegetable oil prices both inside and outside of the United States. However, starting around the time of the boom in California renewable diesel consumption in 2021, U.S. canola and soybean oil prices surged above all of the other prices. These two oils have served as the easiest feedstocks for U.S. BBD producers to increase consumption along with Asian UCO. Close to 50% of U.S. soybean oil is now used in biofuels versus just 25% in 2015. However, prices of palm oil, Brazilian soybean oil, and UCO in Europe did not experience the same sustained price surge from 2021 to early 2024 while Californian UCO appears to experience some of the same shocks from 2022 through 2024. The one exception is the surge in all vegetable oil prices following the Russian invasion of Ukraine.

BBDs from UCO receive far more LCFS credits per gallon than BBDs from either soybean and canola oil, yet soybean and canola oil have experienced the largest price increases since the renewable diesel boom in California. This result is quite surprising given that U.S. rendering of UCO has been static during this boom period. It’s quite possible that Asian imports of UCO are blunting a large portion of the price impacts on US-based UCO from rising biofuel demand. UCO prices both in the US and in Europe more closely track palm oil prices than canola and soybean oil. The marginal supply of UCO in both regions is coming from Asia, and in Asia, the marginal supply of vegetable oils is likely coming from palm oil. Thus, palm oil is the most likely substitute for UCO in Asian consumption, and it appears that spillover effects from the importation of Asian UCO are greatest for the palm oil market.

At the same time, US-based canola and soybean oil experienced unique shocks from 2021 through 2024. These unique shocks caused them to break away from the other prices. Commodity prices dramatically increased coming out of the Covid lockdowns, but that does not explain the divergence in soybean and canola oil prices. Outside of California, soybean oil is the largest feedstock for BBD production, and national volumes have more than tripled since 2015. Likewise, soybean and canola oil are the primary vegetable oils for human food and animal feed use in the United States. If biofuel demand for UCO and other byproducts was crowding out consumption from other industries, then these U.S. producers likely turned to soybean and canola oil. As can be seen in Figures 3 and 4, California UCO experienced significant premiums to European UCO post-2021. This premium correlates with periods of elevated soy and canola oil prices in the United States. Thus, US UCO and soybean oil exhibit a strong price relationship while the most relevant price relationship for European UCO appears to be palm oil.

Nonetheless, the premiums for soybean and canola oil did not fully pass through to the other prices, and the premiums persisted until recently. National production of soybean oil has increased by 20% over the last decade. Likewise, exports of soybean oil are now one-fifth of their levels a decade ago, and imports of canola oil have nearly doubled. These price premiums were needed to increase domestic crushing of soybeans, decrease soybean oil exports, and increase imports of canola oil.

Transportation costs also likely played a role. Shipping costs increased dramatically following the end of Covid lockdowns in 2021, and they have remained elevated until the beginning of 2023. Thereby, increased shipping costs likely ate away at the opportunity for non-U.S. vegetable oil producers to take advantage of the price premiums in the American market. This may be especially true for FAME biodiesel plants located near soybean crushers in the Midwest. These producers would have to also transport the oil from the coast to the Midwest via rail, further adding to the cost of buying from foreign vegetable oil producers. The increase in soybean crushing and decline in shipping costs then likely caused soybean and canola oil prices to revert to a more stable relationship with the other prices.

Discussion

The rapid expansion of BBD consumption, propelled by renewable fuel policies like the RFS and California’s Low Carbon Fuel Standard LCFS, has significantly impacted global vegetable oil markets, raised concerns about increased greenhouse gas emissions, and challenges in resource sustainability. The heightened demand for waste-based feedstocks such as UCO has outpaced domestic supply capacity, leading to an increased reliance on imports from Asian countries where palm oil—a commodity linked to deforestation and significant greenhouse gas emissions—is prevalent.

This dependence on imported UCO introduces potential risks to environmental integrity, including the adulteration of UCO with cheaper palm oil and the displacement of UCO from traditional uses, potentially leading to increased palm oil production to meet this demand and associated emissions. The interconnectedness of global oil markets suggests that heightened demand for UCO can influence prices of both waste-based and crop-based oils like soybean and canola oil, as they serve as substitutes in various industries.

Our observations indicate that U.S. soybean and canola oil prices surged above global levels starting in 2021, coinciding with increased domestic biofuel production and pandemic-related transportation constraints. The price divergence from other oils underscores the complexity of market dynamics and the potential for indirect effects stemming from biofuel policies. The assumption that utilizing waste-based feedstocks does not impact crop production or associated emissions warrants further scrutiny, as market substitutions may offset environmental benefits.

These findings highlight the need for a deeper understanding of the market relationships between UCO and other vegetable oils. An econometric assessment of these linkages would provide valuable insights into the extent of spillover effects and market integration. Quantifying the elasticity of substitution between different oils and analyzing the factors contributing to price fluctuations can help disentangle the interplay between biofuel demand and commodity markets.

Further research is essential to enhance our comprehension of the indirect impacts of renewable fuel policies on global vegetable oil markets. By employing econometric models to analyze price data across regions and time periods, researchers can assess the degree to which biofuel demand influences agricultural commodity prices and supply chains. Such analysis would contribute to more nuanced evaluations of biofuel sustainability and inform future policy considerations, ensuring that environmental objectives are effectively met without unintended consequences.

It’s worth noting that the increasing demand for waste-based feedstocks like tallow, particularly from countries like Brazil, raises concerns about the environmental impacts of their production. While many countries and sectors have restrictions limiting demand for commodities associated with environmental degradation, these restrictions often don’t extend to waste or co-products. This can lead to unintended consequences, as subsidies for these non-source-discriminating waste products may disproportionately benefit those associated with environmental degradation, such as palm oil.

Disclaimer

The findings and conclusions in this presentation are those of the authors and should not be construed to represent any official USDA or U.S. government determination or policy. This work was supported by USDA cooperative agreement no. 58-0111-23-023.

References

California Air Resources Board (CARB). 2024. Quarterly Data Spreadsheet. https://ww2.arb.ca.gov/resources/documents/low-carbon-fuel-standard-reporting-tool-quarterly-summaries

Fastmarkets. 2024. Agriculture and biofuels. https://www.fastmarkets.com/agriculture/

National Agriculture Statistics Service. 2024. Fats and Oils: Oilseed Crushings, Production, Consumption, and Stocks. https://usda.library.cornell.edu/concern/publications/mp48sc77c

Xu, Hui, L. Our, Y. Li, T. Hawkins, and M. Wang. 2022. Life Cycle Greenhouse Gas Emissions of Biodiesel and Renewable Diesel Production in the United States. Environmental Science and Technology, 56:7512-7521. https://pubs.acs.org/doi/full/10.1021/acs.est.2c00289

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.